- UBS reaffirms strategy and ambitions; outlines plans for profit growth

- Highly cash-flow generative business model to continue delivering attractive capital returns to shareholders

- Global Wealth Management outlines plans to deliver at the higher end of its 10-15% target PBT growth range

- Refined efficiency targets for Group and business divisions; aiming for ~72% adjusted Group cost/income ratio in 2021

- Increase in equity and cost allocations from Corporate Center to business divisions to drive efficiency improvements

- Targeting Group reported return on CET1 capital of ~15% in 2019 and ~17% ambition for 2021, even as CET1 capital increases

UBS reaffirms strategy and ambition; outlines plans for profit growth

Building on its successful execution track record, UBS will intensify its focus on delivering growth with further emphasis on capital and cost efficiency. The firm expects to grow revenues at least as fast as real GDP growth, while delivering positive operating leverage. UBS remains strongly positioned to benefit from positive long-term secular growth trends, including global wealth creation and economic expansion in Asia Pacific.

Highly cash-flow generative business model to continue delivering attractive capital returns to shareholders

UBS's business model is capital efficient and highly capital accretive. The firm remains committed to its attractive capital returns policy. UBS targets to grow its ordinary dividend per share at mid-to-high single digit percent per annum. The bank expects to return excess capital, after dividend accruals, likely in the form of share repurchases after considering its outlook and subject to regulatory approval.

In the first quarter of 2018, UBS announced a share repurchase program and an intention to repurchase up to CHF 550 million of shares this year. The firm has already exceeded its target for 2018 by repurchasing CHF 650 million of its shares.

Global Wealth Management outlines plans to deliver PBT growth at the higher end of its 10-15% target PBT growth range

UBS is the only truly global wealth manager with leading positions in the most attractive and fastest growing markets and segments. It reaffirmed its plan to deliver 10-15% pre-tax profit growth over the cycle in its Global Wealth Management business division.

UBS's ambition is to grow profits at the upper end of the target range over the 2019-2021 period. The business division will also target net new money growth of 2-4% per annum while aiming for at least 3% growth by 2021.

The strategic plan for Global Wealth Management focuses on accelerating growth in key geographies, including the Americas and Asia Pacific, as well as strengthening its leadership position in the ultra-high net worth segment. Expansion in the American ultra-high net worth segment alone is expected to contribute significant net new money over the next three years. The business also aims to grow through higher penetration in mandates and banking products.

Global Wealth Management further plans to deliver total annualized gross savings of around CHF 250 million including the CHF 100 million savings announced earlier this year, to be reinvested to support future growth, including technology solutions to improve client experience and enhance advisor capabilities.

Refined efficiency targets for Group and business divisions; aiming for ~72% adjusted Group cost/income ratio in 2021

UBS is providing details on its ambitions to improve cost efficiency ratios. The Group is targeting a cost/income ratio of around 77% for 2019 and is setting a clear path to deliver a cost/income ratio of around 72% in 2021. Over the period, UBS expects to keep costs broadly flat, excluding performance-driven variable compensation, while funding significant investments for growth.

UBS expects to reduce reported Corporate Center costs, including restructuring, by CHF 800 million over the next three years.

Increase in equity and cost allocations from Corporate Center to business divisions to drive efficiency improvements

Earlier this year, UBS gave its business divisions greater ownership of business-aligned Corporate Center functions. UBS will allocate approximately CHF 7 billion of additional attributed equity to the business divisions, of which CHF 3 billion will be allocated to the Investment Bank. The Investment Bank is expected to continue to consume around one third of the Group’s resources.

UBS will also allocate around CHF 90 billion of additional leverage ratio denominator (LRD), and associated risk-weighted assets (RWA), from Corporate Center – Group Asset and Liability Management (Group ALM) to its business divisions. This is incremental to the existing LRD and RWA allocations from Corporate Center – Group ALM to the business divisions.

In addition, UBS plans to allocate around CHF 675 million of P&L currently retained in Corporate Center to business divisions. Further aligning front-to-back cost ownership will create additional incentives to increase efficiency. These changes will result in an approximately two percentage point increase in the business division's adjusted cost/income ratios, while improving the Corporate Center's retained profit/(loss). These changes will be effective 1 January 2019 and UBS will provide restated prior-period information.

Targeting Group reported return on CET1 capital of ~15% in 2019 and ~17% ambition for 2021, even as CET1 capital increases

Reflecting the fact that CET1 capital is the binding constraint of the firm, UBS will target a reported return on CET1 capital of ~15% in 2019 and has an ambition of ~17% for 2021, even as CET1 capital increases. CET1 capital is a simple, transparent measure that is consistent with UBS’s equity allocation framework and how it manages shareholder returns.

Group CEO Sergio P. Ermotti:

"I'm proud of what we've achieved over the last seven years and in particular since our last Investor Update in 2014. We are taking actions to grow profits efficiently and UBS is strongly positioned to benefit from several secular growth trends. There's no doubt in my mind that we will continue to deliver superior and sustainable value for our shareholders, regardless of market conditions."

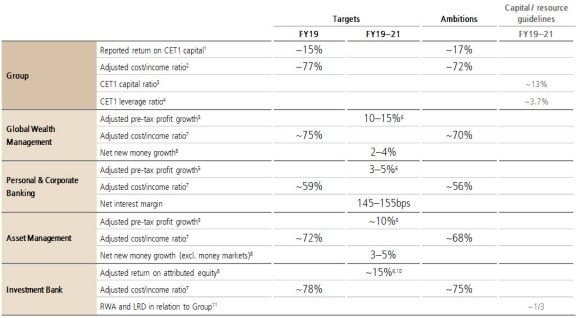

Targets, ambitions and resource guidelines

The table below details annual performance targets, ambitions and capital and resource guidelines for the Group and the business divisions. These take into account the effects of the changes in Corporate Center cost allocations, equity attribution and Corporate Center segment reporting that will become effective in the first quarter of 2019. The performance targets and ambitions exclude, where applicable, items that the management of UBS believes are not representative of the underlying performance of the businesses, such as restructuring-related charges and gains and losses on sales of businesses and real estate. The performance targets assume constant foreign currency translation rates unless indicated otherwise.

UBS’s media release and slide presentations for the Investor Update 2018 will be available from 06.45 CEST on Thursday 25 October 2018 at www.ubs.com/investors.

Results presentation time:

- 09:00–9.45 (CEST)

- 08:00–8.45 (BST)

- 03:00–3.45 (US EDT)

Investor Update time:

- 10:15–18:15 (CEST)

- 09:15–17:15 (BST)

- 04:15–12:15 (US EDT)

Video webcast

All presentations and Q&A sessions (third quarter 2018 results and Investor Update) can be followed live via video webcast on www.ubs.com/investors. A playback will be made available on www.ubs.com/investors later in the day.

Please note that there will be no audio dial-in for this event (webcast only).

UBS Group AG and UBS AG

Investor contact

Switzerland: +41-44-234 41 00

Media contact

Switzerland: +41-44-234 85 00

UK: +44-207-567 47 14

Americas: +1-212-882 58 57

APAC: +852-297-1 82 00