Nuestra experiencia

Cuente con la ayuda de una de los principales gestoras de ETF del mundo. Tenemos los conocimientos necesarios para ofrecer una amplia gama de soluciones a la altura de sus necesidades, ya que contamos con más de 30 años de valiosa experiencia.

¿Quieres más información?

¿Quieres más información?

Suscríbase para recibir las últimas perspectivas e información de los mercados privados en todos los sectores directamente en su bandeja de entrada.

Lo que nos diferencia

Variedad

Los inversores pueden acceder eficazmente a numerosos mercados a través de nuestra amplia selección de ETFs. Ofrecemos soluciones en renta variable, renta fija, materias primas, beta alternativa, cobertura de divisas, metales preciosos, sostenibilidad y real estate.

Experiencia

Puede beneficiarse de nuestra dilatada experiencia, de las más relevantes entre los proveedores europeos de ETF. Ofrecemos estrategias de réplica de índices de alta calidad, respaldadas por un equipo de gestión de carteras experimentado y cualificado.

Inversión sostenible

Nuestra andadura sostenible comenzó en 2011 con el lanzamiento de nuestras primeras estrategias ISR ETF. Como pioneros en este ámbito, ofrecemos una amplia gama de soluciones para ayudarle a cumplir sus objetivos ESG.

UBS ETF Capital Markets Weekly

UBS ETF Capital Markets Weekly

Eche un vistazo a nuestra publicación ETF Capital Markets Weekly. El documento destaca las actividades del mercado primario relevantes para los ETF de UBS, las mayores operaciones del mercado secundario, un repaso al mercado y avanza las cuestiones más relevantes de la semana siguiente. Disfrute de la lectura y no dude en compartir sus comentarios.

ETF Trading

UBS ETF Capital Markets

El equipo de ETF Capital Markets ayuda a nuestros clientes a comprender el trading de ETFs y que la competencia es clave para lograr la mejor ejecución. Una mala ejecución de un ETF puede resultar cara y anular las ventajas de la cobertura del ETF en términos de transparencia, liquidez y seguridad de ejecución.

Explorar ETF Trading

El equipo de UBS ETFs busca mantenerse a la vanguardia y seguir siendo proactivo a la hora de aportar nuevas soluciones de gestión pasiva que se adapten a la amplia variedad de preferencias de los inversores modernos.

Clemens Reuter, Global Head of ETF & Index Fund Client Coverage

Preguntas frecuentes sobre ETF

Conozca las preguntas frecuentes

Un fondo de inversión cotizado (exchange traded fund, ETF) es un fondo de inversión que replica la evolución del índice subyacente y que puede comprarse y venderse en la bolsa de valores. El ETF, al igual que los fondos de inversión colectiva tradicionales, es un fondo de inversión y, por tanto, no le afecta la insolvencia del proveedor del ETF. Ofrece las ventajas de un fondo de inversión colectiva, pero se negocia como una acción.

El ETF puede negociarse en la bolsa de valores o en mercados extrabursátiles (over the counter, OTC) en cualquier momento del día. Al estar vinculados a un índice subyacente, los ETF son vehículos de inversión pasiva que se limitan a replicar el rendimiento del activo subyacente. En otras palabras, cuando el índice subyacente se revaloriza, el valor del ETF también lo hace.

Los primeros ETF aparecieron en Estados Unidos en 1993 y en Europa a partir de 1999. Desde entonces, el número de ETF disponibles no ha dejado de aumentar. Tradicionalmente, los ETF son fondos indexados pasivos, pero desde su autorización en 2008, también han aparecido ETF de gestión activa, que requieren una estrategia de gestión de cartera.

La inversión promocionada se refiere a la adquisición de participaciones o acciones en un fondo, y no en un determinado activo subyacente, como un edificio o acciones de una empresa, ya que estos solo son los activos subyacentes propiedad del fondo

Los ETF de UBS están disponibles con una extensa variedad de clases de activo subyacentes, como acciones, bonos, materias primas, metales preciosos y real estate, y ofrecen a los inversores acceso un gran número de mercados con una sola operación. Además, los inversores pueden elegir el método de réplica que prefieran, ya que UBS dispone de una amplia gama de ETF con réplica física y sintética.

Diversificación

Los ETF aportan diversificación a una cartera de forma muy económica y eficiente, pues distribuyen el riesgo entre varios portadores de riesgo, lo que le permite optimizar el perfil de riesgo de su inversión. Dado que los ETF replican a un índice, puede cubrir todo un mercado con una sola operación.

Flexibilidad

Los ETF son fáciles de comprar y de vender, incluso intradía. De este modo, los inversores pueden actuar en base a las visiones del mercado en cuestión de segundos. Estas características permiten utilizar los ETF de diferentes maneras como parte de una estrategia de inversión: para el rendimiento a largo plazo, para buscar oportunidades de trading a corto plazo y para cubrir partes de una cartera.

Transparencia

Los ETF son instrumentos de inversión especialmente transparentes porque replican el rendimiento del índice subyacente, neto de comisiones. Toda la información importante sobre la operativa y otros datos pueden consultarse al instante o de forma intradiaria. Durante el horario de negociación bursátil, el valor neto de los activos de los ETF de UBS se calcula cada 15 segundos.

Rentabilidad

Los ETF no tienen recargos por emisión o reembolso, solo los costes de transacción por la compra y venta del ETF. Por otra parte, la comisión de gestión que se cobra es mínima.

Seguridad

Los ETF son fondos mutuos, igual que los fondos de inversión colectiva tradicionales. No les afecta la insolvencia del proveedor del ETF o del banco depositario, ya que los activos del fondo no se incluyen en la masa concursal.

El objetivo de un fondo de inversión cotizado (ETF) es replicar lo más fielmente posible la evolución del índice subyacente para proporcionar a los inversores del ETF el mismo rendimiento que el índice.

Ahora bien, los índices se basan en cálculos teóricos, es decir, los costes en los que se incurre en la práctica, por ejemplo, por la compra o venta de los valores representados en el índice, no se tienen en cuenta en el cálculo de este. Sin embargo, estos costes se cobran siempre que se replican un índice y su rendimiento para una inversión.

Por lo tanto, el grado de fidelidad con el que el ETF replica el rendimiento de su índice subyacente es fundamental. En el caso ideal, el rendimiento del ETF se diferencia del rendimiento del índice únicamente en los costes y las comisiones en que se ha incurrido. Dado que, por ejemplo, los índices que solo siguen el mercado de valores de un único país aplican criterios de réplica diferentes en comparación con un índice que contenga valores de varios países, los criterios para lograr una réplica exacta difieren de un índice a otro. Por esta razón, los ETF de UBS están disponibles con varios métodos de réplica de índices.

Réplica física pura

El ETF invierte en los valores representados en el índice de acuerdo con la ponderación en dicho índice.

Réplica física optimizada

El ETF invierte únicamente en aquellos valores representados en el índice que son necesarios para lograr un rendimiento muy cercano al del índice.

Réplica sintética

El ETF invierte en una cartera de valores e intercambia su rendimiento por el del índice.

En principio, el proceso de compra es idéntico para todos los métodos de réplica, pero la entrega física de los valores solo es aplicable a los ETF de réplica física.

- El inversor adquiere las participaciones del ETF en la bolsa o directamente a un creador de mercado o a un participante autorizado (negociación OTC).

- El creador de mercado o participante autorizado paga en efectivo (en el caso de los ETF de réplica física y sintética) o entrega los valores necesarios (solo en el caso de los ETF de réplica física) al ETF.

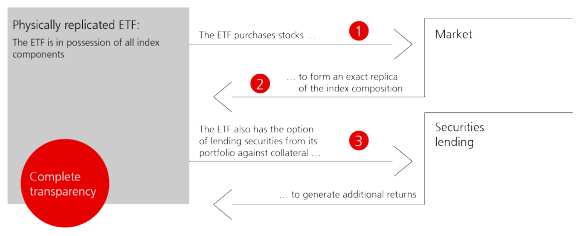

La réplica física pura de un índice consiste en que el ETF adquiere todos los valores representados en el índice subyacente de acuerdo con la ponderación en dicho índice. Es decir, el ETF posee físicamente los componentes del índice y, por lo tanto, es una réplica exacta de este. Si se producen cambios en el índice, por ejemplo, debido a ajustes o a operaciones de capital de los valores representados en el índice, el ETF replica estos cambios, por lo que es necesario realizar transacciones de forma periódica. El ETF distribuye regularmente beneficios, en forma de dividendos o cupones, por ejemplo.

El método de réplica física completa se caracteriza por su sencillez y un tracking error mínimo.

- El ETF posee físicamente todos los valores representados en el índice de acuerdo con la ponderación en dicho índice.

- Todos los ajustes del índice y las operaciones de capital se replican de forma idéntica.

- Algunos ETF prestan valores de su cartera a cambio de una comisión.

Préstamo de valores

Determinados ETF de réplica física efectúan préstamos de valores para generar rendimientos adicionales y reducir los costes netos de los inversores, para lo cual se prestan los valores del ETF a cambio de una comisión. Las operaciones de préstamo de valores de los ETF de UBS están sobrecolateralizadas como mínimo al 105 %.

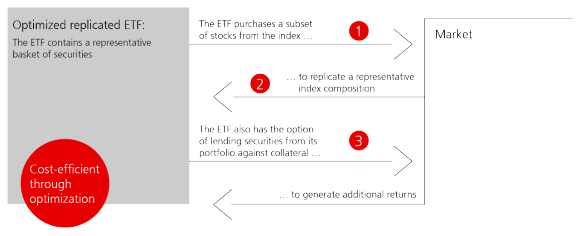

Con el método de réplica física optimizada, el ETF posee una muestra de los valores del índice subyacente. Se recurre a herramientas analíticas y a procedimientos matemáticos de optimización para definir un subconjunto de los componentes del índice que logre una rentabilidad similar a la de los valores originales representados en el índice. El método de réplica física optimizada se utiliza para aumentar la liquidez y reducir a un mínimo el tracking error.

El método de réplica física optimizada es especialmente adecuado para los índices amplios que constan de un alto número de componentes. Por ejemplo, el índice MSCI World consta de aproximadamente 1600 valores de distintos mercados, jurisdicciones y zonas monetarias. La réplica física completa de este índice supondría elevados costes de transacción. Además, algunos de estos valores no son muy líquidos o solo tienen un impacto mínimo en el rendimiento del índice debido a su baja ponderación. Excluir estos valores permite reducir los costes de transacción.

- El ETF posee físicamente un subconjunto de los componentes del índice; este método se utiliza para índices amplios que constan de un alto número de componentes o para índices con valores poco líquidos.

- Se aplican procedimientos de optimización para reducir los costes de transacción, aumentar la liquidez y reducir a un mínimo el tracking error.

Algunos ETF prestan valores de su cartera a cambio de una comisión.

Préstamo de valores

Determinados ETF de réplica física efectúan préstamos de valores para generar rendimientos adicionales y reducir los costes netos de los inversores, para lo cual se prestan los valores del ETF a cambio de una comisión. Las operaciones de préstamo de valores de los ETF de UBS están sobrecolateralizadas como mínimo al 105 %.

Son varios los factores que contribuyen a fijar el precio de los ETF y que afectan a su coste. El coste total de poseer un ETF depende en gran medida de la estrategia de cartera elegida, así como de la clase de activo en la que invierte el fondo. Aunque existe una gran variedad de condiciones de precio, las comisiones de los ETF son más bajas que las de los fondos de inversión colectiva tradicionales. Los spreads de los ETF también varían en función de la actividad del ETF en cuestión.

La tracking difference es la diferencia entre el rendimiento del fondo y el del índice. En el rendimiento del fondo se tienen en cuenta todos los costes relacionados con el fondo y todos los flujos de ingresos que entran en el fondo. Tanto las comisiones de gestión del ETF como la diferencia de rendimiento se publican en el informe semestral y anual del fondo.

El ratio de gastos totales es la relación entre los gastos soportados por el fondo y el tamaño medio de este durante el ejercicio fiscal. Los gastos son todos los gastos de la cuenta de resultados, incluidos los gastos de gestión, administración, custodia, auditoría, jurídicos y de asesoramiento (gastos operativos). El ratio de gastos totales del ETF se indica de forma retroactiva como porcentaje de los activos medios del fondo y se calcula de acuerdo con las pautas de cálculo y la publicación de la TER de los organismos de inversión colectiva.

En la réplica sintética de un índice, el rendimiento del índice subyacente del ETF se obtiene mediante un swap o permuta. En este caso, el ETF firma un contrato de swap con un banco de inversión, la contrapartida del swap. El objeto de este contrato es la transferencia de los flujos de caja del ETF a la contrapartida del swap, que a su vez garantiza al ETF el rendimiento del índice al que replica. El riesgo asociado a la réplica precisa del índice se transfiere del ETF a la contrapartida del swap. Puesto que la propiedad física de los valores representados en el índice ya no es un requisito previo para participar en el rendimiento del índice, es posible realizar un seguimiento eficaz de mercados a los que, por ejemplo, es imposible o difícil acceder debido a que tienen restricciones sobre la operativa.

UBS emplea dos estructuras de swap diferentes en la réplica sintética: el swap totalmente financiado (fully funded swap o FFS) y un modelo mixto (total return swap y cartera de activos con swap totalmente financiado)

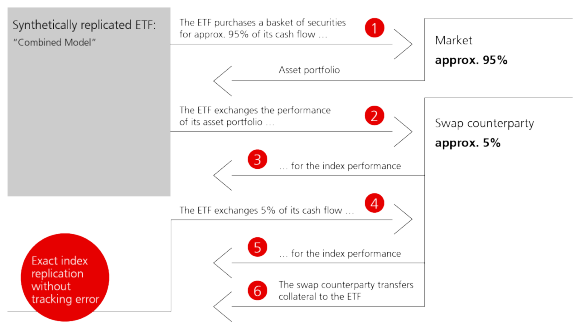

Modelo mixto: una cartera de activos y total return swap más swap totalmente financiado (AP y TRS + FFS)

Este método de réplica consiste en invertir las suscripciones del ETF en una proporción aproximada de 95:5 en una cartera de activos (la «cartera de activos») y en un swap totalmente financiado.

Cartera de activos y swap de rentabilidad total (AP y TRS)

Aproximadamente el 95 % de los activos del ETF se utiliza para comprar una cesta de valores, la cartera de activos. Dicha cesta está formada por una cartera diversificada y líquida de acciones de mercados desarrollados y se optimiza atendiendo a consideraciones de liquidez. Además, el ETF firma un contrato de swap no financiado (unfunded swap) con la contrapartida del swap para intercambiar los rendimientos de esta cartera por el rendimiento deseado del índice. La contrapartida del swap obtiene este rendimiento invirtiendo en valores y derivados que replican el rendimiento del índice.

Swap totalmente financiado (FFS)

El ETF utiliza el resto de los activos del fondo (alrededor del 5 %) para establecer un contrato de swap totalmente financiado con la contrapartida del swap, según el cual sta se compromete a proporcionar el rendimiento del índice.

Exposición a la contrapartida del swap

Con el fin de proteger al ETF contra el riesgo de que la contrapartida del swap incumpla sus obligaciones, esta transfiere un colateral al ETF en forma de bonos del Estado emitidos por países del G10, bonos supranacionales y efectivo. La cuantía transferida como colateral está sujeta a deducciones y los activos de garantía se depositan en un banco depositario independiente a nombre del ETF (transferencia de la titularidad). El ETF tiene acceso inmediato al colateral en caso de que la contrapartida del swap incumpla sus obligaciones.

- El ETF compra una cesta de valores con aproximadamente el 95 % de su efectivo.

- El ETF garantiza el rendimiento de la cesta a la contrapartida

- del swap.

- A cambio, la contrapartida del swap garantiza el rendimiento exacto del índice (menos una comisión).

- El ETF suscribe un swap totalmente financiado con la contrapartida del swap por alrededor del 5 % de su flujo de caja.

- La contrapartida del swap garantiza el rendimiento exacto del índice (menos una comisión).

- La contrapartida del swap transfiere el colateral al ETF en forma de bonos del Estado emitidos por países del G10, bonos supranacionales y efectivo. La cuantía transferida como colateral está sujeta a deducciones.

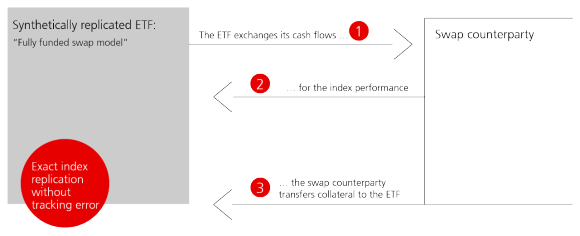

Modelo de swap totalmente financiado

Este método de réplica consiste en que el ETF transfiere flujo de caja a la contrapartida del swap y, a cambio, recibe la rentabilidad del índice por medio de un contrato de swap. Con el fin de proteger al ETF contra el riesgo de que la contrapartida del swap incumpla sus obligaciones, esta transfiere un colateral al ETF en forma de bonos del Estado emitidos por países del G10, bonos supranacionales y efectivo. La cuantía transferida como está sujeta a deducciones y los activos de garantía se depositan en una cuenta separada en un banco depositario independiente a nombre del ETF (transferencia de la titularidad). El ETF tiene acceso inmediato al colateral en caso de que la contrapartida del swap incumpla sus obligaciones.

- El ETF suscribe un swap totalmente financiado con la contrapartida del swap.

- La contrapartida del swap garantiza el rendimiento exacto del índice (menos una comisión).

La contrapartida del swap transfiere el colateral al ETF en forma de bonos del Estado emitidos por países del G10, bonos supranacionales y efectivo. La cuantía transferida como colateral está sujeta a deducciones.

En todos los ETF sintéticos de UBS, la contrapartida exclusiva de todas las operaciones de swap OTC es UBS Investment Bank. No obstante, UBS ETF supervisa periódicamente la solvencia de la contrapartida. Esta supervisión la realizan los directores del consejo de administración en las reuniones trimestrales. Si las circunstancias del mercado lo requieren, la revisión puede tener lugar incluso de forma ad hoc. Aunque UBS Investment Bank es la única contrapartida de los contratos de swap de los ETF de UBS, los precios se comprueban al menos una vez al año a través de un grupo de bancos externos pertenecientes al panel de bancos. Si uno de estos bancos ofrece condiciones más favorables, UBS Investment Bank podrá celebrar un contrato de swap con dicho banco a fin de lograr un precio competitivo para los ETF. En los casos en que está permitido y es posible desde el punto de vista operativo, utilizamos varias contrapartidas de divisas para facilitar la operativa con divisas.

En los préstamos de valores del ETF, el prestamista (el ETF de UBS) transfiere un determinado número de valores de la cartera del ETF a un tercero (prestatario) durante un periodo acordado a cambio de una comisión.

- Solamente determinados ETF de UBS de réplica física domiciliados en Suiza, Irlanda y Luxemburgo ponen en práctica el préstamo de valores.

- El objetivo es reducir los costes netos de los inversores mediante la obtención de ingresos complementarios.

- Las operaciones de préstamo de valores de los ETF de UBS están sobrecolateralizadas como mínimo al 105 %.

- A los ETF domiciliados en Suiza se les aplica además una deducción en la valoración.

- La cuidadosa selección de los prestatarios y la valoración diaria de los colaterales ajustada a precio de mercado contribuyen a minimizar el riesgo.

La publicación diaria del colateral de cada subfondo ofrece un alto grado de transparencia.

Sí, algunos ETF de UBS de réplica física domiciliados en Luxemburgo, Irlanda y Suiza participan en el préstamo de valores. No obstante, la compañía gestora de fondos no realiza ninguna operación de préstamo con los ETF de UBS de renta fija, ASG/ISR y metales preciosos.

El préstamo de los valores del fondo genera ingresos adicionales (normalmente, entre 1 y 20 puntos básicos, dependiendo del índice). Los ingresos obtenidos por el préstamo de los valores repercuten en el valor liquidativo, lo que reduce directamente el coste neto para los inversores.

El prestatario paga al ETF una comisión por el periodo que dure el préstamo de los valores. Además, todos los derechos, como el pago de cupones o dividendos de los valores mientras dura el préstamo, se transmiten al ETF en forma de un pago «fabricado». De este modo, el préstamo de valores permite al fondo generar ingresos adicionales, lo que repercute en el valor liquidativo (NAV) y permite reducir directamente el coste neto para los inversores.

Según la directiva europea UCITS y la CISA suiza, los préstamos de valores pueden alcanzar el 100 %. Las tasas de préstamo reales de los ETF de UBS han sido considerablemente inferiores. Se ha establecido un límite del 50 % del valor liquidativo de los ETF de UBS para el préstamo de valores, aunque algunos tienen un límite del 25 % para cumplir con los requisitos del mercado.

Para reducir a un mínimo el riesgo de préstamo de valores de los ETF de UBS, los prestatarios se seleccionan con sumo cuidado y se supervisan a diario. Antes de que los prestatarios reciban los valores, deben proporcionar un colateral al prestamista, es decir, al ETF. Los colaterales constituyen una garantía de las obligaciones del prestatario frente al prestamista. El colateral se deposita en una cuenta de custodia o cuenta de colateral separada del balance del prestamista.

El préstamo de valores puede cancelarse a petición del prestamista en cualquier momento. La valoración diaria a precio de mercado de los préstamos y los colaterales garantiza que el valor de los colaterales depositados por el prestatario se ajuste siempre al valor correcto. Además, las operaciones de préstamo de valores de los ETF de UBS están siempre sobrecolateralizadas como mínimo al 105 %. A los colaterales subyacentes de los ETF domiciliados en Suiza se les aplica además una deducción en la valoración. El préstamo de valores finaliza cuando es cancelado por el ETF o cuando la demanda del prestatario ha sido satisfecha. El colateral retenido se devuelve al prestatario solo después de que los valores hayan sido devueltos al ETF.

El agente de préstamo de valores de los ETF domiciliados en Luxemburgo es State Street Bank International GmbH, Múnich, Alemania, y State Street Bank and Trust Company. UBS Switzerland AG actúa como único (principal) prestatario del programa de préstamos de los ETF de UBS domiciliados en Suiza.

El agente de préstamo es State Street. La lista de prestatarios del agente de préstamo es aprobada por los representantes de UBS. Además, esta lista coincide con la lista de contrapartidas de UBS. El riesgo de contrapartida es supervisado a diario por el agente prestamista, es decir, State Street. Asimismo, State Street ofrece una indemnización por impago en caso de que un prestatario no pueda devolver los valores. Las operaciones de préstamo de valores de los ETF de UBS están totalmente colateralizadas.

UBS Switzerland AG es el único (principal) prestatario en relación con los ETF y garantiza todas las obligaciones contractuales. A fin de proteger el ETF contra el riesgo de contrapartida de UBS, UBS Switzerland AG proporciona un colateral de conformidad con la estricta normativa de la FINMA (Ordenanza sobre Organismos de Inversión Colectiva).

- El agente prestamista y el prestatario acuerdan las condiciones de la operación y se entrega el colateral.

- Cuando el agente prestamista ha recibido el colateral, los valores prestados se transfieren al prestatario.

- El prestamista (es decir, el ETF) sigue siendo el propietario efectivo del valor prestado. El agente de préstamo percibe todos los derechos pagados por los valores mientras están en préstamo y los devuelve al prestamista en forma de pago «fabricado». Por lo tanto, el prestamista se encuentra en la misma posición económica que si el valor no se hubiera prestado.

- El prestatario paga al agente de préstamo la comisión acordada de antemano. Los pagos acordados se efectúan cada mes.

- El prestatario devuelve los valores cuando la demanda ha sido satisfecha, o antes si el prestamista liquida la posición. No se efectúan operaciones a plazo fijo, por lo que todas las operaciones se pueden recuperar a diario previa solicitud.

- Cuando el valor se devuelve a la cuenta de custodia del prestamista, el agente de préstamo devuelve el colateral al prestatario.

- El mandato de préstamo de valores de los ETF de UBS lo tiene UBS Switzerland AG, que actúa como proveedor principal de préstamos de valores.

- UBS Switzerland AG reutiliza los valores prestados en función de la demanda de los prestatarios del mercado y de las fuentes internas de UBS. UBS negocia con los prestatarios externos e internos en condiciones de igualdad.

- Los ETF de UBS únicamente asumen un riesgo crediticio frente a UBS Switzerland AG, pero no frente a los prestatarios del mercado.

- Las comisiones recibidas del prestatario del mercado se comparten de acuerdo con el acuerdo de reparto de comisiones previamente acordado entre el ETF de UBS y UBS Switzerland AG.

- En el caso de que un valor esté en préstamo en la fecha de inscripción, UBS Switzerland AG transferirá todas las operaciones corporativas al ETF. Los cupones y los dividendos se pagarán al ETF mediante un pago sustitutivo que garantice que el ETF esté al menos en la misma posición económica que tendría si los valores no hubieran estado en préstamo en la fecha de inscripción.

- UBS Switzerland AG devolverá los valores al ETF al finalizar el préstamo, o si el ETF desea recuperar los valores, por ejemplo, en caso de venta. El gestor de la cartera del ETF puede vender los valores en cualquier momento, aunque estos se hayan prestado. Por esta razón, el préstamo de valores no interfiere en el proceso principal de inversión.

Las operaciones de préstamo de valores de los ETF de UBS domiciliados en Luxemburgo están totalmente colateralizadas. El regulador luxemburgués exige una colateralización de al menos el 90 %; sin embargo, los ETF de UBS se sobrecolateralizan al 105 %.

El colateral se deposita en una cuenta de custodia segregada del balance del agente de préstamo. Otras medidas de mitigación del riesgo son la cuidadosa selección de los prestatarios y la revalorización diaria de los préstamos y los colaterales.

Préstamo de valores de los ETF domiciliados en Luxemburgo e Irlanda

Para los ETF de UBS domiciliados en Luxemburgo e Irlanda que efectúan préstamos de valores, se aceptan actualmente los siguientes tipos de colaterales:

- Se aceptan acciones de los siguientes índices: AS30, ATX, BEL20, SPTSX, KFX, HEX25, CAC, DAX, HSI, FTSE, MIB, NKY, AEX, OBX, STI, IBEX, OMX, SMI, SPX, INDU, NYA, CCMP, RAY, UKX, SX5P, N100 y E100

- Se aceptan bonos del Estado de los siguientes países: Alemania, Australia, Austria, Bélgica, Canadá, Dinamarca, Estados Unidos (incluidas las agencias), Finlandia, Francia, Japón, letras SNB, Noruega, Nueva Zelandia, Países Bajos, Reino Unido y Suecia.

Fuente: State Street, 4 de febrero de 2022

Tipo y nivel de colateralización requerido para los ETF domiciliados en Luxemburgo e Irlanda*

Tipo de valores prestados | Tipo de valores prestados | Tipo de colateral Bonos del Estado | Tipo de colateral Bonos del Estado | Tipo de colateral Renta variable internacional | Tipo de colateral Renta variable internacional | |

|---|---|---|---|---|---|---|

Tipo de valores prestados | Renta variable internacional | Renta variable internacional | Tipo de colateral Bonos del Estado | 105% | Tipo de colateral Renta variable internacional | 105% |

Tipo de valores prestados | Renta variable estadounidenses | Renta variable estadounidenses | Tipo de colateral Bonos del Estado | 105% | Tipo de colateral Renta variable internacional | 105% |

Las operaciones de préstamo de valores de los ETF de UBS domiciliados en Suiza están totalmente colateralizadas. UBS Switzerland AG cuenta con un sólido sistema de garantías que se ajusta a la Ordenanza sobre Instituciones de Inversión Colectiva de la FINMA.

Los ETF de UBS reciben un colateral cuyo valor es el 105 % del valor de mercado de los valores prestados. El colateral consiste en activos líquidos, como bonos del Estado, acciones líquidas y bonos con una calificación mínima estipulada por una de las agencias de calificación crediticia aprobadas por la FINMA. A la hora de determinar el valor del colateral de un activo, a su valor de mercado se le aplica una deducción de valoración de hasta el 8 %.

Varios límites de concentración garantizan la adecuada diversificación y liquidez de la cartera de colaterales.

La valoración diaria a precio de mercado garantiza que el valor de los colaterales se actualice para ajustarse al valor del préstamo.

Los colaterales se depositan a nombre del prestamista en una cuenta de garantía segregada y separada de la masa concursal de UBS Switzerland AG.

Préstamo de valores de ETF domiciliados en Suiza

Para los ETF de UBS domiciliados en Suiza que efectúan préstamos de valores, se aceptan actualmente los siguientes tipos de colaterales (excepto los valores de la contrapartida prestataria):

- Bonos del Estado emitidos por países del G10. Los bonos del Estado no emitidos en Estados Unidos, Japón, Reino Unido, Alemania o Suiza deben tener una calificación mínima de «A» o equivalente.

- Bonos corporativos con una calificación mínima de «A» o equivalente.

- Acciones emitidas por empresas que cotizan en los siguientes índices: AEX, ATX, BEL20, CAC, DAX, INDU, UKX, HEX25, KFX, OMX, OBX, SMI, SPI, SPX y SX5E

Fuente: UBS Switzerland AG, 20 de septiembre de 2021

Deducciones y margen*

Al valor de mercado de los valores prestados se añade un margen del 5 % para determinar el requisito del colateral. El valor del colateral de una acciónes igual a su valor de mercado menos una deducción conforme a la tabla siguiente:

Renta variable internacional | 8% | ||

Bonos del Estado emitidos por US, JP, UK, DE y CH | 0% | ||

Bonos del Estado con una calificación mínima de «A» (excepto US, UK, DE y CH) | 2% | ||

Bonos corporativos con una calificación de al menos «A» | 4% |

El préstamo de los ETF de UBS está limitado al 50 % de los activos que administra UBS. Por regla general, la proporción que se presta realmente en la práctica es mucho inferior.

Póngase en contacto con nuestro equipo de UBS ETFs

Ya sea que tenga una pregunta o una solicitud, estaremos encantados de ponernos en contacto con usted.

Nina Petrini

Head ETF & Index Fund Sales Spain