A nossa experiência

Associe-se a um dos principais gestores de ETF do mundo. Temos a perícia necessária para fornecer um amplo leque de soluções para satisfazer as suas necessidades e a experiência adquirida ao longo de mais de 30 anos de excelência.

Quer mais informações?

Quer mais informações?

Subscreva para receber as últimas perspetivas e insights dos mercados privados em todos os setores diretamente na sua caixa de entrada.

O que nos distingue

Opções

Os investidores podem aceder eficazmente a vários mercados através da nossa vasta seleção de ETF. Propomos soluções em ações, rendimento fixo, matérias-primas, beta alternativo, cobertura cambial, metais preciosos, sustentabilidade e imobiliário.

Experiência

Pode beneficiar do nosso estatuto enquanto um dos mais experientes fornecedores europeus de ETF. Propomos estratégias de replicação de índices de elevada qualidade, sustentadas por uma equipa de gestão de carteira experiente e competente.

Investimento sustentável

O nosso percurso sustentável começou em 2011 com o lançamento dos nossos primeiros ETF de SRI. Enquanto pioneiros neste espaço, oferecemos uma vasta gama de soluções para o ajudar a atingir os seus objetivos ESG.

UBS ETF Capital Markets Weekly

Veja a nossa ETF Capital Markets Weekly. O documento destaca as atividades do mercado primário relevantes para os ETF UBS, as maiores transações do mercado secundário, uma análise do mercado, bem como um olhar sobre a semana que se avizinha. Desfrute da leitura e partilhe os seus comentários.

Negociação de ETF

UBS ETF Capital Markets

A equipa ETF Capital Markets acompanha os clientes na sua compreensão da negociação de ETF e da importância da concorrência para a melhor execução. Uma má execução de ETF pode ser dispendiosa e anular os benefícios do envelope de ETF em termos de transparência, liquidez e certeza de execução.

Explorar a negociação de ETF

A equipa de ETF do UBS procura manter-se na vanguarda e ser proativa na apresentação de novas soluções passivas que se adaptem à ampla variedade de preferências dos investidores modernos.

Clemens Reuter, Global Head of ETF & Index Fund Client Coverage

Perguntas frequentes sobre ETFs

Explore perguntas comuns

Um fundo negociado em bolsa (exchange traded fund - ETF) é um fundo de investimento que acompanha o desempenho do seu índice subjacente e pode ser comprado e vendido na bolsa de valores. Como um fundo tradicional, um ETF é um fundo de autónomo e, portanto, não é afetado por qualquer insolvência do provedor do ETF. Permite os benefícios de um fundo de investimento, mas negocia como uma ação.

A negociação de ETF pode ser feita na bolsa de valores ou over the counter a qualquer hora do dia. Como os ETFs estão ligados a um índice subjacente, são veículos de investimento passivos que meramente replicam o desempenho do seu ativo subjacente. Por outras palavras, quando o índice subjacente aumenta de valor, o valor do ETF aumenta da mesma forma.

Os primeiros ETFs foram listados nos EUA em 1993 e na Europa a partir de 1999. Desde então, um número cada vez maior se tornou disponível. Tradicionalmente, os ETFs são fundos indexados passivos, mas os ETFs geridos ativamente também entraram em jogo desde a sua autorização em 2008 e exigem uma estratégia de gestão de portefólio. O investimento em questão diz respeito à aquisição de unidades ou ações num fundo e não num determinado ativo subjacente, como edifícios ou ações de uma sociedade, uma vez que se trata apenas dos ativos subjacentes ao fundo.

Os ETFs do UBS estão disponíveis numa ampla variedade de classes de ativos subjacentes, como ações, obrigações, commodities, metais preciosos e imobiliário e oferecem aos investidores acesso a vários mercados com apenas uma transação. Os investidores também podem escolher o método de replicação de sua preferência, pois o UBS oferece um amplo espectro de ETFs replicados física e sinteticamente.

Diversificação

oferecem a oportunidade de diversificar seu portfólio de maneira muito barata e eficiente, distribuindo o risco entre várias operadoras de risco, permitindo otimizar o perfil de risco do seu investimento. Como os ETFs seguem um índice, pode cobrir um mercado inteiro com apenas uma única transação.

Flexibilidade

Os ETFs são fáceis de comprar e vender - inclusive numa base intradiária. Os investidores são capazes de agir de acordo com as visões do mercado em segundos. Devido a essas caraterísticas, os ETFs podem ser usados como parte de uma estratégia de investimento de várias formas: para crescimento de longo prazo, para oportunidades de negociação de curto prazo e para cobertura de parte de um portefólio.

Transparência

são instrumentos de investimento particularmente transparentes porque correspondem ao desempenho do índice subjacente, líquido de comissões. Todas as principaisinformações de negociação ou outras podem ser visualizadas numa base intradiária ou em tempo real. Os ETFs UBS calculam o valor patrimonial líquido indicativo a cada 15 segundos durante o horário normal de negociação.

Eficiência de custo

ETFs não incorrem em sobretaxas de emissão ou resgate - apenas os custos de transação de compra e venda de um ETF. Além disso, apenas uma taxa de gestãp mínima é cobrada.

Segurança

Assim como os fundos tradicionais, os ETFs são fundos de investimento autónomos. Não são afetados por qualquer insolvência do provedor de ETF ou banco custodiante, pois os ativos do fundo não estão incluídos no balanço da gestora.

O objetivo de um exchange traded fund (ETF) é acompanhar o mais de perto possível o índice em que o ETF se baseia, a fim de proporcionar aos investidores no ETF o mesmo desempenho em relação ao mercado subjacente ao índice.

Os índices baseiam-se em cálculos teóricos, o que significa que os custos incorridos na prática, por exemplo, para a compra ou venda de títulos representados no índice não se refletem no cálculo do índice. No entanto, estes custos são cobrados sempre que um índice e o seu desempenho são replicados para um investimento.

O quão de perto um ETF acompanha o desempenho do seu índice subjacente é, portanto, crítico. Idealmente, o desempenho do ETF difere do desempenho do índice apenas nos custos e taxas incorridos. Uma vez que, por exemplo, os índices que seguem apenas o mercado de ações de um único país aplicam critérios diferentes de replicação de índices em comparação com um índice que contém ações de vários países, os critérios para uma replicação exata do índice diferem de índice para índice. Por estas razões, os ETFs UBS utilizam uma variedade de métodos de replicação de índices.

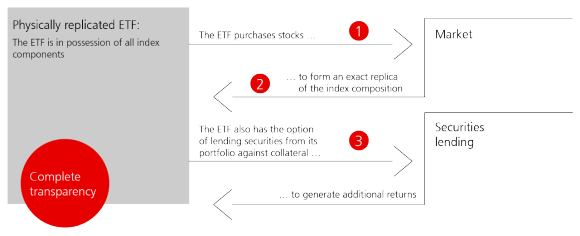

Replicação física completa

A ETF investe nos títulos representados no índice, de acordo com a sua ponderação no índice.

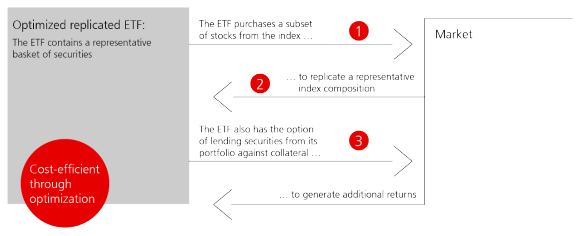

Replicação física optimizada

O ETF investe apenas naqueles títulos representados no índice que são necessários para atingir um desempenho muito próximo do do índice.

Replicação sintética

A ETF investe numa carteira de títulos e troca o seu desempenho pelo do índice.

O processo de compra é, em princípio, idêntico para todos os métodos de replicação - contudo, a entrega física dos títulos aplica-se apenas aos ETFs fisicamente replicados.

- O investidor compra unidades de ETF na bolsa de valores ou dirtamente de um market maker ou parceiro autorizado (negociação OTC)

- O criador de mercado ou o parceiro autorizado paga em dinheiro (para ETFs replicados física e sinteticamente) ou entrega os títulos necessários (somente para ETFs replicados fisicamente) ao ETF

No caso de replicação física completa do índice, o ETF adquire todos os títulos representados no índice subjacente, de acordo com as suas ponderações no índice. Assim, o ETF está na posse física dos componentes do índice e, portanto, de uma réplica exata do índice. Se forem feitas quaisquer alterações ao índice, por exemplo através de ajustamentos de índice ou operações de capital dos títulos representados, o ETF replica estas alterações, tornando as transações necessárias numa base regular. O ETF distribui regularmente rendimentos, sob a forma de dividendos ou cupões, por exemplo.

O método de replicação física completa é caraterizado por simplicidade e erro de seguimento (tracking error) mínimo.

- O ETF está na posse física de todos os títulos representados no índice de acordo com sua ponderação no índice

- Todos os ajustes do índice e operações de capital são replicados de forma idêntica

- Alguns ETFs emprestam títulos de sua carteira por uma taxa

Empréstimo de títulos

Uma série de ETFs seleccionados que replicam fisicamente os índices, fazem empréstimos de títulos a fim de gerar retornos adicionais e reduzir os custos líquidos dos investidores, através dos quais os títulos do ETF são emprestados por uma taxa. As transações de empréstimo de títulos de ETFs do UBS são sobrecolateralizadas a um mínimo de 105%.

No caso de replicação física otimizada, o ETF detém uma amostra dos títulos do índice subjacente. Ferramentas analíticas e procedimentos matemáticos de otimização são implementados para definir um subconjunto dos constituintes do índice que alcançarão um retorno semelhante ao das ações originais representadas no índice. O método de replicação física otimizado pode ser utilizado para aumentar a liquidez e minimizar o erro de rastreamento.

O método de replicação física otimizada é particularmente adequado para índices de base muito ampla. Por exemplo, o MSCI World Index compreende aproximadamente 1.600 ações de diversos mercados, jurisdições e zonas monetárias. Assim, a replicação física completa do índice envolveria altos custos de transação. Alguns desses títulos são pouco líquidos ou têm um impacto mínimo no desempenho do Índice devido à sua baixa ponderação. Os custos de transação podem ser reduzidos excluindo esses títulos.

- O ETF está na posse física de um subconjunto dos componentes do índice, que é utilizado quer para índices de base muito ampla, quer para índices com títulos ilíquidos

- São implementados procedimentos de optimização a fim de reduzir os custos de transação, aumentar a liquidez e minimizar os erros de seguimento

- Alguns ETFs emprestam títulos da sua carteira por uma taxa

Empréstimo de títulos

Uma série de ETFs selecionados que reproduzem fisicamente os índices, dedicam-se ao empréstimo de títulos a fim de gerar retornos adicionais e reduzir os custos líquidos dos investidores, através do qual os títulos do ETF são emprestados por uma taxa. As transações de empréstimo de títulos de ETFs de UBS são sobrecolateralizadas a um mínimo de 105%.

Vários fatores contribuem para o preço dos ETFs e afetam os custos individuais dos mesmos. O custo total de possuir um ETF depende em grande parte da estratégia de carteira escolhida, bem como da classe de ativos em que o fundo investe. As comissões dos ETFs são mais baixas do que os fundos de investimento tradicionais, no entanto, têm uma grande variedade de condições de preços diferentes. Os spreads dos ETFs também variam em relação à atividade do ETF.

A diferença de seguimento é a diferença entre o desempenho do fundo e o desempenho do índice. O desempenho do fundo representa todos os custos relevantes para o fundo e todos os fluxos de rendimento para o fundo. Tanto o rácio de despesas totais (total expense ratio) do ETF como a diferença de seguimento são publicados no relatório semestral e anual do fundo.

O rácio de despesas totais é o rácio entre os custos totais e a dimensão média do fundo durante um ano fiscal. Os custos são definidos como todas as despesas na demonstração de resultados, incluindo gestão, administração, custódia, auditoria, honorários legais e de consultoria (despesas operacionais). O rácio da despesa total do ETF é expresso retrospetivamente como uma percentagem dos ativos médios do fundo e é calculado de acordo com as diretrizes sobre o cálculo e divulgação do TER dos sistemas de investimento coletivo.

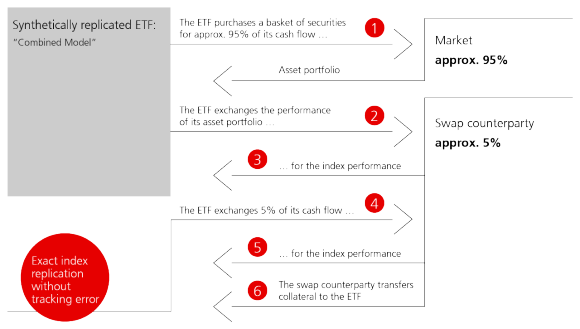

No caso da replicação do índice sintético, o desempenho do índice subjacente ao ETF é alcançado através de um swap. O ETF celebra um acordo de swap com um banco de investimento, a contraparte do swap. O conteúdo deste acordo é a transferência dos fluxos de caixa do ETF para a contraparte do swap, que em troca garante o desempenho do índice associado ao ETF. O risco associado ao seguimento preciso do índice é transferido do ETF para a contraparte do swap. Como a propriedade física dos títulos representados no índice já não é um pré-requisito para a participação no desempenho do índice, é possível acompanhar eficazmente os mercados que, por exemplo, são impossíveis ou de difícil acesso devido a restrições de negociação.

O UBS emprega duas estruturas de swap diferentes em replicação sintética: o swap totalmente financiado e um modelo combinado (swap de retorno total e carteira de ativos com swap totalmente financiado)

Modelo combinado: Carteira de ativos e swap de retorno total mais swap totalmente financiado (AP & TRS + FFS)

Neste método de replicação, as subscrições do ETF são investidas num rácio de aproximadamente 95:5 numa carteira de ativos (a "carteira de ativos") e num swap totalmente financiado.

Carteira de ativos e swap de retorno total (AP & TRS)

Cerca de 95% dos ativos do fundo são utilizados pelo ETF para comprar um cabaz de títulos, a carteira de ativos. O cabaz consiste numa carteira diversificada e líquida de ações de mercados desenvolvidos e é optimizada com base em considerações de liquidez. O ETF também celebra um acordo de swap não financiado com a contraparte do swap para trocar os retornos desta carteira pelo desempenho desejado do índice. A contraparte do swap gera este desempenho ao investir em títulos e derivados que reproduzem o desempenho do índice.

Swap totalmente financiado (FFS)

Os restantes ativos do fundo (aproximadamente 5%) são utilizados pelo ETF para celebrar um acordo de swap totalmente financiado com a contraparte de swap, ao abrigo do qual a contraparte de swap concorda em fornecer o desempenho do índice.

Exposição à contraparte de swap

A fim de proteger o ETF contra o risco de incumprimento da contraparte do swap pelas suas obrigações, a contraparte do swap transfere garantias para o ETF sob a forma de obrigações governamentais do G10, obrigações supranacionais e liquidez. O montante de garantia transferido está sujeito a haircuts e os ativos de garantia são detidos num banco depositário externo em nome do ETF (transferência de propriedade). O ETF tem acesso imediato ao colateral no caso de a contraparte do swap faltar ao cumprimento das suas obrigações.

- O ETF compra um cabaz de títulos com aproximadamente 95% do seu dinheiro.

- O ETF promete o desempenho do cabaz à contraparte do swap.

- A contraparte de swap promete em troca o desempenho exato do índice (menos uma taxa).

- O ETF realiza um swap totalmente financiado com a contraparte de swap por aproximadamente 5% do seu dinheiro.

- A contraparte de swap deve o desempenho do índice exato (menos uma taxa).

- A contraparte do swap transfere colateral para o ETF sob a forma de obrigações governamentais do G10, obrigações supranacionais e liquidez. O montante da garantia transferida está sujeito a haircuts.

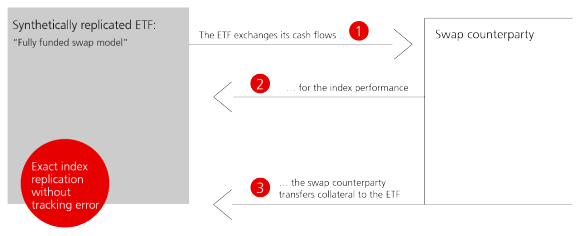

Modelo de swap totalmente financiado

Neste método de replicação, a ETF transfere dinheiro para a contraparte de swap e em troca recebe o desempenho do índice através de um contrato de swap. A fim de proteger o ETF contra o risco de incumprimento da contraparte de swap pelas suas obrigações, a contraparte de swap transfere garantias para o ETF sob a forma de obrigações governamentais do G10, obrigações supranacionais e liquidez. O montante da garantia transferida está sujeito a margens de avaliação e os ativos de garantia são mantidos numa conta segregada num banco depositário externo em nome do ETF (transferência de propriedade). O ETF tem acesso imediato ao colateral no caso de a contraparte do swap faltar ao cumprimento das suas obrigações.

- A ETF participa num swap totalmente financiado com a contraparte do swap.

- A contraparte do swap deve o desempenho preciso do índice (menos uma taxa).

- A contraparte do swap transfere colateral para o ETF sob a forma de obrigações do governo do G10, obrigações supranacionais e numerário. O montante de garantia transferido está sujeito a cortes de margens.

Para todos os ETFs sintéticos do UBS, o UBS Investment Bank é a contraparte exclusiva para todas as transações de swap OTC. No entanto, a UBS ETF controla a solvabilidade da contraparte numa base regular. O controlo é efetuado pelos diretores do conselho nas reuniões trimestrais. Se as circunstâncias do mercado o exigirem, o controlo pode mesmo realizar-se numa base ad-hoc. Embora o UBS Investment Bank seja a única contraparte dos acordos de swap da UBS ETF, a fixação de preços é testada através de uma série de bancos de painel externos, pelo menos numa base anual. Se um banco do painel oferecer condições mais favoráveis, então o UBS Investment Bank tem a capacidade de celebrar um acordo de swap back-to-back com o banco painel, a fim de alcançar preços competitivos para os ETFs. Sempre que permitido e operacionalmente possível, utilizamos múltiplas contrapartes FX para facilitar a nossa execução FX.

No empréstimo de títulos do ETF, o credor (UBS ETF) transfere um certo número de títulos da carteira de ETF para um terceiro (tomador do empréstimo) por um período acordado em troca de uma comissão.

- Os ETFs do UBS só se dedicam ao empréstimo de títulos para ETFs de replicação física selecionados domiciliados na Suíça, Irlanda, e Luxemburgo.

- O objetivo é reduzir os custos líquidos dos investidores através de rendimentos adicionais.

- As transações de empréstimo de títulos dos ETFs UBS estão sobrecolateralizadas a um mínimo de 105%.

- Um haircut é aplicado adicionalmente aos ETFs domiciliados na Suíça.

- A cuidadosa selecção dos tomadores de empréstimos e a avaliação diária das garantias a preços de mercado servem para minimizar o risco.

- Elevado grau de transparência através da publicação diária dos ativos de colateral para cada subfundo.

Sim, alguns UBS fisicamente replicados ETFs domiciliados no Luxemburgo, Irlanda e Suíça participam em empréstimos de títulos. No entanto, no caso de Rendimento Fixo, ESG/SRI e ETFs de metais preciosos, a sociedade gestora do fundo não efetua quaisquer transações de empréstimo.

O empréstimo de títulos pelo fundo gera receitas adicionais (normalmente 1-20 bp, dependendo do índice). As receitas de empréstimo de títulos refletem-se no NAV, reduzindo diretamente o custo líquido para os investidores.

O tomador do empréstimo paga ao ETF uma taxa pela duração do período de empréstimo de títulos. Além disso, todos os direitos, tais como cupões ou dividendos pagos sobre os títulos durante o empréstimo, são transferidos para a ETF sob a forma de um pagamento manufaturado. Como tal, o empréstimo de títulos permite ao fundo gerar receitas adicionais, que se refletem no valor patrimonial líquido (NAV) e, como resultado, reduzem diretamente os custos líquidos para os investidores.

De acordo com a diretiva UCITS de fundos europeus e a Swiss CISA, o empréstimo de títulos pode ir até 100%. As taxas reais de empréstimo para ETFs do UBS têm sido consideravelmente mais baixas. Os ETFs do UBS fixaram um limite máximo de 50% do valor patrimonial líquido de um ETF em empréstimos de títulos, enquanto alguns estão limitados a 25%, a fim de satisfazer as exigências do mercado.

Para minimizar o risco de empréstimo de títulos para ETFs UBS, os tomadores de empréstimos são cuidadosamente selecionados e monitorizados diariamente. Antes de receberem os títulos, devem fornecer ao emprestador - o ETF - uma garantia. Os ativos de garantia servem para garantir as obrigações do tomador do empréstimo para com o credor. A garantia é transferida para uma conta de custódia completamente separada ou para uma conta de garantia que é delimitada do balanço do emprestador.

O empréstimo de títulos pode ser rescindido diariamente, a pedido do emprestador. Uma avaliação diária a preços de mercado dos empréstimos e garantias garante que o valor das garantias prestadas pelo mutuário é sempre ajustado ao nível correto. Além disso, as transações de empréstimo de títulos de ETFs UBS são sempre sobrecolateralizadas a um mínimo de 105%. Para ETFs residentes na Suíça, é adicionalmente aplicada uma margem de avaliação às garantias subjacentes. O empréstimo de títulos cessa quando é rescindido pelo ETF ou quando a procura do tomador do empréstimo é satisfeita. A garantia detida só é devolvida ao tomador do empréstimo depois de os títulos terem sido devolvidos ao ETF.

O agente de empréstimo de títulos para ETFs domiciliados no Luxemburgo é o State Street Bank International GmbH, Munique, Alemanha, e State Street Bank and Trust Company. Para as ETFs UBS suíços, a UBS Switzerland AG actua como o único tomador de empréstimo (principal) no programa de empréstimo.

O State Street age como agente emprestador. A lista de mutuários do agente emprestador é aprovada pelos representantes do UBS. Além disso, coincide com a lista de contrapartes do UBS. O risco de contraparte é controlado diariamente pelo agente de empréstimo, State Street. O State Street também prevê uma indemnização por incumprimento no caso de um tomador de empréstimo ser incapaz de devolver títulos. As transações de empréstimo de títulos dos ETFs do UBS são totalmente garantidas.

O UBS Switzerland AG é o único tomador do empréstimo (principal) em relação aos ETF e garante todos os deveres contratuais. Para proteger o ETF contra o risco de contraparte do UBS, o UBS Switzerland AG fornece garantias de acordo com os rigorosos regulamentos FINMA (Collective Investment Schemes Ordinance).

- Os termos da troca são acordados entre o agente emprestador e o tomador do empréstimo, e os colaterais são entregues.

- Uma vez recebidas as garantias pelo agente emprestador, os títulos emprestados são transferidos para o tomador do empréstimo.

- O credor (ou seja, o ETF) continua a ser o proprietário beneficiário da garantia emprestada. Como tal, o agente de empréstimo cobra todos os direitos pagos sobre cada garantia durante o empréstimo e devolve-os ao emprestador como um pagamento manufaturado. O credor encontra-se na mesma posição económica como se a garantia não tivesse sido emprestada.

- O tomador do empréstimo paga ao agente emprestador a taxa de empréstimo pré-acordada. Os pagamentos são acordados e efetuados numa base mensal.

- O tomador do empréstimo devolve os títulos assim que a procura é satisfeita, ou antes, se o emprestador liquidar uma posição. Todas as transações são resgatáveis a pedido numa base diária e nenhuma transação a prazo fixo é realizada.

- Uma vez que o título tenha sido devolvido à conta de custódia do emprestador, o agente emprestador devolve as garantias detidas ao tomador do empréstimo.

- Os ETFs UBS deram o mandato de empréstimo de títulos ao UBS Switzerland AG, agindo como principal fornecedor de empréstimo de títulos.

- O UBS Switzerland AG reutiliza os títulos emprestados de acordo com a procura dos tomadores de empréstimo externos e de fontes internas do UBS. O UBS Switzerland AG lida com tomadores de empréstimos externos e internos numa base at-arms-length.

- Os ETFs do UBS só têm risco de crédito para o UBS Switzerland AG, mas não para os tomadores de empréstimos externos.

- As taxas recebidas do tomador do mercado são partilhadas de acordo com um acordo pré-acordado de divisão de taxas entre o UBS ETF e o UBS Switzerland AG.

- No caso de uma garantia ser emprestada numa data em que ocorre um evento relevante, o UBS Switzerland AG passa todas as operações corporativas para a ETF. Os cupões e dividendos serão pagos ao ETF através de um pagamento substituto, assegurando que a ETF está economicamente pelo menos na mesma posição que estaria se os títulos não tivessem sido emprestados numa data com eventos corporativos relevantes.

- A UBS Switzerland AG devolverá os títulos ao ETF no termo do empréstimo, ou se o ETF desejar recuperar os títulos, por exemplo, no caso de uma venda. O gestor da carteira do ETF pode vender títulos em qualquer altura, mesmo que estes estejam emprestados. Por este motivo, o empréstimo de títulos não interfere com o processo de investimento principal.

As transações de empréstimo de títulos para ETFs UBS estabelecidos no Luxemburgo são totalmente colateralizadas. O regulador luxemburguês exige uma colateralização mínima de 90%; no entanto, os ETFs UBS são sobrecolateralizados a 105%.

As garantias são mantidas numa conta de custódia que é separada do balanço do agente de empréstimo. Outras medidas de mitigação do risco são uma cuidadosa selecção dos mutuários e uma reavaliação diária dos empréstimos e garantias.

Empréstimos de títulos para ETFs domiciliados no Luxemburgo e na Irlanda

Para ETFs UBS domiciliados no Luxemburgo e na Irlanda, que se dedicam ao empréstimo de títulos, são correntemente aceites os seguintes tipos de garantias:

- As acções dos seguintes índices são aceitáveis: AS30, ATX, BEL20, SPTSX, KFX, HEX25, CAC, DAX, HSI, FTSE, MIB, NKY, AEX, OBX, STI, IBEX, OMX, SMI, SPX, INDU, NYA, CCMP, RAY, UKX, SX5P, N100 e E100

- São aceitáveis obrigações governamentais dos seguintes países: Austrália, Áustria, Bélgica, Canadá, Dinamarca, Finlândia, França, Alemanha, Japão, Países Baixos, Nova Zelândia, Noruega, Suécia, SNB Bills, Reino Unido e EUA (incluindo agências)

Fonte: State Street, Fevereiro 04, 2022

Tipo e nível de colateralização exigido para ETFs* domiciliadas no Luxemburgo e Irlanda

Tipo de títulos emprestados | Tipo de títulos emprestados | Tipo de colateral Obrigações governamentais | Tipo de colateral Obrigações governamentais | Tipo de colateral Ações internacionaisies | Tipo de colateral Ações internacionaisies | |

|---|---|---|---|---|---|---|

Tipo de títulos emprestados | Ações internacionais | Ações internacionais | Tipo de colateral Obrigações governamentais | 105% | Tipo de colateral Ações internacionaisies | 105% |

Tipo de títulos emprestados | Acções dos EUA | Acções dos EUA | Tipo de colateral Obrigações governamentais | 105% | Tipo de colateral Ações internacionaisies | 105% |

As transações de empréstimo de títulos para ETFs UBS de residentes na Suíça são totalmente colateralizadas. O UBS Switzerland AG tem um sólido sistema de garantias que está de acordo com a Portaria sobre Organismos de Investimento Coletivo da FINMA.

Os ETFs UBS recebem garantias com um valor colateral de 105% do valor de mercado dos títulos emprestados. O colateral consiste em ativos líquidos, incluindo obrigações governamentais, ações líquidas e obrigações com uma notação mínima estipulada por uma das agências de notação aprovadas pela FINMA. Ao determinar o valor colateral de um título, o seu valor de mercado é reduzido por um haircut de até 8%.

Vários limites de concentração asseguram uma diversificação e liquidez adequadas da carteira de garantias.

Um processo diário de mark-to-market assegura que o valor do colateral é actualizado para refletir o valor do empréstimo.

As garantias são mantidas em nome do emprestador numa conta de garantia segregada que está afastada do balanço do UBS Switzerland AG.

Empréstimo de títulos para ETFs domiciliados na Suíça

Para os ETFs UBS de origem suíça que se envolvem em empréstimos de títulos, os seguintes tipos de títulos são atualmente aceites como garantia (excluindo títulos da contraparte devedora):

- Obrigações governamentais emitidas pelos países do G10. Obrigações do Estado não emitidas nos EUA, Japão, Reino Unido, Alemanha ou Suíça devem ter pelo menos uma notação "A" ou equivalente

- Obrigações de empresas com notação mínima de "A" ou equivalente

- Ações emitidas por empresas representadas nos seguintes índices: AEX, ATX, BEL20, CAC, DAX, INDU, UKX, HEX25, KFX, OMX, OBX, SMI, SPI, SPX, SX5E

Fonte: UBS Switzerland AG, 20 de Setembro de 2021

Haircuts e margem*

É acrescentada uma margem de 5% ao valor de mercado dos títulos emprestados para determinar a exigência de garantia. O valor colateral de um título é igual ao seu valor de mercado menos um haircut, conforme a tabela abaixo:

Ações internacionais | 8% | ||

Obrigações governamentais emitidas pelos EUA, JP, UK, DE, CH | 0% | ||

Obrigações governamentais com um rating mínimo de "A" (excluindo EUA, UK, DE, CH) | 2% | ||

Títulos corporativos com pelo menos uma classificação 'A | 4% |

O UBS limitou a concessão de empréstimos por qualquer um dos ETF de UBS a 50% dos seus ativos sob gestão. Na prática e como regra, a proporção efectivamente emprestada é significativamente mais baixa

Ponha-se em contacto com a nossa equipa

Não hesite em solicitar-nos qualquer questão, teremos todo o gosto em atendê-lo.

Nina Petrini

Head ETF & Index Fund Sales Spain