Associe-se a uma das empresas de gestão de ETF de crescimento mais rápido do mundo com a perícia necessária para fornecer uma vasta gama de soluções para satisfazer as suas necessidades, e a experiência adquirida ao longo de mais de 30 anos de excelência.

Quer mais informações?

Quer mais informações?

Subscreva para receber as últimas perspetivas e insights dos mercados privados em todos os setores diretamente na sua caixa de entrada.

Opções

Em apenas uma transação, os investidores podem aceder a numerosos mercados através da nossa vasta seleção de ETFs entre ações, rendimento fixo, commodities, metais preciosos, e classes de ativos imobiliárias.

Especialização

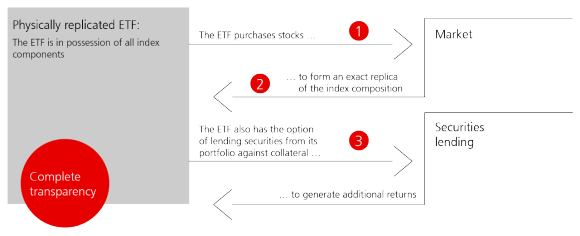

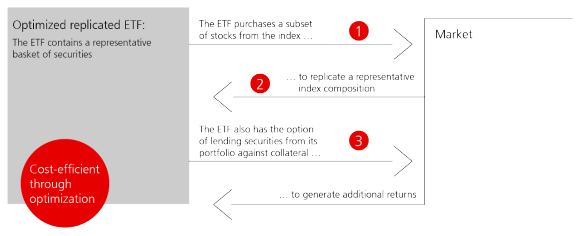

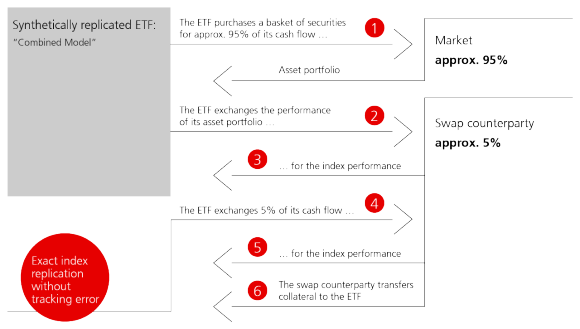

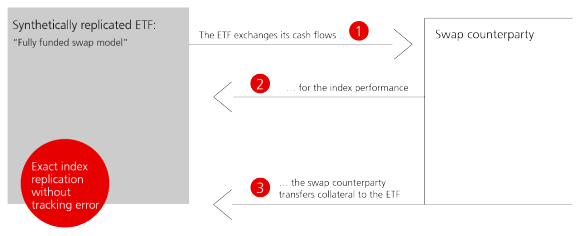

Pode beneficiar do nosso estatuto como um dos mais experientes provedores europeus de ETFs. Oferecemos estratégias de replicação de índices de alta qualidade, apoiadas por uma equipa de gestão de carteiras experiente e qualificada.

Reconhecimento

O reconhecimento como Sociedade referencia em Gestão Passiva no Ano 2021 pela Insurance Asset Risk EMEA Awards foi a mais recente prémio que ressalta as nossas capacidades em ETFs nos últimos anos.

Ações

Aceda aos principais mercados de ações numa única transação com a nossa vasta gama de ETFs UBS Equity.

Rendimento fixo

Invista em segmentos líquidos e bem diversificados do mercado de rendimento fixo, tais como corporativas, dívida soberana ou de Mercados Emergentes.

Cobertura cambial

Pode utilizar a nossa extensa gama de ETFs UBS com cobertura cambial para ajudar a proteger a sua carteira contra flutuações cambiais.

Commodities

Diversifique a sua carteira com os nossos ETFs económicos e líquidos focados em commodities.

Beta alternativo

Concentre-se em índices de fatores sistemáticos para seguir os mercados de uma forma mais sofisticada do que seguindo apenas a capitalização do mercado, ao mesmo tempo que se obtém benefícios de diversificação.

Soluções Climáticas

Reduza sua exposição ao carbono e dirija seu portefólio para um futuro net-zero com nossas soluções de ETF baseadas em regras e eficientes em termos de custos MSCI Climate Paris-Aligned e Climate Aware.

Investimento Sustentável

A nossa viagem sustentável começou em 2011 com o lançamento dos nossos primeiros quatro ETFs de SRI. Como pioneiros neste espaço, oferecemos uma vasta gama de soluções para o ajudar a atingir os seus objetivos ESG.

UBS ETF Capital Markets Weekly

Veja a nossa ETF Capital Markets Weekly. O documento destaca as atividades do mercado primário relevantes para ETFs UBS, as maiores transações do mercado secundário, uma análise do mercado, bem como um olhar sobre a semana que se avizinha. Desfrute da leitura e partilhe os seus comentários.

Negociação de ETF

UBS ETF Capital Markets

A equipa de ETF Capital Markets auxilia os clientes na sua jornada para entender a negociação de ETF e que a competição é a chave para a melhor execução. Uma má execução de ETF pode ser cara e anular os benefícios do invólucro ETF em termos de transparência, liquidez e certeza de execução.

Explore a negociação de ETF

A equipa de ETFs do UBS procura permanecer na vanguarda e ser proativa ao trazer novas soluções passivas que se ajustem à ampla variedade de preferências dos investidores modernos.

Clemens Reuter, Responsável Global de Cobertura de Clientes em ETF & Fundos Indexados

Ya sea que tenga una pregunta o una solicitud, estaremos encantados de ponernos en contacto con usted.

-

Nina Petrini

Head ETF & Index Fund Sales Spain

-