Investor Sentiment 2Q22

Principais conclusões

Principais conclusões

Inflação | Investidores preocupados quanto ao valor do seu dinheiro

Volatilidade | Os investidores permanecem otimistas devido ao retorno das coisas ao normal e à forte demanda dos consumidores

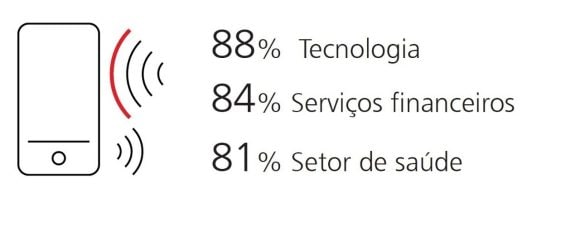

Oportunidades | Investidores interessados em investimentos em disrupção tecnológica e alternativos (p.ex., mercados privados)

Sentimento

Sentimento

Principais fontes de otimismo ...

... e de preocupação

Market outlook

Market outlook

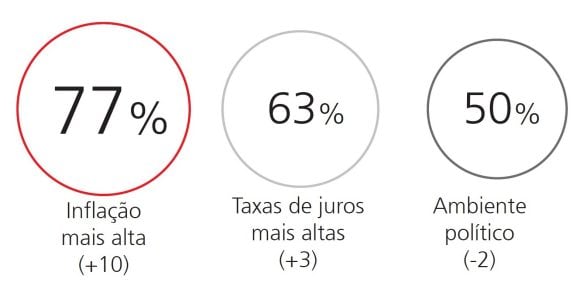

Investidores brasileiros ainda se deparam com ameaças em potencial

Pensamentos dos investidores brasileiros sob o ambiente atual

Temas de investimento mais atraentes

Ativos com maior probabilidade de serem investidos

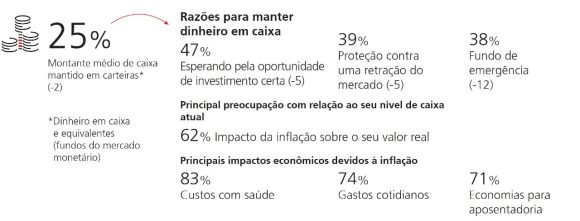

Dinheiro em caixa e equivalentes

Dinheiro em caixa e equivalentes

Investidores brasileiros reduzem suas alocações de caixa

Proprietários de empresas

Proprietários de empresas

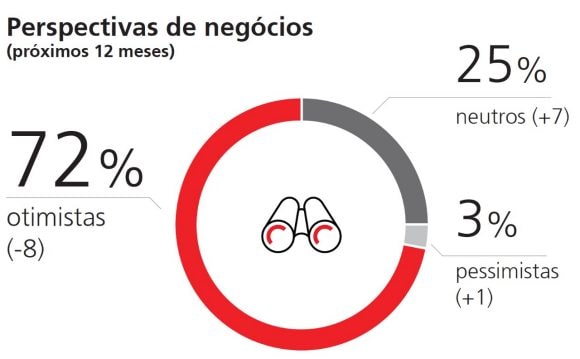

O sentimento dos proprietários de empresas brasileiros cai

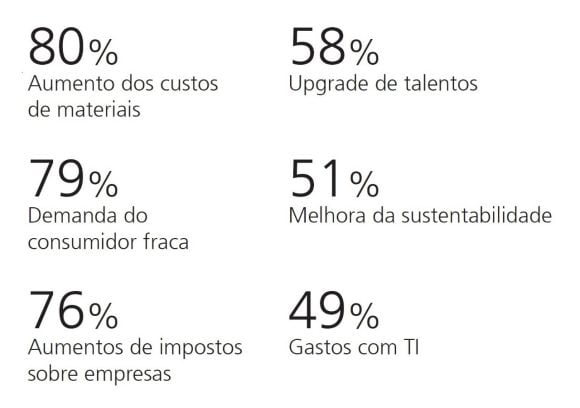

Principais preocupações

Prioridades de investimento para empresas (próximos 6 meses)

O UBS entrevistou 148 investidores e 52 proprietários de empresas no Brasil com no mínimo 1 milhão de dólares em ativos que podem ser investidos (no caso de investidores) ou no mínimo 1 milhão de dólares em receitas anuais e no mínimo um funcionário além de eles próprios (no caso de proprietários de empresa), de 29 de junho a 18 de julho. Para os resultados do 1T22, o UBS entrevistou 150 investidores e 50 proprietários de empresas no Brasil, de 30 de março a 14 de abril.

Este documento foi preparado pelo UBS AG, sua subsidiária ou afiliada (“UBS”). Este documento e as informações nele contidas são fornecidos exclusivamente para fins informativos e/ou educacionais. Não deve ser considerado como pesquisa de investimento, ou aconselhamento de investimento, prospecto de venda, oferta ou solicitação de oferta para ingressar em qualquer atividade de investimento, para comprar ou vender qualquer título, instrumento de investimento, produto ou outro serviço específico, ou como recomendação ou apresentação de qualquer instrumento de investimento ou serviços financeiros específicos, ou para efetuar quaisquer transações ou concluir qualquer ato legal de qualquer tipo. O UBS não faz nenhuma declaração ou garantia relacionada a quaisquer informações aqui contidas que sejam derivadas de fontes independentes. O destinatário não deve interpretar o conteúdo deste documento como consultoria de investimento, jurídica, fiscal ou de outra natureza profissional. Nem o UBS nem qualquer um de seus funcionários presta assessoria fiscal ou jurídica, e este documento não constitui tal assessoria.

Aprovado e publicado pelo UBS, este documento não pode ser redistribuído ou reproduzido no todo ou em parte ou ter cópias distribuídas sem a prévia autorização por escrito do UBS, e nenhuma responsabilidade pelas ações de terceiros a esse respeito é aceita. Na medida do permitido por lei, nem o UBS nem quaisquer de seus diretores, administradores, funcionários ou agentes aceitam ou assumem qualquer obrigação, responsabilidade ou dever de cuidado por quaisquer consequências, incluindo quaisquer perdas ou danos, de você ou qualquer outra pessoa agindo ou se abstendo de agir, com base nas informações contidas neste documento ou por qualquer decisão baseada nesse.

Important information in the event this document is distributed by the following domestic businesses

Brazil if distributed by UBS Brasil Administradora de Valores Mobiliarios Ltda. and/or by UBS Consenso Investimentos Ltda., both entities regulated by the Brazilian Securities Commission. This document is not intended to constitute a public offer under Brazilian law or a research analysis report as per the definition contained under CVM Instruction 598/2018 or an offer to buy or sell any services or specific products. This document cannot be considered a representation or a promise of the past or future.

Mexico UBS Asesores México, S.A. de C.V (“UBS Asesores”) UBS Asesores is a non-independent investment advisor due to the direct relation it has with UBS, AG a foreign financial institution. UBS Asesores was incorporated under the Securities Market Law. UBS Asesores is a regulated entity and it is subject to the supervision of the Mexican Banking and Securities Commission (Comisión Nacional Bancaria y de Valores, “CNBV”) registered under number 30060 before the CNBV, which exclusively regulates UBS Asesores regarding the rendering of portfolio management services when investment decisions are taken on behalf of the client, as well as on securities investment advisory services, analysis and issuance of individual investment recommendations, so that the CNBV has not surveillance over any other service provided by UBS Asesores. Such registry will not assure the accuracy or veracity of the information provided to its clients. UBS Asesores is not part of any Mexican financial group, is not a bank and does not receive deposits or hold securities. UBS Asesores does not offer guaranteed returns. UBS Asesores has disclosed any conflict of interest that it is aware of. UBS Asesores does not advertise any banking services and can only charge the commissions expressly agreed with their clients for the investment services actually rendered. UBS Asesores will not be able to receive commissions from issuers or local or foreign financial intermediaries that provide services to their clients.

UK UBS AG is registered as a branch in England and Wales Branch No. BR004507 (a public company limited by shares, incorporated in Switzerland whose registered offices are at Aeschenvorstadt 1, CH-4051, Basel and Bahnhofstrasse 45, CH-8001 Zurich). Registered Address: 5 Broadgate, London EC2M 2QS. Authorised and regulated by the Financial Market Supervisory Authority in Switzerland. In the United Kingdom, UBS AG is authorised by the Prudential Regulation Authority and subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. A member of the London Stock Exchange.

Important information in the event this document is distributed to US Persons or into the United States

Wealth management services in the United States are provided by UBS Financial Services Inc. (“UBSFS”), a subsidiary of UBS AG. UBSFS is a US registered broker/dealer offering securities, trading, brokerage services, and related products and services. UBSFS is a member of the Securities Investor Protection Corp. (SIPC) and is registered with the Financial Industry Regulatory Authority (FINRA). Private Wealth Management is a business unit within UBSFS.

As a firm providing wealth management services to clients, UBS Financial Services Inc. offers investment advisory services in its capacity as an SEC-registered investment adviser and brokerage services in its capacity as an SEC-registered broker-dealer. Investment advisory services and brokerage services are separate and distinct, differ in material ways and are governed by different laws and separate arrangements. It is important that you understand the ways in which we conduct business, and that you carefully read the agreements and disclosures that we provide to you about the products or services we offer. For more information, please review client relationship summary provided at ubs.com/relationshipsummary, or ask your UBS Financial Advisor for a copy.

Sustainable investing strategies aim to incorporate environmental, social and governance (ESG) considerations into investment process and portfolio construction. Strategies across geographies and styles approach ESG analysis and incorporate the findings in a variety of ways. The returns on portfolios consisting primarily of sustainable investments may be lower or higher than portfolios where ESG factors, exclusions or other sustainability issues are not considered, and the investment opportunities available to such portfolios may also differ.

© UBS 2022. The key symbol and UBS are among the registered and unregistered trademarks of UBS. All rights reserved. UBS Financial Services Inc. is a subsidiary of UBS AG.Member FINRA/SIPC. 2022-885750, Review Code: IS2204155, Approval date: 07/31/2023, Exp.: 07/25/2022