China fixed income: what is Bond Connect?

Bond Connect opened another channel into China's onshore fixed income markets to global investors when it began on July 3, 2017. Here we explain in detail how Bond Connect works, what benefits it offers investors, and how it has performed.

China Bond Connect – Three Key Investor Takeaways

China Bond Connect – Three Key Investor Takeaways

- Bond Connect is an investment channel that gives overseas investors access to fixed income markets in Mainland China;

- Bond Connect is the fourth official channel for international investors to invest in China's onshore fixed income market, other official channels include China Interbank Bond Market (CIBM) Direct, Qualified Foreign Institutional Investor (QFII) Scheme, and RMB Qualified Foreign Institutional Investor (RQFII) Scheme.

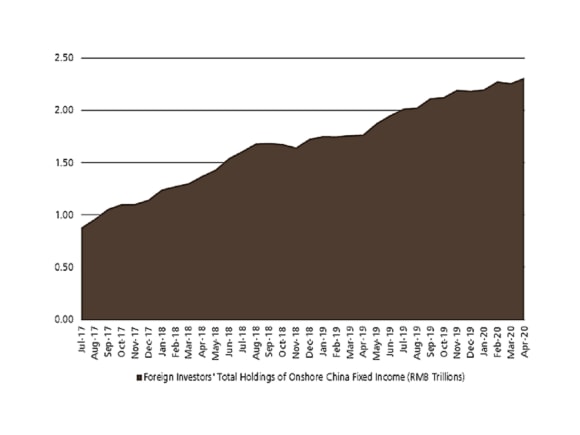

- Since Bond Connect started in July 2017, overseas investors' holdings of onshore China fixed income have grown from RMB 880 billion to RMB 2.31 trillion as of April 30, 2020, according to data from Shanghai Clearing House (SHCH) and China Central Depository & Clearing (CCDC).

What is Bond Connect?

What is Bond Connect?

Bond Connect is an investment channel that gives overseas investors access to fixed income markets in Mainland China via trading infrastructure in Hong Kong. The program began on July 3, 2017.

Currently, Bond Connect only handles 'Northbound' trading, i.e. overseas investors buying and selling bonds on markets in Mainland China.

Bond Connect is the fourth official channel for international investors to invest in China's onshore fixed income market.

China's onshore fixed income market is the second largest in the world, with a total of USD 13.7 trillion in outstanding bonds as of December 2019, according to the Bank of International Settlements.

Bond Connect is an investment channel that gives overseas investors access to fixed income markets in Mainland China

Other official channels for investment into China's bond markets include China Interbank Bond Market (CIBM) Direct, Qualified Foreign Institutional Investor (QFII) Scheme, and RMB Qualified Foreign Institutional Investor (RQFII) Scheme.

How is Bond Connect different to CIBM Direct?

How is Bond Connect different to CIBM Direct?

Operationally, Bond Connect is based offshore, while CIBM Direct is based onshore.

CIBM Direct gives greater access to opportunities in onshore markets in terms of a wider range of counterparties you can deal with, and also access to a wider range of products, like repos and interest rate swaps.

Additionally, CIBM Direct trades in CNY rather than CNH, and allows investors to hold onshore balances in CNY.

That's different to Bond Connect, which may not allow an investor to hold CNY balances, instead requiring investors to exchange them into CNH, which runs a basis risk each time funds are repatriated.

CNH refers to the Chinese Yuan (RMB) traded in offshore markets.

CNY refers to Chinese Yuan (RMB) traded in onshore markets.

Category/Bond Connect/CIBM | Category/Bond Connect/CIBM | Bond Connect | Bond Connect | CIBM | CIBM |

|---|---|---|---|---|---|

Category/Bond Connect/CIBM | Investment objectives | Bond Connect | Fixed Income only | CIBM | Fixed Income only |

Category/Bond Connect/CIBM | Source of funds | Bond Connect | Foreign currencies/offshore RMB | CIBM | Foreign currencies/offshore RMB |

Category/Bond Connect/CIBM | Liquidity requirement | Bond Connect | No lock-up | CIBM | No lock-up |

Category/Bond Connect/CIBM | Quota availability | Bond Connect | No quota for medium-to-long-term investors | CIBM | No quota |

Category/Bond Connect/CIBM | Certainty of order filling | Bond Connect | Not affected by availability of market quota | CIBM | Not affected by availability of market quota |

Additionally, the account opening process is more streamlined on Bond Connect, taking between six-to-eight weeks to get set up, compared to between six-and-12 weeks on CIBM Direct.

Bond Connect & CIBM Direct: Advantages & Disadvantages

Bond Connect & CIBM Direct: Advantages & Disadvantages

Channel/Bond Connect Northbound/CIBM Direct | Channel/Bond Connect Northbound/CIBM Direct | Bond Connect North Bound | Bond Connect North Bound | CIBM Direct | CIBM Direct |

|---|---|---|---|---|---|

Channel/Bond Connect Northbound/CIBM Direct | Advantages | Bond Connect North Bound | Trading through offshore trading platforms that investors are familiar with | CIBM Direct | OTC trading with all CFETS members |

Investors are registered as direct CFETS member | Dedicated service from the Bond Settlement Agents | ||||

Bond coupons and repayment will be automatically repatriated back to Hong Kong on the date of payment | Wider scope of hedging tools are available including FX (Spot, Forward, Swap, Options), bond lending, bond forward, IRS, CCS, FRA | ||||

Nominee account structure: Bonds will be held through sub-custodian in the CMU account. No need to open accounts with CDC/SCH | Direct trading in CNY | ||||

CNY FX conversion and derivatives can be traded with offshore CFETS FX settlement bank. Offshore documentations are used for derivative hedging transactions |

| ||||

Channel/Bond Connect Northbound/CIBM Direct | Disadvantages | Bond Connect North Bound | Only FX hedging tools are available | CIBM Direct | Except for Central Banks, investors need to trade bonds and FX hedge through their appointed Bond Settlement Agents |

Trading with Bond Connect Market Makers only | Onerous documentation including service agreement with BSAs, account opening with CFETS/CDC/SCH | ||||

Excess cash from trading or coupon payments is swept back into CNH | Onshore documentation for derivatives hedging transactions |

How has Bond Connect changed since it was launched in July 2017?

How has Bond Connect changed since it was launched in July 2017?

There have been a number of changes to Bond Connect in recent years, including:

- Introduction of block trading: allowing investors to allocate block trades to multiple client accounts prior to the trades. This change was announced in August 2018 by the Bond Connect Company.

- Implementation of delivery-versus-payment (DvP): in August 2018 all transactions began trading via DvP, ensuring that payment and delivery of securities occur simultaneously, thus reducing or eliminating exposure to settlement risk.

- Tax exemptions: three-year tax exemptions from corporate income tax and value-added tax on interest income derived by overseas investors from their investments in China's bond markets were announced by China's Ministry of Finance and State Administration of Taxation on November 22, 2018.

How much investment has flowed into China's fixed income markets via Bond Connect?

How much investment has flowed into China's fixed income markets via Bond Connect?

Net figures for inflows into China's onshore fixed income market via Bond Connect are not available.

Since the start of Bond Connect in July 2017, overseas investors' total holdings of China onshore fixed income have grown from RMB 880 billion to RMB 2.31 trillion as of April 30, 2020, according to data from Shanghai Clearing House (SHCH) and China Central Depository & Clearing (CCDC)

Foreign Investors' Total Holdings of Onshore China Fixed Income (RMB Trillions), Jul 2017-Apr 2020.