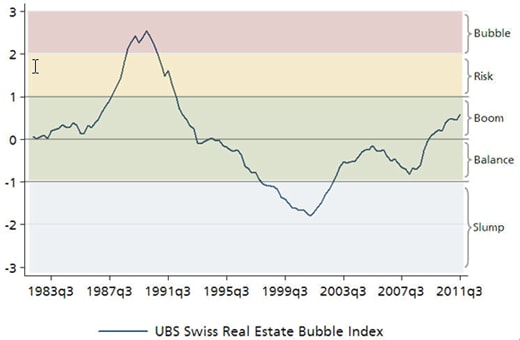

The quarterly UBS Swiss Real Estate Bubble Index currently stands at a level of 0.58. This represents an increase of 0.13 index points compared to the prior quarter.

Tracking current values, the UBS Swiss Real Estate Bubble Index utilizes the following risk-based level system: slump, balance, boom, risk and bubble. A value of 0.58 corresponds to the boom level and implies no elevated risk of a Switzerland-wide correction. Only when the index surpasses a value of 1 is the market considered risky. The index reached its peak in the early 1990s at a level of 2.5 at the height of the last Swiss real estate bubble.

Four of the six sub-indices rose in the third quarter of 2011. Strikingly, loan applications for real estate purchased for leasing increased further despite being at a high level already. Neither is any trend reversal in sight for household mortgage debt. The relatively small increase in nominal house prices has had a cooling effect on the market.

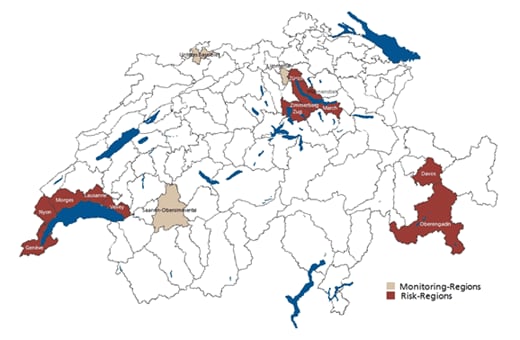

In parallel with the UBS Swiss Real Estate Bubble Index, UBS Switzerland also publishes a regional risk map showing risk and potential risk regions (known as monitoring regions). These are defined as regions that represent a substantial risk to the Swiss real estate market due to their potential for a correction in regional home prices. The selection of risk regions is directly linked to the UBS Swiss Real Estate Bubble Index.

The Oberengadin and Morges regions are now counted among the risk regions. The Zurich, Geneva and Lausanne regions remain Switzerland’s most risky as a result of their national importance. Other regions still considered risky include the large metropolitan areas of Zug, Pfannenstiel, March, Vevey, Nyon and Zimmerberg, as well as the tourist region of Davos. Limmattal is still one of the monitoring regions, and the Unteres Baselbiet and Saanen-Obersimmental regions have been newly added to this group.

UBS Swiss Real Estate Bubble Index

Regional risk map

Method

The UBS Swiss Real Estate Bubble Index comprises six sub-indices that track: the relationship between purchase and rental prices, the relationship between house prices and household income, the development of house prices relative to inflation, the relationship between mortgage debt and income, the relationship between construction and gross domestic product (GDP) and the proportion of credit applications for residential property not intended for owner occupancy by UBS clients.

Our selection of risk regions is tied to the level of the UBS Swiss Real Estate Bubble Index and is based on a multi-level selection process utilizing regional population and property price data.

UBS AG

Kontakte:

Dr. Daniel Kalt, Chief Economist Switzerland

Tel. +41 44 234 25 60

Claudio Saputelli, Head of WM Real Estate & Swiss Regional Research

Tel. +41 44 234 39 08

Dr. Matthias Holzhey, Economist WM Real Estate & Swiss Regional Research

Tel. +41 44 234 71 25

The next date of publication for the UBS Swiss Real Estate Bubble Index is 3 February, 2012.