Benefit from our advisory approach

- Set goals in lifeTogether we find out what your short- and long-term goals are in life.

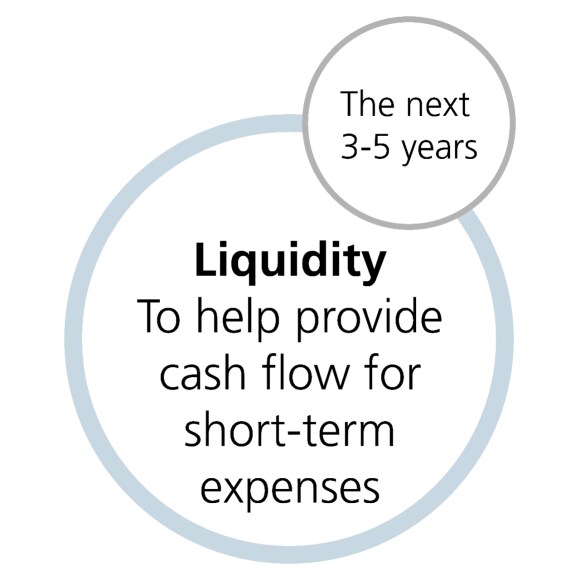

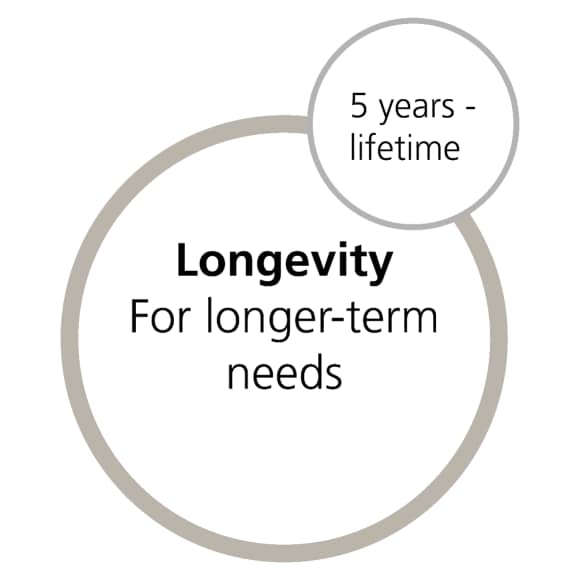

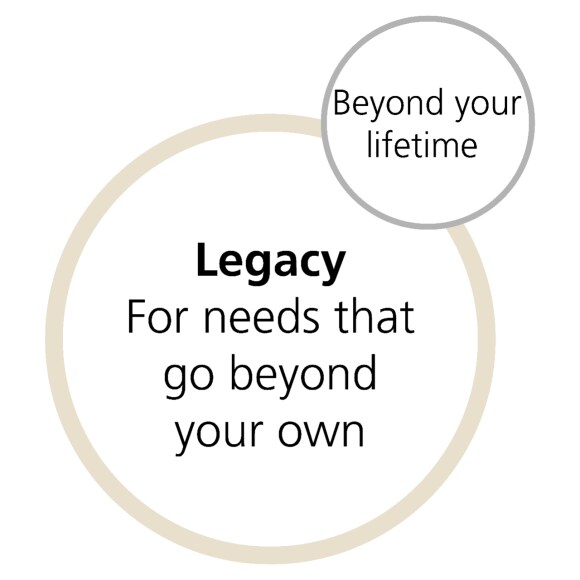

- Work out a planWe structure your wealth and draw up an individual plan along the three strategies of liquidity, longevity and legacy.

- Carry out a "check-up"We make sure you are still on track once a year or if any major changes occur in your life.

Our three key Wealth Way strategies

Liquidity for today

You always have enough liquidity to maintain your current lifestyle, for example:

- Entertainment and vacations

- Tax payments

- Safety margin

Longevity for tomorrow

You use your wealth for the long term to preserve your assets whilst achieving all your life goals, for example:

- Retirement security

- Expenses for health and long-term care

- Purchase of a second home

Legacy for others

You define what is important to you and how you want to help future generations or society, for example:

- Legacy for your family

- Philanthropy

- Wealth transfer to future generations

Define your path with UBS Wealth Way

What are your goals and priorities?

Asking relevant questions helps you know where you‘re going.

What do you want to accomplish in your life?

Who are the people that matter most to you?

What do you want your legacy to be?

What are your main concerns?

How do you plan to achieve your life's vision?

Financial advice for your individual needs

The price and value of investments and income derived from them can go down as well as up. You may not get back the amount originally invested.

UBS does not provide tax or legal advice. You should consult your independent tax/legal advisor for specific advice before entering into or refraining from entering into any services or investments.