The value of collecting

When it comes to collecting, it's passion over profit

Passion. Beauty. Culture.

Passion. Beauty. Culture.

Wealthy investors have many reasons for building collections of art, antiques, automobiles and more. Profit is rarely one of them.

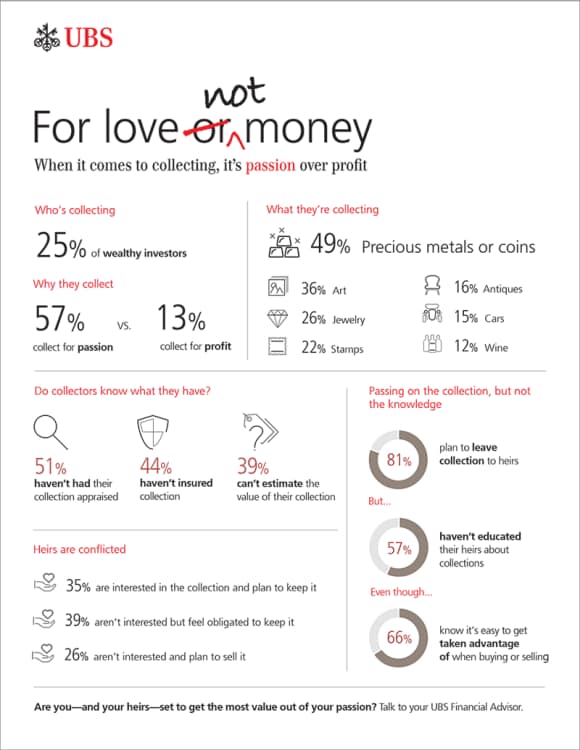

In this issue of UBS Investor Watch, we found that a quarter of wealthy investors are collectors. They spend significant time and money building their collections, driven by a deep passion for their subject.

Though motivated by passion, most collectors consider their collections to be valuable, estimating them at 10% or more of their net worth. Despite this, many collectors fail to treat their collections as a meaningful investment. For example, 51% of collectors have never sought an appraisal, and almost half have no insurance on their collection.

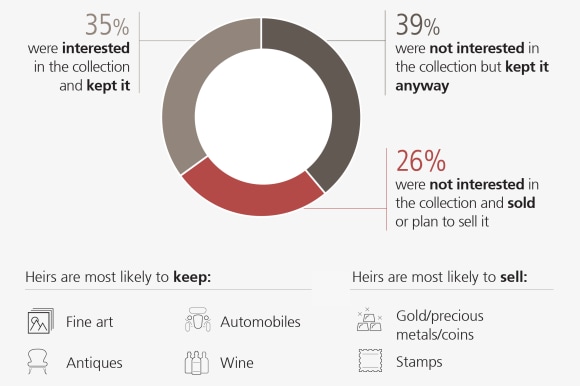

Overwhelmingly, collectors prefer to pass on their valuables to heirs rather than sell them. Yet few have educated their heirs on how to manage, appraise or sell the collection. Moreover, heirs are rarely enthusiastic about inheriting collectibles, though duty and guilt lead many to hold onto them.

Overall, just 35% of investors who inherited a collection had an interest in it. Objects, it seems, are easier to transfer than passion.

Many wealthy investors are committed to collecting…

Approximately 25% of wealthy investors consider themselves to be “collectors.” The majority has spent more than 20 years cultivating their hobby and consider their collections to be extensive.

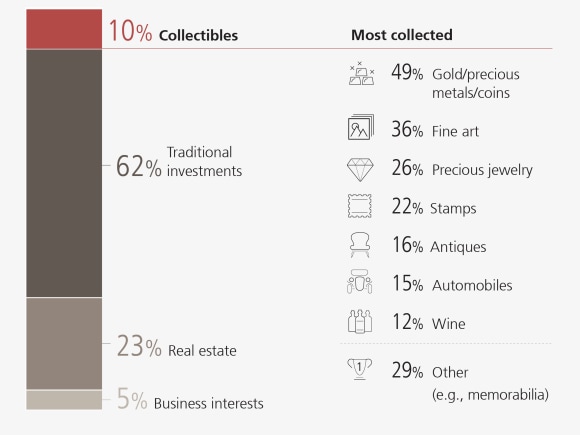

Most collectors view their valuables as part of their total wealth. Collectors estimate their collections represent 10% or more of their total wealth on average.

I’ve been collecting for many years. I’ve literally written a book about each of my collections.

Collectibles represent approximately 10% of collectors’ wealth

I bought my first piece in college as a reward to myself. I spend hours every week polishing, cleaning and looking for new pieces.

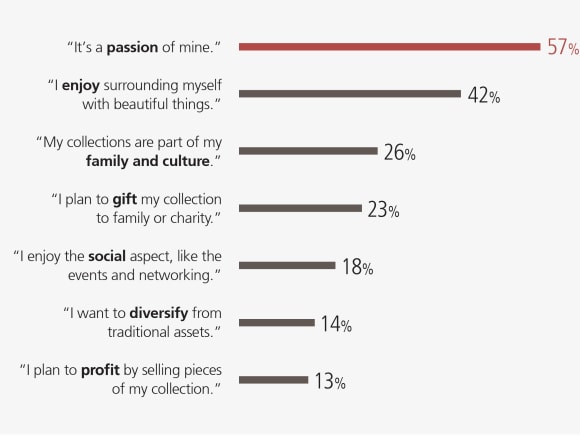

...and they are driven by passion, not profit

Few collectors are motivated by profit. Instead, they are driven to collect by passion for their hobby. In fact, 62% of collectors have never sold an object in their collection, generally because they have such strong emotional ties to it.

I collected for my pleasure. It just turned out to have more value than I realized as I was building it.

Passion is the primary reason for collecting

I’ve probably doubled my money from what I’ve invested in my collection, but that’s not the point. Collectibles are for fun.

Collectors willingly let their emotions dictate their decisions...

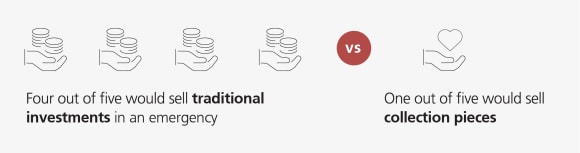

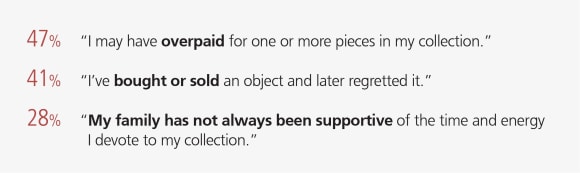

While pursuing their passion can be very fulfilling, many collectors believe they occasionally go overboard. Nearly half admit they have overpaid for specific objects, and many have bought or sold pieces they later regretted. If money is needed for an emergency, four out of five collectors would sell assets in their portfolio instead of parting with a piece from their collection.

I’ve been collecting for many years. I’ve literally written a book about each of my collections.

Collectors would rather disrupt their portfolio than their collection

Passion may be clouding judgment

I feel I have overpaid for some of my art. I just move on because I enjoy them.

…and they are often unaware of their collection’s true worth

Though collectors spend their lives building a collection, they often lose sight of its true value. Many can’t estimate what their collection is worth—and half have never had their collections appraised.Collectors generally rely on their own research when managing the financial aspects of their collection. Two in three have never discussed their collection with a financial advisor.

I rely on my own expertise to determine what I should buy. I purchase what I like and not so much for an appreciation in value.

Many collectors don’t know their collection’s value

Recently we’ve started thinking about everything we’ve acquired over several decades and realized it definitely has value. But it’s not something I think of as a source of income.

Most collectors intend to leave their collections to heirs…

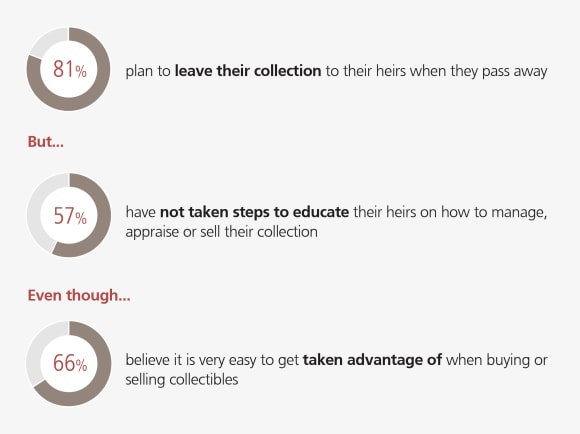

Eighty-one percent of collectors plan to leave their valuables to heirs, rather than sell them. Despite this, more than half of collectors have taken no steps to educate their heirs on how to manage, appraise or sell their collection. Yet, collectors say their biggest fear is that heirs won’t get a fair price if they sell the collection. Two out of three say it’s easy to get taken advantage of when buying or selling collectibles.

I will pass my collections down. I have no intention of selling them. I have one son and he will get everything.

Collectors are not preparing heirs for ownership

I worry that my kids will sell my collections for far less than their true value. I’m OK with them selling if they get a reasonable value.

…but heirs are reluctant to take ownership

Among investors who inherited a collection, nearly all felt honored to receive it. However, only one in three inheritors were interested in the collection and happily kept it. Another 39% had no interest in the collection, but obligation and guilt compelled them to keep it anyway. A quarter of inheritors sold or intend to sell the collection.

Part of me wants to sell the collection, but another part feels I should keep it since it was important to my mother.

Most heirs are not interested in collections

I wish my mother had sold her collection before she died. She could have sold it to individual collectors and maybe made more money. Instead I sold it at auction.

Wealth spotlight

The collecting bug is even stronger among wealthier investors...

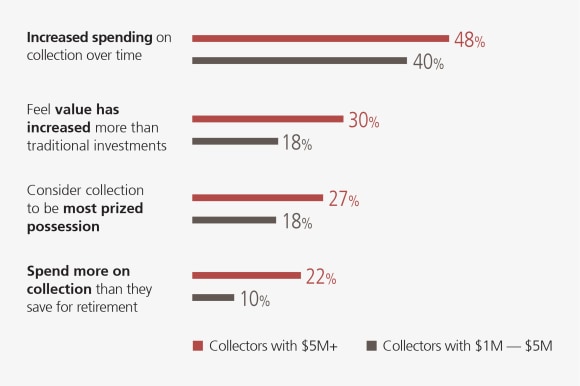

Wealthier investors (those with $5 million or more in investable assets) spend more time and money pursuing their hobby and are more likely to have built a very extensive collection. Wealthier collectors also feel they are getting more in return—in terms of both monetary appreciation and sentimental value.

It could be an investment. But for me, I just can’t think of parting with it. It’s more of a treasure.

Wealthier investors are more serious collectors

…who are more drawn to fine art

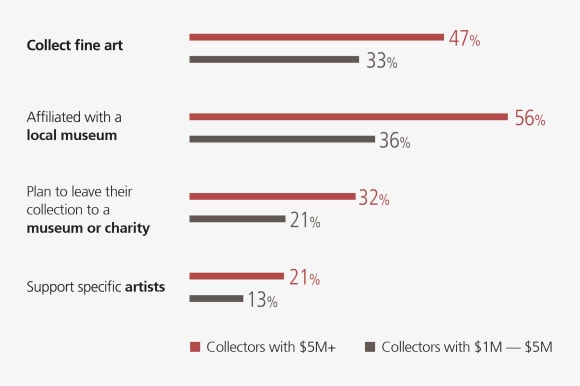

Wealthier collectors are particularly likely to focus on fine art and to support specific artists. Most are affiliated with a local museum, and one in three plans to leave their collection to a museum or charitable organization.

Wealthier collectors are more passionate about art

I have bought paintings over the years as well as other hand-crafted pieces. I always loved art, and as my financial situation improved, I bought better pieces.

Connect with your UBS Financial Advisor today

About the survey

About the survey

UBS Wealth Management Americas surveys U.S. investors on a quarterly basis to keep a pulse on their needs, goals and concerns. After identifying several emerging trends in the survey data, UBS decided in 2012 to create the UBS Investor Watch to track, analyze and report the sentiment of high net worth investors.

UBS Investor Watch surveys cover a variety of topics, including:

- Overall financial sentiment

- Economic outlook and concerns

- Personal goals and concerns

- Key topics, like aging and retirement

For this twenty-first edition of UBS Investor Watch, we surveyed 2,475 high net worth investors (with at least $1 million in investable assets) from September 15 – 25, 2017, including 608 with at least $5 million. 1,017 survey respondents are collectors. With 90 respondents, we conducted qualitative follow-up interviews.