A volatile mix

Factors to beat the market

Clemens Reuter

Clemens Reuter

Head of ETF and Passive Investment Specialists

In volatile conditions, investors can rotate between cyclical and defensive factors if they have a view on upcoming market dynamics.

Institutional investors have adopted factor-based equity investment strategies to improve returns over standard passive index strategies. But if markets become more volatile in coming quarters, will factor investing perform as expected? We look at how various factors may perform in more volatile markets.

Factor investing aims to construct portfolios of stocks defined by specific characteristics, or 'factors,' with the objective of outperforming the broader market. For example, the value factor selects stocks with attractive relative valuations based on ratios such as price-to-earnings or price-to-book, while the momentum factor picks stocks that have displayed strong upside trending price movements. Other common factors include size, quality, dividend and low volatility.

Extensive academic research has demonstrated that factors have historically delivered excess returns over different time periods and across geographies. Yet factor investing entails risks. Factors may experience periods of underperformance versus the market and exhibit a certain degree of cyclicality.

In volatile markets, it is important for investors to understand how factors might behave. Generally, low-volatility and quality stocks are defensive, whilst momentum and small-caps are cyclical in nature. To a lesser degree, value stocks tend to be cyclical while traditional dividend stocks more defensive. A specific implementation can also mitigate factor cyclicality, for example the value factor can embed quality screening. Not all factors are created equal, and investors need to look closely at the methodology employed.

In more volatile markets, investors may rotate between cyclical and defensive factors in anticipation of short- or medium-term market changes. This requires market-timingskills, but has the potential for higher outperformance. Another approach is to focus on long-term harvesting of premia and diversify exposure by using a combination of factors. The latter approach can be implemented as a multi-factor solution.

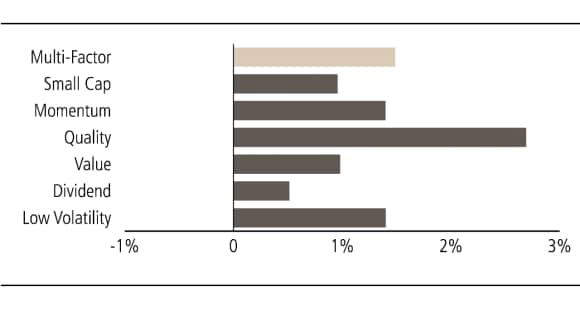

To confirm the merits of factors investing in the long-term, let us look at the period from October 2007 until April 2019, with the first date representing an all-time high for the US market preceding the financial crisis. This timeframe therefore encompasses all stages of the business cycle. The US equity market over that period had an average return of 7.4% per annum (MSCI USA). All single-factor strategies delivered a robust outperformance (Figure 1). A multi-factor strategy would have enjoyed an excess return of 1.5% per annum against the market-cap MSCI USA Index. The least impressive outperformance was for the yield strategy (+50bps per annum), while the highest was for the quality factor (+270bps). A similarly positive picture is visible for the Eurozone market (Figure 2).

Figure 1. Excess MSCI USA factor returns

Figure 1. Excess MSCI USA factor returns

October '07 to April '19

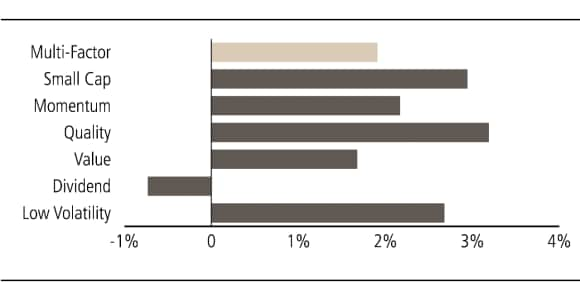

Figure 2. Excess MSCI EMU factor returns

Figure 2. Excess MSCI EMU factor returns

October '07 to April '19

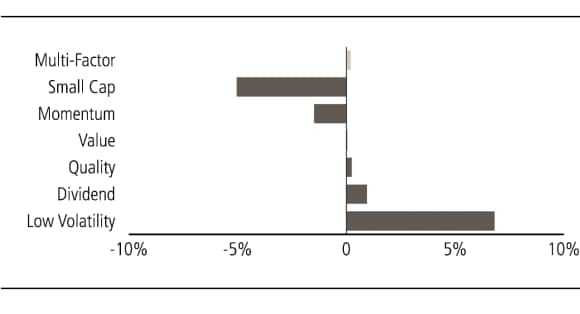

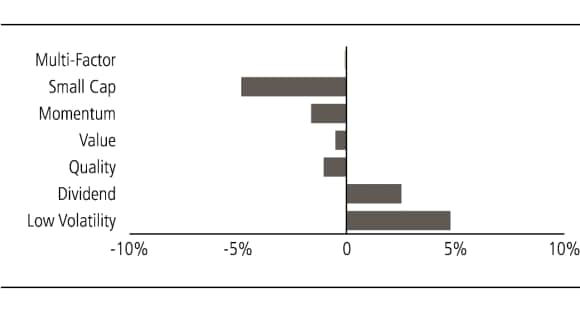

To investigate the behavior of factors in market corrections, we look more closely at a period from 20th September 2018 to 24th December 2018 during which the MSCI USA declined 19.6% and the MSCI EMU incurred a 14.0% drawdown. Looking at the US market, the multi-factor approach delivered a small relative outperformance (Figure 3), showing the benefits of diversification. The low volatility factor delivered a substantial 7.0% relative outperformance, while the quality factor, which is also considered highly defensive, outperformed by only 0.25%. The latter might be explained by a strong overweight in IT stocks which suffered more severely in the latest correction. Dividend and value stocks performed broadly in-line with the US market, while momentum and small caps in particular suffered larger drawdowns, which would be expected as these are highly cyclical factors. Interestingly, a very similar pattern is seen for European stocks (Figure 4).

Figure 3. Excess MSCI USA factor returns

Figure 3. Excess MSCI USA factor returns

20 September '18 to 24 December '18

Figure 4. Excess MSCI EMU factor returns

Figure 4. Excess MSCI EMU factor returns

20 September '18 to 24 December '18

Factors may offer excess returns vis-a-vis the broader market. In volatile conditions, investors can rotate between cyclical and defensive factors if they have a view on upcoming market dynamics. An alternative is a constant allocation to harvest factor premia over the long-term, which most efficiently can be implemented as a multi-factor solution. Looking ahead, we expect the low-volatility factor to have the lowest drawdowns during market corrections, while we have a positive outlook on performance of all factors in the long-term.