Driving the global economy and creating opportunities

Dr. Axel A. Weber, Chairman Board of Directors, UBS AG

As we look forward to the coming years, reforms will rebalance global asset allocation to China's markets and a series of themes will propel China's economy into the world's largest

As we look forward to the coming years, reforms will rebalance global asset allocation to China's markets and a series of themes will propel China's economy into the world's largest

In a year when the US economy accelerated, it is worth bearing in mind that it is still China that drove the world economy, delivering an estimated 25%+ of total global growth during 2018.

That is a reality that we'll have to get used to, with a range of estimates forecasting that China will eventually overtake the US as the largest and most influential economy in the world within the next ten years.

Three near-term challenges

Three near-term challenges

But as we move into 2019, near-term challenges, like trade tensions, debt and the sustainability of reforms, dominate the outlook. We don't underestimate the importance or scale of these challenges, but we feel that – properly managed – China still has undoubted potential to grow sustainably over the longer term.

Looking at trade, we estimate US policy measures will slow China's growth to 6.1% in 2019. China's response here will be crucial.

Policy support is coming to stabilize the economy over the short term but China will have to diversify its export markets in the long-term, and new trade deals indicate China's trading future may lie in Asia, Africa, the Middle East and South America, where growth in both the population and middle class will be greatest in the coming years.

Moving onto debt, China's post-crisis debt build-up remains a concern but, unlike in the rest of the world, China has been aggressive about deleveraging and instilling new discipline on credit flows. These steps are encouraging but more work needs to be done to propel China in the future, not least in ensuring that the financial system works not only for the previously dominant SOEs but also for the small-and-medium private enterprises that are the backbone of the economy.

There also remains lots to do on the reform front, but China is making progress, albeit at its own pace. In the past year, we have seen closures of 'zombie' SOEs, easing of urban residency rules, opening of auto sectors to overseas investment, and reforms to rural property rights.

From our conversations with regulators, there's immense desire to push further reforms in the future, and we hope that regulators continue actively to simplify the regulatory framework and promote international standards.

Financial reform continues

Financial reform continues

Continuing on the reform theme, one area where there has been marked progress is in financial markets, specifically through opening up onshore markets to overseas investors via the Stock and Bond Connect programs.

We believe that these reforms, and the subsequent inclusion of onshore markets in global equity and bond benchmarks, have the potential to spark a rebalancing of global asset allocation to China.

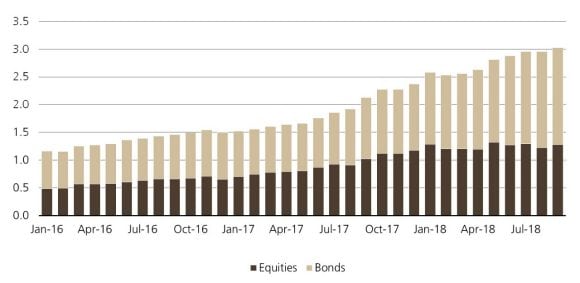

And the evidence shows that this is starting to happen, with overseas investors increasing their allocations to China during the past three years.

This is a significant change both for China and global investors.

Overseas investors' holdings of onshore China assets (RMB Trillions), Jan 2016-Sept 2018

For China, it’s a positive step because it opens new sources of capital and has the potential to bring longer-term, more fundamentally-driven institutional investors to onshore markets, and particularly the retail investor-driven equity markets.

For investors, onshore access opens up a large opportunity set of investible companies and securities. This market opening has come at an opportune time because it brings investors an entry point into thematic trends like data-driven innovations in 'new economy' sectors, industrial upgrading, and evolving consumer demand, which we believe has the potential to grow strongly over the coming years.

China: too big to ignore

But for all that we are constructive about China, we're also mindful that it can be a risky place in which to do business. Policy can sometimes be opaque and markets can be volatile.

But that is no reason to ignore it. On the contrary, we are committed to expanding in China to build our capabilities to both navigate onshore markets and capitalize on opportunities. As such, we plan to build a majority stake in our existing onshore Joint Venture, boost our headcount, and expand our range of investible products for both onshore and offshore clients.

Putting in resources like this and aligning with the thematic trends described above shows that we are taking a long-term strategic view around China. This approach has brought numerous benefits to investors in the past and, as China continues to take the lead in the global economy, we expect the future to be no different