Turning positive? Three reasons to look at fixed income again

After many years of negative interest rates, yields on fixed income assets have finally turned positive. Charlotte Baenninger, Head of Fixed Income, discusses the benefits of positive yields currently available in fixed income markets.

To say 2022 has been a difficult year for fixed income investors is a gross understatement. With central banks across developed economies responding to inflation reaching 40-year highs, bonds have repriced significantly, causing the largest losses across the fixed income spectrum in many years.

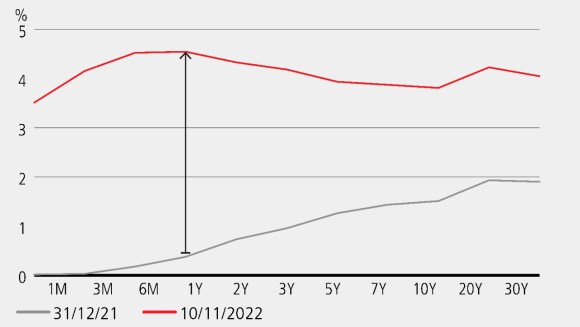

In the US, the yield curve has flattened substantially since the beginning of the year; almost the whole curve now exceeds 4% (Chart 1).

Chart 1: US yield curve flattens over 2022

Chart 1: US yield curve flattens over 2022

In the UK, intermediate (7-10 year) gilts have been a significant underperformer, selling off by more than 260 bps to get to a current yield level of 3.54%, while returning -16.9%. For those investors who either track a benchmark or had a low flexibility tolerance and had to own negatively yielding bonds in markets such as Germany, they also felt a lot of pain. German intermediate government bond yields rose 235 bps to +2.06%, resulting in a negative return exceeding 16%.

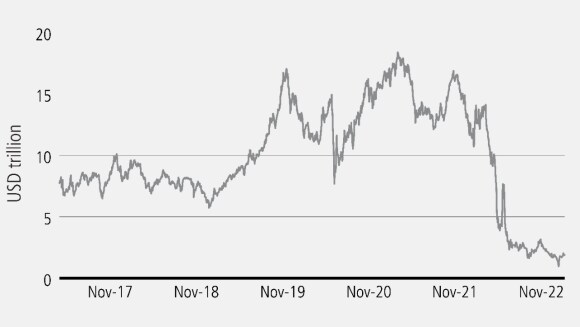

The flip side to these market moves is that not only are the yields on offer in most fixed income sectors considerably higher today than in the past , but the amount of negatively yielding debt has all but evaporated (Chart 2). From a high of USD18 trillion at the end of 2020, now there is less than USD 2 trillion of negative yielding debt outstanding.

Chart 2: Universe of negative yielding debt shrinks over 2022

With income finally back in fixed income, we outline three factors for optimism:

- Over the long-term, yield is by far the most stable and reliable component of total return for bonds.

- Higher break-evens (from higher yields) act as “shock absorbers”.

- Investors no longer need to reach for yield by taking unnecessary credit risk.

1: Over the long-term, yield is by far the most stable and reliable component of total return for bonds

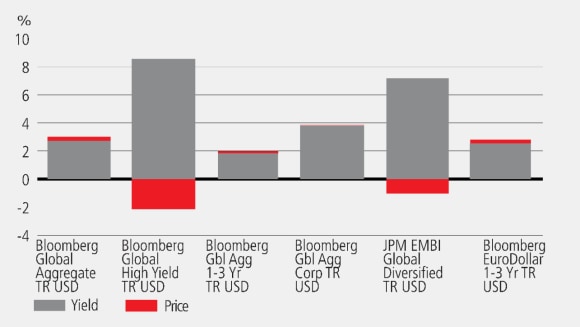

Over the past 20 years, yield (income) has been the dominant driver of total returns in bond portfolios. For certain asset classes such as high yield and emerging markets, price return has been negative over the long term yet performance has been positive and very strong, demonstrating the power of yield (Chart 3).

Chart 3: Fixed income sub asset class returns broken down by price and yield over the past 20 years

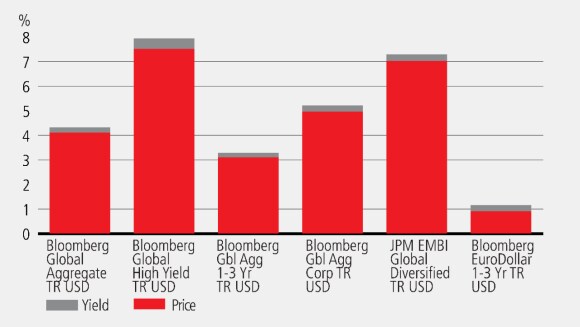

Despite the large role yield plays in total return, it only contributes a minor proportion towards total return volatility. Looking at Chart 4 – which simplistically displays yield and price as a proportion of total return volatility – we can see that while yield has contributed the most to total return over the past two decades, it has done so while contributing a lower percentage to the overall volatility.

Chart 4: Fixed income sub asset class volatility broken down by price and yield over the past 20 years

2: Higher break-even rates (from higher yields) act as ‘shock absorbers’

Break-evens in this context simply refer to the magnitude of rate increases needed to wipe out the head-start provided by yield income from a total return perspective. In general, the higher the level of yield, the larger the magnitude of rate increases required to generate a negative total return (i.e., wipe out positive contribution from income). In Table 1, we show break-evens for major fixed income asset classes and how much they have changed since the beginning of the year.

Looking at the Global Aggregate Corporates Index break evens have risen from needing 25bps of yields rising to 92bps before negative total returns set in. The short duration sectors are really shining: this is because curves have flattened, and short duration assets have much less interest rate sensitivity. At the end of 2021 the Global Aggregate 1–3 Year Index required just a 38 bps rise in bond yields to generate a negative return. More recently, this same benchmark now requires nearly 190 bps of yield increases to erase its higher yield advantage.

Table 1: Change in break-evens for major fixed income asset classes in 2022 YTD

Index | Index | Break-even at end Dec 2021 (bps) | Break-even at end Dec 2021 (bps) | Break-even at end Oct 2022 (bps) | Break-even at end Oct 2022 (bps) | Extra cushion to absorb rising yields (bps) | Extra cushion to absorb rising yields (bps) |

|---|---|---|---|---|---|---|---|

Index | Bloomberg Global Aggregate Index | Break-even at end Dec 2021 (bps) | 17 | Break-even at end Oct 2022 (bps) | 57 | Extra cushion to absorb rising yields (bps) | 40 |

Index | Bloomberg Global Aggregate 1-3 Year Index | Break-even at end Dec 2021 (bps) | 38 | Break-even at end Oct 2022 (bps) | 189 | Extra cushion to absorb rising yields (bps) | 152 |

Index | Bloomberg Global High Yield Index | Break-even at end Dec 2021 (bps) | 114 | Break-even at end Oct 2022 (bps) | 242 | Extra cushion to absorb rising yields (bps) | 128 |

Index | Bloomberg Global Aggregate Corporates Index | Break-even at end Dec 2021 (bps) | 25 | Break-even at end Oct 2022 (bps) | 92 | Extra cushion to absorb rising yields (bps) | 66 |

Index | ICE BofA 1-3 Year Eurodollar Index | Break-even at end Dec 2021 (bps) | 63 | Break-even at end Oct 2022 (bps) | 283 | Extra cushion to absorb rising yields (bps) | 220 |

Index | JPM EMBI Global Diversified Index | Break-even at end Dec 2021 (bps) | 66 | Break-even at end Oct 2022 (bps) | 148 | Extra cushion to absorb rising yields (bps) | 82 |

3: Investors no longer need to reach for yield by taking unnecessary credit risk

In a regime of ultra-low government bond yields and steep yield curves, investors in developed markets bonds were faced with a rather difficult trade-off: generate higher yields by going out further on the maturity curve and taking on more interest rate risk, or take on more credit risk by moving down the credit quality spectrum.

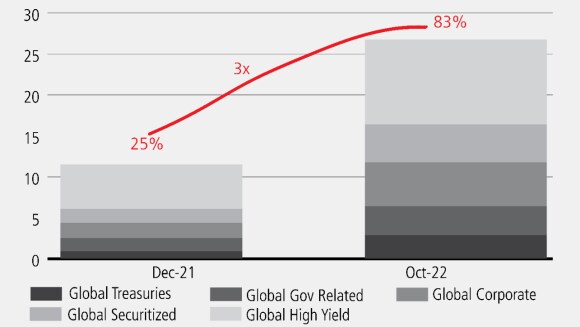

As Chart 5 shows, at the end of last year, only a quarter of the market offered yields of more than 2% (in USD). Today, this universe has more than tripled to 83%. We would argue that this development allows for a much better starting point for investors to achieve their investment goals, with an ability to build a much more diversified portfolio in terms of both issuers and sectors.

Chart 5: The growth in the proportion of the fixed income market yielding 2% or more

Risks in a world of rising yields

Risks in a world of rising yields

Investors now have much greater flexibility to achieve their yield targets, but clearly, while there are benefits to having higher yields today, we should keep in mind that, with the Federal Reserve and other central banks focused on stamping out persistently high inflation, markets are likely to remain volatile over the short-to-medium term. However, for long-term investors, bonds are arguably better placed today to handle any further price declines than in the past.

About the author

-

Charlotte Baenninger

Global Head of Fixed Income

Charlotte Baenninger is Global Head of Fixed Income responsible for CHF 270 billion in assets across Fixed Income and Money Market investment strategies leading over 130 fixed income investment professionals. In this capacity, she chairs the Fixed Income Investment Forum and the Fixed Income Management Team and is a senior ambassador for Fixed Income towards UBS Wealth management.

Charlotte was appointed President of UBS Asset Management Switzerland AG in 2020. In this position she chairs the Swiss executive board. She also continues to be Head of Investments, UBS Asset Management Switzerland AG. Furthermore, she is the Vice Chair of the board of the AMAS (Asset Management Association Switzerland).

Prior to becoming Global Head of Fixed Income, she was Head Fixed Income Switzerland since 2001. During this time she was instrumental in building the Swiss franc bond franchise with over CHF 46 billion in assets under management to be the largest Swiss franc bond Asset manager.

Charlotte started her career at the former UBS as a graduate trainee in 1987 and was Portfolio manager and Desk head until 2001.

PDF

Investment outlook 2023

Investment outlook 2023

In this edition of Panorama, our investment experts recap on the past investment year and explore where the challenges, opportunities and surprises might spring from.

Was this article helpful?

Please enable javascript in your browser and retry.

The feedback component cannot be displayed.

Read more

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.