Market outlook 2021: Early cycle recovery for 2021

Success in vaccine development means a return to economic normality is a matter of when, not if. We like early-cycle beneficiaries like value stocks, non-US equities and emerging market currencies.

Early cycle recovery: key highlights

Early cycle recovery: key highlights

- Accommodative monetary and fiscal policy should continue to provide a strong foundation for a vigorous recovery and hand-off to private demand and services-led growth.

- We favor classic early-cycle beneficiaries like value stocks, non-US equities, and emerging market currencies.

- Most identifiable risks in 2021, such as delays in vaccine administration, are concerned with the timing and intensity of the economic rebound not whether it can be sustained. Corrections tied to those catalysts are likely to serve as opportunities to increase exposure to procyclical positions.

Market outlook 2021

Trending towards normal

Trending towards normal

Medical innovation has seemingly alleviated the biggest economic risk linked to COVID-19 – a permanent change in historical patterns of behavior and activities with no end in sight. Herd immunity from COVID-19 is now a matter of when, not if.

Pandemic-induced restraints will eventually dissipate as the inoculation process gains traction. A burst of strength in supply-constrained services sectors after robust activity in goods sectors will mark the start of a transition in which growth is rebalanced towards a more pre-pandemic composition.

Expansive monetary and fiscal stimulus should ensure the bridge towards normalization is long and strong enough to weather a seasonal upturn in COVID-19 cases, complicating virus mutations, and any delays in vaccinations that arise in the interim. Importantly, the additional stimulus package passed by US Congress during the lame-duck session bolsters our belief that the early-cycle growth phase will be vigorous once the latter portions of this shock have passed.

The Democrats are poised to gain control of the Senate following victories in the Georgia special elections. A unified Democratic government adds an additional catalyst for our procyclical positions, but may also be a temporary source of volatility for US equities at the index level.

More fiscal relief in the near-term is now likely, in our view. We expect the new Congress to quickly pursue a package that extends enhanced unemployment insurance benefits, provides support for state and local governments, and also larger stimulus checks to households.

On the other hand, this electoral outcome increases the risk of higher US taxes as well as more stringent antitrust efforts against big technology firms. We expect, at worst, relatively modest increases in corporate and personal tax rates, since the balance of power rests in the most moderate Democrat Senators. Importantly, any revenues raised will likely be offset by additional spending on initiatives like green infrastructure, supporting the US and global recoveries.

We believe that Europe’s more collectivist approach to fiscal policy will begin to bear fruit in 2021, and EU restrictions that limit national borrowing will stay suspended. China has also pledged that while credit growth will slow, there will be no abrupt departure from its macroeconomic stabilization initiatives.

The Federal Reserve (Fed) has indicated that it will not overreact to any short-term burst of inflation in 2021, and will wait for more persistent signs of price pressures before considering the withdrawal of stimulus. Other developed-market central banks are also poised to maintain highly accommodative policy in order to help foster the strongest and most widely-shared recovery possible. In doing so, they will be buoying procyclical forces in 2021 simply by standing still as the expansion gains traction, inflation picks up, and realized real rates decline.

Market outlook 2021

Detours, not downturns

Detours, not downturns

The identifiable risks in 2021 surround the timing and intensity of the economic recovery rather than posing an existential threat to the nascent expansion. As such, we would expect them to spark only short-term bouts of risk aversion; diversions from an early-cycle backdrop that should continue to benefit procyclical positions.

For instance, we expect that a material share of the population in advanced economies will be vaccinated around mid-2021, with variable lags for different emerging market economies. Persistent sluggishness in the roll out of vaccinations could force investors to scale back any optimistic expectations on the timetable for a return to normal. This would likely challenge the procyclical trade set. There are material logistical challenges at every step of the process: production, distribution, and administration. Issues in the latter two phases have led to the US falling far short of its goal to administer 20 million shots in 2020. These problems may grow more intense as all aspects of the process attempt to scale, or may lessen as different candidates become available.

There may also be an uneven handoff in the rebalancing of growth if the withdrawal of Chinese policy support precedes sufficient vaccinations and the normalization of services sectors in developed economies. The temporary absence of a meaningful global growth impulse may interrupt, but not derail, cyclically-oriented positions.

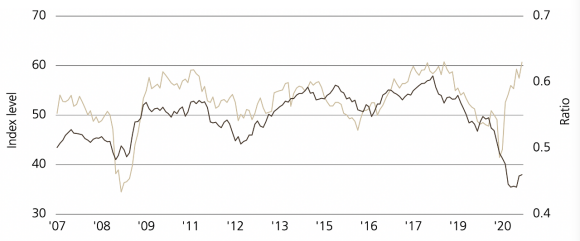

Ample room for value stocks to catch up to rebound in manufacturing activity

Investors could choose to focus on some of the market-unfriendly implications of a unified Democratic government, which include the potential for higher taxes and regulatory scrutiny – particularly for technology giants. This would likely disrupt some of our pro-risk positions given the weight of these companies and US stocks in global benchmarks, while our more procyclical relative value positions may benefit from greater government spending and stronger economic growth.

On the other end of the spectrum, robust fiscal stimulus, expedient progress on vaccinations, and a base effect-driven upturn in inflation could fuel a disorderly spike in bond yields as investors pull forward expectations on the timing of the tapering of monetary stimulus. Any negative spillover effects on risk assets would be temporary, in our view.

Possible spike in bond yields but effects on risk assets likely temporary

We believe the Fed will be quick to push back against a rise in bond yields that is sharp, contributes to a broad tightening of financial conditions, or challenges its forward guidance to keep rates on hold until the dual mandate goals are achieved. Establishing the credibility of its structurally dovish shift to flexible average inflation targeting will require evidence of the central bank following through on its commitment by allowing price pressures to be sustained.

Risks to our outlook will increase by the middle of the year as investors begin to price in how much global growth will decelerate in 2022. Indications as to how swiftly and how much fiscal support may be withdrawn will be among the key signposts that determine the longevity of the procyclical trade set. Reflation trades may peter out if the lasting structural change from COVID-19 proves to be the pulling forward of market share gains for technology firms rather than a regime shift towards expansionary fiscal policy.

We would revisit our risk-on stance if, contrary to our expectations, vaccines proved ineffective against mutations of the virus, global governments quickly pivoted towards austerity, or real yields were to sharply rise.

Risks to outlook to increase by middle of year

Risks to our outlook will increase by the middle of the year as investors begin to price in how much global growth will decelerate in 2022. Indications as to how swiftly and how much fiscal support may be withdrawn will be among the key signposts that determine the longevity of the procyclical trade set. Reflation trades may peter out if the lasting structural change from COVID-19 proves to be the pulling forward of market share gains for technology firms rather than a regime shift towards expansionary fiscal policy.

We would revisit our risk-on stance if, contrary to our expectations, vaccines proved ineffective against mutations of the virus, global governments quickly pivoted towards austerity, or real yields were to sharply rise.

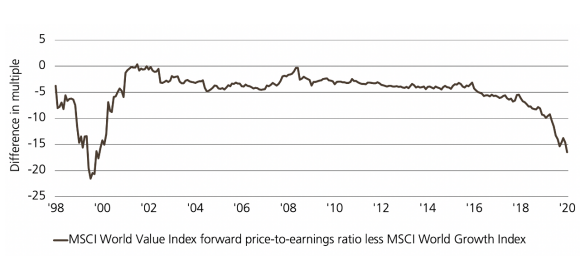

Value stocks trade at discount to growth not seen since dot-com bubble

Market outlook 2021

Asset allocation: favour equities and credit

Asset allocation: favour equities and credit

Low real rates and our expectation for continued economic growth and increasing earnings lead us to favor equities and credit relative to sovereign bonds and the US dollar. Valuations in risky assets may appear on the expensive side compared to history but they are not in the context of still low bond yields.

Within our preferred asset classes, the stage of the cycle and the relatively accommodative fiscal stance help steer us towards the more reflationary areas of the market, with a tilt towards value and non-US stocks as well as credit. We favor emerging market equities, particularly ex-China, vs. developed market counterparts. The high levels of implied volatility that persisted in 2020 due to COVID-19 and the US election should also ease following the Georgia vote on enhanced confidence and visibility into a comprehensive recovery.

We expect this thesis to be tested by aforementioned risks or unexpected ones, but emerge intact. Most diversions should be viewed as buying opportunities.

This is the start of an economic upswing, and the early-cycle trade set should continue to outperform.

Value stocks are still lagging the degree of success that would be expected based on earnings revisions and the change in manufacturing activity, while trading at a discount to growth stocks not seen since the dot-com bubble. A superior earnings recovery in the near term amid a robust economic expansion could serve as a catalyst for a rerating of value stocks and hefty outperformance. Further out, the speed, breadth, and endurance of the combined policy response deployed during this shock may reduce the amount and persistence of earnings declines for cyclically-oriented companies in subsequent downturns, if this crisis-era pandemic playbook is used as a future blueprint.

Conclusion

Conclusion

We believe 2021 will bring about the realization, and in some cases, continuation of many trends we anticipated would unfold in early 2020 before the pandemic derailed all macro prognostications. And for the same reasons, to boot: An expected cyclical upturn leaves us constructive on global equities, and should disproportionately benefit non-US stocks and weigh on the US dollar.

Changes in the fundamental backdrop over the past year have made these relative value opportunities even more compelling and resilient to shocks.

The degree of policy support provided in 2020 increases our conviction in superior earnings growth and outperformance of more cyclically oriented sectors and country indexes going forward. And because of the past price performance, the valuation discrepancies are even wider, creating a more attractive opportunity with a higher margin of safety,

The observed interest rate convergence, reinforced by a structural dovish policy shift from the Federal Reserve, should leave the US dollar out of favor, especially compared to high-beta emerging market currencies.

We believe sticking with a procyclical playbook through most obstacles that may emerge in 2021 is the best approach, as vaccination efforts allow economic momentum to be reclaimed.

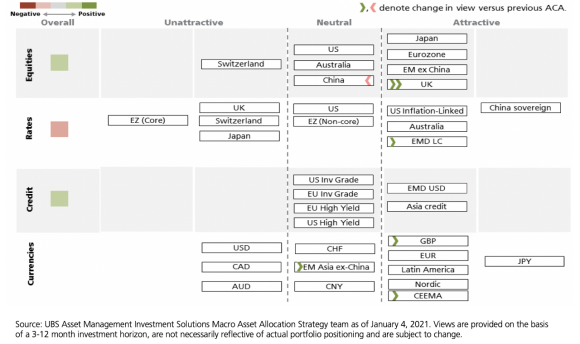

Asset class attractiveness

Asset class attractiveness

The chart below shows the views of our Asset Allocation team on overall asset class attractiveness, as well as the relative attractiveness within equities, fixed income and currencies, as of 4 January 2021.

Asset Class | Asset Class | Overall signal | Overall signal | UBS Asset Management’s viewpoint | UBS Asset Management’s viewpoint |

|---|---|---|---|---|---|

Asset Class | Global Equities | Overall signal | Light green | UBS Asset Management’s viewpoint |

|

Asset Class | US Equities | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed market Equities | Overall signal | Light green | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets (EM) Equities(ex. China) | Overall signal | Light green | UBS Asset Management’s viewpoint |

|

Asset Class | China Equities | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Global Duration | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US Bonds | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Ex-US Developed-market Bonds | Overall signal | Light red | UBS Asset Management’s viewpoint |

|

Asset Class | US Investment Grade (IG) Corporate Debt | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | US High Yield Bonds | Overall signal | Neutral | UBS Asset Management’s viewpoint |

|

Asset Class | Emerging Markets Debt - US dollar / Local currency | Overall signal | Light green | UBS Asset Management’s viewpoint |

|

Asset Class | Chinese Bonds | Overall signal | Dark green | UBS Asset Management’s viewpoint |

|

Asset Class | Currency | Overall signal |

| UBS Asset Management’s viewpoint |

|

A comprehensive solutions provider

UBS Asset Management Investment Solutions manages USD 124.2 billion (as of 30 September 2020). Our 100+ Investment Solutions professionals leverage the depth and breadth of UBS's global investment resources across regions and asset classes to develop solutions that are designed to meet client investment challenges. Investment Solutions' macro-economic and asset allocation views are developed with input from portfolio managers globally and across asset classes.

Evan Brown

Head of Macro Asset Allocation Strategy

Ryan Primmer

Head of Investment Solutions

Lucas Kawa

Asset Allocation Strategist

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.