Tough questions on regulatory changes in China

As investors worry about policy risks, our panel of China experts answers tough questions on regulatory changes.

Questions answered

At a webinar, our panel of China experts explained the impact of recent policy changes.

#1 How long will this challenging environment last?

#1 How long will this challenging environment last?

Bin Shi, Head of China equities: We’d argue that the point where fear is greatest is the closest to the turning point.

#2 What does tighter credit mean for property developers and investors?

#2 What does tighter credit mean for property developers and investors?

Hayden Briscoe, Head of Fixed Income, Global Emerging Markets and Asia Pacific: Property developers will no longer be able to exceed 15% leverage (vs 20%, 30% previously) – this is good for investors.

Also, China property bonds is likely to experience lower volatility because of these leverage caps.

What does tighter credit mean for property developers and investors?

What does tighter credit mean for property developers and investors?

Hayden Briscoe, Head of Fixed Income, Global Emerging Markets and Asia Pacific replies:

Property developers have become increasingly highly leveraged and systemically important – accounting for an estimated one-third of China’s economy – whilst also becoming more concentrated. Back in 2013, the top 50 developers accounted for approximately a quarter of property development. Fast-forward to 2019 and they account for 60% of new building activity. In our view, when 2021 numbers are published, they are likely to show a figure of around 70%, making it especially important that the government acts to ensure they are financially viable. The ‘three red lines’ policy is designed to reign in the property development companies, slowing the speed of over-leveraging and preventing firms from taking on more obligations than they are capable of repaying (which may lead to their collapse and failure to deliver properties).

In China, as opposed to the West, people typically pay for their properties up front before they are built. Given that property is expensive relative to average incomes – Chinese property prices have been appreciating by 5% annually on average since 2007 indicating that property remains peoples’ preferred asset – it is important to the government that the sector is sensibly levered. Thus, while there’s now a big slowdown in property developers’ activity, this is not because of a lack of demand.

Fundamentally, demand is still outstripping supply, and will likely be the case for many years.

To balance the strong demand for housing whilst creating a healthier property development sector, implementing the ‘three red lines’ policy is the government’s way of managing a property development corporation at the balance sheet level. We have never seen this done anywhere in the world until now. Shunning de-leveraging is no longer an option for property companies, as they will be forced to do it. Companies who get through this will look good from an investors’ perspective: property developers will no longer be able to exceed 15% leverage, compared to a high leverage of 20%, 30% before the policy was implemented.

From a creditor’s perspective, the asset class is likely to experience lower volatility because of these leverage caps.

How long is this challenging environment likely to last and how can investors navigate their way through it?

How long is this challenging environment likely to last and how can investors navigate their way through it?

Bin Shi, Head of China equities replies:

We’d argue that the point where fear is greatest is the closest to the turning point.

We have seen sharp drawdowns in Chinese equities. But I would argue that now most of the concerns are reflected in valuations. At this point, there is no shortage of liquidity, but a loss of confidence. If we see policy adjustment, people will start to look ahead. And if confidence returns over the long term outlook, investors will come back.

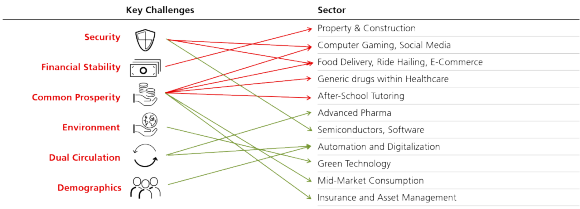

We take lots of factors into account when we construct our portfolios. We have looked into sectors which are favored by the government as part of the approach – the red and green lines in the illustration below reflect whether the different policies are likely to have a negative or positive impact on different sectors of the economy. However, policy support alone is not enough, investors still need to consider the sustainability of the policy and whether valuations are fair.

This table illustrates the key areas where Chinese government policy is focused on. The arrows linking the policy areas to market sectors show how policy may impact the various market sectors positively (green) or negatively (red).

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.