China A shares 101

Here's all you need to know about China A shares

China A-shares are RMB-denominated equity shares of China-based companies that trade on the Shanghai and Shenzhen Stock Exchanges.

China A-shares trade on the Shanghai Stock Exchange (SSE) and the Shenzhen Stock Exchange (SZSE).

Questions on China A shares answered

Questions on China A shares answered

Yes. Foreign investors may invest in A-shares via Stock Connect, Qualified Foreign Institutional Investor (QFII), or RMB Qualified Foreign Institutional Investor (RQFII) programs.

In August 2019, the five most popular China A-shares with foreign investors, measured by total northbound buy volume on Stock Connect were:

- Kweichou Moutai, a Chinese baijiu/white liquor producer, RMB 15.2bn of buy volume;

- Wuliangye Yibin, a Chinese baijiu/white liquor producer, RMB 12.1bn of buy volume;

- Ping An Insurance, a China-based insurance company, RMB 9.6bn of buy volume;

- Ping An Bank, a China-based commercial bank and a subsidiary of Ping An Insurance, RMB 9.3bn of buy volume;

- Midea Group, China-based consumer appliance manufacturer, RMB 5.7bn of buy volume

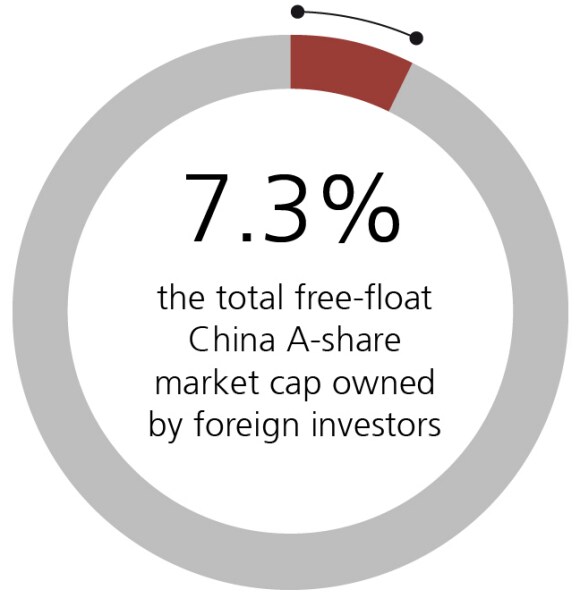

As of the end of June 2019, foreign investors owned RMB 1.65trn (USD 230bn) worth of China A-shares, according to data compiled by the People's Bank of China.

Foreign investors owned an estimated 7.3% of the total A-share free float market cap on China's domestic equity market, according to UBS estimates.

China A-shares are only quoted in RMB. China B-shares are traded in USD on the Shanghai Stock Exchange and in HKD on the Shenzhen Stock Exchange.

China A-shares are RMB-denominated equity shares of China-based companies and trade on either the Shanghai Stock Exchange (SSE) or Shenzhen Stock Exchange (SZSE). H-shares are HKD-denominated equity shares of mainland China companies listed on the Hong Kong Stock Exchange.

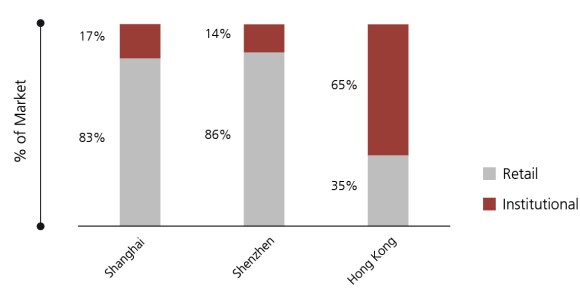

Shanghai and Shenzhen Stock Exchanges have higher participation from retail investors. The Hong Kong Stock Exchange has higher participation from institutional investors.

Comparison of investor bases

Comparison of investor bases

Shanghai, Shenzhen & Hong Kong Stock Exchanges (% of Market), 2018

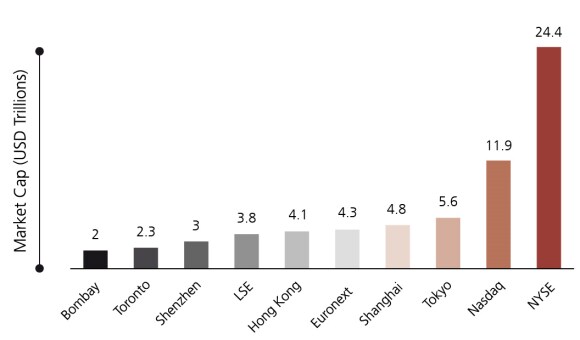

USD 4.8 trillion at the end of July 2019, according to data from the World Federation of Exchanges.

USD 3.0 trillion at the end of July 2019, according to data from the World Federation of Exchanges.

10. Bombay Stock Exchange (Market cap: USD 2.0 trillion);

9. Toronto (Market cap: USD 2.3 trillion);

8. Shenzhen (Market cap: USD 3.0 trillion);

7. LSE (Market cap: USD 3.8 trillion);

6. Hong Kong (Market cap: USD 4.1 trillion);

5. Euronext (Market cap: USD 4.3 trillion);

4. Shanghai (Market cap: USD 4.8 trillion)

3. Tokyo (USD 5.6 trillion)

2. Nasdaq: (USD 11.9 trillion)

1. NYSE: (USD 24.4 trillion)

Data comes from World Federation of Exchanges website and is correct as of end-July 2019.

The World's Ten Largest Stock Exchanges

The World's Ten Largest Stock Exchanges

by Market Cap (USD Trillions), July 2019)

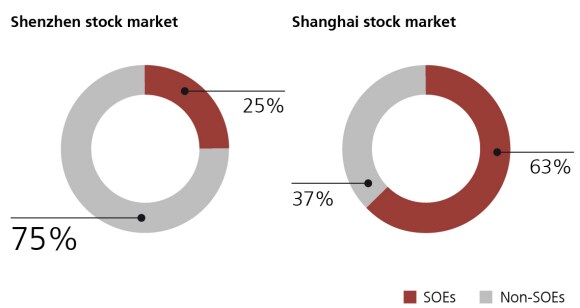

- Shenzhen Stock Exchange has more listed companies (2,179) than the Shanghai Stock Exchange (1,518);

- Shenzhen Stock Exchange has a market cap of USD 3.0 trillion at the end of July 2019, smaller than the USD 4.8 trillion market cap of the Shanghai Stock Exchange;

- Shenzhen Stock Exchange has more private companies in the market than Shanghai Stock Exchange, which is dominated by larger, state-owned companies;

- Almost half of the Shenzhen stock market consists of China’s new economy sectors including, information technology, consumer discretionary and healthcare. In the Shanghai stock market, these three sectors only make up less than 20% of the market cap.

Shares of SOEs and non-SOEs in terms of market cap

Shares of SOEs and non-SOEs in terms of market cap

China A-share markets are dominated by retail investors. Retail investors tend to have shorter investment time horizons than institutional investors and trade in and out of positions much more frequently. As such, China's A-share markets can be volatile.

Stock Connect is an equity trading link that connects the Hong Kong Stock Exchange and the Shanghai and Shenzhen Stock Exchanges. Via Stock Connect, Hong Kong-based investors may trade in Shanghai and Shenzhen markets, and vice versa.

Shanghai-Hong Kong Stock Connect began on November 17th 2014 and provides mutual stock market access to investors in Hong Kong and Shanghai. In July 2019, Shanghai-Hong Kong Stock Connect saw HKD 22.4bn of average daily trading.

Shenzhen-Hong Kong Stock Connect links the Shenzhen and Hong Kong Stock Exchanges and allows mutual market access to investors in each market. Shenzhen-Hong Kong Stock Connect launched on December 5th 2016 and handled HKD 21.4bn in average daily trading in July 2019.

Northbound Stock Connect trading refers to equity trading by Hong Kong-based investors in the Shanghai and Shenzhen Stock Exchanges via the Hong Kong-Shanghai/Shenzhen Stock Connect. Total northbound trading turnover in August 2019 was RMB 869.1bn, with RMB 441.4bn on Hong Kong-Shanghai Stock Connect, and RMB 427.7bn on Hong Kong-Shenzhen Stock Connect, according to data from Hong Kong Exchanges and Clearing.

Southbound Stock Connect trading refers to equity trading by Shanghai and Shenzhen-based investors on Hong Kong Stock Exchanges via the Hong Kong-Shanghai/Shenzhen Stock Connect. Total southbound trading turnover in August 2019 was HKD 224.2bn, with HKD 143.1bn of southbound trading on Hong Kong-Shanghai Stock Connect, and HKD 81.1bn of northbound trading on Hong Kong-Shenzhen Stock Connect, according to data from Hong Kong Exchanges and Clearing.

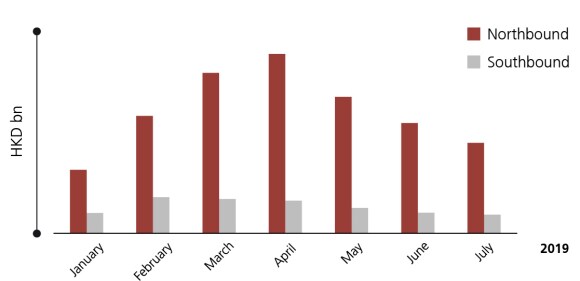

Northbound Stock connect trading has been historically larger than southbound stock connect trading, mainly because southbound trading is more restricted than northbound.

Stock connect

Stock connect

Northbound & Southbound Average Daily Trading

Note: Southbound refers to combined "southbound" trading on the Shenzhen & Shanghai-Hong kong Stick Connect, Northbound refers to combined "northbound" trading on the Shenzhen & Shanghai-Hiong Kong Stock Connect

In August 2019, the five most popular H-shares with mainland China investors, measured by total buy volume on Southbound Stock Connect were:

- China Construction Bank, a state-owned Chinese bank, HKD 13.7bn of buy volume

- Tencent, a Chinese tech company, HKD 12.2bn of buy volume

- Ping An, a China-based insurance company listed in Hong Kong, HKD 5.1bn of buy volume

- ICBC, a state-owned Chinese bank, HKD 4.6bn of buy volume

- Sunny Optical, optical product designer and manufacturer, HKD 4.4bn of buy volume

Yes, and their share in MSCI indices will increase in the future. MSCI has started a process through which it is increasing the weighting of China A-shares in its indices.

The process of A-share inclusion in MSCI indices began on June 1, 2018 when the benchmark provider added 230 A-shares to its Emerging Market index.

Mainly because economic reforms, including Stock Connect, have made China A-shares much more accessible to international investors.

MSCI will increase A-share's weighting or inclusion factor in its indices from 5% to 20% in three steps:

- Raising the index inclusion factor of all China A Large Cap shares from 5% to 10% and adding ChiNext Large Cap shares with a 10% inclusion factor in May 2019.

- Further increasing the inclusion factor of all China A Large Cap shares from 10% to 15% in August 2019.

- Finally raising the inclusion factor of all China A Large Cap shares from 15% to 20% and adding China A Mid Cap shares with a 20% inclusion factor in November 2019.

China's STAR equity market, officially known as the Shanghai Stock Exchange Science and Technology Innovation Board, is focused on early-stage tech companies, featured 25 companies when it started on July 22, 2019, and is intended to be similar in form and function to the US-based Nasdaq index.

STAR market stocks are only accessible to foreign investors via the QFII and RQFII programs. Currently, foreign investors may not invest in STAR stocks via Stock Connect.

In the past, not many Chinese companies published ESG reports. However, from 2020, all listed Chinese companies will be required to produce ESG reports.

Sources:

Contact us

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.