China consumers: driving the world economy

China consumer demand is driving the world economy, but how?

China consumers: driving the world economy – in 60 seconds

China consumers: driving the world economy – in 60 seconds

- Chinese consumer demand is arguably the most important driver of the world economy;

- Demand-side drivers in China are positive for a whole range of consumer categories;

- But supply-side drivers are also important and potential long-term winners in China's consumer-driven economy will be those companies that can innovate not only their products, but the ways they engage with and serve their clients;

- Chinese companies are coming up with a range of new innovations that are penetrating China's retail markets, and potentially creating retail trends that will play out over the whole world.

China's reach on the streets of London

China's reach on the streets of London

Standing on the platform of one of London's busiest train stations, you might be surprised to hear Mandarin passenger announcements.

No other train station in London has them, but Marylebone Station is the leaving point for Bicester Village, a retail hotspot that sells top brands at discounted prices and attracts thousands of Chinese tourists per year.

And it doesn't just stop at train announcements, Bicester Village maintains Chinese language pages on Weibo and WeChat, has a Chinese language app, and now accepts payments through Alipay – one of China's biggest cashless payment systems, which handled 197.5 bn transactions in 2018

And given the spending power of Chinese tourists, Bicester Village's efforts to adapt and tap into demand from China make perfect sense.

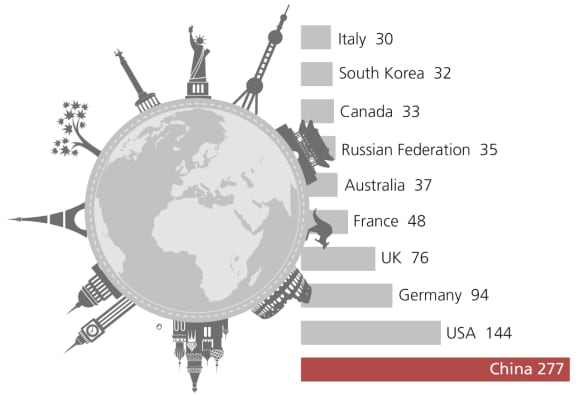

Chinese tourists spent a record USD 277bn in 2018, up 8% y-o-y, and are now well in the lead as the biggest tourism spenders globally, according to UN World Tourism Organization.

Global tourism spending (USD billions), 2018

Driving the world economy

Driving the world economy

And as is true for global tourism, so is true for the global economy.

China is the biggest contributor to global economic growth and 76% of China's growth in recent years has come from consumption.

Despite trade tensions, the good news then for the world economy then is that consumer demand in China remains strong: retail sales were up 9.0% y-o-y at the end of November 2019, with online retail growing 16.4% y-o-y in the same period1.

The demand drivers behind China's consumer story are wide-ranging and well-known:

That's a boon for many companies selling consumer products related to these trends, like high-end alcohol, luxury cars, restaurants, cosmetics and services like healthcare and education.

But focusing on the demand side misses important changes on the supply side.

By supply side we mean efforts by companies - like those made by Bicester Village - to spot demand trends but adapt their services and products to meet the changing demands of China's consumer market.

And that's where we are seeing a range of innovations by Chinese companies to penetrate China's retail markets and build market share.

Livestreaming

Livestreaming

China's reputation for producing fake goods has taken a battering in recent years, with Greater China estimated to be the source of 86% of counterfeit goods globally, according to estimates by the US Chamber of Commerce3.

And that's affecting many industries, and China's pearl industry is a case in point. China is the world's biggest pearl producer, but it also produces a lot of fakes, thus presenting a dilemma for buyers.

But with the help of technology, one Chinese entrepreneur has a solution.

He Hai, owner of an online jewellery store, hosts a series of live broadcasts in which he opens clams, digs out pearls, shows them to the viewers, convinces them of their authenticity and then watches the orders roll in.

Livestreaming through Taobao, Alibaba's online shopping channel, plugs Mr He into China's massive online population of 820 million internet users but also a sales platform through which viewers can snap up products they want by rapidly paying via one-click links to their online payment system.

For Mr He, his online sales masterclass on the Taobao channel proved to be a goldmine during Singles Day, where he racked up an impressive USD 14,300 worth of sales within 24 hours.

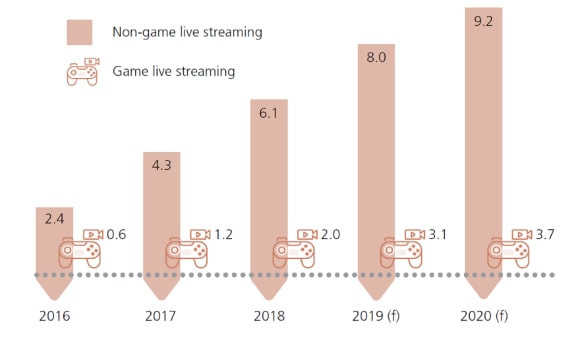

And more than pearl orders, livestreaming channels brought in an estimated RMB 20 billion (USD 2.85 billion)4 during Singles Day in November 2019. And it's not just limited to Singles Day, leading platforms in China are ramping up their livestreaming efforts because they realize the potential for it to engage with consumers. Deloitte estimates livestreaming will drive RMB 12.9 billion of online sales in 2020.

China: Livestreaming revenues (RMB billions), 2016-2020 (f)

Facial recognition payments

Facial recognition payments

Video technology is more than about engaging customers, it's also being increasingly used as a form of payment via facial recognition technology.

Check into a Starbucks at Beijing railway station and you'll be able to pay with your face, and it’s the same for fried chicken, bread, and bus tickets, where facial recognition is becoming an increasingly common form of payment.

This marks the next step in payment technology being used in China and, if projections are to believed, will see 100m people switch to facial recognition payments by 2025.

For consumers, the benefits are obvious. All they need to do is register a personal photo with their bank account or digital payment system. Once registered, consumers can pay freely, without the need to carry their phone, wallet, or train ticket.

Drone delivery

Drone delivery

China's e-commerce market is colossal, but it's also where we are seeing some of the most innovative approaches to tackle the pain points for most online shoppers – last-mile delivery.

And online retailers are reaching for the sky – literally. That's because drone delivery is becoming an increasingly common form of delivery.

Proposed by Amazon in 2013, but developed and put into practice by JD.com since 20165, drone delivery systems are taking to the skies in specially designated areas and linking up hard-to-reach markets with China's e-commerce sellers.

That's one of the reasons why rural e-commerce sales grew 21% y-o-y in H1 20196 as these new innovations, coupled with growing smartphone usage and broadband connections, tap into previously unserved parts of China's vast consumer market.

And these drone services, part of a system that links 100 villages with 40 drones, are part of a large-scale, government-sanctioned test run intended to prove the concept before being more widely applied across the nation in specially designated areas and along closely stipulated routes.

But it's not just rural areas that are seeing drone tests. Fast food chains, coffee shops, online food delivery companies, hospitals, and logistics companies are all conducting their own tests in urban areas, with one world-famous logistics company reporting that their drone tests cut costs, reduced emissions, and brought delivery times down from 40 minutes to eight minutes.

Concluding remarks

Concluding remarks

So while the story of China's growth in recent years has been the shift to consumer demand, we believe the story of the future is how companies are using innovation to tap into China's growing consumer market.

And that's an important differentiator in China's fast-paced, smartphone-driven and highly competitive consumer sector, where technology is making the difference in engagement, payments and delivery.

We believe innovation holds the key to identifying both long-term winners and also spotting new trends, because if we want to know how we'll consume in the future, it makes sense to look at how Chinese consumers operate now.