Tough questions

China in H2 2019

China's economy and markets dominate the headlines and our China experts, Bin Shi, Hayden Briscoe, and Gian Plebani sat down to answer a series of tough questions on the outlook for China, and their equity and fixed income strategies.

Bin Shi, Head of China Equities

Bin Shi, Head of China Equities

1. What's your expectation for China-US trade tensions?

We don't expect a rapid resolution to trade tensions, rather we expect an extended period of confrontation between the US and China – and that means markets will continue to be volatile.

2. How have you adjusted your strategy this year?

'The likelihood of continued noise around the trade issue means it is even more important for us to stay focused on what matters, and we are focused on companies with good fundamentals and valuation support.'

3. What's your view on the outlook for China's economy?

'The Chinese government has introduced stimulus to maintain economic stability, and further policy support largely depends on the progress of trade talks.

Looking at recent data releases, domestic demand remains quite healthy and many of the companies we follow in the consumer sector have delivered better-than-expected performance so far this year.'

4. A-shares or H-shares, can you talk about recent performance and what prospects you see for the future?

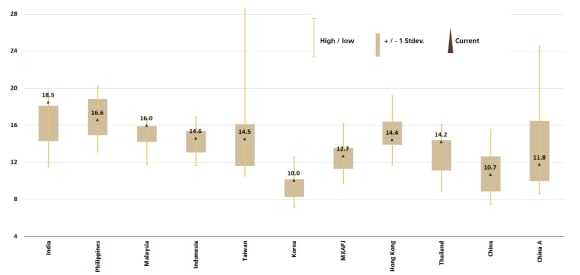

'A-shares have outperformed H-shares YTD because they have corrected a lot more1. At this point we think that A-shares are trading in line with H-shares in terms of valuation.

Going forward we expect that the two markets will move in the same direction, with some minor differences in magnitude'

5. Where are the opportunities in the China equity space?

'Trade issues are affecting the market but investors need to remember that earnings growth and company fundamentals determine long-term returns.

From that perspective, there are still many opportunities in the Chinese equity markets because there are many good companies currently trading at attractive valuations.'

Exhibit 1: 12M forward price-to-earnings ratio (P/E)

Now that reforms have opened up onshore equity markets, investors will increasingly look at Chinese companies based on their investment merit rather than whether they are listed on offshore or onshore markets. We believe this All-China approach is the way it should be for investors in the long-run.'

Hayden Briscoe, Head of Asia-Pacific Fixed Income

Hayden Briscoe, Head of Asia-Pacific Fixed Income

1. What about China's real estate sector?

'Despite restrictions, real estate prices are growing and demand for real estate is outstripping supply. Developers' pre-sales have been strong, so there's a lot of property still to be built.

As developers mobilize, we expect the activity from a pick-up in construction to feed into the economy and support macro numbers in the future.

These trends are positive for real estate developers, and we particularly favor the larger names in the sector, many of whom have successfully deleveraged during the past one-to-two years and who have good access to capital.'

2. What are the prospects for China monetary policy?

We're expecting further monetary stimulus from a combinations of rate cuts, RRR cuts, and open market operations

3. Where are the opportunities for fixed income investors?

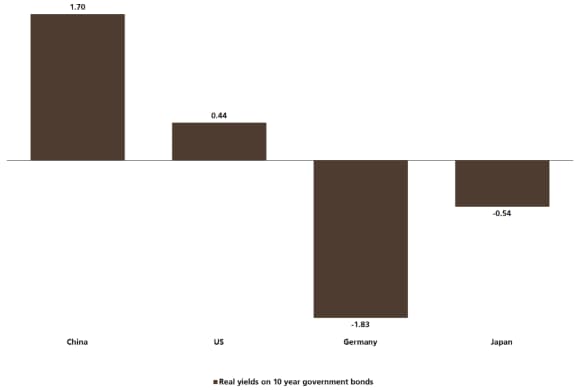

'If we are going into a slowdown, fixed income investors have a problem because yields in Japan and Germany are now negative, and US Treasuries are extremely low2.

From a yield perspective, China fixed income markets are some of the best in the world, and particularly Chinese government bonds which are safe from a credit perspective, have low correlation to other markets, and have the potential to offer capital appreciation if, as expected, the global economy enters a slowdown.

Exhibit 2: Real yields (%) on 10-year government bonds

Additionally, China High Yield offers relative value compared to other high yield markets because valuations look reasonable and core fundamentals look strong.'

Gian Plebani, Portfolio Manager, Investment Solutions

Gian Plebani, Portfolio Manager, Investment Solutions

1. What's your high-level view on China?

I'm bullish on China assets over a six-to-twelve month time horizon because there has been an improvement in global liquidity as central banks across the world turned more dovish and because the Chinese government has put stimulus into the economy.

2. What specifically have you seen in China recently?

'In the past six months we have seen a turning point in China's leading economic indicators and that tells me that it is time to start allocating to risk assets. There has been strong support for the economy in terms of looser monetary policy, infrastructure investments, and tax cuts for companies and individuals.'

3. What's your view on Fed policy?

'One-to-two rate cuts from the Fed this year. And that's actually positive for China because it opens up space for potential monetary policy easing in the future.'