Alternatives in the Asian Century

Alternative investments – how do they offer an entry point into Asia’s growth story? Our expert panel explained at Alt+Shift, our recent alternative investments conference.

Benno Klingenberg-Timm, Head of Global Sovereign Markets APAC

Benno Klingenberg-Timm, Head of Global Sovereign Markets APAC

There is little doubt that the alternative investments space is heating up in Asia.

Albourne Partners1 – a leading consultant in the hedge fund space - recently expressed a view that they expect to see “strong net inflows” in 2021, with China equities the most sought-after areas.

Similarly, Asia Pacific ranks as the most in-demand region for investment allocation for hedge fund investors globally.

Greater China markets are leading the way as the most preferred destination for global capital, according to another recent survey, done by Credit Suisse2.

No doubt these flows are intended to position for future growth. But before looking forward to what is anticipated to be the Asian Century, let’s first look back.

The term ‘The Asian Century’ was first coined by China’s leader Deng Xiaoping - regarded as the architect of modern China - in 1988 to describe the 21st Century.

Since then, what have we seen in Asia? A few statistics can explain:

- Asia has risen to become the largest contributor to the world economy3;

- Some 437 million people have moved to Asia’s cities, according to UN statistics4;

- We have seen Asia’s consumer markets grow into the largest in the world, fired by rising incomes and the rapid rise of e-commerce5;

- Asia has risen to become an innovation hub, generating technologies and hardware that are used in daily life across the globe

We believe that these trends, coupled with Asia’s massive 4.65 billion population, mean that the 21st century truly will be the Asian Century. Let’s turn to our experts now to learn how alternative investment strategies can tap into this growth outlook.

Adolfo Oliete, Head of APAC Investments, UBS Hedge Fund Solutions

Adolfo Oliete, Head of APAC Investments, UBS Hedge Fund Solutions

We have certainly seen interest in the region increase recently, but this is not anything new to us.

For us in HFS, Asia has been a big allocation for a number of years, and our conviction is so high that over the last five years or so we have more than doubled our allocation to Asia equity long/short funds.

China is obviously a big part of that, to the extent that in our global portfolios we have a similar weight in our Asia equity exposure as we do in the US.

Three ways to judge the Asia opportunity set

Three ways to judge the Asia opportunity set

We judge the opportunity set in three ways.

First, from a top-down perspective, China offers growth and abundant secular themes that underpin that growth. Trends like, for example, the consumption upgrade or urbanization provide hedge funds with abundant long and short opportunities as winners and losers emerge within these trends.

Number two, from a bottom-up perspective, China benefits from a cracking market structure. In essence, the market is inefficient, very inefficient.

Number three, market technicals are very favorable, and significantly more than in other markets. It's a market that is not crowded due to the limited capital from institutional foreign players. In addition, markets are currently very liquid with significantly higher turnover, and this is a great feature for active investors.

It is not very common to align these three elements so perfectly, but we at HFS believe that China clearly does.

Inefficient markets are key for alpha generation

I can't stress enough just how inefficient the market is, and this is really key for the outsized alpha generation potential seen in the region.

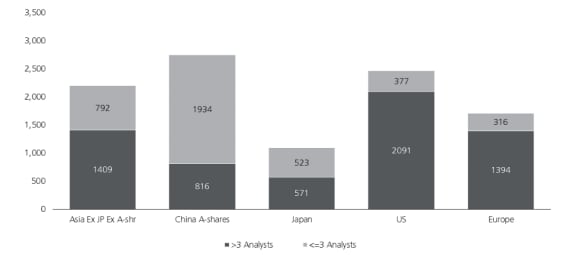

Looking at analyst coverage, you can see China A-shares are 70% under-researched6, whereas in the US only 13% of the stocks are considered under-researched, meaning covered by less than three analysts. And this is one of the main reasons why the markets exhibit higher dispersion of returns.

Analyst coverage in major global markets

Analyst coverage in major global markets

No. of companies and analyst coverage

Such high dispersion can really yield higher impact from active management; in other words, higher alpha for stock pickers. Hedge funds can take advantage of dislocations in the markets on both the long and short side. In this case, volatility is our friend.

We can also see higher turnover - driven primarily by retail investors - which also adds to the dispersion, since they tend to be driven less by fundamentals and carry more momentum characteristics.

And finally, if the market structure as it stands today isn’t exciting enough for you, it is only going to get better for hedge funds. Recent regulatory changes will add new return drivers and we expect the availability of A-share borrow to increase.

Focus on returns

Let's go into what really matters, which is returns and the quality of those returns.

One myth I usually have to address is ‘can hedge funds produce high returns’ - in China in particular the answer is it can.

Take a look at our investor manager annualized returns for the last five-to-six years - you will see that the returns are high and the volatility significantly lower than the markets.

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | Annualized return | Annualized Volatility | ||||||||||

MSCI China | 4.7% | -10.0% | -1.4% | 51.1% | -20.4% | 20.9% | 27.3% | 8.0% | 20.1% | ||||||||||

HFRX China | 2.1% | 6.5% | -3.2% | 35.8% | -22.2% | 20.3% | 12.4% | 6.0% | 13.9% | ||||||||||

HFS China EH Avg | 17.6% | 31.8% | 5.5% | 22.2% | 16.3% | 19.9% | 49.0% | 21.5% | 8.6% |

Myth number two is ‘isn’t China a beta play and isn’t alpha dependent on the market direction’ – no it is not. You can generate good returns even in very challenging markets.

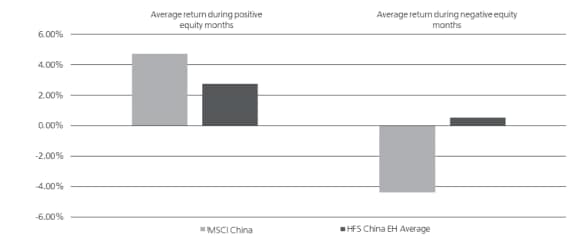

The best way to judge the quality of returns is to judge how managers performed in up and down markets, in other words the upside/downside capture.

The results of our managers show good symmetry as they made money in most cases when the market was on the way up and, remarkably, during the drawdown our hedge funds actually made money. That’s why exposure in China via hedge funds can be very powerful exposure within these risk-return characteristics.

Average returns across varying equity markets

Average returns across varying equity markets

January 1, 2014-December 31, 2020

One quick point to bear in mind is that the dispersion of the Asian hedge fund universe is large, and significantly larger than any other any other market. Therefore, careful bottom-up selection, active management and portfolio construction are paramount.

Three investor concerns when looking at China

Three investor concerns when looking at China

#1 US China tension

Geopolitical events will continue to deliver headlines and market volatility. However, our experience shows that historically7 our managers tend to thrive during periods of high volatility as it provides dislocations and an ability to trade around events.

In addition, it's evident by now that it provides winners and losers in some sectors and companies as China is forced to reshore and localize capabilities that in the past were heavily dependent on other countries.

#2 Government interventions

Government interventions are not new. Managers here have had to adapt to multiple efforts from the government to close loopholes and address potential systemic risks.

We saw it in the education and gaming sectors, for example, in the recent past. These create no doubt temporary headwinds, but in the medium-to-long term some companies emerged as winners and others losers, so - again - not a bad thing for stop picking.

#3 Market technical headwinds

ADR delistings are definitely a risk we should watch. However there is a mitigating factor. Companies are applying for a listing in China exchanges and investors are migrating from ADRs into local listings, and we believe we will see more of that activity going forward.

But it also creates potential opportunities: one, because lower quality ADR-listed companies won’t have the luxury of listing elsewhere because they may not meet requirements and, two, relative value trading opportunities between the local and ADR listings when these companies have these dual listings.

To summarize, we have a good global backdrop for hedge funds, combined with a compelling opportunity set and an exposure with superior risk-return return characteristics if you pick the right managers, and I think you should look no further than Asia for superior alpha generation.

Tan Jia, Portfolio Manager, UBS O’Connor

Tan Jia, Portfolio Manager, UBS O’Connor

After years of opening and reform, China can offer alpha rather than just beta opportunities for global investors.

We define these opportunities in a number of ways:

#1: China has been deeply involved in the global supply chain, fast following or even leading innovation. The dynamics between China and the rest of the world help us create many profitable ideas8.

#2: China has been entering into the new normal, which means acceleration of market consolidation in many industries. The winners and their competitors will perform very differently in this stage.

#3: QFII and RQFII reforms will enable the A-share borrow market to develop further. We believe that the capacity of fundamental long-short strategies will be significantly improved. We expect the short capability can be doubled as soon as the credit account gets ready. As a result, relative value investors have the potential to benefit from information asymmetries, data science, and understanding evolving industries to chase attractive risk-adjusted return with low correlation to other asset classes and fund managers.

Currently, people have some concerns about China, so let’s focus on some domestic issues:

The Huarong default event

The Huarong default event

I view this as a storm in a teacup, and no different from previous risk events.

Holistically speaking, the financial system in China has been more transparent since 2016, and fiscal discipline has also been established gradually.

To remove implied guarantees for state-owned enterprises (SOEs) and local government financing vehicles (LGFVs) is an important step to establish a market-driven financial system.

The fact is that the People’s Bank of China (PBoC) and China Banking Regulatory Commission (CBRC) have already established a risk assessment system which covers all banks and the large non-bank financial institutions, in order to make sure they are on top of risk management.

In China, the first priority is to avoid significant volatility, so the whole banking system has chosen to provision higher and higher, and to write off non-performing loans (NPLs) both quietly and significantly.

To investors like us, Huarong is likely to be the next name to be forgotten, like the LGFVs were a few years ago.

China’s anti-trust policies

China’s anti-trust policies

Some of the current policies, including the suspension of the Ant Financial IPO last year, are anti-trust – not anti-innovation.

An interesting question to ask to those mega tech companies globally that have actively participated into online lending – is that the kind of real innovation we want to have?

I think what China should do is to learn from the (US) Bayh-Dole Act launched in 1980 in order to protect intellectual property (IP) and encourage innovation in schools and small-and medium-enterprises (SMEs).

Q&A

Q&A