Late cycle rebound

Global growth stands at an important inflection point. Are recession concerns overdone? Could central bank easing, lower geopolitical risks and China's fiscal action prompt a rebound in demand?

Evan Brown

Evan Brown

Head of Multi-Asset Strategy

Dan Heron

Dan Heron

Senior Investment Strategist

Ryan Primmer

Ryan Primmer

Head of Investment Solutions

The global economy stands at an important late cycle inflection point. But late cycle does not mean end cycle. We continue to view short-term recession fears as overdone. Rather, we expect a moderate growth reacceleration in early 2020 as geopolitical risks abate, China's growth slowdown stabilizes and as the lagged impact of looser monetary policy globally feeds through to demand. Lower USD borrowing costs also herald an important easing of financial conditions to emerging markets that is likely to be positive for global demand growth.

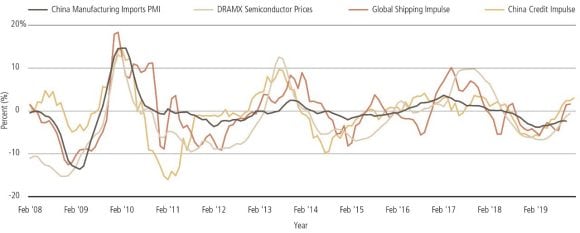

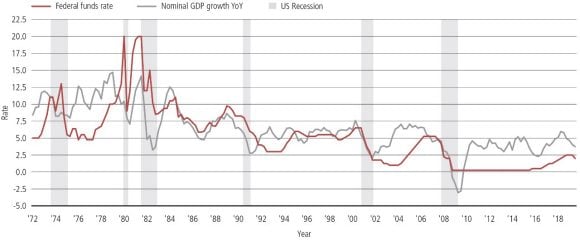

The global demand slowdown in 2019 has been largely driven by global industrial production and trade as the negative impacts of the US/China trade dispute have increased. But global manufacturing lead indicators are now turning and we expect these tentative signs of improvement to become more definitive in the coming months. Key to the moderate demand pickup we expect is the delayed boost to economic activity from the significant easing of global financial conditions. Over the past year, the US Federal Reserve has performed a sharp policy pivot from the tighter stance and rhetoric of late 2018 to its current more accommodative position. Recent statements support our view that the Fed is now more likely to let US growth and inflation 'run hot' than it is to tighten policy early and risk a sharp downturn. We do not see the US Federal Funds rate rising in the near term.

Exhibit 1: Lead indicators suggest global manufacturing growth is rebounding

Importantly, the shift to looser policy has not taken place only in the US, but has been broad based across both developed and emerging markets. Absent any extraneous demand shock, we see this supporting growth throughout the early part of 2020 as the boost from lower rates feeds through more powerfully to manufacturing. We also expect consumption growth to remain resilient in 2020, underpinned by low unemployment and solid wage growth. Should growth falter, we believe that calls for fiscal stimulus to play a greater role in the overall policy mix will grow louder in a number of major economies.

Despite GDP at its lowest level since 1992, the one major central bank whose policy stance has not moved to unequivocally loose is the People's Bank of China (PBoC). The five basis point cut in one-year bank lending rates in early November is evidence that the PBoC is not ignoring the growth slowdown. But its modest nature perfectly reflects the difficult balancing act it faces between conflicting cyclical and structural goals. This does not concern us unduly. With the full monetary and fiscal policy toolkit at their disposal the Chinese authorities are able to turn to other measures alongside interest rates to influence the rate of demand while rebalancing its drivers. We expect Chinese growth to stabilize as these policy actions take effect and there is scope for further stimulus measures if necessary.

Exhibit 2: US monetary policy is loose

Geopolitics represent both risk and opportunity. Brexit and the US/China trade standoff were the headline geopolitical stories of 2019. However, the probability of a worst case scenario on both issues has clearly diminished. We see sufficient goodwill in the most recent US/China rhetoric to suggest that some of the previously announced tariffs could be cancelled rather than just postponed. Such an outturn could provide much needed support to global corporate confidence.

Twelve months ago we said that global growth fears were overdone given the likely resilience of developed world labor markets. We therefore entered 2019 with a positive view on global equities that has since been well rewarded. We continue to see short-term recession concerns as exaggerated and there are major opportunities from a tactical asset allocation perspective in an extension of the business cycle and a stabilization of growth prospects relative to what is priced into markets. We expect some sharp rotation within risk assets.

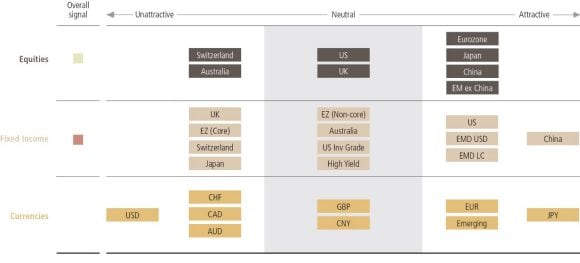

Asset class attractiveness

Asset class attractiveness

Traditional asset classes and currencies

Asset class views

Asset Class | Asset Class | Overall | Overall | UBS Asset Management’s Viewpoint | UBS Asset Management’s Viewpoint |

|---|---|---|---|---|---|

Asset Class | Global Equities

| Overall | Slightly positive | UBS Asset Management’s Viewpoint |

|

Asset Class | US Equities | Overall | Neutral | UBS Asset Management’s Viewpoint |

|

Asset Class | Ex-US Developed Market Equities | Overall | Slightly positive | UBS Asset Management’s Viewpoint |

|

Asset Class | Emerging Markets Equities

| Overall | ·Slightly positive | UBS Asset Management’s Viewpoint |

|

Asset Class | China Equites

| Overall | ·Slightly positive | UBS Asset Management’s Viewpoint |

|

Asset Class | Global Duration | Overall | Slightly negative | UBS Asset Management’s Viewpoint |

|

Asset Class | US Bonds | Overall | Slightly positive | UBS Asset Management’s Viewpoint |

|

Asset Class | Ex-US DM Bonds | Overall | Slightly negative | UBS Asset Management’s Viewpoint |

|

Asset Class | US IG Corporate Debt | Overall | Neutral | UBS Asset Management’s Viewpoint |

|

Asset Class | US HY Corporate Debt | Overall | ·Neutral | UBS Asset Management’s Viewpoint |

|

Asset Class | EM Debt US dollar Local currency | Overall | Slightly positive Slightly positive | UBS Asset Management’s Viewpoint |

|

Asset Class | Chinese Bonds | Overall | Slightly positive | UBS Asset Management’s Viewpoint |

|

Asset Class | Currency | Overall |

| UBS Asset Management’s Viewpoint |

|