Conversations with Bin Shi

China equities had a strong year in 2020, so we sat down with Bin Shi, Head of China Equities, to discuss market trends and the future outlook

1. How would you summarize 2020?

1. How would you summarize 2020?

2020 was a year of huge change and many challenges. It has forced most people to adapt to new realities.

2021 will likely also be a year of changes and challenges, which will create many winners and losers. We are optimistic about the Chinese equity market in the long run. There are many high quality companies with strong management which deliver sustainable growth.

2. What’s your strategy with cash?

2. What’s your strategy with cash?

Throughout the year, we have adhered to our investment philosophy and process and invested with discipline.

In 2020, markets rose and we were cautious about valuations in certain segments of the market that rose particularly quickly, such as the small and mid-cap names in IT and healthcare, electric vehicles (EVs) and biotech-related. We believe increased retail participation has led to exuberance in certain segments of the market.

Over the past couple of months there have been some positive developments on the macro front, such as progress on vaccines globally and the US election result, which have reduced the short-term headwinds for China, and we have been deploying cash to some of our high conviction ideas.

Bin Shi is a member of the Global Emerging Market and Asia Pacific Equities team, located in Hong Kong. He is the lead Portfolio Manager for the China equity strategies.

3. Is the China A-share market overvalued?

3. Is the China A-share market overvalued?

Investors should stay invested. The A-share market has, overall, done very well and some of the sectors have done even better.

If you look at the overall market, valuations are just above the 10-year historical average so from that perspective it is not so overheated.

In the A-share market you are either hot or not. Some sectors are very hot, but other sectors did not participate as much. We believe we can still find long-term opportunities in those other not so hot sectors. So we are actively deploying our money into the A-share market at this point.

We are actively deploying our money into the A-share market at this point

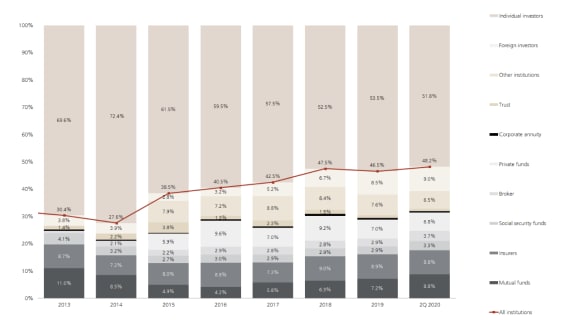

China’s A-share market: investor base, 2013-2Q 2020

China’s A-share market: investor base, 2013-2Q 2020

4. What is your outlook for US/China relations under the Biden administration?

4. What is your outlook for US/China relations under the Biden administration?

We have held the view that the US-China rivalry is not going away in a hurry, even if the incoming Biden administration might be more measured in dealing with such confrontational issues.

The key difference now is that the president's governing philosophy is different, and there will be differences in style and specific measures.

China is catching up very quickly, and it is expected that US measures against China will continue, but they will perhaps not be as extreme as those imposed on Huawei.

The reason is that, in the long run, harsh measures from the US will force China to actively develop its own technologies so that it can be independent.

And when that happens, the US will not only lose a huge market, but also create a strong competitor.

A more pragmatic approach for the two sides is "Coopetition" which means to cooperate and compete at the same time.

5. Which themes are you particularly focused on?

5. Which themes are you particularly focused on?

We believe our predominant exposure to long term, domestic themes should hold us in good stead.

These areas include China’s rebalancing into services and consumption, increasing share of discretionary spending and premiumization, and increasing spending on R&D and technology leading to innovations.

6. What impact have US/China tensions had on the A-share market?

6. What impact have US/China tensions had on the A-share market?

There has been some impact, but not too much. The Chinese A-share market is driven by domestic investors and domestic liquidity and global investors’ participation is, at this point, still comparatively small.

US moves to limit investment in some specific companies has had some impact, but that vacuum has been quickly filled by domestic investors.

7. What are your views on the potential relisting of Chinese companies in Hong Kong?

7. What are your views on the potential relisting of Chinese companies in Hong Kong?

With regard to ADR relisting in Hong Kong, I think they should continue to be listed in the US because they have benefited from the deep pools of money there and have also benefited US investors too since they have performed extremely well.

The size of the opportunity for Hong Kong depends on how they are treated in the US. If the US regulators can reconcile the difference in accounting standards, I think they (ADRs) will continue to be listed there and potentially seek a secondary listing in Hong Kong, which is fine.

This will benefit investors because at this point I own both ADRs and secondary listed Hong Kong names, and I like the fact I can choose between the liquid market in the US and Hong Kong listings, which trade in my timezone.

This allows me to put ideas to work right away, instead of waiting for the US market to open. The ideal situation is to have a primary listing in the US and a secondary listing in Hong Kong and then let investors pick and choose whichever they prefer.

We will have to wait and see though. If Chinese companies are treated badly in the US and get unfair treatment, it is possible they will move their primary listing to Hong Kong, which has the potential to benefit local investors here tremendously.

8. The Ant Financial IPO suspension and anti-trust legislation have been sizeable shocks to global investors, do you really think A-shares are ready to be unleashed on global investors just yet?

8. The Ant Financial IPO suspension and anti-trust legislation have been sizeable shocks to global investors, do you really think A-shares are ready to be unleashed on global investors just yet?

Definitely yes. You can’t just focus on isolated incidents like Ant Financial. A-shares are still not perfect, but neither are other markets. I believe the A-share market is still a good market in which to make money and generate a return.

On antitrust legislation, actually it was announced many years ago. What we are seeing now is stronger enforcement, which may have surprised people.

The reason behind it is that the internet platform companies are becoming very large indeed and their strategies can have major impacts on the whole country. As such, I believe there is a need for stronger enforcement of antitrust regulations.

9. China has made a big commitment to be carbon neutral by 2060 – just how serious is the Chinese government about building environmental factors into policy making, and how is this creating opportunities in the equity markets?

9. China has made a big commitment to be carbon neutral by 2060 – just how serious is the Chinese government about building environmental factors into policy making, and how is this creating opportunities in the equity markets?

When the Chinese government says something, they really mean it.

For the carbon neutral targets, I think they have done a lot of calculations and work behind the scenes to make sure that this is something they can live up to.

So I think they are very serious about this target and this most likely means more support for electric vehicles and renewable energy.

"When the Chinese government says something, they really mean it.

For the carbon neutral targets, I think they have done a lot of calculations and work behind the scenes to make sure that this is something they can live up to.

So I think they are very serious about this target and this most likely means more support for electric vehicles and renewable energy."

10. What’s your view on recent and future trends for IPOs in the China equity space?

10. What’s your view on recent and future trends for IPOs in the China equity space?

2020 has been an extremely active year for IPOs in the China equities space and we actively participated in many of them.

Structural changes in China have driven the new rounds of IPOs, with many new companies with new business models coming to market. We find many of these newly-IPO’d companies attractive from a long-term investment perspective.

We think 2021 will continue to be an active year in terms of new companies coming to market in China. Many of these companies used private equity funding to develop their business, but now they are mature enough to become public companies.

Multi Asset investing

Multi Asset investing

Multi Asset solutions for modern markets