Investing in an ESG World

Sustainable investing is going mainstream. What do investors need to know?

It no longer matters what you think of ESG. Like it, or not, trading is happening around the ESG discussion, so investors need to understand the effect that ESG is having on capital flows and investment returns. We've looked at what that means in practice, explored some of the ways that investors are already adapting to this changing landscape and constructed an investors' guide to investing in an ESG world.

We've focused on four key areas:

We've focused on four key areas:

- The accelerating and persistent flow of capital into ESG funds

- Regulation as a driver of ESG flows, disclosures, and opportunities to generate alpha

- The role of data, both current and prospective, in ESG analysis

- The 17 Sustainable Development Goals and their potential to accelerate ESG flows

Going with the flow

Going with the flow

2019 was a year in which ESG investing really accelerated. According to Morningstar, flows into ESG funds quadrupled in 2019 compared to 2018, a trend which continued strongly into the first quarter of 2020. While the rest of the market saw outflows ESG funds continued to attract assets.

Regulation, regulation, regulation

Regulation, regulation, regulation

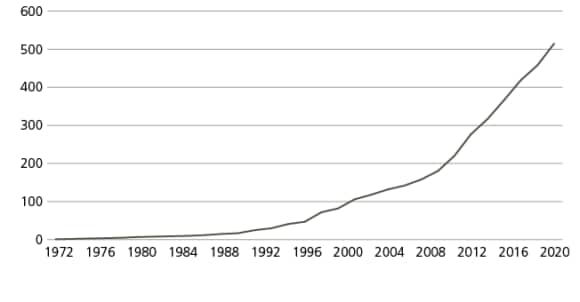

A key driver of those flows has been regulation. In Europe particularly, the pace of ESG regulation is speeding up, both for investors and corporations. At the end of 2019 the EU passed legislation designed to target so-called 'greenwashing'. Meanwhile, over the coming months it's likely that the EU Taxonomy will have a significant impact on the investment landscape, given its target of encouraging private investment in sustainable growth while contributing to a climate neutral economy. And on that note, we can't forget the work of the TCFD and its focus on climate disclosures, which continues to gather momentum.

Exhibit 1: The rise of regulation - cumulative number of policy interventions per year

Better data, better decisions

Better data, better decisions

This push of ESG regulation is amplifying the calls for better ESG data. For some time now, concerns have been voiced regarding the quality of many ESG data sets, the inconsistent metrics and the tendency for much of the data to be backward looking. In our assessment, we consider the analytical frameworks being built by sustainability analysts and explore some new approaches that utilize non-financial, big data sources to deepen ESG insights. Within our own firm, two teams – UBS Evidence Lab and the QED team – are innovating in this space and we highlight some of their work.

Another important element of the data discussion is the degree to which ESG factors influence risk and return. In other words, how do investors think about material non-financial factors? We explore this topic by looking at the question of governance, it's short and long-term impact on share prices and how that compares versus an aggregated ESG score.

But what about the SDGs?

But what about the SDGs?

In today's world, an evaluation of the ESG landscape can't ignore the 17 UN Sustainable Development Goals. With just ten years left to achieve their ambitious aims, how should investors be thinking about them and their targets of addressing topics like poverty, hunger, health, education, climate change, gender equality, environment and social justice?

We think outcome focused legislation, like the EU taxonomy, will be important in encouraging investment towards the SDGs. We also see a growing role for investors to engage and collaborate with companies in line with specific SDG targets to influence their progress towards aligning their business models with the SDGs' aims. This represents an important next step for engagement as it then becomes not just a tool for addressing risk, but rather a way of driving opportunity.

Where next?

Where next?

All these considerations now sit against the backdrop of the COVID-19 pandemic, the consequences of which are profound. For investors, they provide the starkest proof of why ESG matters. The prioritization of social factors like sound business ethics or employee health and wellbeing; the role of governance factors such as effective risk management, and the importance of environmental factors which calls for a 'greening' of the pandemic's recovery phase – all these demonstrate why ESG is material to the investment case.

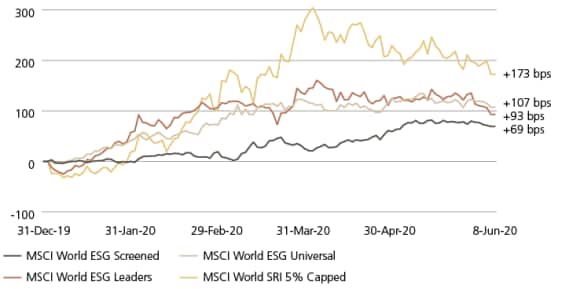

So far, we've seen the performance of many ESG funds hold up well – a factor which will likely add support to ESG flows. In addition, it's quite possible that regulators will pay even closer attention to the ways that ESG risks are integrated within investment processes, which could further reinforce those flows. This in turn makes it possible to foresee a state where institutional investors choosing not to integrate ESG might find themselves in dereliction of their fiduciary duty.

Exhibit 2: Relative performance (in bps) of ESG Indices vs. MSCI World parent Index

In conclusion, if anyone had any doubt as to the value of ESG before the pandemic, there can be little question in their minds now. We are standing on the cusp of a transformation in the capital markets. Our world has become an ESG world.