The transformative power of capital

Large asset managers can lead the way in equities-based impact investing

Impact investing has become the fastest-growing segment of sustainable investing by offering a tantalizing promise: meaningful improvement in global social and environmental challenges along with competitive returns.

Assets in impact investing strategies more than doubled from 2018 to 2019, to USD 502 bn1, targeting solutions for challenges including global poverty, water scarcity and climate change. We believe that incorporating the scale of a large asset manager as a force multiplier can help bring impact investing into the mainstream.

Before 2000, impact investing primarily referred to philanthropic or mission-focused investments, typically in illiquid assets or private equity that sought to achieve a goal but did not necessarily produce competitive returns. Over the last several years, impact investing has expanded to include listed equities, opening the door for investors of all types to invest with the goal of addressing global issues without sacrificing competitive returns.

We believe that the larger asset managers have a structural advantage when it comes to impact investing. UBS Asset Management held total invested assets of USD 831 bn as of 30 June 2019. Because we own the same companies' shares across a wide variety of active and passive strategies, we often have total positions that eclipse those held by smaller 'boutique' impact funds.

Impact investing: Essential requirements

Impact investing: Essential requirements

In order for impact investing in listed equities to succeed long-term, it must generate a competitive financial return, equal to or better than a broad benchmark. In addition, a true impact strategy must meet three other requirements: intentionality, measurement & verifiability, and additionality.

Impact comes from intention

Impact comes from intention

Intentionality requires that the universe for impact portfolios consist of companies with products or services that generate positive impact (tied to the UN SDGs).

Exhibit 1: United Nations Sustainable Development Goals: A roadmap for change

Exhibit 1: United Nations Sustainable Development Goals: A roadmap for change

The law of active management suggests that such a selection set challenges the active investor’s ability to match or exceed the benchmark return. We believe that over time, skilled managers will be able to produce competitive returns, but only by taking more risk through portfolio concentration as well as by engaging companies to improve their business models and potentially increase the positive impact further than would otherwise occur, which is what is meant by additionality.

Measurement & verifiability are essential

Measurement & verifiability are essential

Measurement & verifiability are critical components of impact investing because they provide the basis for demonstrating the difference of impact investing on the world. UBS Asset Management has been an innovator in developing frameworks for impact measurement and verifiability. In 2016, our Sustainable & Impact Investing team began developing an impact measurement framework in conjunction with experts in the disciplines of public health and environmental science. Measurement gives us a baseline for assessing whether and how much an invested company's impact continues to improve over time.

Additionality through engagement

Additionality through engagement

Additionality requires that an investment realizes positive change that would have otherwise not occurred, which is extremely challenging in public markets where investors provide no direct funding to companies and where liquidity entails a limited price impact from any particularly investment made. Most fundamentally, engagement addresses the 'so what' question about impact investing: whether capital invested in a company results in incremental or additional change.

Narrowing the gap between private and public impact investing through engagement strategies

Narrowing the gap between private and public impact investing through engagement strategies

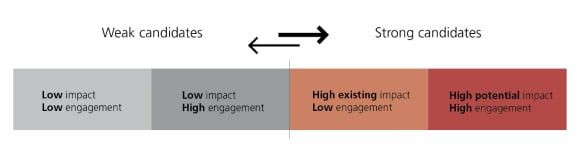

We look for companies that have high existing impact or clear opportunities to create additional impact and are open to engaging with us to increase that impact. Companies that are good candidates for an impact fund are those that have existing positive impact as well as the potential to enhance positive impact through engagement. Companies that have low existing impact and low potential for increased impact through engagement are not good candidates. Our team takes a long-term approach to developing and tracking our engagement objectives for each company held in the strategy.

Exhibit 2: Candidates for impact investment: High engagement can substantially increase potential impact and valuations

Exhibit 2: Candidates for impact investment: High engagement can substantially increase potential impact and valuations

Impact investing: The investment challenge

Impact investing: The investment challenge

The projections for asset growth in impact investing are very ambitious and surveys suggest that there is considerable momentum. In the end, however, if these trends are to prove out, asset owners and investors have to be satisfied that their returns are adequate and competitive.

We believe that for asset managers to succeed in delivering the dual promise of social and environmental change and investment returns they will need to allocate more resources to the effort than has been done to date. First, the manager must have an excellent fundamental research platform that can deliver strong valuation input to the process.

Second, the manager must have a strong engagement capability with experience in more established ESG-focused engagement and act as a trusted advisor who can provide valuable input to help the target company achieve incremental impact.

We believe that in the end, the most successful managers will forge a new form of friendly activism able to generate meaningful incremental impact. This will require a strong rapport with company management and other stakeholders along with the expertise to provide concrete suggestions that can create more impact and an improved business model that the market values more highly

Harnessing capital and capitalism for social change

Harnessing capital and capitalism for social change

The evolution of impact investing to listed equities holds considerable promise for the future if it harnesses the power of capitalism to deliver changes in society and the environment that are sorely needed. We believe that in the years to come impact investing will lead listed companies to reassess their products and services, to align their interests better with the external world and to use the power of capital to solve problems.