Sustainable leaders in emerging markets

Sustainable leaders are an exciting part of the Emerging Markets (EM) space, so we sat down with our Emerging Markets and Asia Pacific Equities team to learn more about them.

What do we mean by sustainable leaders?

What do we mean by sustainable leaders?

The word sustainable can have more than one mean meaning.

Primarily, when we talk about sustainable leaders, we mean:

- Industries and sub sectors that are benefiting from trends that are structural and long lasting in EM, and

- Industry leaders within these industries who we believe have (or will have) a sustainable competitive edge that will allow them to deliver above industry average growth over the long term, and

- Companies which typically have a better than average to high ESG profile.

What themes and trends are helping create sustainable leaders?

After extensive research, we have identified a series of trends that we currently believe will drive EM over the long term. We believe that winners and losers will emerge as these trends play out. These include:

- Climate change and environment: Consciousness around this subject has ramped up in recent years and now investors can find may companies within this theme that weren’t so visible a few years ago.

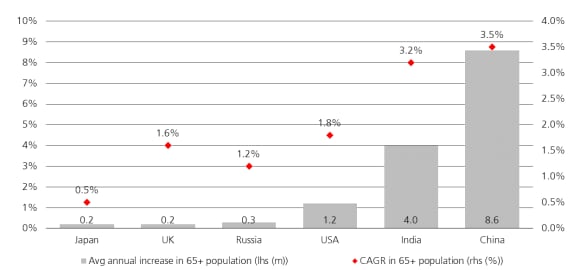

Energy efficiency, smart mobility, and renewable energy are key themes, and we believe companies exposed to renewables, and energy storage systems are expected to see strong growth, as these technologies not only enjoy policy support but are also scaling up and becoming more cost competitive. - Healthcare: Amid rapid population aging and urbanization, there is increasing demand for health care as lifestyles change. Additionally, and accelerated by the COVID pandemic, we are seeing new health care horizons with new technologies, drugs, and treatments coming to market.

Healthtech is one example where digitization may improve efficiency and save time in the drug development process. We believe that leading pharma companies and large Biotech firms are well positioned with their innovative pipeline to mitigate the risk of falling drug prices and take advantage of new opportunities arising from changes mentioned above.

Annual Increase in 65+ Population, 2020 – 2040

Annual Increase in 65+ Population, 2020 – 2040

- Evolution of the emerging market consumer: We are seeing the average EM consumer move up the value chain in terms of goods and services, as well as going up the discretionary and premium value chain and spending less on basic food and clothing as their habits change.

We believe that companies leading in categories such as Leisure & Entertainment and Health care services should see an acceleration of growth because of the above trends. - Deglobalization and geopolitics: Amid US/China tensions and the COVID-19 pandemic there is a shift toward self-reliance in many EM countries which we think could lead to the emergence of national and regional champions in new industries.

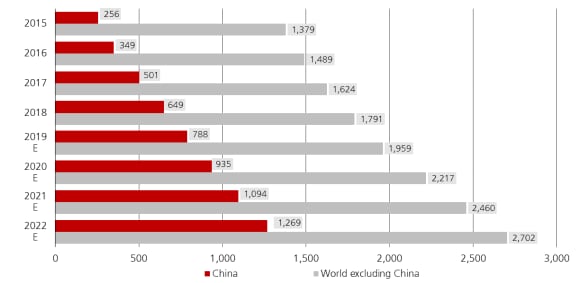

Companies with state-of-the-art manufacturing capabilities outside of China, in South East Asia or Eastern Europe, are expected to gain market share and thus experience above average growth. - Digital transformation: This theme encompasses nearly every sector and industry today. A few industries stand out, however, such as Media & Entertainment, Fintech, and Robotics.

We see major changes in how consumers use video and digital banking services in the future, as well as the rise of automation amid rising wages and developments in artificial intelligence.

Total installed robots (1,000s), 2015-2022 (f)

Total installed robots (1,000s), 2015-2022 (f)

How are we incorporating sustainability into our approach?

How are we incorporating sustainability into our approach?

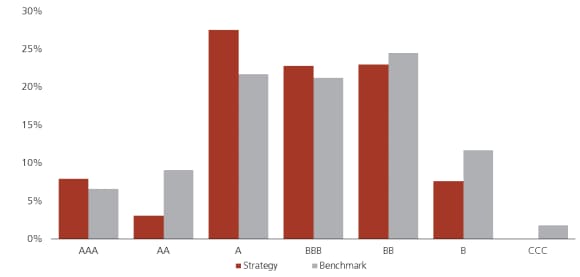

Firstly, we exclude companies that are engaged in activities like tobacco production and fossil fuel extraction, as well as companies with poor corporate governance standards.

Secondly, we strive to identify companies with a superior ESG profile to the benchmark index .

Additionally, we also actively engage with many companies to improve their ESG profile by meeting with them and exercising our board voting rights.

Applying these standards leads to a portfolio for the strategy that offers a superior ESG profile to the index, as well as a strong ranking in terms of carbon footprint and intensity.

MSCI ESG rating

MSCI ESG rating

Why does investing in sustainable leaders matter?

Why does investing in sustainable leaders matter?

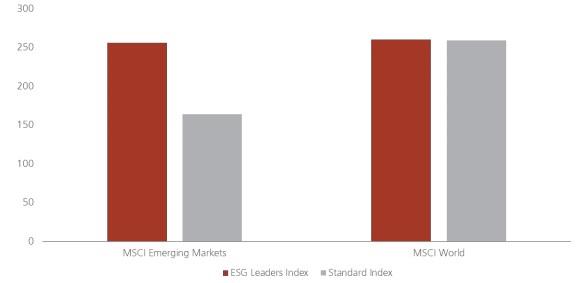

Ultimately, this approach matters because we believe that industry leaders with a good ESG profile will eventually deliver in terms of long-term performance.

Looking at historical data shows that, in EM at least, an ESG focus can deliver stronger performance than the standard MSCI EM benchmark.

Cumulative index performance — gross returns (USD)

Cumulative index performance — gross returns (USD)

What kinds of companies do we consider to be sustainable leaders?

What kinds of companies do we consider to be sustainable leaders?

One example is a South Korean chemicals company with a growing electric vehicle (EV) battery business.

That company is well positioned to benefit as EV adoption increases as the world shifts to lower emission transportation and sustainable energy systems.

Additionally, we see it being a long-term leader due to its cost and technological advantages against all if not most of its peers and its position as a key supplier to some of the world’s largest carmakers.

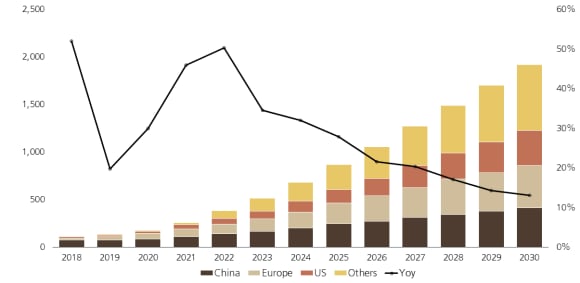

Global demand for EV batteries, 2018-2030 (Est)

Global demand for EV batteries, 2018-2030 (Est)

Total demand in gwh (LHS) / Annual-o-y increase in global demand (RHS)

Battery global demand (gwh)

Battery global demand (gwh)

What about engaging with sustainable leaders?

Take the example of a food company in China where our ESG dashboard flagged certain risks around disclosure.

We worked with the SI team to review the stock and found that the stock is attractive because of continued market share gain, favorable industry structure driving consolidation and the milk price upcycle lowering competition.

The SI research team identified food quality & safety, energy intensity and water intensity topics as financially material risks to the business, requiring further information from the company on how they manage these risks considering the lack of detailed disclosure.

To follow up on our concerns, the investment team participated in two engagements with the company aiming to evaluate the strength of ESG risk management practices and to encourage greater transparency.

As a result of our engagements, the company has enhanced its profile in the Coller FAIRR Protein Producer Index, a benchmark to assess ESG risks for meat, dairy, and fish producers.

We continue to work with the company on enhanced disclosure, extension of the carbon and water reduction targets to the supply chain as well as Board independence and diversity.

In summary: the EM sustainable leaders opportunity

EM are being driven by megatrends which are creating disparities in the fortunes of companies with strong winners as well as losers.

The key to long-term success in EM is to be able to identify these megatrends and, more importantly, the future leaders & winners and stick with them as these fundamental trends play out.

ESG is a key component behind the long-term success of these leaders in delivering sustainable growth and shareholder value.