China and the gravity shift in global asset allocation

If the world economy is a solar system, then China is at the heart of it. What does it mean for asset allocators?

China and the gravity shift in global asset allocation – in 60 seconds

China and the gravity shift in global asset allocation – in 60 seconds

- If the world economy is a solar system, then China is at the heart of it;

- Global monetary policy, consumer demand, and tech innovation are three of many fields where China's influence is profound and wide-ranging;

- China is the source of a wide range of investible trends that are changing the world we live in;

- Despite trade tensions, global investors are increasingly recognizing this, driving what we believe is a gravity shift in global asset allocation to China.

If the world economy is a solar system, then China is at the heart of it.

And just as the sun pulls in the planets, so the gravitational pull from China's economy affects every one of us, and in ways we might not initially realize.

That's especially true when we think of 2019, because if the story of 2019 was looser global monetary policy and stronger stock markets, then China wrote it.

32 Chengfang Street

32 Chengfang Street

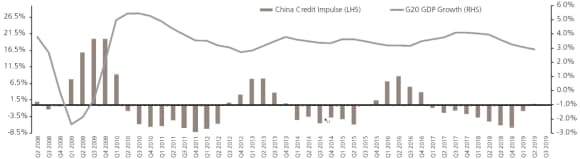

That's because China made the first move to ease monetary policy in October 2018, which the rest of the world then followed.

And it's not for the first time, because China monetary policy was behind the post-GFC rebound in 2010, the upturn in global growth in 2016, and the subsequent slowdown in 2018.

We think this is both underappreciated driver of the past and an indicative one of the future where global monetary policy will increasingly be shaped out of the HQ of the People's Bank of China at 32 Chengfang Street in Beijing.

China Credit Impulse (LHS) & G20 GDP Growth (RHS) (%/YoY Change), Q2 2008-Q3 2019

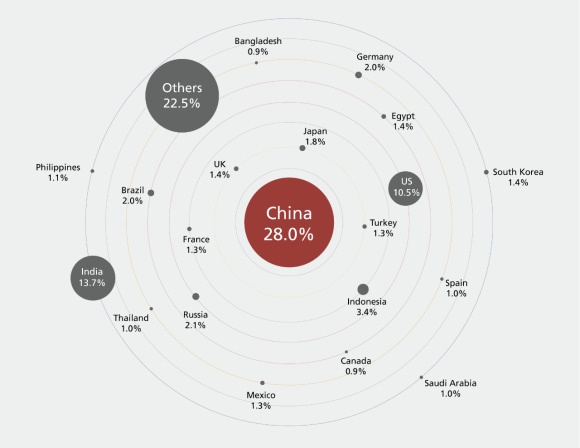

China adds more to global growth than any other country

China adds more to global growth than any other country

Contribution to global growth (PPP, Intl $), 2019-2020

Chinese consumers – the world economy's underappreciated driver

Chinese consumers – the world economy's underappreciated driver

But while monetary policy is important, what matters is how policy affects the economy. In the world economy at least, it's the spending decisions of Chinese consumers that make the difference.

That's because they propel what will soon be the world's largest retail market and contribute an estimated 76% to China's annual economic growth, according to McKinsey estimates.

That's why pitchside ads in English Premier League matches are in Chinese and why the world's best hotels now have Chinese staff as standard in their receptions.

Cashless payments are a case in point, with the People's Bank of China counting RMB 277.4 trillion (USD 41.51 trillion) cashless payments in China in 2018.

And that has changed Chinese society to such an extent that 62% of Chinese consumers say they can survive for between one-to-four weeks with only RMB 100 in cash.

China's ongoing consumer story is as much tied to the innovations of Chinese companies than it is to the driving forces of urbanization and income growth.

China’s tech capabilities are catching up (and overtaking) leading countries

China’s tech capabilities are catching up (and overtaking) leading countries

Continuing the innovation theme, China's achievements in other parts of the world of technology are starting to lead the world.

None more so than in the world of space exploration. China didn't just land on the moon in 2019, it went one further and landed on the previously unexplored far side.

That landing, so typical of China's efforts across the world of tech, showed how it is catching up with competing nations and going one further.

And that's bringing forth a whole range of tech innovation, ranging from drones to supercomputers, which we believe have the potential to not only change China, but change the world in the coming years.

Watch Bin Shi talk about the China/US tech race here:

China’s gravitational pull

China’s gravitational pull

And, despite trade tensions, investors are responding to China's gravitational pull.

Take foreign direct investment for example. Though tariffs and US pressure might have made companies think twice about investing in China, inflows actually rose in 2019, according to the United Nations.

For companies around the world, China is now less of a destination for low-cost manufacturing for export, but an attractive market in itself and a place in which to test ideas.

And it’s a similar story for stock and fixed income investors.

The attraction of opportunities onshore from China's vibrant sectors like consumer and technology have driven a steady increase in onshore asset ownership, with total ownership increasing 30% y-o-y to RMB 4trillion in September 2019, according to the People's Bank of China.

In part that's because of fundamentals.

Domestic dynamics like urbanization, automation, demographic change, premiumization, the growth of China's internet population, all have much more room to grow and they present a whole range of opportunities for investors.

Four key drivers for China's economy

More importantly, we're seeing growing confidence in China because it has a demonstrated capacity to change with the times.

Just think about the policies enacted in the past few years: the one-child policy has been reversed, rural-to-urban migration controls have been abolished, and foreign investors have been allowed into onshore markets.

Put together, this mixture of attractive long-run fundamentals and commitment to reform is one that we believe is a long-term story.

Looking forward, we believe global asset allocation, the process of index inclusion, coupled with the outstanding opportunities available onshore, is going to require a global reallocation of capital to reflect China's economic heft in the coming years.

And that means China allocations are no longer a niche, 'nice-to-have' investing approach.

In fact, given China's weight, we believe it should be treated as a standalone allocation of its own, as it is for the US, UK and Japan, and, furthermore, that the key question for allocators is not 'what's your strategy for 2020?' but 'what's your China strategy for 2020?

And as we go through the prospects for the RMB, the wave of exciting innovations coming from China, the strength of its consumer sector, and the steps China is taking to lead the fight against climate change, we believe investors will find a whole range of opportunities to base their strategies around and ensure that they too fall into China's orbit.

Find out why a standalone strategy allocation to China makes sense

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.