Macro Monthly The market will test the Fed. The Fed will win.

In coming months, the market may confuse the Federal Reserve’s increasing bullishness on the US economic outlook with hawkishness on rate expectations.

Highlights

Highlights

- In coming months, the market may confuse the Federal Reserve’s increasing bullishness on the US economic outlook with hawkishness on rate expectations.

- We expect volatility in financial markets as investors overestimate how soon monetary stimulus will be withdrawn.

- In our view, this would be premature, as it will take time to develop persistent inflationary pressures and return to full employment.

- We have strong conviction that the Fed will successfully push back against any sharp increases in rates and tightening of financial conditions by reaffirming its commitment to providing support until the recovery is complete.

- This means episodic volatility will serve as opportunities to add risk, as the outlook remains bright in light of progress on vaccinations and still-accommodative monetary and fiscal stances.

The approaching season of spring holds great promise as the time when the developed world will begin to collectively exhale. Flash forward two months, and our base case is that the picture looks something like this: Vaccinations have accelerated further and are poised to continue to do so. Regional and local authorities will be mapping out plans for reopening. Stateside, additional fiscal stimulus will have further bolstered excess savings, improving the outlook for pent-up consumer demand. Readings of inflation will be boosted by base effects.

Lingering fears about the pandemic’s drag on the growth outlook are poised to ebb, replaced by a swell of relief and optimism. Fixed income markets may appear ripe for a repricing. On the surface, ultra-low interest rates and massive bond purchases by central banks may appear to be obviously inconsistent with this improving outlook. Investors could look to more aggressively price in the withdrawal of stimulus. There would likely be pressure on yields, particularly at the 10 and 30 year parts of the curve, and to a lesser extent, two and five-year borrowing costs, as well. This would be the market testing the Fed on the implications of its new flexible average inflation targeting framework. And we believe that the Fed will win by not allowing prolonged market volatility that jeopardizes future progress towards its dual mandate goals. Strengthening and reinforcing forward guidance, both by rhetoric and in its forecasts, will affirm that rates are poised to remain at zero until the recovery is complete and push back against any disorderly bond selloff.

The early phase of reopening may feel like a sprint. But repairing the economic damage done by the pandemic is far longer than a 100-meter dash. Under the Fed’s new framework, a rate hike requires a return to both pre-pandemic levels of tightness in the labor market and evidence of a sustained rise in inflation to, and slightly above, its 2% target – not just an expectation that price pressures will increase.

The central bank’s focus is binary: Policy makers do not care how fast the runner is going, but whether or not the finish line has been crossed. As such, accommodative monetary policy is poised to continue to support risk asset valuations and do its part to foster a robust recovery, which benefits our preferred procyclical positions.

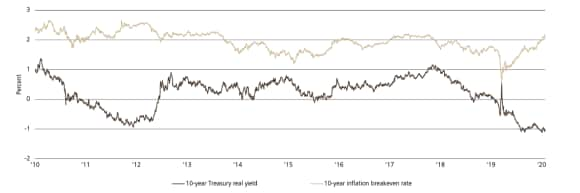

Exhibit 1: Negative real yields support risk assets, rising breakevens benefit procyclical positions

Exhibit 1: Negative real yields support risk assets, rising breakevens benefit procyclical positions

The risk is in the right tail

The risk is in the right tail

We are cognizant of the downside risks to growth posed by virus mutations that could undermine the effectiveness of vaccines. But we think a more probable source of disruption to risk assets will be found in how the Fed navigates its looming communications challenge.

The initial burst of annual inflation this spring will be spun as the start of an era of more elevated price pressures resulting from expansionary monetary and fiscal policy, leading to premature worries that the Fed is behind the curve. This may foster a broad tightening of financial conditions: a potentially disorderly rise in real yields and the US dollar with negative spillovers for risk assets. Long-duration assets like growth stocks, whose particularly lofty valuations are predicated on ultra-low rates lasting in perpetuity, would be particularly challenged in such an environment.

But we believe such an episode would be short-lived, because this is not 2013. In his memoir, former Fed Chair Ben Bernanke singled out Jay Powell, Betsy Duke, and Jeremy Stein as the three board members who pushed him into remarks that kick-started the infamous Taper Tantrum. We are confident Powell will not repeat this communications error.

Fed Chair Jay Powell, Vice Chair Rich Clarida, and Governor Lael Brainard have already soothed a market that threw a mini-tantrum on the increased likelihood of material fiscal stimulus in early January. For instance, Clarida said that inflation running at 2% for one year was a prerequisite for liftoff. In addition, Powell indicated that the central bank does not view rate hikes as an appropriate tool to address perceived excesses in financial market and potential instability. When the market demands proof of the Fed’s change in the reaction function under a flexible average inflation targeting regimes, we believe the Fed will be eager to keep providing reminders. Early-cycle overestimation of how quickly central banks will return to policy tightening is common, and commonly wrong.

This task may grow more difficult as we get more progress on the Fed’s dual mandate goals over time. The amount of volatility will likely depend on how well the Fed is able to separate the tapering of asset purchases from a subsequent liftoff of rates by strengthening its forward guidance to offset the impact of less accommodative balance sheet policy.

All in all, we believe the Fed will allow some repricing of interest rates, particularly at the long end of the curve. Rises in longer term yields, particularly if concentrated in market-based estimates of future inflation, would suggest the market has faith in their ability to allow for sustained inflation and tighten policy further down the road. In our view, 10-year Treasury yields should not trade below levels that prevailed prior to the Georgia Senate elections unless mutations of the virus materially undermine the effectiveness of vaccination campaigns. As such, the risk-reward of shorting US Treasuries increased as yields drifted back down towards 1%.

We retain a moderate overweight to equities, but do not view this as the appropriate time to add risk since this negative catalyst could soon surface. Within equities, value and cyclical segments of the market are better equipped to outperform amid this kind of volatility. Credit, particularly IG credit, may also be vulnerable in a rates-driven bout of risk aversion because of its duration component. We have reduced some of our short dollar exposure ahead of any potential premature Fed tightening scare.

Fiscal firepower

Fiscal firepower

The magnitude of the incoming US fiscal impulse is a critical factor behind our expectations for a rise in yields that upsets risk assets. More US stimulus both pulls forward the anticipated timing of an eventual Fed liftoff, and provides evidence that would support calls of a regime change to a permanently more muscular fiscal policy which introduces upside risk to longer-run growth, inflation, and rate expectations.

Republicans and Democrats are very far apart on the price tag for the next round of fiscal relief. We believe President Biden and Congressional Democrats will prioritize size over bipartisanship and utilize a process known as reconciliation, which can only be used if certain conditions are met, to pass a bill with only a bare majority. Therefore, the risks to the size of the next fiscal package are meaningfully tilted to the upside, in our view, relative to consensus expectations for a USD 1 trillion deal.

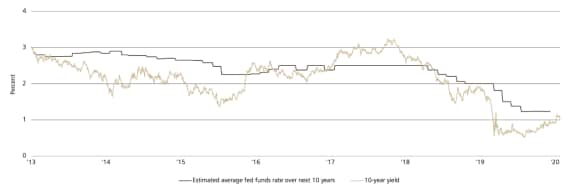

Since 2014, the 10-year Treasury yield has tended to trade below what primary dealers expect the federal funds rate to average over the next decade – 1.25%, according to the most recent survey. This number is likely to move higher along with expectations of the fiscal thrust. This informs our view that longer term yields are poised to ascend, but that any sharp, outsized overshoot of such a threshold would garner Fed push-back and be temporary.

Exhibit 2: 10-year Fed expectations often a ceiling for 10-year Treasury yields

Exhibit 2: 10-year Fed expectations often a ceiling for 10-year Treasury yields

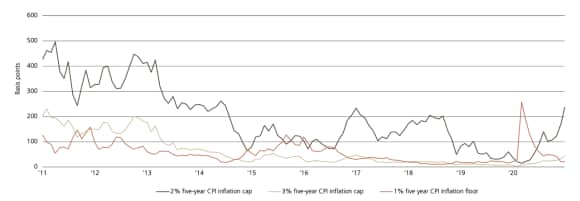

Exhibit 3: Left tail inflation outcomes have been priced out, but little sign of right tail being priced in

Exhibit 3: Left tail inflation outcomes have been priced out, but little sign of right tail being priced in

Inflated expectations

Inflated expectations

Policy support in 2020 cut off the left tail of the inflation distribution. Vaccine development meaningfully reduced the odds of a prolonged period of time with the Fed policy rate stuck at the zero lower bound. And expected US fiscal support in 2021 and beyond is opening up right-tail outcomes for growth and inflation. While we expect the market may episodically lean in to this right tail during 2021, we believe that will prove to be a hurdle too high in the short term.

Pent-up demand from consumers and the potential for supply constraints may enhance this base-driven pickup in inflation during the early stages of reopening.

But investors should take into account the amount of healing in the jobs market required for the Fed to declare its two missions accomplished. A pre-COVID unemployment rate of 3.5% was insufficient to generate significant inflation. If the trend in labor market recovery runs equal to its strongest phase of the last cycle, it would take nearly three years to eclipse a minimum standard of what the Fed considers to be maximum employment. Achieving that objective in coordination with 2% inflation or slightly above is what will convince the Fed that price pressures are indeed persistent. Spare labor capacity is therefore likely to keep a lid on realized and expected domestic services sector inflation for quite some time.

The near-term outlook for US fiscal stimulus buoys the domestic inflation outlook, as does the increasing likelihood of pro-growth measures to bolster the expansion in the years to come. But it will be difficult for the US to power a durable, sustained upturn in global inflation on its own. For that, it will likely need a supporting cast – and certainly no countervailing forces introduced by the likes of China and Europe. A regime change for global inflation requires a sustained turn in global fiscal policy on the scale of moving from mere crisis-time triage to macroeconomic steroids. At this time, forward market pricing of yields suggests much more confidence in the medium-term outlook for growth and inflation in the US than in Europe.

Exhibit 4: Core measures of US inflation have been tame for decades

Exhibit 4: Core measures of US inflation have been tame for decades

Exhibit 5: Services inflation is domestically-oriented and typically runs hotter than goods

Exhibit 5: Services inflation is domestically-oriented and typically runs hotter than goods

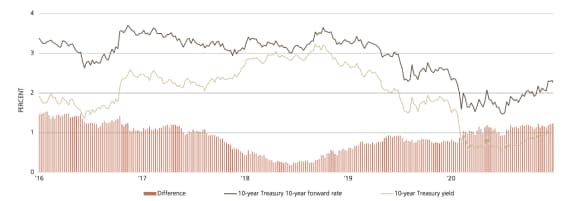

Exhibit 6: Treasury forwards point to relative optimism on the US recovery

Exhibit 6: Treasury forwards point to relative optimism on the US recovery

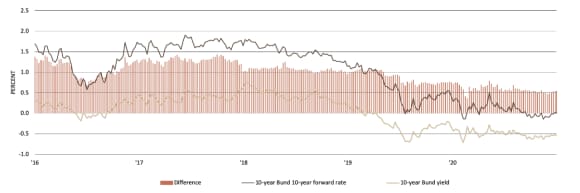

Exhibit 7: Bund forward rates suggest risk of a prolonged economic malaise

Exhibit 7: Bund forward rates suggest risk of a prolonged economic malaise

Conclusion

Conclusion

We are prepared for a rates-driven shock which could prove disruptive to risk assets given elevated valuations and tight credit spreads. We have trimmed our US dollar short in light of the attendant consolidation in foreign exchange that would likely accompany such an event. Since we believe that this episode will not prove a genuine threat to the nascent recovery, maintaining some dry powder to deploy on a pullback is prudent. The Fed should reaffirm that the expansion remains supported by substantial monetary stimulus, while additional fiscal spending also improves the economic outlook. These forces, in concert with accelerating vaccinations, will prevent prolonged or lasting market damage, in our view.

Given this view, we believe the case for staying underweight developed market duration relative to stocks, with a neutral view on credit, remains compelling.

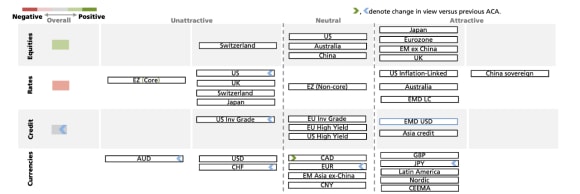

Asset class attractiveness

Asset class attractiveness

The chart below shows the views of our Asset Allocation team on overall asset class attractiveness, as well as the relative attractiveness within equities, fixed income and currencies, as of 29 January 2021.

Read more

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.