Macro Monthly The policy response and its implications

This month's edition examines the longer-term risk-return profile for asset classes beyond the current period of elevated volatility.

Highlights

Highlights

- The COVID-19 shock has catalyzed a historic policy response from monetary and fiscal authorities in the US and globally.

- Policymakers have significantly reduced the left tail risk, namely that this economic and health crisis would morph into a financial crisis.

- The Fed in particular has substantially expanded its mandate to support corporate credit markets more broadly, and even purchase equity securities linked to bonds.

- In the near term, investors will have to weigh the severe economic contraction against this policy response, alongside evolving news on the virus and mobility restrictions. This will keep markets volatile over coming weeks.

- Going forward, we believe that the expected returns on risk assets have improved while those on sovereign bonds have worsened.

- Investors must keep an open mind to upside inflation risks in the future, as aggressive stimulus meets supply side constraints.

Our Q1 2020 Macro Quarterly, 'The Next Decade in Asset Allocation,' discussed how the policy response to the next recession would create a new era for markets. Writing it in December, we certainly did not think the timing of that recession would come so soon. But the policy reaction in a broad sense has come in line with our expectations. With rates near the effective lower bound across developed economies, the commonly used tools of monetary policy on their own would not be enough. We suggested elected officials would need to step up fiscal stimulus and that the lines would blur between where central bank policy ends and fiscal policy begins. In this Macro Monthly we discuss the features of the US and global policy response to the COVID-19 recession, near-term implications and some thoughts about how the economy, policy and markets may look when the virus has largely run its course.

COVID-19 and the associated steps to contain its spread have caused what is likely to be the sharpest contraction in economic growth in history. In addition to causing tragic human and direct economic costs, the speed of the shock exposed underlying fragilities in financial markets. These included a banking system, partly due to constraints of post-crisis regulation, reluctant to intermediate the US Treasury Curve, the world’s liquid benchmark, discount rate and diversifier. The cost of dollar funding for both domestic and international users spiked, credit markets froze and volatility in major asset classes reached record highs.

The Fed swiftly cut rates to zero, expanded quantitative easing on an unlimited basis to re-liquefy the Treasury Curve and mortgage-backed securities, and opened foreign exchange swap lines to heal dollar funding. These were all vital steps, but it wasn’t until partnerships with the fiscal agent, the US Treasury, to provide direct financing to corporations, that risk assets began to stabilize. The Fed and Treasury brought back some of the 2008-2009 ‘alphabet soup’ of programs, supporting commercial paper and consumer ABS markets. But they also introduced new facilities to purchase corporate bonds in primary and secondary markets, including notably the purchase of ETFs tied to corporate bonds, a direct intervention of US policymakers into the stock exchange. Last but certainly not least, the Fed and Treasury announced new programs to provide lending to small- and medium-sized businesses.

Exhibit 1: The Fed's 'alphabet soup' of programs to support the economy and markets

Fed Action | Fed Action | Description | Description | Used '08 | Used '08 |

|---|---|---|---|---|---|

Fed Action | Commercial Paper Funding Facility (CPFF) | Description |

| Used '08 | X |

Fed Action | Primary Dealer Credit Facility (PDCF) | Description |

| Used '08 | X |

Fed Action | Money Market Mutual Fund Lending Facility (MMLF) | Description |

| Used '08 | X |

Fed Action | Term Asset-Backed Securities Loan Facility (TALF) | Description |

| Used '08 | X |

Fed Action | Primary Market Corporate Credit Facility (PMCCF) | Description |

| Used '08 | - |

Fed Action | Secondary Market Corporate Credit Facility (SMCCF) | Description |

| Used '08 | - |

Fed Action | Main Street Business Lending Program | Description |

| Used '08 | - |

In the meantime, the US Congress also acted quite swiftly relative to its history to pass the CARES Act, a USD 2.2 trillion (~10% of GDP) headline stimulus bill. A large share was allocated to industry relief, including USD 450 bn in capital for the Treasury to back the programs listed above, which can be levered 10 to 1 by the Fed. More broadly, the bill’s purpose is to at least partially restore lost incomes for individuals, keep workers tied to employers, and prevent larger numbers of bankruptcies. Reports suggest congressional leaders see this as just one of several large stimulus packages to come.

Exhibit 2: The CARES Act in brief

Relief target | Relief target | Size (Billions USD) | Size (Billions USD) | Purpose and breakdown | Purpose and breakdown |

|---|---|---|---|---|---|

Relief target | Industry relief | Size (Billions USD) | 529 | Purpose and breakdown |

|

Relief target | Small business assistance | Size (Billions USD) | 377 | Purpose and breakdown | Loans that become grants if employers pay workers, utilities, rent |

Relief target | Payroll relief | Size (Billions USD) | 300 | Purpose and breakdown | Employers can defer 2020 payroll taxes for up to 2 years |

Relief target | Individual checks | Size (Billions USD) | 300 | Purpose and breakdown | USD 1,200 per individual, USD 2,400 per couple and USD 500 per child for individual incomes under 75k. Phases out after that |

Relief target | Unemployment insurance benefit | Size (Billions USD) | 250+ | Purpose and breakdown | Increase of USD 600 per week benefit, expanded availability |

Relief target | Additional funding for state and local governments and hospitals | Size (Billions USD) | ~250 | Purpose and breakdown | Includes USD 150Bn for state/local. USD 100Bn for hospitals |

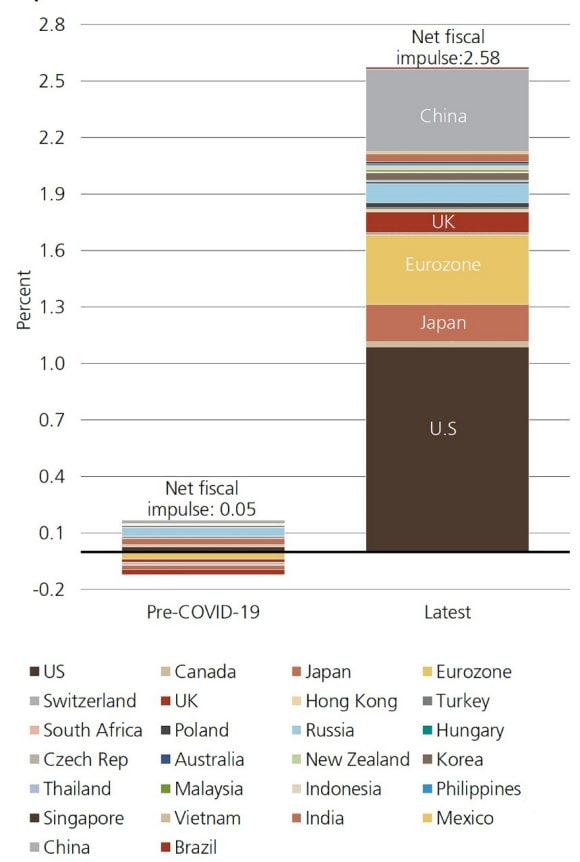

Policymakers around the world are delivering robust policies to defend against the COVID-19 shock. China has stepped up infrastructure investment and introduced tax cuts. In Europe, the European Central Bank (ECB) has significantly expanded quantitative easing to stem the widening of Italian debt spreads to bunds. While joint bond issuance has not yet gone ahead, budget rules have been relaxed on a national level and Germany, long reluctant to engage in fiscal stimulus, has broken from constitutional rules that prevented deficit spending. Countries like Germany, France and the UK have stepped in to guarantee business survival and employee wages. Overall, the net global fiscal stimulus as a percent of GDP already surpasses that of 2008-2009.

Exhibit 3: Contributions to change in global fiscal impulse

In our view the global monetary and fiscal response will be enough to prevent a health and economic crisis from turning into a financial one. Indeed, while we are enduring an unprecedentedly sharp contraction, this may end up being the shortest recession in history assuming economies can come back online over the coming months. Still, as impressive as the monetary and fiscal response to this crisis has been, the only true ‘bazooka’ is a healthcare breakthrough. Progress towards widely available therapeutics and eventually a vaccine seem the most dependable ‘solutions’ to normalize consumer and business behavior and establish a more solid foundation for risk assets. We expect to hear progress on potential anti-viral medications by late April while a broadly available vaccine still appears over a year away.

As such we continue to expect volatile markets as investors grapple with the virus’s evolution, the duration of social distancing policies and the speed at which macro policies announced gain traction. How these factors evolve will help determine whether the ultimate recovery in the economy and markets is V, U, or L shaped. At this point, given the sharp increase in unemployment expected in the US, a true V-shape looks unlikely and we expect finding a durable bottom in risk assets will be a process rather than a distinct event.

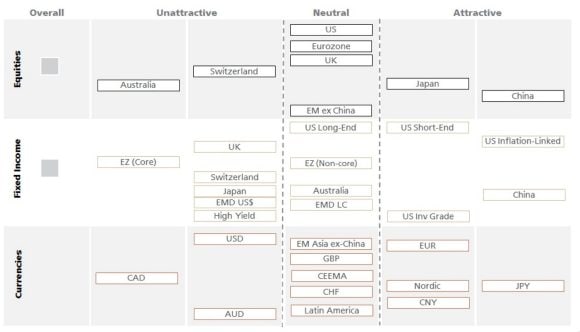

Given the wide range of possibilities in this environment, we are keeping overall risk asset exposure near benchmark. Our focus continues to be on relative value, overweighting equity markets in Asia, which appear to have seen the worst of the virus as compared to developed markets including the US, where the battle is still in early stages. In fixed income, we are long real yields as protection against further deterioration in risk appetite and as central banks do whatever is needed to ease financial conditions. In foreign exchange we are underweight the USD against reserve currencies EUR and JPY as dollar funding stresses ease and underlying vulnerabilities in the US economy become apparent. Indeed, relatively less flexible labor markets in Europe and other regions can be a blessing in disguise during a crisis, ensuring workers and businesses remain tied together and geared for the rebound once the virus is contained.

We of course also remain focused on the longer-term risk-return profile for asset classes beyond the current period of elevated volatility. With the recent selloff, valuations for risk assets have broadly improved and may provide opportunities for long-term investors. At the same time, the prospective returns for sovereign bonds have worsened. As discussed in ‘The Next Decade in Asset Allocation,’ investors must recognize that with policy rates near their effective lower bound and fiscal policy becoming a more important driver, that the equity-bond correlation can become less negative. While the first-order effects of the COVID-19 shock as well as the sharp oil price decline are disinflationary, investors should be prepared for a surprise in inflation down the road, as aggressive monetary-fiscal policy meets potential supply side constraints. We reiterate the importance of diversifying portfolios broadly against a variety of macroeconomic outcomes, including exposure to real assets and absolute return.

Asset class attractiveness

The chart below shows the views of our Macro Asset Allocation Strategy team on overall asset class attractiveness, as well as the relative attractiveness within equities, fixed income and currencies, as of 30 March 2020.

Read more

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.