Will the 60/40 portfolio rise from the ashes?

2022 has so far been one of the worst years on record for a US 60/40 portfolio. Here, the multi-asset team explain the appeal of diversifying exposures beyond traditional stocks and government bonds.

For much of the past 25 years, investors have benefitted from a consistently negative correlation between equities and bonds. Simply put, when equities sold off, investors could generally rely on bonds to provide ballast and protection in a multi-asset portfolio.

However, persistently elevated inflation and aggressive central bank tightening campaigns have put financial markets under significant pressure this year. Investors have had virtually nowhere to hide: the total return from global stocks is -21% through the first 10 months of the year. Global sovereign bonds and credit have also performed poorly, with total returns of -22% and -21% respectively, over this same period.1

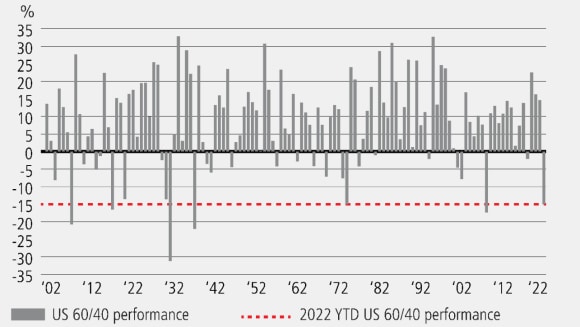

This has seen the typically negative stock-bond correlation turn positive. As of mid-November, the year-to-date return from a portfolio with a 60% weighting to US stocks and 40% weighting to US Treasuries is -15% (Chart 1). There have only been five calendar years on record in which the annual performance for this traditional portfolio structure has been worse – and besides the 2008 global financial crisis, all were more than 80 years ago.

Chart 1: 2022 has been one of the worst years on record for a US 60/40 portfolio

Chart 1: 2022 has been one of the worst years on record for a US 60/40 portfolio

Good news about bad markets

Good news about bad markets

We acknowledge that the near-term macro outlook is unusually uncertain. But regardless of what 2023 brings, we believe the inflation, growth, and geopolitical factors that have caused market strife in 2022 are increasing the potential rewards for medium- and long-term investors willing to bear these risks. This is the good news about bad markets.

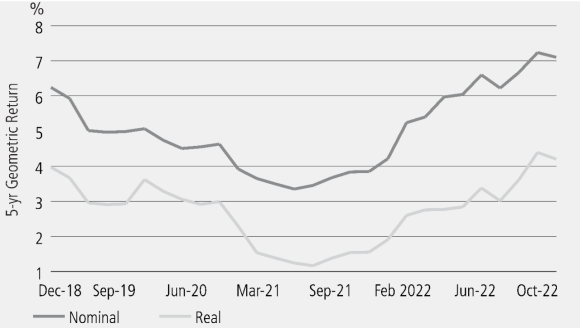

We develop capital market expectations, which are projections for how different asset classes will perform over five years given our assumptions for growth, inflation, monetary policy, and other key macro factors. These estimates indicate that now is a much more attractive investing backdrop compared to 12-15 months ago. In our baseline scenario, expected five-year annual returns for a global 60/40 portfolio are now 7.1%, vs. 3.3% in July 2021, while real (that is, inflation-adjusted) returns are 4.2% vs. 1.2% (Chart 2).

Chart 2: History of five-year expected annual returns for a global 60/40 portfolio

This is the best outlook for returns since at least the fourth quarter of 2018. For investors who embrace diversification and augment portfolios with additional asset classes, the prospective return profile is even better. This is particularly pertinent in the current environment, where investors have to entertain the possibility that more inflationary macroeconomic regimes endure for some time.

Valuations improve

Valuations improve

The main driver of better expected returns across asset classes is the improvement in valuations relative to those embedded in our capital market assumptions from mid-year 2021. More favorable valuations, while retaining a similar outlook for real activity, naturally entail higher return expectations, all else being equal. Our expected return on cash has increased substantially, from less than 1.0% to 3.8%, following substantial interest rate hikes by central banks. The extent of monetary tightening is linked to another change in our estimates: the average outlook for inflation over this horizon, which has risen from near 2% to close to 3%. Importantly, while more robust price pressures help improve nominal expected returns, expected real (inflation-adjusted) returns across asset classes have also improved materially.

Currencies are another key consideration. The US dollar has become even more expensive over the past year, which in our projections increases the expected depreciation of the US dollar over time as it reverts towards fair value. We believe this is poised to boost returns for USD-based investors who hold international assets over a five-year horizon.

Coupon-paying assets

Coupon-paying assets

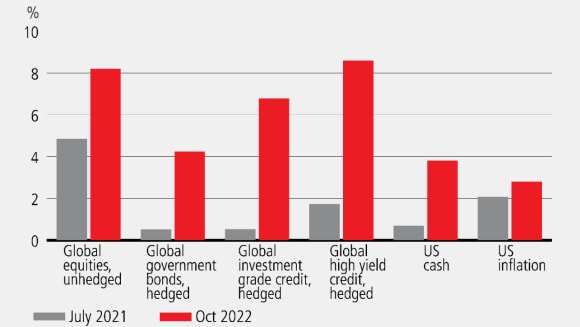

Across the major liquid asset class of equities, government bonds and credit, our baseline outlook for expected returns is meaningfully higher as of October 2022 than in July 2021 (Chart 3). The improvement in the return profile is most evident in assets that pay a coupon – government bonds and credit. This is a function of the higher starting point for risk-free rates thanks to central bank tightening.

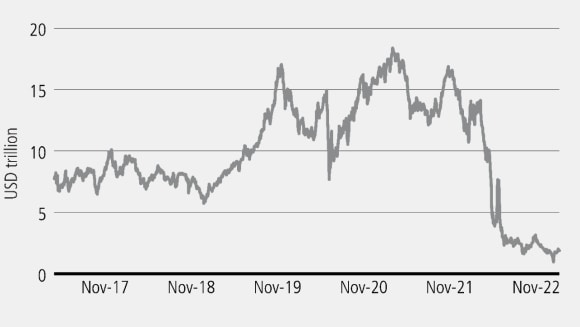

With this regime shift, it is finally possible to earn some income in bonds. Perhaps this development is best illustrated by the dwindling stock of negative-yielding debt globally (Chart 4). Credit markets, across both investment grade and high yield, are looking particularly attractive too. For example, the expected return of global investment grade credit has seen a huge jump, rising from a mere 0.5% to 6.8%. We believe this leads to the end of the TINA era (“there is no alternative” besides stocks). This should be a good-news story on the outlook for diversified multi-asset portfolios. We believe diversification beyond a broad 60/40 portfolio matters now more than ever with positive expected returns across asset classes and a less reliable negative stock-bond correlation.

Chart 3: Five-year expected returns: then and now

Chart 4: The disappearance of global negative-yielding debt

Scenario analysis

Scenario analysis

We also explore how sensitive our return expectations are to different mixes of growth and inflation over five-year time frames:

- Deep recession: lower inflation, lower (or negative) growth.

- Stagflation: a sustained period of above-trend inflation and below-trend growth.

- Goldilocks: a moderation of inflation, along with above-trend growth.

- Reflation: above-trend inflation and above-trend growth.

These scenarios (see Table) reflect the economic backdrop that will play out over the first two years of the horizon, followed by a three-year period of mean reversion (that is, baseline annual returns). As shown in the previous section, the global 60/40 portfolio has a nominal expected annual return of 7.1% and a real expected annual return of 4.2% over the next five years in our baseline projection.

Expected annual real returns are 5.5% and 8.0% in the reflation and goldilocks scenarios, respectively. Real expected returns are meaningfully negative in a stagflation scenario (-6.2%), with a positive stock-bond correlation challenging performance in all parts of the 60/40 portfolio. In a deep recession, real projected returns are also modestly to the downside (-0.4%).

Expected 5Y Returns by Scenario in USD Terms: 31 October 2022

Economic Assumptions | Economic Assumptions | Baseline | Baseline | Deep Recession | Deep Recession | Stagflation | Stagflation | Goldilocks | Goldilocks | Reflation | Reflation |

|---|---|---|---|---|---|---|---|---|---|---|---|

Economic Assumptions | Inflation | Baseline | 2.8% | Deep Recession | 1.3% | Stagflation | 6.0% | Goldilocks | 2.0% | Reflation | 5.0% |

Economic Assumptions | Economic Growth | Baseline | 2.5% | Deep Recession | 1.1% | Stagflation | 1.2% | Goldilocks | 3.0% | Reflation | 3.0% |

Economic Assumptions | Nominal Growth | Baseline | 5.3% | Deep Recession | 2.5% | Stagflation | 7.3% | Goldilocks | 5.1% | Reflation | 8.2% |

Nominal Terms

Title | Title | Title | Title | Starting Yield | Starting Yield | Baseline | Baseline | Deep Recession | Deep Recession | Stagflation | Stagflation | Goldilocks | Goldilocks | Reflation | Reflation |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Title | Cash | Title | Cash | Starting Yield | 4.5% | Baseline | 3.8% | Deep Recession | 1.5% | Stagflation | 6.5% | Goldilocks | 3.2% | Reflation | 4.9% |

Title | Fixed Income | Title | Global Government Bonds | Starting Yield | 3.0% | Baseline | 4.2% | Deep Recession | 5.5% | Stagflation | 2.1% | Goldilocks | 4.4% | Reflation | 2.1% |

Title |

| Title | Global Investment Grade Bonds | Starting Yield | 6.0% | Baseline | 6.8% | Deep Recession | 8.2% | Stagflation | 5.0% | Goldilocks | 7.0% | Reflation | 6.2% |

Title |

| Title | Global Agg | Starting Yield | 3.8% | Baseline | 5.0% | Deep Recession | 6.0% | Stagflation | 3.1% | Goldilocks | 5.1% | Reflation | 3.4% |

Title |

| Title | Global High Yield | Starting Yield | 10.0% | Baseline | 8.6% | Deep Recession | 5.5% | Stagflation | 5.3% | Goldilocks | 11.0% | Reflation | 10.1% |

Title |

| Title | TIPS | Starting Yield | 1.7% | Baseline | 4.9% | Deep Recession | 4.5% | Stagflation | 8.5% | Goldilocks | 3.6% | Reflation | 6.0% |

Title | Equity | Title | Global Equity | Starting Yield | - | Baseline | 8.2% | Deep Recession | -1.7% | Stagflation | -1.6% | Goldilocks | 12.4% | Reflation | 15.1% |

Title |

| Title | 60/40 Portfolio | Starting Yield | - | Baseline | 7.1% | Deep Recession | 1.4% | Stagflation | -0.2% | Goldilocks | 10.1% | Reflation | 10.5% |

Title |

| Title | Standard Deviation | Starting Yield | - | Baseline | 10.7% | Deep Recession | 14.1% | Stagflation | 16.4% | Goldilocks | 8.8% | Reflation | 9.3% |

Title |

| Title | Diversified Portfolio | Starting Yield | - | Baseline | 7.4% | Deep Recession | 1.2% | Stagflation | 1.2% | Goldilocks | 10.5% | Reflation | 11.9% |

Title |

| Title | Standard Deviation | Starting Yield | - | Baseline | 10.7% | Deep Recession | 14.1% | Stagflation | 16.4% | Goldilocks | 8.8% | Reflation | 9.3% |

Real terms

Title | Title | Title | Title | Baseline | Baseline | Deep Recession | Deep Recession | Stagflation | Stagflation | Goldilocks | Goldilocks | Reflation | Reflation |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Title | Cash | Title | Cash | Baseline | 1.0% | Deep Recession | 0.2% | Stagflation | 0.5% | Goldilocks | 1.2% | Reflation | 0.0% |

Title | Fixed Income | Title | Global Government Bonds | Baseline | 1.4% | Deep Recession | 4.1% | Stagflation | -3.7% | Goldilocks | 2.4% | Reflation | -2.8% |

Title |

| Title | Global Investment Grade Bonds | Baseline | 3.9% | Deep Recession | 6.7% | Stagflation | -0.9% | Goldilocks | 4.9% | Reflation | 1.2% |

Title |

| Title | Global Agg | Baseline | 2.2% | Deep Recession | 4.6% | Stagflation | -2.8% | Goldilocks | 3.1% | Reflation | -1.5% |

Title |

| Title | Global High Yield | Baseline | 5.6% | Deep Recession | 4.1% | Stagflation | -0.7% | Goldilocks | 8.8% | Reflation | 4.8% |

Title |

| Title | TIPS | Baseline | 2.0% | Deep Recession | 3.1% | Stagflation | 2.4% | Goldilocks | 1.6% | Reflation | 0.9% |

Title | Equity | Title | Global Equity | Baseline | 5.3% | Deep Recession | -3.0% | Stagflation | -7.2% | Goldilocks | 10.2% | Reflation | 9.6% |

Title |

| Title | 60/40 Portfolio | Baseline | 4.2% | Deep Recession | -0.4% | Stagflation | -6.2% | Goldilocks | 8.0% | Reflation | 5.5% |

Title |

| Title | Standard Deviation | Baseline | 10.9% | Deep Recession | 14.2% | Stagflation | 16.8% | Goldilocks | 9.0% | Reflation | 10.0% |

Title |

| Title | Diversified Portfolio | Baseline | 4.5% | Deep Recession | -0.2% | Stagflation | -4.5% | Goldilocks | 8.3% | Reflation | 6.6% |

Title |

| Title | Standard Deviation | Baseline | 10.9% | Deep Recession | 14.2% | Stagflation | 16.7% | Goldilocks | 8.9% | Reflation | 9.8% |

A good time to diversify

A good time to diversify

We strongly believe that the persistence of unusually elevated macroeconomic uncertainty increases the appeal of diversifying portfolio exposures beyond traditional stocks and government bonds. In particular, adding a larger suite of assets to the portfolio should help address challenges posed by a prolonged period of elevated inflation

For example, in the Table we also present a more diversified portfolio consisting of global equities, a wider array of bonds such as global high yield, and exposure to real assets that can provide inflation protection. Applying our capital market assumptions, this diversified portfolio offers the same risk profile as the 60/40 portfolio, but with a superior baseline expected return despite a 5% reduction in the global equities allocation. Importantly, this portfolio’s projected returns are meaningfully better than the 60/40’s when inflation runs hot, that is, in the stagflation and reflation scenarios.

Brighter outlook for longer-term investors

Brighter outlook for longer-term investors

Our five-year capital market expectations send a clear message: 2022’s pain may be laying the foundation for better future gains. The range of return projections, both at the portfolio level and for individual asset classes, remains wide – particularly in the near term. But for medium- and long-term investors, the outlook is much brighter now than it was in the middle of last year.

We see benefits to diversifying beyond a broad 60/40 portfolio by incorporating additional building blocks in portfolio construction – a wider selection of markets within fixed income such as credit, as well as exposure to real assets. These diversified multi-asset portfolios are likely to be more resilient and better positioned to perform in different regimes, and in particular, more inflationary macroeconomic environments going forward.

About the authors

-

Louis Finney

Research Analyst Investment Solutions

Louis Finney is Co-Head of the Strategic Asset Allocation Modeling group in the Investment Solutions team of UBS Asset Management. In this role he co-leads the team in modeling portfolio returns, risks and characteristics for clients and the Investment Solutions platform. Before joining UBS AM in 2011, Louis was Chief Economist and Principal at Mercer Investment Consulting.

-

Nicole Goldberger

Head of Growth, Multi-Asset Portfolios

Nicole is a Portfolio Manager and Head of Growth Multi-Asset Portfolios within the Investment Solutions team, based in New York. She is responsible for the management and investment oversight of all growth portfolios globally.

PDF

Investment outlook 2023

Investment outlook 2023

In this edition of Panorama, our investment experts recap on the past investment year and explore where the challenges, opportunities and surprises might spring from.

Was this article helpful?

Please enable javascript in your browser and retry.

The feedback component cannot be displayed.

Read more

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.