Accessing 2023 tax reporting information from UBS Online Services

Easy access to your UBS tax reporting documents

Easy access to your UBS tax reporting documents is just one of the many features UBS Online Services offers to support managing your wealth.

To help you prepare for tax season, please review the following information and frequently asked questions, including accessing your tax reports on UBS Online Services and downloading your tax information for 2023 reporting.

A1: Forms 1099 will be available online as follows:

Form or document description | Form or document description | Postmarked/available on UBS Online Services by | Postmarked/available on UBS Online Services by |

|---|---|---|---|

Form or document description | Form 1099-R | Postmarked/available on UBS Online Services by | January 31 |

Form or document description | First mailing—Consolidated Forms 1099 The first mailing includes Consolidated Forms 1099 that we do not anticipate will have any additional updates or issuer-driven reclassifications (e.g., reclassifications made by issuers such as mutual fund and unit investment trust (UIT) companies). Mortgage-Backed Securities (MBS) Form 1099 Information | Postmarked/available on UBS Online Services by | February 15 Please note: If an account owner has multiple accounts with UBS, Forms 1099 may be mailed on different dates. |

Form or document description | Final mailing—All pending Consolidated Forms 1099 | Postmarked/available on UBS Online Services by | February 28 |

Form or document description | K-1 (Limited Partnership Income) Clients who own Publicly Traded Partnerships (PTP) (for example, master limited partnerships) will be sent a K-1 directly from the PTP. Therefore, PTP K-1s are not available on OLS. Instead, you may obtain a copy of the K-1 from the partnership directly. You can locate contact numbers and investor services websites for PTPs on the Tax Package Support website and/or the Partner DataLink website. Additionally, K-1 corrections may be requested through the Tax Package Support website if the PTP is listed on the site. Clients who own Alternative Investments (AI) will receive either a Form 1099 or a K-1 directly from the issuer, depending on the structure of the investment. However, most tax forms are also uploaded to the Alternative Investments Document Portal. This can be accessed by clients by following these steps in OLS: Accounts -> Alternative Investments -> Launch AI Hub. This will bring you to Document Center where client you can search by fund and document type. | Postmarked/available on UBS Online Services by | Various |

Form or document description | Revised form(s)—All Forms 1099 | Postmarked/available on UBS Online Services by | Beginning March 11 |

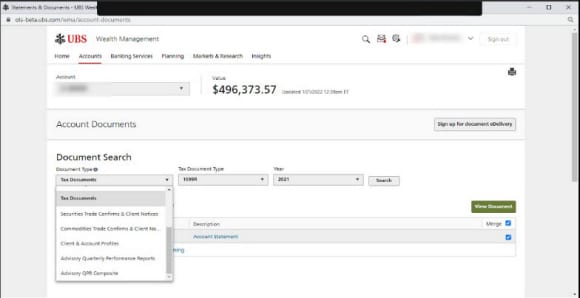

A2: You will find your tax reports under the Accounts tab and then Statements & Documents. You can search using one or multiple accounts. In the Document Search section, under Document Type, from the dropdown menu select Tax Documents.

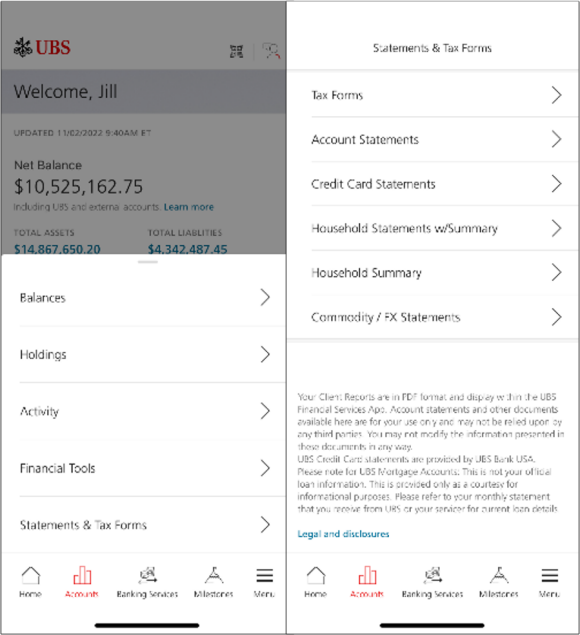

A3: You are able to through the UBS application. First, please go to the Statements & Tax Form section in the Accounts tab. Then, click on Tax Forms.

Note: For Android users, you will see Tax Documents (rather than Tax Forms) when viewing through the application.

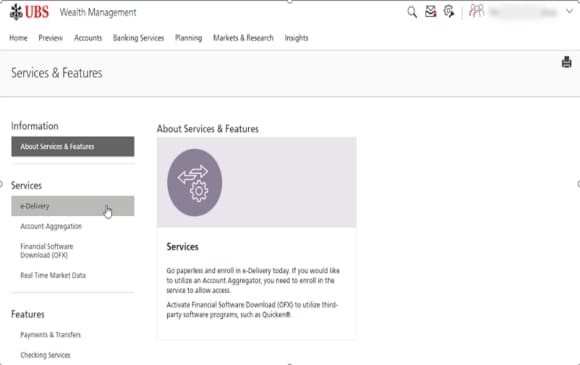

A4: Yes, all accounts enrolled in e-Delivery of Tax Reports will receive an e-mail when your tax forms are available. To verify your e-Delivery settings, select the profile tools icon on the top of any page in Online Services, then Services & Features. On the left-hand side, select e-Delivery.

Please note, it can take up to 48 hours for e-Delivery alert changes to take effect.

A5: UBS supports downloading tax information to Turbo Tax, H&R Block, Tax Form Drop-off (Lacerte) and Tax Act. Downloads may be available within other tax preparation software, provided the software manufacturer gathers Form 1099 data from the Open Financial Exchange (OFX), a secure financial data clearinghouse. Please check with your software manufacturer.

- Note: All UBS tax documents are available for download without having to request access. You only need your UBS account number and the unique Document ID printed on each Form 1099 as your credentials to download. Read this quick card to learn more.

Disclosures

This material is prepared for informational purposes only. Neither UBS Financial Services Inc. nor its employees provide tax or legal advice. Please consult your tax or legal advisors regarding your particular situation.

As a firm providing wealth management services to clients, UBS Financial Services Inc. offers both investment advisory services and brokerage services. Investment advisory services and brokerage services are separate and distinct, differ in material ways and are governed by different laws and separate arrangements. It is important that clients understand the ways in which we conduct business and that they carefully read the agreements and disclosures that we provide to them about the products or services we offer. For more information, please visit ubs.com/workingwithus.

© UBS 2024. All rights reserved. The key symbol and UBS are among the registered and unregistered trademarks of UBS. UBS Financial Services Inc. is a subsidiary of UBS AG. Member FINRA. Member SIPC.