Offering a one-stop solution for investing in Asia

UBS Asia Allocation Opportunity Fund

Please read the important information of the fund before proceeding

Please read the important information of the fund before proceeding

UBS (HK) Fund Series – Asia Allocation Opportunity (USD)

1. The Fund, UBS (HK) Fund Series – Asia Allocation Opportunity (USD) ("UBS Asia Allocation Opportunity Fund”), invests primarily in Asia equities and Asian debt securities.

2. The asset allocation of the Fund will change according to the Manager’s views of fundamental economic and market conditions and investment trends across the globe, taking into consideration factors such as liquidity, costs, timing of execution, relative attractiveness of individual securities and issuers available in the market.

Asia in the pole position for attractive capital growth in the future.

Get to the top with Asia

Get to the top with Asia

This multi-asset Asia Fund invests across equities, Real Estate Investment Trusts (REITs), investment grade and high yield bonds. The top down asset allocation is actively managed and it taps into the UBS active traditional capabilities for security selection.

Why Asia?

Why Asia?

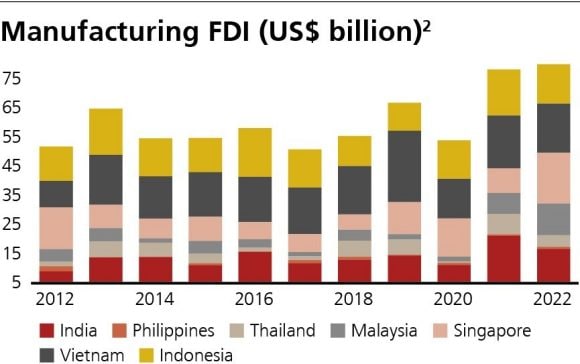

1. Supply chain shifts drive foreign direct investment (FDI) growth in ASEAN and India

1) Strong Policy Support

- FDI incentives and tax incentive

- Reforming the economy through digital transformation and upskilling labour…

2) Cheap Manufacturing Cost

- Average monthly manufacturing wages of China is 2.78 times higher than the average of Indonesia, India, Philippines, Vietnam, Thailand and Malaysia1

3) Geographical Advantage

- Neighboring the China’s pearl river delta region

Supply chain diversification is advantageous to ASEAN & India…

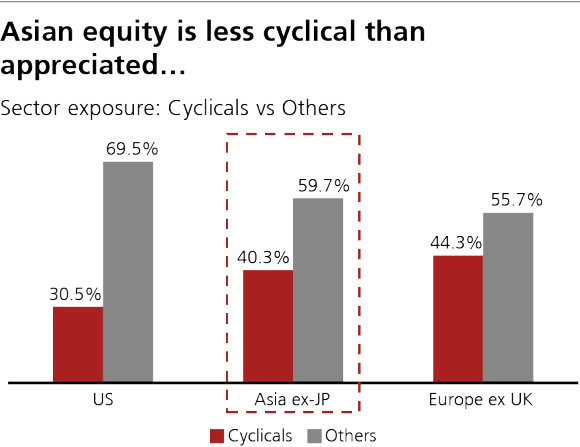

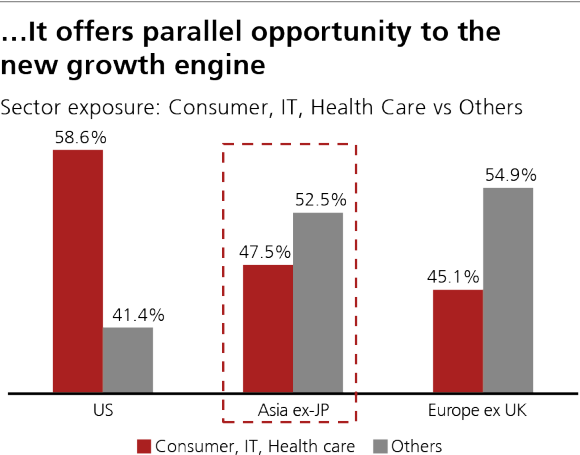

2. Asian equity markets have evolved

2. Asian equity markets have evolved

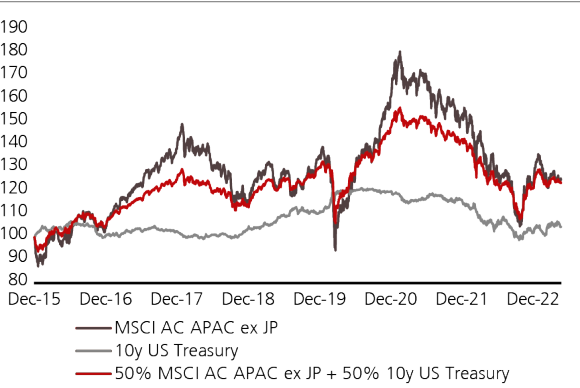

3. A multi-asset approach would provide a smoother journey

Available share classes

Share class | Share class | ISIN | ISIN | Distribution yield | Distribution yield |

|---|---|---|---|---|---|

Share class | Class A USD-acc | ISIN | HK0000678273 | Distribution yield | Distribution reinvested |

Share class | Class A USD-mdist7, 8 | ISIN | HK0000678281 | Distribution yield | 5.9% |

Share class | Class A USD-6%-mdist7, 8 | ISIN | HK0000678299 | Distribution yield | 5.9% |

Share class | Class A HKD-mdist7, 8 | ISIN | HK0000678307 | Distribution yield | 6.0% |

Share class | Class A HKD-6%-mdist7, 8 | ISIN | HK0000678315 | Distribution yield | 6.1% |

Share class | Class A RMB hedged-mdist7, 8 | ISIN | HK0000678323 | Distribution yield | 5.3% |

Share class | Class A USD-8%-mdist7, 8 | ISIN | HK0000959244 | Distribution yield | 8.0% |

Share class | Class A HKD-8%-mdist7, 8 | ISIN | HK0000959251 | Distribution yield | 8.0% |

More funds

More funds

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.