The century club

The rising prospect of living ten decades

In this first global issue of UBS Investor Watch—and the largest survey of wealthy investors in the world—we explore the interplay among wealth, health and longevity. More than 5,000 investors in Germany, Hong Kong, Italy, Mexico, Singapore, Switzerland, Taiwan, the U.S., U.K. and UAE

shared their views with us.

We found that more than half of wealthy investors expect to live 100 years. However, this expectation varies significantly by country. For example, three quarters of those in Germany anticipate reaching age 100, while less than a third of U.S. investors believe they will live that long.

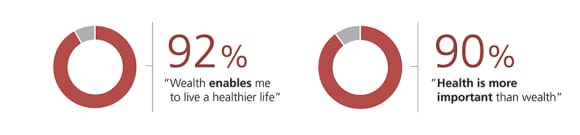

Regardless of how long investors expect to live, nine out of 10 believe health to be of paramount importance. In fact, they consider their health to be more important than their wealth. However, investors do recognize a fundamental connection between the two. Nearly all say their wealth enables them to live a healthier life.

Despite overall confidence in living longer, many investors are anxious about the financial implications of old age. Healthcare costs are the top concern. They also worry about having less wealth to pass on to successors, and working longer to maintain their lifestyle. In the face of these concerns, investors already have started to adjust their financial holdings and inheritance planning.

As for whether they are successful, the ultimate judge will be time itself.

Click here to download the investor watch report in each region:

More than half of wealthy investors expect to live for 100 years

More than half of wealthy investors expect to live for 100 years

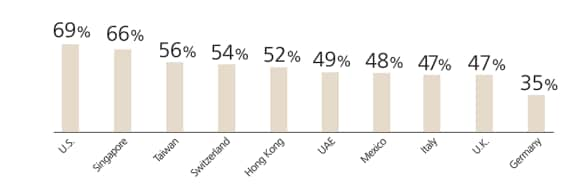

On average, 53% of wealthy investors around the world expect to reach age 100. This is considerably higher than the 80-year life expectancy in most developed countries today. Despite the fact that women worldwide live longer than men, both genders have the same expectation of living to 100.

The outlook for longevity varies by region and country. In continental Europe, more than two-thirds of wealthy investors expect to live to 100. In Asian countries, about half think they will reach that age.

In the U.K. and U.S., this expectation is significantly lower, with less than a third of investors expecting to reach the century mark.

Waiting for one hundred

Percentage of investors who expect to live to 100

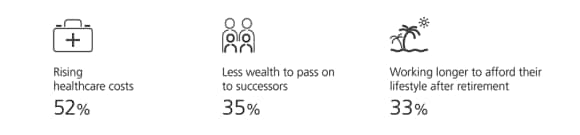

The prospect of living to 100 creates financial anxiety

Despite their wealth, investors worry about affording a 100-year life. Healthcare costs top their list of concerns, with 52% of investors worrying about rising medical expenses. This concern varies significantly by country. Investors in the U.S. are the most anxious while those in Germany are the least concerned.

Following healthcare, wealthy investors worry about having less wealth to pass on to successors, and needing to work longer to afford the lifestyle they desire.

Top concerns due to longevity

Concerns about rising healthcare costs

Percentage who select healthcare as biggest financial concern

Health is more valuable than wealth

Health is more valuable than wealth

Being healthy is the top priority—and the top concern—for wealthy investors. In fact, 90% say investing in their health is more important than growing their wealth.

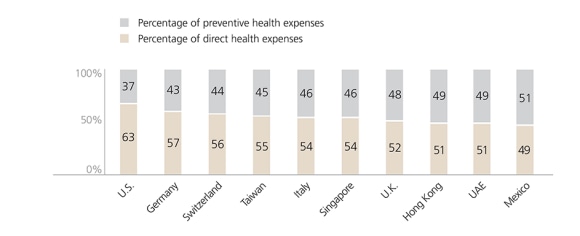

Investors believe their wealth is a primary reason for their well-being. A full 92% say their wealth enables them to live a healthier life. Not only do they spend on doctors’ visits and insurance premiums, but preventive services are also popular. Investors spend significantly on gyms, coaches, supplements and other “lifestyle” expenses. Millennials tend to spend more on these services than

other generations.

Health over wealth

Direct vs. preventive health expenses by country

Investors would sacrifice wealth for 10 extra years

The very wealthiest investors are spending the most to preserve their health. Annual healthcare expenditures for investors with more than $10 million are four times higher than those of less wealthy investors.

The wealthiest are also more willing to sacrifice wealth for health. In fact, they would part with nearly half of their riches for an extra 10 years of healthy life. This number decreases by asset level, with investors in the $1M – $2M segment willing to give up only about one third of their wealth for a decade of healthy living.

Wealthy investors spend the most on healthcare

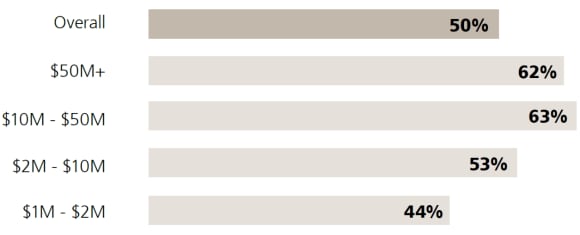

Wealthy investors willing to sacrifice for health

Percentage of wealth willing to sacrifice by wealth bracket

Investors believe working longer ensures well-being

Investors believe working longer ensures well-being

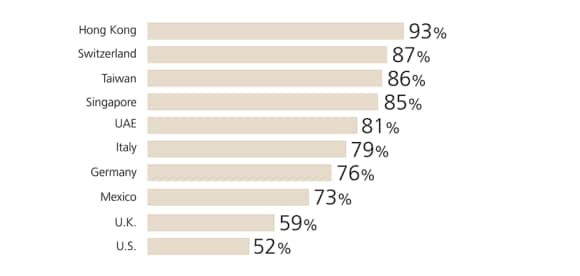

Nearly eight in 10 investors (77%) believe that work has positive effects on health. This sentiment is particularly strong in Asia and Switzerland but far less so in the U.S. and the U.K.

A favorable attitude toward work may be necessary, since most investors believe they will have to work longer to afford the years ahead. Nearly two in three investors are already working beyond traditional retirement age, or would consider doing so, in order to maintain their lifestyle.

Is working longer the fountain of youth?

Percentage who agree with each statement

Percentage who believe working as long as possible is good for health

Investors are making efforts to improve work/life balance

Though investors see work as good for health, many, particularly those in Asian countries, are actively taking steps to balance their work and personal lives. They are reducing their hours and have stopped working on weekends and holidays. In contrast, U.S. investors are least likely to have cut back on work.

Across age groups, Millennials in particular are committed to achieving a better work/life balance. They are more likely to have made changes such as not working weekends or holidays, not using work e-mail or cellphones outside work hours and taking a sabbatical.

Investors strive to work more sensibly

Percentage who have made the following changes to improve work/life balance in the last 3 years

Stopped working on weekends by country

Longevity is prompting investors to act differently

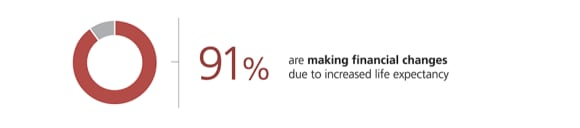

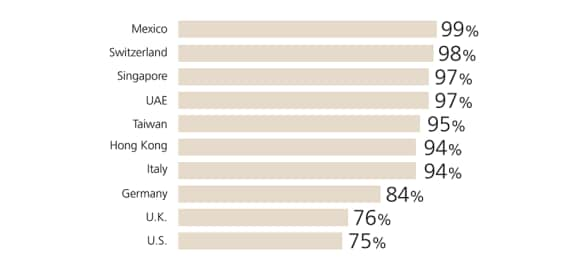

Longevity is prompting investors to act differently

Nine in 10 investors are taking steps in response to increasing life expectancy such as adjusting spending habits and financial plans, and allocating their wealth to long-term investments. In addition to real estate and equities, cash surprisingly rounds out the top three asset classes for long-term investing.

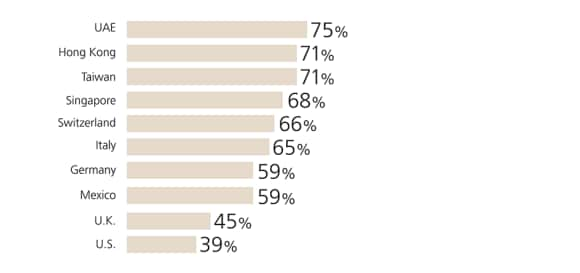

Investors who expect to live longer are the most likely to make financial changes. Those least likely are in the U.S. and the U.K., where less than a third of investors count on a 100-year life.

Longevity impacts investing, planning and spending

Percentage who are making financial changes by country

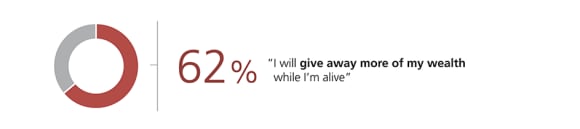

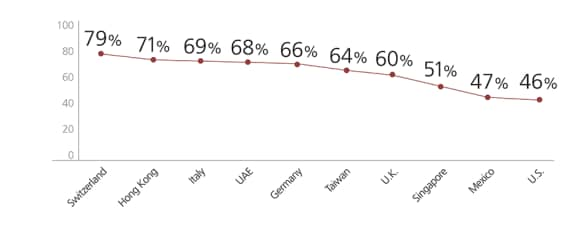

Investors adapt legacy plans to accommodate longer lives

Not only is longevity affecting the wealthy’s investment approach, it is also impacting their legacy planning. Nearly two in three investors plan to give more of their wealth away while they are still alive to see heirs enjoy it. This trend is especially prevalent in Switzerland, but less so in Mexico and the U.S., where investors cite concerns about outliving their assets.

Percentage who are doing each of the following due to increased life expectancy

Percentage who give away more of their wealth while still alive

About the survey

About the survey

UBS Global Wealth Management provides financial advice and solutions to wealthy, institutional and corporate clients worldwide. As part of our leading research capabilities, we survey global investors on a regular basis to keep a pulse on their needs, goals and concerns. Since 2012, UBS Investor Watch tracks, analyzes and reports the sentiment of high net worth investors.

UBS Investor Watch surveys cover a variety of topics, including:

- Overall financial sentiment

- Economic outlook and concerns

- Personal goals and concerns

- Key topics, like aging and retirement

For this edition of UBS Investor Watch, we surveyed more than 5,000 high net worth investors (with at least $1 million in investable assets). The global sample was split across 10 markets: Germany, Hong Kong, Italy, Mexico, Singapore, Switzerland, Taiwan, UAE, the U.K. and the U.S. The research was conducted between December 2017 and April 2018.