Setting a new course

Global investors rethink health and wealth in a post-COVID world

Amid the confinement of the pandemic – and facing threats to their lives and livelihoods – investors looked inward.

Most rediscovered the joy of family, the importance of feeling safe and secure, and the value of health.

Now, emerging from lockdowns and still grappling with COVID-19, investors find themselves in a world that may have changed forever.

Look more closely at the findings

Talk to your UBS client advisor

Global investors believe that things will never be the same ...

Global investors believe that things will never be the same ...

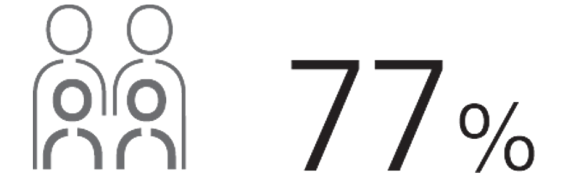

... and want to focus on family, health and safety.

... and want to focus on family, health and safety.

“Staying healthy is my top priority.”

“I want to protect my family more.”

“I want to spend more time with loved ones.”

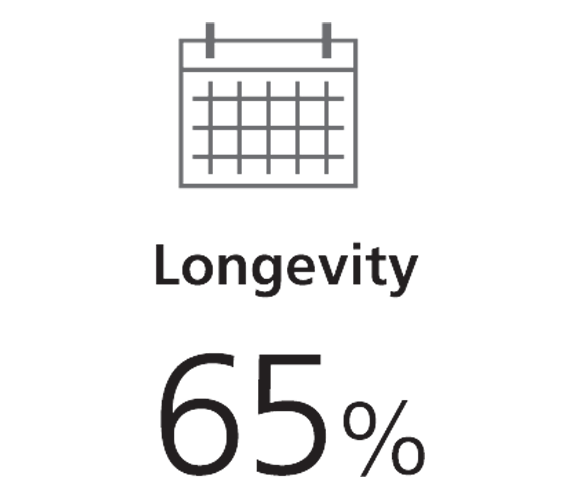

Global investors were impacted financially by COVID-19 ...

Global investors were impacted financially by COVID-19 ...

...and many have financial concerns.

...and many have financial concerns.

“I worry about not having enough saved if there is another pandemic.”

“My retirement savings were impacted by COVID-19.”

“I worry about being a financial burden to my family if I get sick.”

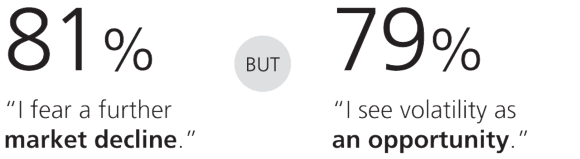

Global investors want to protect their wealth, but also see opportunities ahead.

Global investors want to protect their wealth, but also see opportunities ahead.

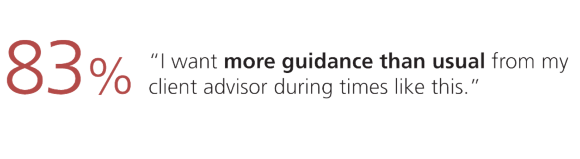

Advice is key for global investors.

Advice is key for global investors.

If you want to know more

If you want to know more

About the survey: For this edition of UBS Investor Watch, we surveyed more than 3,750 investors. They were made up of 25-30 year olds with at least $250k in investable assets, 31-39 year olds with at least $500k in investable assets, and those 40 or above with at least $1 million in investable assets. The global sample was split across 15 markets: Argentina, Brazil, mainland China, France, Germany, Hong Kong, Italy, Japan, Mexico, Singapore, Switzerland, Taiwan, the UAE, the UK and the US. The research was conducted in May 2020.

Recommended reading

Recommended reading