Investing in Europe’s greentech leaders

The Green Deal and investments in green technologies (greentech) offer huge opportunities for investors, executives and entrepreneurs.

Overview: A new (green) deal for Europe

Overview: A new (green) deal for Europe

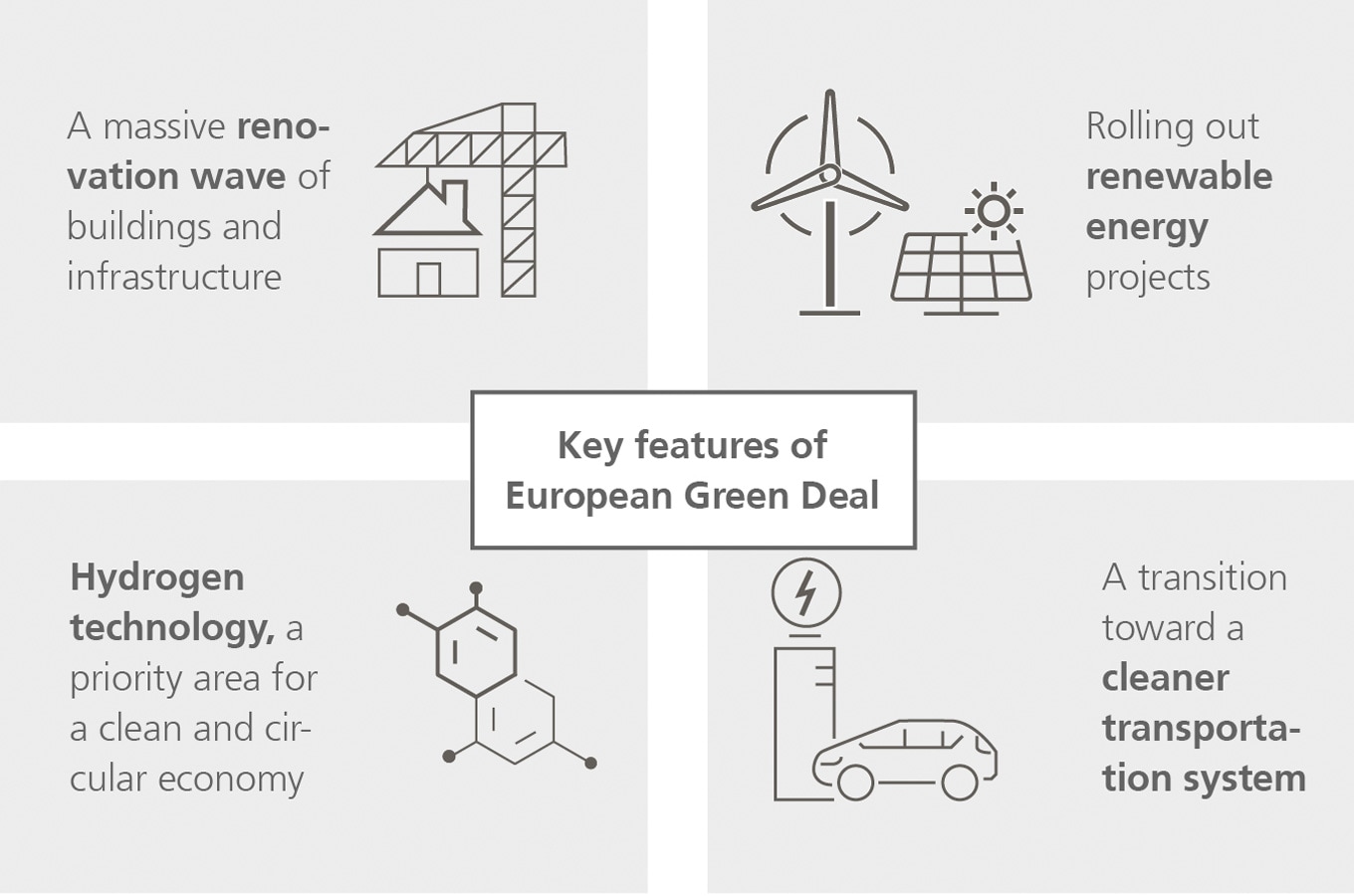

European Commission President Ursula von der Leyen launched the European Green Deal in December 2019, which we see as a game changer for the continent. It is the biggest green stimulus package in history, and includes a set of policy measures and actions which aim to transform the EU’s economy for a sustainable and climate neutral future by 2050.

The Green Deal’s aim is for the European Union to remain a global frontrunner in cleantech and climate action. Economic growth should decouple from resource use. The Green Deal will firmly put Europe on the path toward a “green economy”, with a shift from high greenhouse gas emission activities or modes of production to low emission activities and will cover all sectors of the economy.

The Green Deal follows a long history of binding European climate targets. Europe (predominantly the European Union) has been a global leader in the fight against climate change for many decades. It has been making progress on tackling climate change, with a constant decline in CO2 emissions since a peak in 1987 and a decoupling of economic and carbon emission growth. The new Green Deal is a long-term plan which affects most sectors but many key decisions will be taken in the coming quarters, and consequently capital expenditure and the impact on companies’ earnings will soon accelerate. As such, the Green Deal and investments in green technologies (greentech) offer huge opportunities for investors, executives and entrepreneurs.

Enabling green technologies

Enabling green technologies

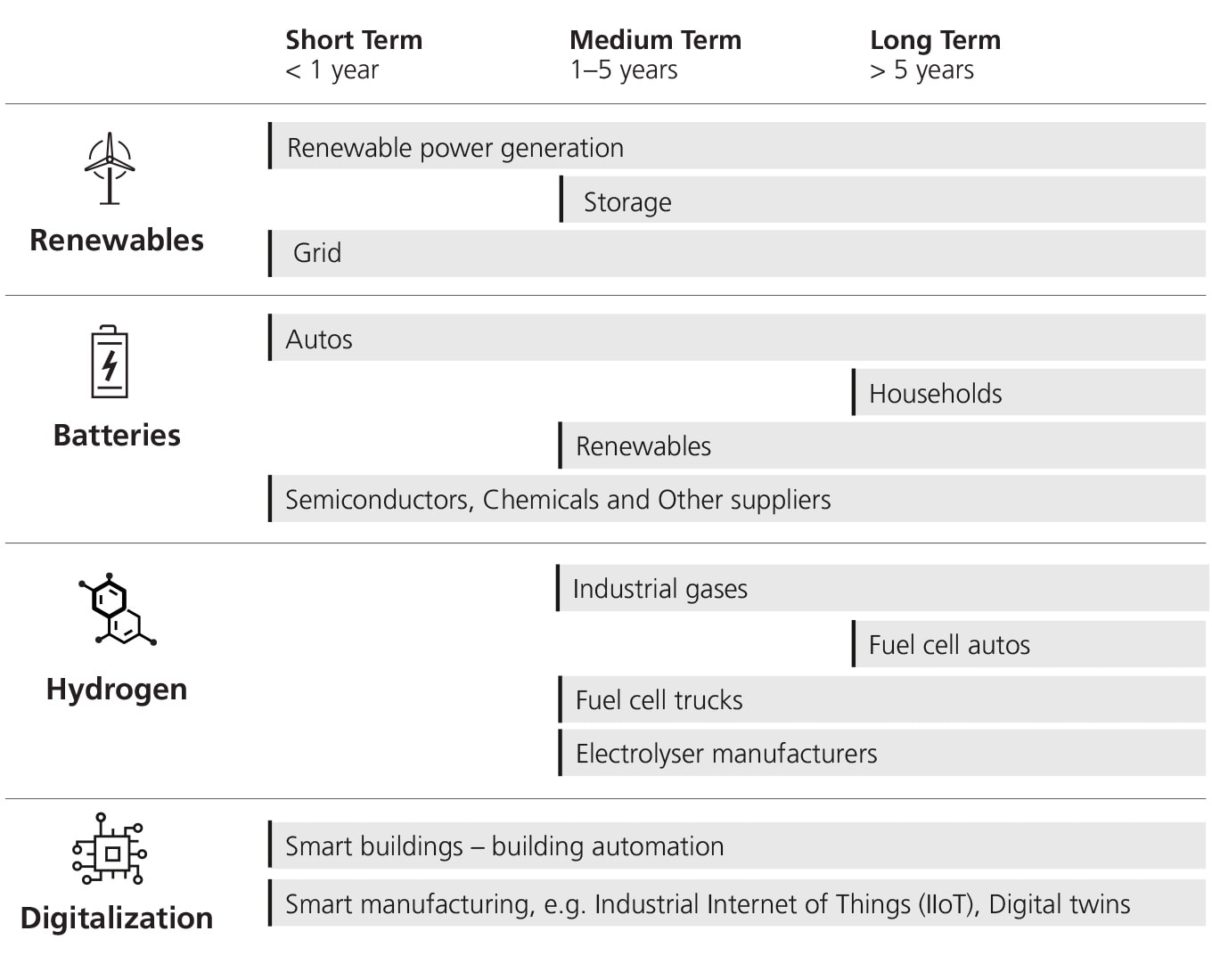

A meaningful response to climate change will not be possible without new green technologies as an important enabler to reach the net-zero target by 2050, in our view. While these are longterm developments, we see attractive short- to medium-term investment opportunities. We see investment opportunities in this transitioning economy, in areas like energy generation, transportation, industry, buildings and digital technologies.

While sustainable development is a long-term goal, it has immediate relevance today as investors can benefit from environment and climate-focused economic recovery packages. We believe now is the time to act, and we see growing opportunities in companies that address environmental, social and governance (ESG) topics including climate change.

Implications for sustainable investing

Implications for sustainable investing

Environmental, social and governance (ESG) considerations are becoming increasingly relevant to companies’ profitability, business models and cost of capital. They affect all investment portfolios, whether sustainability-focused or not. Sustainable investments (SI) have demonstrated a comparable or better financial performance in 2020 than conventional equivalents in a volatile market environment1, which has further increased investor confidence in this investment philosophy. European private investors are increasingly turning to sustainable investing solutions as they have successfully passed bull and bear market tests. This is important as private green investments will likely play an increasingly more important role. Already this year has seen record inflows into SI funds and growing issuance of EUR-denominated green bonds.

In addition to its ambitious climate related investment targets and green recovery approach, the EU has been leading the way in regulating the SI industry. For example, all SI products marketed in the EU from 2021 will need to disclose the degree of alignment with the new EU Taxonomy for Sustainable Activities that covers climate change mitigation/adaptation, sustainable water use, waste management, pollution prevention, and biodiversity protection.

European investors can expect to see more detailed and more consistent information about sustainability in their investment options from 2021 or 2022. They will be asked about their sustainability preferences when they sign up with a new advisor. Overall, we expect these policy trends to generate strong growth momentum for sustainable industries. Investors can access SI opportunities through active and passive funds, and work with their investment advisors to identify companies that address ESG risks and opportunities better than their peers based on robust data-driven SI assessments and methodologies.

Recommended reading

Recommended reading