UBS's wealth management and retail and corporate businesses delivered improved profits despite increased risk aversion and lower client activity. The Investment Bank's performance was impacted by declining client volumes and lower trading income especially in FICC.

New capital and regulatory requirements, combined with a weakening economic outlook, are likely to weigh on future returns, constraining growth prospects for the industry. While we believe we will deliver higher profitability, our target for pre-tax profit set in 2009 is unlikely to be achieved in the original timeframe of 3 to 5 years. Over the next 2 to 3 years, UBS will eliminate costs of CHF 1.5 - 2.0 billion, while remaining committed to investing in growth areas.

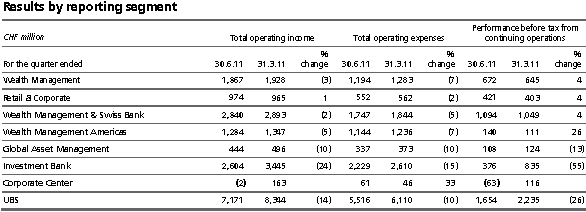

Pre-tax profit CHF 1.7 billion compared with CHF 2.2 billion in the previous quarter

Net profit attributable to UBS shareholders CHF 1.0 billion compared with CHF 1.8 billion; profit attributable to non-controlling interests CHF 263 million compared with CHF 2 million; diluted earnings per share CHF 0.26 compared with CHF 0.47; net tax expense CHF 377 million

Group revenues CHF 7.2 billion, down 14% due to lower client activity and currency movements

BIS tier 1 capital ratio strengthened further to 18.1% from 17.9% in the prior quarter

Invested assets CHF 2.1 trillion, down 6% quarter on quarter, primarily attributable to the strengthening of the Swiss franc and partially offset by net new money inflows

Group net new money of CHF 8.7 billion compared with CHF 22.3 billion in the first quarter

Wealth Management's pre-tax profit up 4% to CHF 672 million quarter on quarter; gross margin on invested assets 97 basis points; net new money CHF 5.6 billion

Retail & Corporate's pre-tax profit up 4% to CHF 421 million, mainly due to lower credit loss expenses and non-recurring revenue items

Wealth Management Americas' pre-tax profit up by CHF 29 million to CHF 140 million; net new money CHF 2.6 billion

Global Asset Management's pre-tax profit down 13% to CHF 108 million due to lower performance fees, and lower net management fees resulting from the impact of currency movements on invested assets; net new money CHF 1.1 billion

Investment Bank's pre-tax profit CHF 376 million in the second quarter of 2011 compared with CHF 1,314 million in the second quarter of 2010; pre-tax profit excluding own credit CHF 401 million compared with CHF 719 million, reflecting lower revenues in all businesses

Zurich/Basel, 26 July 2011 - Commenting on UBS's second quarter 2011 results, Group CEO Oswald J. Grübel said: "Banks' returns have declined overall in the last 12 months, reflecting deleveraging and the actions being taken in advance of increased capital requirements. We are responding to this changed environment and the weakening economic outlook by adapting our business and increasing efficiency. While our target for pre-tax profit set in 2009 is unlikely to be achieved in the original timeframe, our strong competitive positioning and our capital strength give us confidence for the future."

Second-quarter net profit attributable to UBS shareholders CHF 1,015 million

UBS reports second-quarter net profit attributable to UBS shareholders of CHF 1,015 million compared with CHF 1,807 million in the first quarter of 2011. Lower revenues across most businesses were caused by the strengthening of the Swiss franc as well as lower trading income in the Investment Bank's fixed income, currencies and commodities (FICC) business. This decline in revenues was only partially offset by lower Group personnel and general and administrative expenses. In the second quarter we had CHF 263 million net profit attributable to non-controlling interests (dividends on preferred securities) compared with CHF 2 million in the prior quarter.

Wealth Management's pre-tax profit was CHF 672 million, up 4% from the previous quarter. Lower income due to lower invested asset levels and reduced client activity was more than offset by reduced operating expenses. Total operating income decreased 3% to CHF 1,867 million from CHF 1,928 million in the prior quarter, reflecting lower fee and net interest income. The gross margin on invested assets was 97 basis points compared with 98 basis points in the prior quarter, as revenues declined 3%, while average invested assets decreased 1%. Net new money was positive for the fourth consecutive quarter with net inflows of CHF 5.6 billion compared with net inflows of CHF 11.1 billion in the previous quarter. The business had continued net inflows in the Asia Pacific region and emerging markets, as well as globally from ultra high net worth clients. Our European onshore business reported continued net inflows, while our European cross-border business recorded net outflows mainly from the cross-border business related to neighboring countries of Switzerland. Invested assets were CHF 748 billion on 30 June 2011, a decrease of CHF 43 billion from 31 March 2011. This was mainly due to a decrease in the value of the US dollar and the euro against the Swiss franc.

Retail & Corporate's pre-tax profit was CHF 421 million in the second quarter of 2011, up 4% from the previous quarter as operating income benefited from lower credit loss expenses and certain non-recurring revenue items. Total operating income was CHF 974 million, up 1% from the prior quarter, mainly reflecting lower credit loss expenses, income from a small divestment and higher dividends from participations. In the second quarter, credit losses declined to zero compared with a credit loss expense of CHF 7 million in the first quarter of 2011. Net fee and commission income of CHF 301 million was 2% higher, mainly reflecting pricing adjustments on selected products. Net trading income was CHF 78 million, almost unchanged from the previous quarter. Operating expenses decreased by CHF 10 million to CHF 552 million compared with the previous quarter.

Wealth Management Americas' pre-tax profit improved to CHF 140 million in the second quarter of 2011 from CHF 111 million in the first quarter of 2011. Total operating income decreased 5% to CHF 1,284 million from CHF 1,347 million. In US dollar terms, operating income increased 4% due to improvements in fee and interest income, as well as higher realized gains on sales of securities held as available-for-sale. Second quarter net new money was CHF 2.6 billion compared with CHF 3.6 billion in the first quarter. Second quarter net new money was affected by annual client income tax payments, which contributed to a decline in net inflows among financial advisors employed with UBS for more than one year. Net recruiting of financial advisors was the primary driver of net new money in the second quarter. The gross margin on invested assets in Swiss franc terms declined 2 basis points to 76 basis points, reflecting a 5% decrease in income compared with a 3% decline in average invested assets. In US dollar terms, the gross margin on invested assets increased 2 basis points to 79 basis points, as a 4% increase in income exceeded a 2% increase in average invested assets. The increase reflected higher fee and interest income, partly offset by lower transactional and trading income. Total operating expenses decreased 7% to CHF 1,144 million from CHF 1,236 million. Excluding the impact of currency translation, operating expenses increased 1%.

Global Asset Management's pre-tax profit in the second quarter of 2011 was CHF 108 million, compared with CHF 124 million in the prior quarter. Total operating income was CHF 444 million compared with CHF 496 million, mainly due to lower performance fees in alternative and quantitative investments and lower net management fees resulting from a lower average invested asset base due to the strengthening of the Swiss franc. Net new money inflows from third parties were CHF 4.8 billion compared with CHF 5.8 billion - the sixth quarter in a row of positive third party inflows. These were partly offset by net outflows of CHF 3.7 billion from clients of UBS's wealth management businesses compared with net outflows of CHF 0.2 billion. Total net new money inflows were CHF 1.1 billion compared with net inflows of CHF 5.6 billion. Excluding money market flows, net new money inflows were CHF 3.5 billion compared with net inflows of CHF 7.2 billion. The gross margin was 32 basis points compared with 35 basis points in the prior quarter, as a result of lower performance fees. Total operating expenses were CHF 337 million compared with CHF 373 million, with the strengthening of the Swiss franc contributing to a decrease across most expense lines.

The Investment Bank's pre-tax profit was CHF 376 million in the second quarter of 2011 compared with CHF 1,314 million in the second quarter of 2010. The pre-tax profit excluding own credit was CHF 401 million compared with CHF 719 million in the second quarter of 2010, mainly reflecting lower revenues in all businesses. An own credit loss on financial liabilities designated at fair value of CHF 25 million was recorded in the second quarter of 2011, compared with an own credit gain of CHF 595 million in the second quarter of 2010. In investment banking, total revenues were CHF 410 million, compared with CHF 478 million in the year-earlier quarter. The combined advisory and capital markets revenues increased 10%. Securities revenues were CHF 2,204 million, down from CHF 3,068 million in the second quarter of 2010. Equities revenues decreased to CHF 1,054 million from CHF 1,365 million. FICC revenues were CHF 1,150 million, down from CHF 1,703 million, largely due to a decrease of CHF 435 million in other FICC revenues and the strengthening of the Swiss franc. Total operating expenses were CHF 2,229 million compared with CHF 2,788 million, partially due to the strengthening of the Swiss franc. Lower personnel expenses were due to reduced accruals for variable compensation.

The Corporate Center's pre-tax result from continuing operations in the second quarter of 2011 was a loss of CHF 63 million. This compares with a profit of CHF 116 million in the previous quarter, mainly due to a lower valuation gain of CHF 13 million on our option to acquire the SNB StabFund's equity compared with a gain of CHF 192 million in the prior quarter.

Capital position and balance sheet

The increase in our regulatory capital more than compensated for the increase in risk-weighted assets, improving our BIS tier 1 capital ratio to 18.1% on 30 June 2011 from 17.9% at the end of the previous quarter. Our BIS core tier 1 capital ratio increased to 16.1% from 15.6%. Our risk-weighted assets increased by CHF 2.9 billion to CHF 206.2 billion, while our balance sheet stood at CHF 1,237 billion, CHF 55 billion lower than on 31 March 2011.

Invested assets

Invested assets were CHF 2,069 billion, compared with CHF 2,198 billion as of 31 March 2011. This decline was primarily attributable to the strengthening of the Swiss franc, and was partially offset by net new money inflows. Of the invested assets, CHF 882 billion were attributable to Wealth Management & Swiss Bank (CHF 748 billion thereof attributable to Wealth Management and CHF 134 billion attributable to Retail & Corporate); CHF 650 billion were attributable to Wealth Management Americas; and CHF 536 billion were attributable to Global Asset Management.

Outlook

Current economic uncertainty shows little sign of abating. We therefore do not envisage material improvements in market conditions in the third quarter of 2011, particularly given the seasonal decline in activity levels traditionally associated with the summer holiday season, and expect these conditions to continue to constrain our results. In the second half of 2011, we may recognize deferred tax assets that could reduce our full-year effective tax rate. The levy imposed by the United Kingdom on bank liabilities, formally introduced just after the end of the second quarter, is expected to reduce the Investment Bank's performance before tax by approximately CHF 100 million before the end of 2011. As a result of our intention to initiate cost reduction measures, it is likely that we will book significant restructuring charges later this year. Going forward, our solid capital position and financial stability as well as our sharpened focus on cost discipline will enable us to build further on the progress we have already made.

Media release available at www.ubs.com/media

Further information on UBS’s quarterly results is available at www.ubs.com/investors:

• Second quarter 2011 financial report

• Second quarter 2011 results slide presentation

• Letter to shareholders (English, German, French and Italian)

Webcast

The results presentation, with Oswald J. Grübel, Group Chief Executive Officer, Tom Naratil, Group Chief Financial Officer, and Caroline Stewart, Global Head of Investor Relations, will be webcast live on www.ubs.com/media at the following time on 26 July 2011:

* 0900 CEST

* 0800 BST

* 0300 US EST

Webcast playback will be available from 1400 CEST on 26 July 2011.

UBS AG

Media contact

Switzerland: +41-44-234-85 00

UK: +44-207-567 47 14

Americas: +1-212-882 58 57

APAC: +852-297-1 82 00