For the first quarter of 2011 we report higher profits than in the fourth quarter of 2010. Net new money for the Group was positive, with positive net flows recorded across all of our asset-gathering businesses confirming the return of client trust and confidence. Our Basel II tier 1 capital ratio remains among the highest in the industry.

Net profit attributable to UBS shareholders increased to CHF 1.8 billion from CHF 1.7 billion in the fourth quarter of 2010, with diluted earnings per share of CHF 0.47 compared with CHF 0.43 in the prior quarter

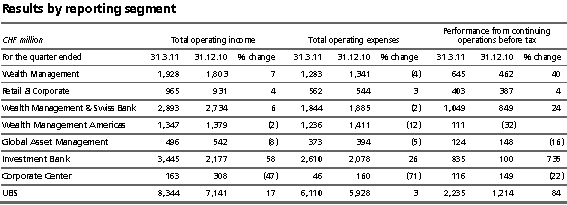

Group revenues up to CHF 8.3 billion compared with CHF 7.1 billion in the prior quarter

Pre-tax profit rose to CHF 2.2 billion from CHF 1.2 billion in the previous quarter

Net tax expense of CHF 426 million compared with a net tax credit of CHF 469 million in the fourth quarter

Group net new money rose to CHF 22.3 billion from CHF 7.1 billion in the fourth quarter

BIS tier 1 capital ratio 17.9%, up from 17.8% in the fourth quarter of 2010

Invested assets for the Group stood at CHF 2.2 trillion, up 2% quarter on quarter

Wealth Management's net new money increased significantly to CHF 11.1 billion; pre-tax profit up 40% to CHF 645 million; gross margin rose to 98 basis points

Retail & Corporate's pre-tax profit up 4% to CHF 403 million

Wealth Management Americas' pre-tax profit was CHF 111 million, up from a small loss in the prior quarter; net new money at CHF 3.6 billion improved for the fifth consecutive quarter

Global Asset Management's pre-tax profit was CHF 124 million; net new money increased significantly to CHF 5.6 billion from CHF 1.0 billion in the prior quarter

Investment Bank's pre-tax profit increased to CHF 967 million excluding own credit charges of CHF 133 million; strong credit trading revenues in FICC and a more vibrant performance in equities drove this result

Basel/Zurich, 26 April 2011 - Commenting on UBS's first quarter 2011 results, Group CEO Oswald J. Grübel said: "I am satisfied with our result considering market activity during the first quarter, and I am particularly pleased by the increase in net new money, confirming the return of client trust and confidence."

First-quarter net profit attributable to UBS shareholders of CHF 1.8 billion

UBS reports first-quarter net profit attributable to UBS shareholders of CHF 1,807 million, compared with CHF 1,663 million in the fourth quarter of 2010. Operating income increased due to higher trading income, particularly in our credit and equities businesses within the Investment Bank, partially offset by lower fees and commissions as well as reduced other income, which included a significant gain from a property disposal in the prior quarter. Operating expenses increased due to higher personnel expenses, partially offset by lower general and administrative expenses, most notably due to lower charges for litigation provisions. The result was also impacted by a net tax charge, compared with a net tax credit in the previous quarter.

Wealth Management's pre-tax profit was CHF 645 million compared with CHF 462 million in the previous quarter, mainly as a result of 7% higher operating income. Total operating income increased to CHF 1,928 million from CHF 1,803 million in the prior quarter following an improvement in all major income components. The gross margin on invested assets improved by 6 basis points to 98 basis points in the first quarter, due to higher revenues, as average invested assets remained virtually unchanged. Net new money inflows improved significantly to CHF 11.1 billion from very small inflows in the prior quarter, providing a sign of client confidence in our business. International wealth management reported net inflows of CHF 8.9 billion, with net inflows in the Asia Pacific region and emerging markets, as well as globally from ultra high net worth clients. Net outflows in the European cross-border business were partially offset by net inflows from European onshore clients. Swiss wealth management reported net inflows of CHF 2.2 billion compared with CHF 1.1 billion in the previous quarter. Invested assets were CHF 791 billion on 31 March 2011, an increase of CHF 23 billion from 31 December 2010. This increase was mainly driven by positive net new money inflows, a 4% increase in the value of the euro against the Swiss franc, and positive market performance. In Wealth Management, 31% of invested assets were denominated in euros and 31% in US dollars as of 31 March 2011. Operating expenses decreased 4% to CHF 1,283 million from CHF 1,341 million, as the previous quarter included a CHF 40 million litigation provision and a CHF 40 million charge to reimburse the Swiss government for costs incurred in connection with the US cross-border matter.

Retail & Corporate's pre-tax profit was CHF 403 million compared with CHF 387 million in the previous quarter. Revenues were CHF 965 million, up 4% from CHF 931 million in the prior quarter, mainly due to significantly lower credit loss expenses. Credit loss expenses declined to CHF 7 million from CHF 63 million in the fourth quarter. Net fee and commission income, at CHF 295 million, was up 4%, reflecting increased client activity. In addition, fee income benefited from an increase in client assets. Net trading income was CHF 79 million, up from the previous quarter due to stronger client activity. Operating expenses increased 3% to CHF 562 million compared with CHF 544 million in the previous quarter, reflecting increased accruals for variable compensation, which were particularly low in the fourth quarter, as well as salary increases effective 1 March 2011 and higher pension fund costs.

Wealth Management Americas' pre-tax performance improved to a profit of CHF 111 million in the first quarter of 2011 from a loss of CHF 32 million in the fourth quarter of 2010. Total operating income decreased 2%, or CHF 32 million, to CHF 1,347 million. In US dollar terms, operating income increased 2%, principally due to higher fee income. Net new money at CHF 3.6 billion marked the third consecutive quarter of net inflows. Net new money in the first quarter was primarily generated by net inflows from financial advisors employed with UBS for more than one year. The gross margin on invested assets fell 2 basis points to 78 basis points, reflecting a 2% decrease in income compared with a 1% increase in average invested assets. Invested assets increased CHF 11 billion, or 2%, to CHF 700 billion on 31 March 2011, reflecting positive market performance and net new money inflows, partly offset by currency translation effects. Total operating expenses decreased 12% to CHF 1,236 million from CHF 1,411 million, mainly due to lower charges for litigation provisions. Excluding the impact of currency translation, operating expenses decreased 9%.

Global Asset Management's pre-tax profit was CHF 124 million in the first quarter of 2011 compared with CHF 148 million in the fourth quarter of 2010. The decrease resulted from lower operating income. Total operating income was CHF 496 million compared with CHF 542 million, mainly due to lower net management fees across alternative and quantitative investments, global real estate and fund services. In addition, performance fees were lower in comparison with the fourth quarter in alternative and quantitative investments and, to a lesser extent, in global real estate. Net new money inflows were CHF 5.6 billion compared with net inflows of CHF 1.0 billion in the prior quarter. Excluding money market flows, net new money inflows were CHF 7.2 billion compared with net outflows of CHF 0.3 billion. Total operating expenses were CHF 373 million compared with CHF 394 million, mainly due to lower accruals for variable compensation, as well as lower professional fees, IT costs and advertising expenses.

The Investment Bank's pre-tax profit rose to CHF 835 million from CHF 100 million in the fourth quarter of 2010. The pre-tax profit excluding own credit was CHF 967 million compared with CHF 608 million. Our credit spreads tightened less markedly, reducing own credit charges to CHF 133 million from CHF 509 million in the prior quarter. Revenues in investment banking declined to CHF 466 million from CHF 910 million, mainly due to lower capital market revenues. Within securities, equities revenues increased to CHF 1,310 million from CHF 945 million, as all businesses reported broadly flat or positive revenue growth over the prior quarter. Revenues in the FICC business increased to CHF 1,801 million from CHF 939 million, largely due to higher revenues across all businesses, in particular our credit business. Total operating expenses were CHF 2,610 million compared with CHF 2,078 million. Personnel expenses were CHF 1,871 million compared with CHF 1,256 million, largely due to an increase in variable compensation, which was particularly low in the fourth quarter.

Corporate Center generated a pre-tax profit of CHF 116 million in the first quarter compared with CHF 149 million in the fourth quarter, which benefited from a gain of CHF 158 million on the sale of a property in Zurich.

Net profit attributable to non-controlling interests was CHF 2 million compared with CHF 21 million in the fourth quarter.

Net new money and invested assets

Wealth Management - Net new money inflows improved significantly to CHF 11.1 billion from very small inflows in the prior quarter, providing a sign of client confidence in our business. There were net inflows in the Asia Pacific region and emerging markets, as well as globally from ultra high net worth clients, while Swiss wealth management doubled its reported net inflows. Net outflows in the European cross-border business were partially offset by net inflows from European onshore clients.

Wealth Management Americas - Net new money inflows were CHF 3.6 billion compared with CHF 3.4 billion in the fourth quarter of 2010, improving for the fifth consecutive quarter.

Global Asset Management - Net new money inflows increased significantly to CHF 5.6 billion compared with net inflows of CHF 1.0 billion in the prior quarter.

Invested assets rose by 2% to CHF 2,198 billion reflecting net new money inflows and positive market performance, though this was partially offset by the depreciation of the US dollar, in which a significant proportion of invested assets are denominated, against the Swiss franc. Of the invested assets, CHF 929 billion were attributable to Wealth Management & Swiss Bank (CHF 791 billion thereof attributable to Wealth Management and CHF 138 billion attributable to Retail & Corporate); CHF 700 billion were attributable to Wealth Management Americas; and CHF 569 billion were attributable to Global Asset Management.

Capital position and balance sheet

The increase in our regulatory capital more than compensated for an increase in risk-weighted assets, improving our BIS tier 1 capital ratio to 17.9% on 31 March 2011. Our BIS core tier 1 capital ratio increased to 15.6% from 15.3%. Our risk-weighted assets increased to CHF 203.4 billion from CHF 198.9 billion, while our balance sheet stood at CHF 1,291 billion, down by CHF 26 billion from 31 December 2010.

Outlook

In the second quarter we expect trading volumes in the equity markets to remain at or around the levels that obtained in the first quarter. This should support transaction-based income in our wealth management businesses and flow trading in the Investment Bank. Price volatility will also continue to present potentially attractive buying opportunities for our clients and investment managers. Volatility in currency markets is likely to continue, driven by concerns about European sovereign debt and developments in the Middle East and Japan. Notwithstanding the emergence of inflation in a number of economies, we expect short-term interest rates in the West, and in particular in Switzerland, to remain low, continuing to constrain interest margins, particularly in our wealth management businesses and in our Swiss retail and corporate banking operations. Subject to market conditions, we expect to see some improvement in a number of our business lines in the Investment Bank, even taking into account the constraint imposed on some of our FICC businesses by our focus on controlling risk levels. The competition for talent in certain regions and recent base salary increases will put some pressure on our expense base. Nevertheless we remain confident that we can continue to build on the progress we have made.

Media release available at www.ubs.com/media

Further information on UBS’s quarterly results is available at www.ubs.com/investors:

• First quarter 2011 financial report

• First quarter 2011 results slide presentation

• Letter to shareholders (English, German, French and Italian)

UBS AG

Media contact

Switzerland: +41-44-234-85 00

UK: +44-207-567 47 14

Americas: +1-212-88 58 57

APAC: +852-297-1 82 00