Plant-based meats

Coming, ready or not

Author: Andrew Stott, Head of European Chemicals Research, UBS Global Research

Our base case forecasts the global plant-based meat market reaching USD 51 billion in size by 2025, implying a threefold increase in penetration from 2019 levels. The pace at which consumers respond will have major ramifications for investment portfolios on a global basis.

The biggest revolution in food in more than 20 years is upon us…

The biggest revolution in food in more than 20 years is upon us…

In 1997, genetically modified food was introduced to the US agricultural market and farmers in the Americas have never looked back, with corn yields improving by 50% over the past 20 years. Now, we have the advent of not just one but two major developments in the food industry:

- a generational shift in consumer diets, as increasingly meat alternatives build traction across a background of environmental concerns; and

- gene editing technology in seeds, which will not only improve farm economics through yield enhancement, but also alter food products themselves (“output traits”).

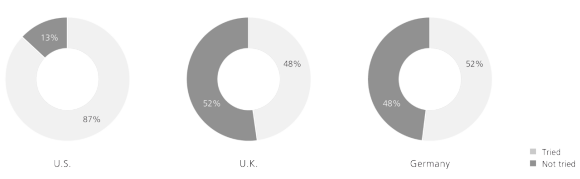

Percent of respondents who had tried vs. not tried plant-based meats

…with key implications for many industries

…with key implications for many industries

Grain yields could jump by 10%–40% in certain crops. Consumers could eat significantly less animal protein in the coming decade and well beyond.

These trends will have dramatic impacts on our use of land and will contribute to addressing two of the major environmental challenges we have today: greenhouse gas (GHG) emissions from livestock, and the loss of arable land across the planet.

These developments will have major ramifications for chemicals, machinery, healthcare, food production and food retail companies.

Consumers and governments will clearly dictate the pace of this from the perspective of meat consumption and the acceptance of biotechnology in food – until now a controversial aspect of policy in parts of Europe and Asia.

The consumer speaks loudly

The consumer speaks loudly

UBS Evidence Lab surveyed 3,000 consumers and 50 restaurant franchisees, reviewed more than 20 million social media interactions, and interviewed protein scientists and supply chain experts. All-in, we forecast the global plant-based meat market to reach USD 51 billion by 2025, implying a threefold increase in penetration from 2019 levels.

There appear to be four compelling “principle-based reasons” for purchasing plant-based meats:

- Environmental: At the 2019 UBS ESG and Sustainability Symposium, panelists estimated that food production is responsible for 25% of the world’s CO2 emissions. The Johns Hopkins Center for a Livable Future estimates that red meat (beef, pork, and lamb) and dairy production account for some 48% of the greenhouse gas emissions associated with the US food supply chain. In a “cradle to distribution” life-cycle study of the Beyond Burger vs. a ¼ lb US beef burger, the University of Michigan found that the Beyond Burger causes 90% less green-house gases to be emitted than the beef burger.

- Resource scarcity: In 2017, according to data from the Food and Agriculture Organization of the United Nations, 25% of the world’s land was used for animal husbandry.

- Animal welfare: some 72 billion animals globally are slaughtered annually for food, according to data from the Food and Agriculture Organization of the United Nations.

- Health: According to the American Heart Association, consuming a primarily plant-based diet reduces one’s risk of heart failure by 42%. We note that plant-based meat products often have lower cholesterol than their animal-based meat counterparts. The addressable market for plant-based protein could be very significant, with our base case at USD 51 billion (only 2.5% penetration by 2025) and our upside case at USD 72 billion (3.5% penetration):

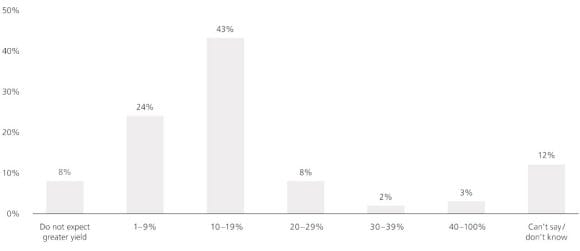

Gene editing can bring substantial improvements in land efficiency – see Figure below from a survey of US farmers carried out by UBS Evidence Lab in 2019. In addition, “output traits,” which can alter the nutritional value and overall appeal of food groups, could help address nutritional deficiencies and improve the affordability of food.

How much yield improvement is expected from gene edited seeds?

Disregarding these trends comes with a cost

Disregarding these trends comes with a cost

The environmental impact of consumers being largely inactive with regard to plant-based protein and resistant to adoption of gene edited food would be far reaching. Potential impacts on food prices (limited yield improvement against a backdrop of ongoing climate challenges) and GHG emissions could be especially costly.

The good news, though, is that signposts along the way should be highly visible with a clear ability to track the revenue progress of companies involved in plant-based meat and gene edited seed technologies. Ongoing survey work and social media tracking by UBS Evidence Lab will also act as measures of progress on both fronts.

To sum up, food technology and consumption patterns will be key determinants in measuring the global collective response to major economic and environmental challenges. The pace at which consumers respond will have major ramifications for investment portfolios on a global basis.

Discover other trends

Discover other trends

Investor engagement

More influential than regulation

Impact investing

The next wave of growth

Electric transport

Adoption sooner than expected

Net zero

From aspiration to firm targets

Big Oil

The opportunity for reinvention

Diversity

The destructive potential of prejudice

Climate stress testing

The transformation of capital allocation

Sustainable data

Insights from new lenses

Transparency revolution

The convergence of standards underestimated

Want to know more?

To get more insight into sustainable finance in the year to come, download your copy of Sustainable Finance: Ten Trends for 2021.

Interested in more content?

Interested in more content?

Subscribe to our newsletter to receive the latest insights.

Recommended reading

Recommended reading