Impact investing

The next wave of growth

Author: Andrew Lee, Head Sustainable and Impact Investing, UBS Global Wealth Management

Investors are increasingly factoring in environmental, social and governance (ESG) considerations because they can be financially material and useful in analysis and decision making. We expect the next wave of growth will be driven by investors actively seeking to identify and address sustainability challenges in areas ranging from climate to inequality to healthcare. In a recent survey, 62% of family offices indicated that impact investments will be a key focus.

As ESG integration mainstreams…

As ESG integration mainstreams…

We expect investors to increasingly shift their attention (and portfolios) toward the real world impact of their investments in 2021 and beyond. Growing interest in understanding the actual positive or negative sustainability outcomes not just relative performance resulting from different investment approaches will drive this evolution.

Overall sustainable investing assets under management have grown significantly in recent years, with a legacy focus on exclusionary or negative screened solutions and ESG integrated solutions the driver of recent growth. The former can help investors achieve values or policy alignment, and the latter ensure that material sustainability factors are considered in investment analyses. Neither approach, however, directly leads to measurable positive impact on sustainability issues, apart from signaling effects. Intentional impact investing, which does target measurable impact, and sustainability focused investments together represent a smaller, but rapidly growing portion of the sustainable investing universe.

…investor focus is evolving toward impact

…investor focus is evolving toward impact

The world is changing rapidly, and so are investors’ priorities. ESG integration will continue to enter the mainstream as a result of investors recognizing that sustainability factors matter for fundamental analysis regardless of strategy or motivation, as we touch on in the discussion in our Perspective on Sustainable data. As ESG factors become core inputs into conventional investment processes, the focus for sustainable investment is shifting toward more focused and impactful solutions.

This evolution will be driven by investors. Regulatory initiatives in the EU and elsewhere are certainly significant influences, but the key motivations are investor recognition of the structural and investment implications of not taking action, the potential growth inherent in sustainable and impact opportunities, and increasing desire for transparency and accountability. Investors with diversified portfolios want to know how each of their investments aligns with their preferences, whether they capture long-term opportunities or exacerbate existing issues, and how they address the sustainability challenges facing society as framed by the United Nations’ Sustainable Development Goals (the SDGs). Understanding how investments perform on these dimensions is just the starting point; consistent, comparable data assessing of investments’ actual real world impact will eventually enable investors to optimize portfolios for impact as a third dimension, in addition to risk and return.

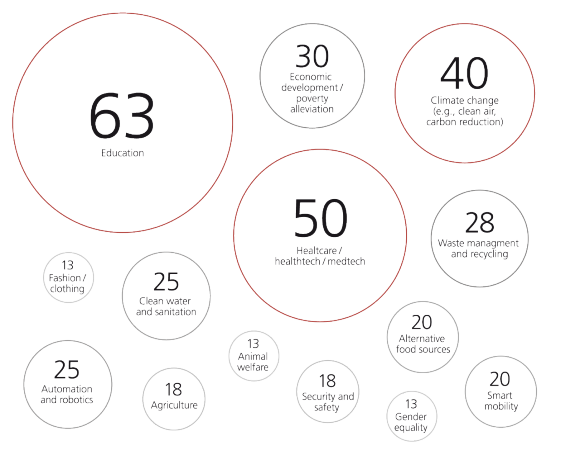

Global family offices prioritize multiple impact themes – impact investing priorities in %

Targeting positive change a clear driver for sustainable investing in 2021 and beyond

Targeting positive change a clear driver for sustainable investing in 2021 and beyond

Private clients in particular clearly signal this interest in discussions and surveys we conduct, with, for example, 62% of family offices indicating that impact investments are a key part of their legacy. We also see this reflected in the recent rapid growth (from a low base) of assets invested in various sustainability focused and impact investing solutions, as well as in the growing number of asset managers and asset owners who have signed up to the Operating Principles for Impact Management launched by the International Finance Corporation (IFC) in April 2019 (110 at the time of publication).

Also in line with this trend is the growing development of outcomes focused investment strategies and instruments across asset classes. Many investment opportunities focused on intentional, measurable impact are best accessed via private market investments, such as growth equity or real assets, due to their long-term orientation and greater influence to target and drive measurable impact. The universe of these solutions continues to expand to meet investor demand and is increasingly complemented by opportunities for impact through publicly traded securities, given the ability to drive corporate behavior change at scale.

Mechanisms for positive change in public markets include investments that open up new capital sources and drive change in different ways, ranging from active fund manager engagement that can influence company strategy and operations to bonds that fund development banks’ work on job creation and economic development globally, and, more recently, the emergence of sustainability linked bonds imposing penalties if issuers don’t achieve specified ESG goals. The challenge with these liquid investments is consistent quantification and demonstration that they contribute to actual impact over the longer term. As investor and industry focus shifts toward outcomes, the universe of solutions targeting sustainability objectives or quantifiable impact will continue to expand along with impact data and measurement tools, enabling investors to increase the percentage of their diversified investment portfolios that can deliver actual change.

This clear focus on sustainability objectives and tangible impact is what will, in our view, define and differentiate sustainable investing in the coming years. Investor interest, regulatory initiatives and the development of products and measurement tools, as well as broader industry efforts, all point to these areas being in focus going forward. We expect to see increased targeted investment in the areas of climate, resource scarcity, diversity, food and agriculture, and healthcare, among others, as society rebuilds post pandemic and investors seek return opportunities through solutions to these large scale challenges.

Discover other trends

Discover other trends

Investor engagement

More influential than regulation

Electric transport

Adoption sooner than expected

Net zero

From aspiration to firm targets

Big Oil

The opportunity for reinvention

Diversity

The destructive potential of prejudice

Plant-based meats

The future of food

Climate stress testing

The transformation of capital allocation

Sustainable data

Insights from new lenses

Transparency revolution

The convergence of standards underestimated

Want to know more?

To get more insight into sustainable finance in the year to come, download your copy of Sustainable Finance: Ten Trends for 2021.

Interested in more content?

Interested in more content?

Subscribe to our newsletter to receive the latest insights.

Recommended reading

Recommended reading