Big Oil

The opportunity for reinvention

Authors: Jon Rigby, Head of US and European Oil Integrated Research, UBS Global Research

Amy Wong, Head of Global Oil Services Research, UBS Global Research

Rather than viewing the energy transition as an existential risk to the oil majors, and seeing the majors as the problem, we should perhaps regard it as a potential opportunity for them to remake themselves and become part of the solution. The energy transition could require USD 1.1 trillion in investment per year inconceivable without the skill sets of the existing players – initially as hybrids and then increasingly as a fully-fledged integrated energy industry.

The question is no longer “whether” but “when”

The question is no longer “whether” but “when”

It is worth noting that many of today’s major oil firms have been around for much of the industry’s history: ExxonMobil and Chevron originated as Standard Oil, founded in 1870, and Royal Dutch Shell was founded in 1907 by two firms that had been competing with Standard since 1890. Can an industry so inextricably tied to a single product evolve into an important player in the process of replacing that product? It is rare to see an industry participate in its own disruption, but that is the question we are asking. Or should a company stick to what it is good at until it is no longer needed and leave the future up to specialists in the new field? The oil majors and their supply chains are saying that investors are better off allowing them to progressively rede-ploy the capital generated from oil & gas activities into renewable and new energy solutions.

Experience will matter for the change that is coming

Experience will matter for the change that is coming

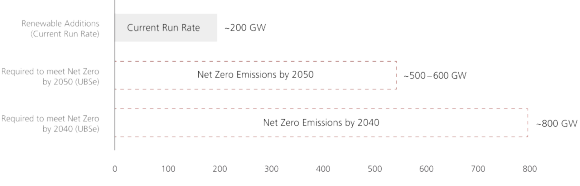

At first glance, it is not so obvious where the oil majors have a particular competitive advantage in delivering the energy transition. But that would write off all too quickly an industry that has adapted to changes since Edwin Drake’s well in Pennsylvania 160 years ago; it would under appreciate the level of technical and financial complexity involved in building and managing energy systems in the manner that the oil industry currently builds those systems. The International Energy Agency estimates that under a Paris consistent scenario the world needs to add 7,700 giga watts of wind and solar generating capacity over the next 20 years, effectively increasing it to seven or eight times today’s figure. That requires some USD 1.1 trillion per year of investment (some 50% more than current levels and in addition to the approximately USD 800 billion per year needed to sustain adequate oil and gas supplies even in a Paris compliant scenario) – an enormous task requiring deep financial resources and stewardship featuring operational skills, exactly what Big Oil firms possess.

Renewable energy generation

How will the upstream and downstream industries adapt to the new world?

How will the upstream and downstream industries adapt to the new world?

Within the estimate of investment needed to reconstruct the world’s energy system, a significant portion of the new renewable capacity will be wind, and an increasing portion of that will be floating (in water depths of more than 60m), as the available shallow continental shelf is used up. Although only a component part of the engineering skill-set of the oil industry, the engineering, construction, installation and management of facilities distant from the shoreline is a core competency for such operations, as is understanding the complexities of meteorological and marine conditions, critical for efficient, safe and reliable running.

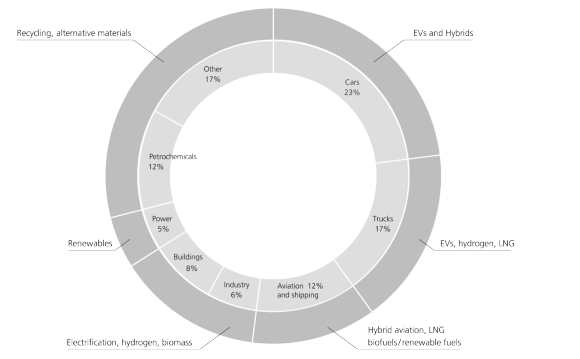

Solar power is less obviously an industry where there is a read across from the upstream oil industry, but that is where we then need to begin to think about the practicalities of the transition. The new world will have a more distributed energy base with complex flows of power to and from customers needing to be managed and matched logistically. Customers’ energy needs, whether for heat, light or transportation, and wherever or whenever required, will need to be met. The oil majors, with their downstream experience and success in managing customers (be they B2B or B2C), and their existing know how in oil, gas and power trading, seem to be ideally set up for this challenge. Moreover, the existing oil (transportation) and gas (power and heating) will remain in use through the transition, and graduating from the old to the new is probably best handled by these incumbents.

Longer-term demand trends – oil consumption by type and potential threats to use

Is this the beginning of the end of the traditional oil & gas business model?

Is this the beginning of the end of the traditional oil & gas business model?

Oil and gas use is not going away completely. There are pockets of demand that will be difficult to abate. There could easily be up to gross 10 gigatonnes of CO2 still being emitted in 2050, even in the IEA’s Sustainable Development Scenario. To address this, green hydrogen for combustion, and carbon capture, utilization and storage (CCUS) for offsetting emissions, will be critical to achieving the Paris goals. Large-scale industrial projects involving significant capital costs, the blending of engineering, manufacturing and distribution, chemistry and, in the case of CCUS, sub surface geological disciplines are all highly familiar to Big Oil firms.

To sum up, rather than viewing the energy transition as an existential risk to the oil majors, and they as the problem, we should perhaps regard it as a potential opportunity for them to remake themselves as initially a hybrid and then increasingly a fully-fledged integrated energy industry, and to thus become part of the solution.

Discover other trends

Discover other trends

Investor engagement

More influential than regulation

Impact investing

The next wave of growth

Electric transport

Adoption sooner than expected

Net zero

From aspiration to firm targets

Diversity

The destructive potential of prejudice

Plant-based meats

The future of food

Climate stress testing

The transformation of capital allocation

Sustainable data

Insights from new lenses

Transparency revolution

The convergence of standards underestimated

Want to know more?

To get more insight into sustainable finance in the year to come, download your copy of Sustainable Finance: Ten Trends for 2021.

Interested in more content?

Interested in more content?

Subscribe to our newsletter to receive the latest insights.

Recommended reading

Recommended reading