Global economic growth 2022: 4 potential scenarios

The persistence of inflationary pressures is a crucial differentiating factor in this economic cycle. Here, the UBS Asset Management Macro team analyze four scenarios: a growth scare, a soft landing, stagflation, and an inflationary boom.

Key highlights

Key highlights

- The many forces keeping inflation high around the world are increasing the risks that global economic growth heads lower

- The persistence of elevated price pressures is a crucial differentiating factor in this economic cycle from what has transpired over the prior two decades.

- We are open-minded as to which regime markets will eventually settle into over the next six to twelve months, and believe it is a close call between a growth scare that culminates with a recession, or a soft landing.

- We assess four potential macro backdrops: a growth scare, a soft landing, stagflation, and an inflationary boom

Introduction

Introduction

The many forces keeping inflation high around the world are increasing the risks that global economic growth heads lower. Macroeconomic uncertainty is high because investors are constantly reassessing how much and how fast central banks will raise rates to tamp down inflation and economic activity – and if they’ll deliver too much tightening and have to reverse course. This persistence of elevated price pressures is a crucial differentiating factor in this economic cycle from what has transpired over the prior two decades.

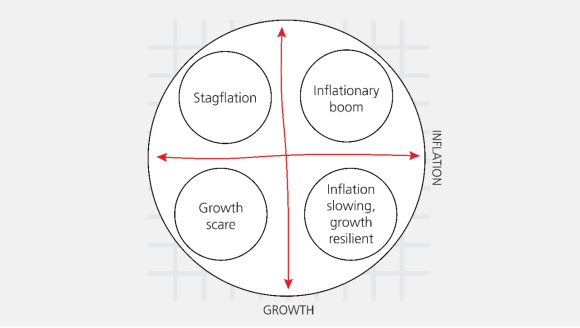

Market participants are likely to entertain a wide range of outcomes based on the trajectories for inflation and growth during the rest of 2022. Below we assess four potential macro backdrops: a growth scare, a soft landing, stagflation and an inflationary boom.

We are open-minded as to which regime markets will eventually settle into over the next six to twelve months, and believe it is a close call between a growth scare that culminates with a recession or a soft landing. But sequencing is important. A soft landing is certainly achievable, but the path to get there may feature a sharp deceleration in the data that makes it difficult for market participants to distinguish between a benign endgame and a recession. In other words, we believe that market pricing of recession risk is more likely to increase than decrease in coming months, even if a recession is ultimately avoided. The potential for a further inflationary shock (stagflation) complicates this picture, and could well be part of the path towards the ultimate landing zone of soft or hard landing.

As such, our tactical asset allocation for now is more oriented towards trades that we expect to perform well in the event of a growth scare and/or stagflation. We find global equities unattractive, and prefer the energy sector on a relative basis. The combination of slowing growth and sticky, high inflation leaves us neutral on global government bonds. And we think that Chinese equities represent a unique opportunity in large part because policy is incrementally stimulative, unlike other major economies. Going forward, we anticipate that our positioning will be guided in large part by incoming inflation data and its implications for policymakers.

Growth scare

Growth scare

Global activity is already slowing, and central banks are indicating that a further deceleration in activity is needed to bring inflation sustainably lower. Over the past few months, the increased speed and magnitude of tightening telegraphed by monetary policymakers to enforce a slower-growth, lower-inflation outcome is raising the odds that an economic downturn ultimately ensues. And a recession may, in the eyes of central bankers, even end up being a result that is preferred if the alternative is letting inflation expectations get out of hand. In our view, this makes a growth scare the most likely economic regime to be priced by market participants during the second half of 2022.

So far, there are more signs that growth is slowing than inflation, which is why central banks continue moving towards a restrictive policy stance. Housing sales and new starts have tumbled, as has the wherewithal for homeowners to take money out of their residences to boost consumption. Real spending, both in the US and Europe, has been fairly soft, and there is little reason to expect an acceleration. Aggregate US labor income growth has been moderating, reducing how much households will be able to increase spending going forward. The buildup of retail inventories (ex-autos) implies the forward outlook for goods production is weakening. With yields and spreads higher and demand for goods slowing, businesses are also more likely to prioritize paying down debt over expansion plans.

Stagflation

Stagflation

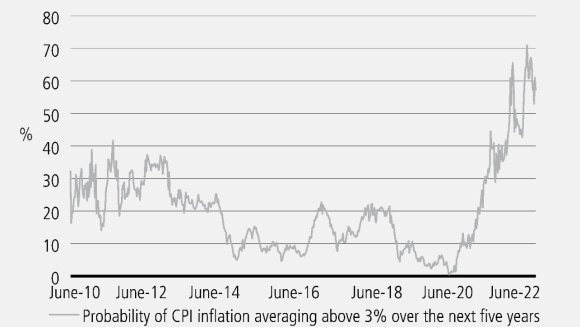

Commodity prices – and central banks’ desire to protect inflation expectations from becoming unhinged to the upside (Chart 1) – are the primary source of stagflationary risk to the global economy. Energy markets could face further supply-side vulnerabilities before demand cools appreciably. Given that activity is moderating, any move to a stagflationary backdrop would be a relatively temporary shift before markets aggressively priced the risk of growth and inflation falling through a recession, in our view.

Chart 1: Inflation likely to peak but stage elevated

In the US, this stems from how depressed gasoline inventories and curtailed refinery capacity threaten to exacerbate the pain families are feeling at the pump. Federal Reserve Chair Jerome Powell has indicated that an unsettling increase in inflation expectations is contributing to the urgent pace of rate hikes. These expectations are heavily influenced by the price of gasoline. In this way, higher gasoline prices would likely cause the Federal Reserve to increase how much it tightens policy, and in turn, the downside risks to growth.

In Europe, this risk is a function of high natural gas prices and potential shortages should access to Russian supplies be abruptly curtailed, since imports from other countries would be hard-pressed to make up the difference. A harsh rationing of supply for industrial use could be in the offing later this year in the event of natural gas shortages, while the negative supply shock will weigh on real incomes and reduce discretionary consumption.

Soft landing

Soft landing

As discussed above, we think the market will price in a higher risk of recession before the potential relief of a soft landing. At first glance, the odds don’t favor one. Historically, when inflation has risen this far above target, the amount of central bank tightening delivered to bring down price pressures results in a recession roughly 80% of the time. The good news is that it is almost equally as unlikely for a recession to occur when private sector balance sheets are starting off in such a strong position.1

The same forces that are presently contributing to slower growth can also, over time, propel inflation lower. The reorientation of spending towards services should help core goods prices normalize, perhaps rapidly. Any resolution of Russia’s war on Ukraine would also likely involve a partial, though not complete, reversal of some of the negative supply shocks in commodity markets. The entire US policy apparatus – both fiscal and monetary – appears to be focusing on bringing gasoline prices down, and the former may reach a legislative or geopolitical solution before the latter weighs on the economy so much that demand contracts.

And of course, monetary policymakers can also be flexible and pivot should inflation decelerate more than anticipated. But in our view, central bankers will only turn dovish following considerably more damage to the economic outlook and risk assets rather than through any benign “immaculate disinflation” dynamic playing out.

Inflationary boom

Inflationary boom

Developed market economies have been surprisingly resilient in 2022 in the face of negative supply shocks. But the more activity holds up while inflation remains high, the more motivated central bankers will be to tamp down both. In our view, retaining something resembling an inflationary boom is the least likely outcome going forward given the persistence of negative supply shocks and policy-induced tightening of financial conditions. Excess savings in the US and subsidies in Europe to cushion consumers are a helpful but insufficient offset to these headwinds.

However, China stands out as a region that is poised to add to global growth momentum over the next three-to-six months. Improving public health outcomes should allow for the stimulus Beijing is pursuing to more visibly buoy economic activity. But we believe this positive impulse to growth will be overwhelmed by the slowing transpiring elsewhere. Nonetheless, this expected improvement in Chinese macroeconomic performance relative to the rest of the world is an investable opportunity, in our view.

Asset allocation implications

Asset allocation implications

From a market perspective, hot inflation is a problem with no good solutions in the near term. Headline inflationary pressures will likely constrain central banks from turning in a dovish direction. And economic data would likely need to get materially worse – raising risks to earnings – before monetary policymakers would consider pivoting in light of the deterioration in the growth outlook.

Global stocks remain unattractive given this macro backdrop. Inflation, and the central bank response to quell it, are the key reasons why stocks are still expensive on a cross-asset basis despite declining by 20%. The equity risk premium – the difference between the expected earnings yields for global stocks less bond yields – is near its tightest level of the past decade, implying stocks are pricey compared to government debt.

In addition, earnings expectations in 12 months’ time continue to be revised higher, albeit modestly, despite the rising risks to the expansion. Historically, bottom-up analysts’ estimates have come under some pressure before equity markets bottomed.

Chinese equities, however, stand out to us as attractive because the country is not that afflicted by many of the headwinds weighing on other regions. Inflation is not very high, so policy is easing rather than tightening. Even with zero-COVID-19 policies in effect, we believe there should be fewer, not more, disruptions to economic activity going forward after the large-scale lockdowns earlier this year. And the peak in the tech regulatory crackdown is in the rear-view mirror, in our view.

We place non-trivial odds on a stagflationary scenario in the near term where spiking energy prices prompt central banks to act to curb inflation expectations. This informs our relative preference for energy stocks, which we think remain very inexpensive despite their strong outperformance year to date. The trade-off between slowing growth and elevated inflation also leaves us neutral on global government bonds for the time being.

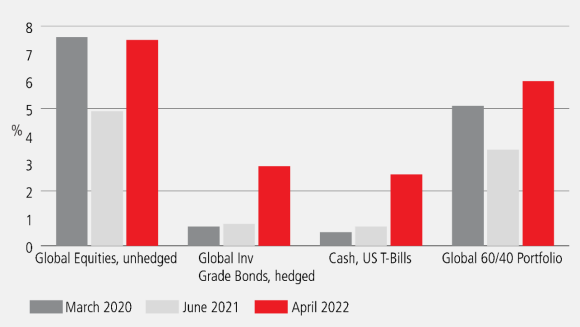

The silver lining of the year-to-date weakness across financial markets is that medium-term forward returns for investors have improved considerably relative to one year ago, according to our capital market expectations (Chart 2). On a tactical basis, we expect that patient investors will be able to enjoy an even more attractive entry point for global equities, which may come if a cyclical moderation in inflation allows central banks to shift in a more dovish direction allowing global economic activity to inflect higher.

Chart 2 : Projected returns for the next five years are improving

Chart 2 : Projected returns for the next five years are improving

PDF

Mid-year outlook 2022

Mid-year outlook 2022

With inflation reaching multi-decade highs in many parts of the world, how can investors position their portfolios for this changing investment landscape?

Was this article helpful?

Please enable javascript in your browser and retry.

The feedback component cannot be displayed.

About the authors

-

Evan Brown

Head of Multi-Asset Strategy

Evan Brown, CFA is Head of Multi-Asset Strategy in the Investment Solutions team at UBS Asset Management. In this role, Evan drives macro research and tactical asset allocation investment process for over USD100 billion in client portfolios. Additionally, he is responsible for advising UBS Asset Management’s global institutional and private wealth client base on the macroeconomic outlook and asset allocation.

-

Ryan Primmer

Head of Investment Solutions

Ryan oversees UBS Investment Solutions, including Asset Allocation, Portfolio Management, Implementation, Analytics, and Modelling teams. Ryan rejoined UBS in June 2018 from KCG Holdings, holding roles like Head of Quantitative and Systematic Trading, and Head of Global Quantitative Strategies. At UBS (1991-2013), he held leadership roles including Global Head of Equities Trading, Global Head of Equities Proprietary Trading, and Head of SNB StabFund Investment Management managing distressed mortgage assets.

-

Louis Finney

Research Analyst Investment Solutions

Louis Finney is Co-Head of the Strategic Asset Allocation Modeling group in the Investment Solutions team of UBS Asset Management. In this role he co-leads the team in modeling portfolio returns, risks and characteristics for clients and the Investment Solutions platform. Before joining UBS AM in 2011, Louis was Chief Economist and Principal at Mercer Investment Consulting.

Read more

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.