What next for central bank policy?

Will central banks stick to their goal of raising rates until inflation is back under control or will rising debt servicing costs make tolerance of inflation a more attractive choice? What does this mean for fixed income investors?

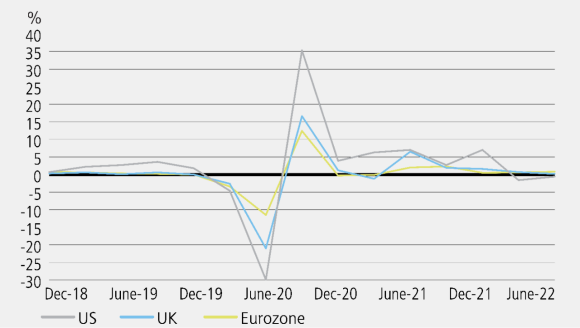

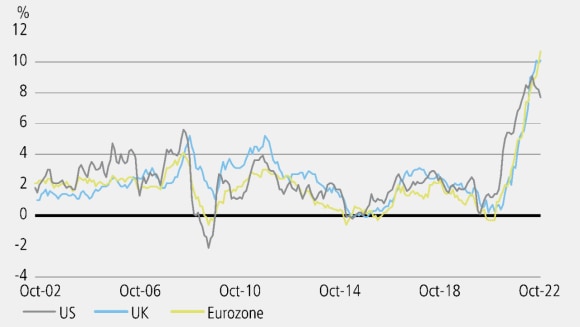

We are in an unusual situation: central banks are tightening monetary policy to curb record levels of inflation, not when economic growth is strong, but as economies are already slowing dramatically and some are heading for recession (Charts 1&2). What does this mean? Will the fixed income strategies deployed over the last 10 years work again?

Central banks in many areas, including the US, Eurozone and the UK, are likely to face a very stark choice as 2023 progresses: either keeping to a path of deflation (effectively tipping their economies into recession to help tackle inflation), or accept devaluation (effectively accepting inflation running at higher levels than they target, for longer).

Chart 1 – Real rates of GDP growth flatlining in developed markets

Chart 1 – Real rates of GDP growth flatlining in developed markets

Chart 2 – Inflation in the US, UK and Eurozone see strong acceleration

Central banks, keen to reestablish their inflation-fighting credentials, will be determined and keep going down the deflation route, deploying hawkish rhetoric along with big rate hikes. But as recession looms, that may become a tough line to stick to.

Controlling inflation

Controlling inflation

In trying to turn around economies for over a decade, central banks aimed for inflation that was close to or below target. A wide range of policy tools were brought to bear, at enormous scale but arguably with very little effect. Despite deploying zero or negative policy rates in many countries and creating trillion-dollar balance sheets, central banks found it was extremely difficult to bring inflation back to target.

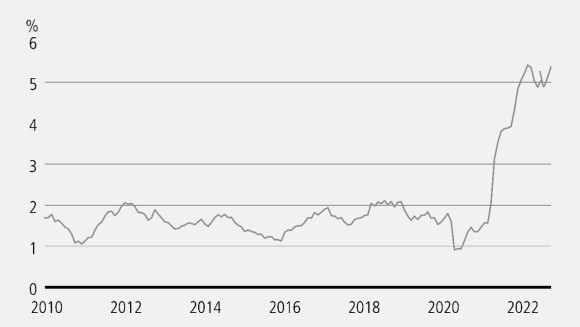

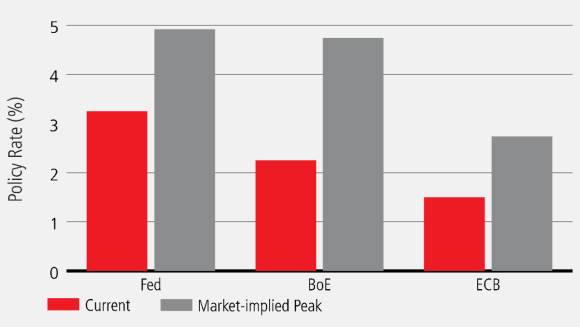

With central banks raising rates in the face of record levels of inflation (Chart 3&4), it would be unwise to underestimate how much might be needed to bring inflation back to target. Cyclical factors will probably help stem the tide of inflation in coming months, but structural factors will also play a part and these could turn out to be much more sticky.

Chart 3 – US inflation breaches 5%

Chart 4 – Central Bank policy rates vs forecast peak

The changing approach to policy

The changing approach to policy

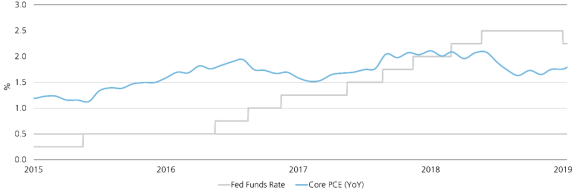

Central bank policy making has always been subject to change over time. The last Federal Reserve (Fed) rate hiking cycle, which really began in 2016, was overseen by Janet Yellen. Policymaking was forward-looking, preemptive and generally model-based. Rates were raised well before inflation got back to target. And, in fact, it only just got above target in that period (Chart 5).

The ‘Yellen years’ were very different to the world of today. In 2020, the Fed changed its language on inflation in quite an important way, where they emphasized managing average inflation over time. This allows policymakers more flexibility in that inflation can be allowed to modestly and temporarily run above target, or vice versa.

But policy making seems to have changed in a more fundamental way too. Today’s Fed seems more focused on current inflation prints than has been the case historically and therefore is much more reactive than preemptive. It is also less clear what rules or models are informing decision making. A lot has changed, and that includes policymaking.

Chart 5 – The Yellen Fed certainly did things differently

Collateral damage

Collateral damage

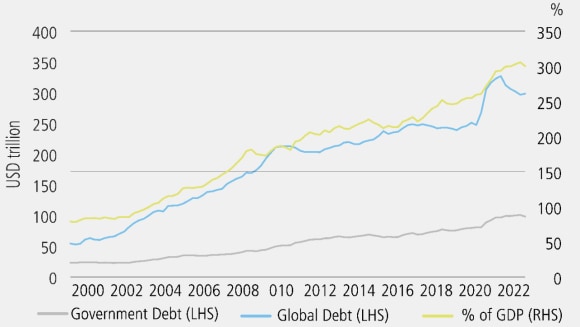

Global debt levels are now around 350% to global GDP; relative debt levels have generally been increasing over the last twenty years, as have absolute debt levels (Chart 6). For some commentators, the argument was that this didn't matter. Why? Because financing costs were generally falling around the world. Central banks were cutting rates, real rates fell and debt service was therefore getting easier, even at higher absolute levels.

But if both real rates and nominal rates are increasing, will these high debt levels start to matter? We think so. Debt servicing is likely to get harder, not only for companies, but also for governments. And it is a fact of life, when debt levels are high, tolerating higher levels of inflation can become a more attractive policy choice.

Chart 6 – Global debt levels reach 350% to GDP

Implications for fixed income investors

Implications for fixed income investors

The themes that we have touched on here are global in nature, and will unfold at different rates in different countries. The policy choices made in Europe are likely to be quite different from the policy choices made by the US in the coming years. And that is going to mean different risks and different returns for those markets. That will be particularly true if central banks are forced to either increase rates much higher than anyone is currently anticipating, or equally if they retreat from the hawkish rhetoric and decide to tolerate higher levels of inflation for longer. In this environment, we believe strategies that are flexible and able to exploit those different opportunities are likely to be the most successful.

PDF

Investment outlook 2023

Investment outlook 2023

In this edition of Panorama, our investment experts recap on the past investment year and explore where the challenges, opportunities and surprises might spring from.

Was this article helpful?

Please enable javascript in your browser and retry.

The feedback component cannot be displayed.

Read more

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.