Macro Monthly US election ends, global expansion continues

Joe Biden was declared the winner of the US presidential race, and is likely to take office with a Republican Senate. The stage is set for sustained US dollar weakness and the continued outperformance of emerging market assets.

Highlights

Highlights

- Joe Biden was declared the winner of the US presidential race, and is likely to take office with a Republican Senate.

- Recent comments from legislators suggest this outcome likely leads to at least some additional fiscal support, reducing the tail risks associated with divided government.

- The stage is set for sustained US dollar weakness and the continued outperformance of emerging market assets.

- The odds of legal challenges reversing the outcome of the presidential vote are negligible.

Democrat Joe Biden will be the next president of the United States, and is likely to take office with a divided Congress.

This scenario is likely to result in sufficient fiscal support for an economy still facing pandemic-induced headwinds, although less than would have been the case under a united Democrat government. The incoming president is likely to pursue a more predictable foreign policy. Major tax increases that would have been a part of the full set of “Blue Wave” policies can be largely ruled out, in our view. And the potential for an upside surprise in fiscal stimulus could further boost activity, as control of the Senate is yet to be decided, as discussed further below.

To be sure, the election is not the only powerful market catalyst competing for investors’ attention. In particular, seasonal waves of COVID-19 threaten to delay the timing and magnitude of the broad earnings recovery. But we expect increased visibility into the continued healing of the global economy, coupled with more progress towards an effective COVID-19 vaccine, to emerge as the dominant drivers of price action.

Market reaction and implications

We believe that the early cycle environment remains positive for global equities and the tactical outperformance of cyclical segments of the market.

In our view, the clearest market implication of the election is that the stage is set for sustained softness in the US dollar and the outperformance of emerging market assets. Most of the protectionism discount embedded in foreign assets is slated to fade, and a moderation in the outlook for fiscal stimulus likely reduces the odds of a disorderly spike in real yields that could buoy the greenback.

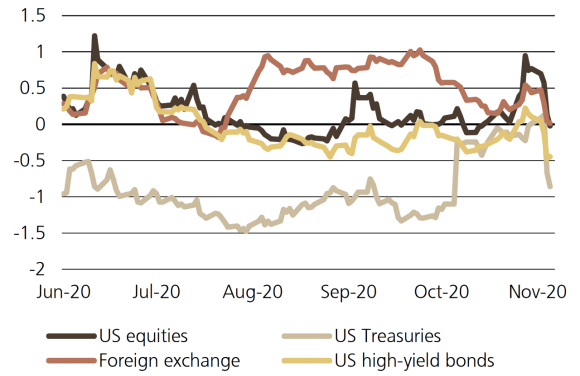

Exhibit 1: Volatility craters after the US vote

Exhibit 1: Volatility craters after the US vote

Z-score of where implied volatility for different assets stands relative to its one-year average

Emerging market (EM) currencies trade at attractive valuations and have among the most catch-up potential of the procyclical trade set. We believe that EM equities are poised to benefit from this currency appreciation, while positive trends in global trade as well as Chinese manufacturing imports and credit growth support continued outperformance. The growth outlook could receive another tailwind before year-end, by which time we expect the emergency approval of at least one COVID-19 vaccine by the US Food and Drug Administration.

Financial assets have reacted positively to the conclusion of the elections. Implied volatility across asset classes had been rising ahead of the event, and proceeded to tumble after Election Day. In our view, investors have correctly extrapolated that the result is clear, and any attempts to contest the election will not be worthy of serious consideration or alter the current outcome across several states.

Fiscal fillip

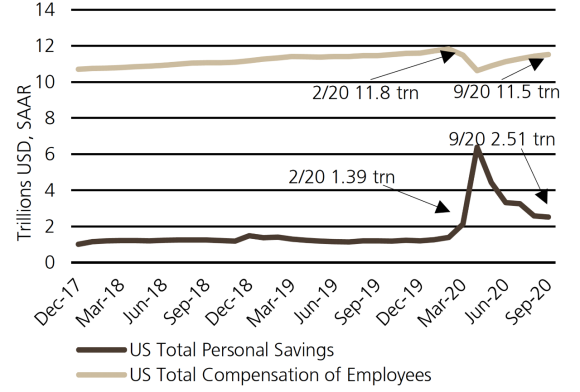

Our concern about this particular election outcome was the downside risk that Senate Republicans would not agree to any additional fiscal support, rediscovering a commitment to fiscal hawkishness. Recent comments from Republican Mitch McConnell, presumptive Majority Leader in the Senate, alleviate some of these worries. He expressed a desire to deliver additional stimulus before year-end and openness towards aid to state and local governments as part of such a package. A scaled back stimulus is better than nothing, with a meaningful but slimming stock of household savings. As such, the left-tail risk associated with this configuration of the legislative and executive branches has abated. Of course, we will closely monitor whether McConnell’s willingness to strike a fiscal deal extends beyond the lame duck session.

The most recent edition of a Democrat President and Republican Senate while the economy was still on the mend from a severe economic downturn occurred in 2010. The fiscal consolidation that ensued as Republican Senators took a hard line on government spending was a drag on the unfolding recovery.

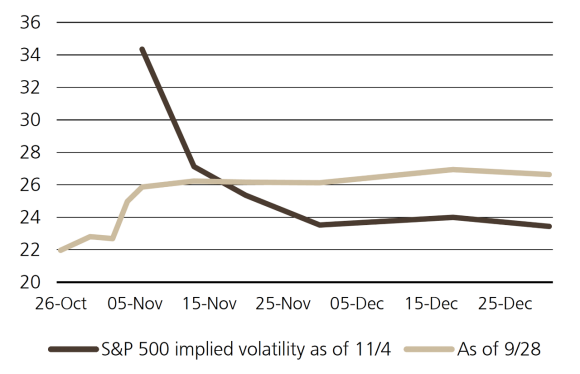

Exhibit 2: Election not seen as a persistent shock to volatility

Exhibit 2: Election not seen as a persistent shock to volatility

S&P 500 vol. term structure changed drastically by the vote

We believe that investors ought not expect a persistently sluggish economy based on this loose historical parallel. In our view, the economy enjoys more tailwinds and fewer headwinds at this juncture. To date, the recovery, particularly in the labor market, has been more vigorous than anticipated. Fiscal measures were ample, allowing household incomes to rise even in the midst of the sharp retreat in activity.

Household balance sheets are healthier than in the wake of the financial crisis. Monetary policy is poised to stay more accommodative to buoy growth as the recovery gains traction. And since the nature of this shock is fundamentally different, an effective vaccine has the potential to substantially brighten the outlook for activity.

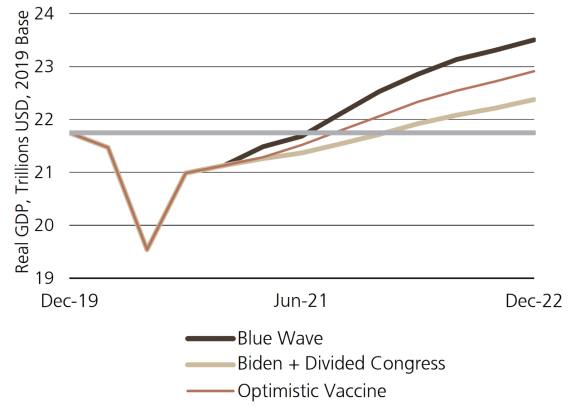

According to our colleagues at UBS Investment Bank, an optimistic scenario is one in which medical breakthroughs and robust production allow half of the world’s population to receive an effective vaccine by the middle of the year. The ensuing impact on global growth would be roughly equivalent to what they expected under a Blue Wave scenario. Our expected timeline for developed markets is broadly similar to this upside scenario, with a more cautious base case towards vaccine deployment in emerging markets.

Exhibit 3: Household savings still able to cushion shortfall in compensation

Exhibit 3: Household savings still able to cushion shortfall in compensation

Exhibit 4: Optimistic vaccine scenario provides upside risk to divided government growth outlook

Exhibit 4: Optimistic vaccine scenario provides upside risk to divided government growth outlook

Lingering unknowns about the election results also provide an upside risk to fiscal expansion. Control of the US Senate will not be confirmed until two Jan. 5 special elections in Georgia are completed. Democrats appear to have an uphill battle to win both races and attain 50 seats. Republicans in statewide elections performed better than Trump, winning a higher cumulative share in both races. We believe an eventual Democratic Senate majority would lead to higher spending than our base case of Biden with a GOP Senate, and give the party more control over committees and the legislative process. This outcome would be unlikely to lead to the full suite of “Blue Wave” policies being enacted, as a number of Senate Democrats do not appear to be inclined to support tax increases. However, we view the likelihood of the Democrats winning both races to be just one-in-four.

Transition turmoil?

Based on the election results, there is still more than 5% of the Trump presidency left before the Jan. 20 inauguration. This transition period includes both the prospect of a contested election and geopolitical risks that may contribute to market volatility.

We ascribe negligible, near-zero odds to a potential reversal of the declared outcome of the presidential election. Biden has secured a plurality of votes in more than enough states to command an electoral college majority. And in swing states, particularly Pennsylvania, his margin of victory is sufficient based on votes cast by the day of the election.

Legal challenges to the voting protocols as well as the election results in many states are already underway, and the possibility of recounts looms. The president pledged that there would be lots of litigation, which we expect will be manifold, broad in scope, and have varying degrees of credibility and materiality. An important factor to monitor will be the final reported margin of victory in a collection of states that give Biden at least 270 electoral college votes. The bigger this is, the lower the likelihood that legal challenge(s) would result in a different outcome. In any event, the experience of 2000 suggests that all legal challenges should be resolved by Dec. 8, the safe harbor deadline by which states must certify their election results.

A primary focus on domestic considerations pertaining to the presidential election result over the transition period may diminish the risk of international disputes. But we do see a meaningful threat of an escalation in US-China tensions initiated by an outgoing president who may blame China as the cause of negative socioeconomic conditions that prevailed in 2020. Measures could include an end to phase one trade deal, bans on the use of Chinese e-commerce payment platforms by US corporates, and sanctions against Chinese/Hong Kong banks.

We expect China would continue to hold off on strong retribution to any fresh measures imposed by the Trump administration, judging that they would be undone early in Biden’s tenure. We suspect markets too would be able to “look through” some of these developments. That said, we also see a non-negligible risk of an escalation of tensions in the South China Sea or elsewhere in the region during this transition phase in US leadership.

Actions taken in the transition period are not likely to cause irreversible damage, but the US-China relationship already appears to be on an irreversibly negative trajectory. We do not believe that this will change under a Biden administration.

US-China under Biden

In our view, Biden’s approach towards China is poised to be more predictable, but still confrontational. There will be less emphasis on the balance of trade and a gradual move away from tariffs, but technology will serve as a focal point in the continuing deterioration of US-China relations. Unlike the outgoing president, Biden may choose to build multilateral coalitions with American allies to address China on matters pertaining to trade, technology, human rights, and the environment.

The incoming president’s methods for leveling perceived inequities in the US-China relationship will likely focus on building up the US, to the extent Congress is amenable, rather than measures in which the primary aim is to curtail Chinese production.

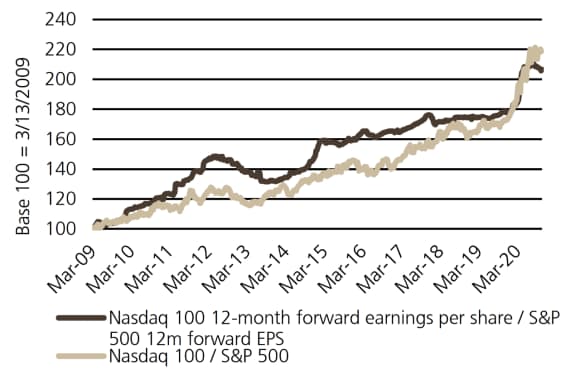

Exhibit 5: Nasdaq 100 earnings, price outperformance fading in early-cycle environment as policy risks mount

Exhibit 5: Nasdaq 100 earnings, price outperformance fading in early-cycle environment as policy risks mount

Conclusion

The passing of the US elections allows investors to begin to focus less on policy risks and more on the global economic recovery from the COVID-19 downturn. Now that the relief rally has seen investors price out some of the negatives that may have accompanied a Blue Wave or highly disputed, inconclusive election, underlying trends that were in place before the election are poised to resume. We are cognizant of near-term downside risks pertaining to COVID-19, chiefly a more severe than anticipated seasonal wave of infections and ensuing mobility restrictions as well as the potential for delays and disappointment on vaccine development. Such a backdrop could elicit a return to the outperformance of tech stocks, particularly ones that benefit from a stay-at-home environment. Our procyclical bias would be challenged in this situation. Ultimately, we expect the market to be forward-looking and focus primarily on re-opening in 2021, even if the growth outlook faces intermittent headwinds.

We have the highest conviction in sustained dollar weakness and the outperformance of emerging market assets. A diminished threat of tariffs under the incoming administration should reduce much of the protectionism discount in foreign currencies and reverse prior US dollar strength. The lack of an aggressive fiscal impulse stateside will keep real yields subdued, in our view, also contributing to a broad downdraft in the dollar. We deem a broad swath of emerging market assets – from foreign exchange, to equities, to dollar-denominated debt – to be particularly attractive in this backdrop.

The forward earnings outlook points to stronger profit growth for the broader US market relative to tech-heavy Nasdaq 100 Index in the coming year, which informs our bias towards value, procyclical stocks. US small caps, which have the most leverage to the improving domestic economy, should also outperform their larger cap peers.

The ongoing normalization of the global economy and expected development of a trusted, effective vaccine are shaping up to be the dominant features of the macroeconomic and market backdrop in the months to come. While the lack of a clear Blue Wave failed to spark a swift procyclical rotation, we believe that the presence and proximity of these catalysts bodes well for the sustained success of this trade set over time as the expansion progresses.

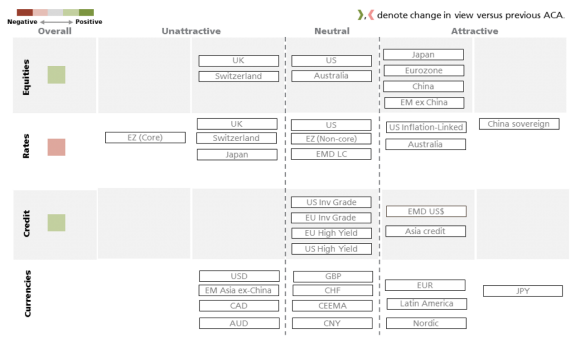

Asset class attractiveness (ACA)

The chart below shows the views of our Asset Allocation team on overall asset class attractiveness, as well as the relative attractiveness within equities, fixed income and currencies, as of 9 November 2020.

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.