UBS Sustainability Report 2019

UBS has made significant progress toward meeting its ambitious sustainability targets in 2019. Read the sustainability report now.

UBS has made significant progress toward meeting its ambitious sustainability targets in 2019. The firm reports on its sustainability performance, applying an industry-leading, comprehensive approach, based on major, internationally recognized disclosure frameworks.

What are the key takeaways from the recent report?

What are the key takeaways from the recent report?

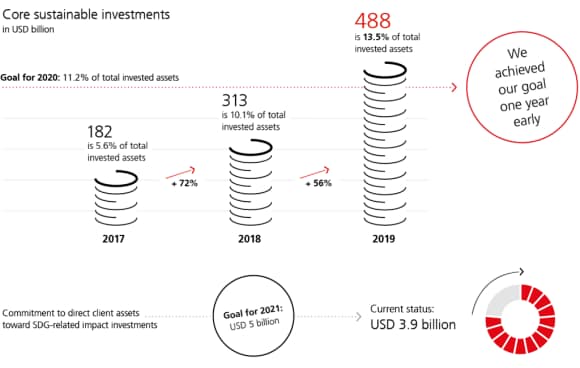

- Core sustainable investments rose to USD 488 billion or 13.5% of invested assets at the end of 2019, surpassing a three-year goal ahead of schedule.

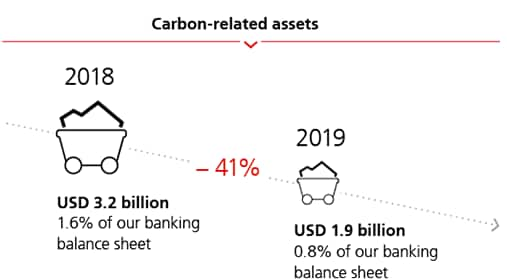

- Carbon-related assets on the balance sheet cut by more than 40% to USD 1.9 billion, or 0.8% of total gross banking products exposure.

- UBS has already directed USD 3.9 billion of client assets into impact investments related to the United Nations Sustainable Development Goals (SDGs), making substantial headway on a 2017 WEF goal to mobilize USD 5 billion by the end of 2021.

- UBS is also well on track to meet its target of reducing the firm's own greenhouse gas emissions in 2020 by 75% from 2004 levels, with a 71% reduction already achieved in 2019.

- The firm has been awarded with the industry leadership position in the Dow Jones Sustainability Indices (DJSI), the most widely recognized sustainability rating, for the fifth time in a row.

In finance

In finance

UBS' core sustainable investments rose to USD 488 billion or 13.5% of invested assets at the end of 2019, surpassing a three-year goal ahead of schedule.

In business

In business

UBS' carbon-related assets on the balance sheet cut by more than 40% to USD 1.9 billion, or 0.8% of total gross banking products exposure.

Awards

Awards

The firm has been awarded various industry leading awards including the leadership position in the Dow Jones Sustainability Indices (DJSI), the most widely recognized sustainability rating, for the fifth time in a row.

To read more about UBS' sustainability efforts in 2019, download the full report.