Choppy waters

Global macroeconomic and tactical asset allocation outlook

Evan Brown

Evan Brown

Head of Macro Asset Allocation Strategy

After a rather sharp deceleration in 2018, we expect the global economy to stabilize around its trend rate.

Ryan Primmer

Ryan Primmer

Head of Investment Solutions

We believe that this environment favors a neutral approach to risk assets with hedges against geopolitical risks.

The first half of 2019 has been a turnaround story, as the US and China, the world’s two largest economies implemented growth-supporting policies that helped reverse the late 2018 global market downturn.

The Fed’s January pivot from a tightening to a neutral bias was a powerful lift to risk assets, bringing down discount rates and increasing the probability of a longer economic cycle. China’s easing has also gained some traction, cushioning the economy from the pressures of deleveraging and trade tensions. With valuations for risk assets having rebounded, we have turned neutral from overweight global equities, given moderating economic growth and associated risks from the trade and technological conflict between the US and China. In our base case tensions are dialed down given strong incentives on both sides to avoid major disruption. If we are right, we are likely enduring another mid-cycle slowdown in this record long economic cycle. We believe that this environment favors a neutral approach to risk assets with hedges against geopolitical risks.

Global economy stabilizing

Global economy stabilizing

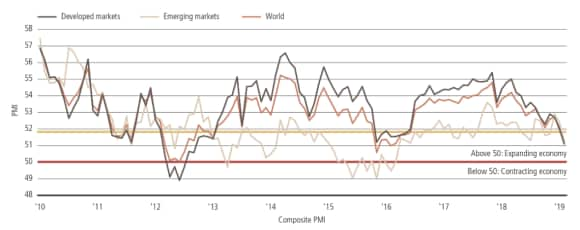

After a rather sharp deceleration in 2018, we expect the global economy to stabilize around its trend rate. We are closely watching Purchasing Manager Indexes (PMIs), which remain above the 50 line which separates expansion from contraction. Our base case for coming months is that the global PMI will hover near its long term trend, implying a soft landing for the global economy. Our assessment is based on the view that while there has been pronounced weakness in the manufacturing and goods sectors, global services sectors have remained resilient. This underlying durability is linked to ongoing strength in developed economy household income growth and is supporting consumption, by far the largest driver of growth in developed economies.

Meanwhile, China’s easing of monetary, fiscal and regulatory policy is helping to cushion its economy. Credit growth has rebounded and infrastructure investment is showing signs of life. Ongoing trade uncertainties create risks for business confidence, but ultimately we expect some de-escalation given strong incentives on both sides to avoid unacceptable economic and market weakness.

An extended economic cycle

An extended economic cycle

With this US economic expansion now the longest on record, it is unsurprising that investors are increasingly cautious on how long it can possibly go on. But a confluence of developments have materialized that suggest this economic expansion can continue even longer. These include rising productivity and prime age labor force participation, along with a Fed that is still providing accommodation.

Risks to the base case

Risks to the base case

Of course, markets have priced-in much of the good news from these tailwinds. This leaves markets vulnerable to negative developments. As mentioned above, trade policy risks remain and are difficult to handicap. Another concern is that the China stimulus we are seeing is much more targeted at the domestic economy than to the external sector.

Exhibit 1: Global purchasing managers indices show stabilization around the long term trend of just under 52

Finally, in the US, domestic political uncertainty is rising. We may see another fiscal showdown potentially involving the debt limit showdown between President Trump and the House Democrats over coming months. Beyond that, uncertainty created by the 2020 election may start to filter through into markets.

The bottom line

With an extended economic cycle, an accommodative Fed and a stable global economy, we would not underweight risk assets despite the potential for near-term volatility particularly around developments in trade policy. We hedge our overweight to equities with underweights in credit, where we see less attractive risk-reward at current spreads amid elevated corporate leverage.