China fixed income: under the microscope

China fixed income is a growing asset class, and our presentation at the 2021 Greater China Conference delved deeper into it with four sector experts and a lively Q&A session.

In brief

In brief

- Changes in the global economy mean it is time for investors to rethink their portfolio buckets;

- As we move into 2021, both China and Asia have an attractive set-up for fixed income investors;

- Chinese bonds - particularly in the rates space – can be said to have safe haven status, and developments in 2020 support that;

- New policies in China’s real estate sector - the three red lines – could offer an attractive rerating opportunity to bond investors in 2021 and beyond.

China fixed income markets and economy – a seven point overview

China fixed income markets and economy – a seven point overview

Hayden Briscoe started with a high-level overview of China’s economy and fixed income space. He drew attention to seven specific factors:

- China’s onshore bond market has doubled in five years because of a fundamental shift away from loan financing in China’s financial system and opening to foreign investors;

- Accessibility reforms, index inclusion, and onshore opportunities are attracting global capital, but international investors still only own approximately 2.6% of the market;

- China’s V-shaped recovery is levelling off but inflation looks under control – and low;

- Credit growth may slow in 2021, and that will likely mean slower growth numbers for the economy;

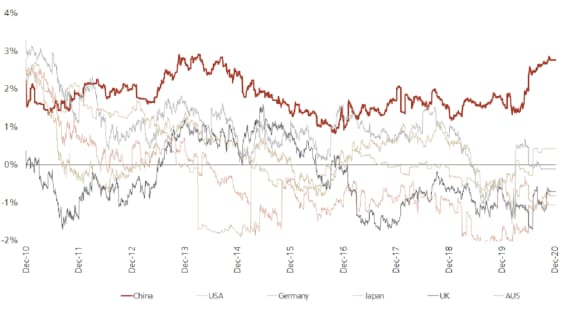

- Sovereign yields – both nominal and real - on Chinese bonds standout in a world of low, or negative yields;

- New policies for China real estate developers have the potential to create a rerating opportunity for bond investors;

- Asia credits currently look attractive, and there’s room for a narrowing of the valuation gap vs markets in the US and Europe.

10-year real sovereign bonds yields compared (%), Dec 2010-Dec 2020

10-year real sovereign bonds yields compared (%), Dec 2010-Dec 2020

To further the discussion, Hayden then opened up the floor to our three-man panel, starting with Tom Becket, Chief Investment Officer at Punter Southall Wealth.

Sovereign yields – both nominal and real - on Chinese bonds standout in a world of low, or negative yields

Tom Becket, CIO, Punter Southall Wealth

Tom Becket, CIO, Punter Southall Wealth

Think differently to generate returns

Towards the end of 2020, it became an uphill battle to generate the kinds of things that clients want, i.e. total return, income, and inflation protection. Further, I’d say, in recent months that situation has gone from being an uphill battle to a lost war.

Valuations look expensive, just look at UK gilts – why anyone wants to lend money to the UK government at 25bps for 10 years is beyond me. I think we can extrapolate out those negative and expensive valuations to other developed markets as well - just look at investment grade and high yield credit.

What we have done is think differently and cast our net extremely wide to generate returns – and that has lead us to the East.

Asia: no longer ‘emerging’

To us, it makes no sense whatsoever for Asia to be put into an emerging markets bucket, and I think that term is now outdated to the point of becoming pre-historic. Interestingly, I think the COVID-19 experience and the year of 2020 pushed the reference to Asia as ‘emerging’ way into the past.

Ultimately, what we are seeing in the developed markets now is similar to what we used to criticize emerging markets for in the past, such as the creation of huge amounts of debt and large-scale relaxation of fiscal policies. I think we are the point where people are starting to think very differently about how we see the world, and particularly about Asian fixed interest markets.

Towards the end of 2020, it became an uphill battle to generate the kinds of things that clients want, i.e. total return, income, and inflation protection………

What we have done is think differently and cast our net extremely wide to generate returns – and that has lead us to the East.

Adrian Zuercher, Head of Global Asset Allocation, UBS Chief Investment Office

Adrian Zuercher, Head of Global Asset Allocation, UBS Chief Investment Office

China, Asia and asset allocation

It is hard to pick long-term changes and regime shifts, and we are focused on the short-term picture for markets and the political world.

That said, one of the key trends in our asset allocation strategies is the shift in economic gravity towards the East.

Let’s not forget that Asia is 60% of the global population, a quarter of global GDP, 50% larger as a whole than the US, so the trend toward Asia is obvious and the growth is here. Over the next ten years, China will likely contribute around 30% of global GDP growth.

However, investors in the US and Europe are under allocated to China and Asia as a whole, despite Asian financial markets offering growth and returns.

That’s largely because those investors are hesistant to embrace new asset classes. Historically, few investors bought high yield before the 1980s and pension funds didn’t allocate to equities in the 1970s.

But we believe that investors are missing out if they are underinvested in Asia and China. We have been allocating quite high levels to Asia in recent years, and it has worked quite successfully for us.

China bonds offer low correlation, yield and safe haven properties

Looking at our strategy, and China fixed income in particular, we have replaced some US high-grade exposure with China central government bonds (CGBs) and other high-quality bonds.

In our confidence metrics we can see that these China fixed income assets are negatively correlated to the USD space, which is the ‘holy grail’ for any asset allocator.

Looking at our most recent changes amid the COVID-19 situation, we completely sold off our high-grade USD exposure in many of our solutions and moved into China CGBs because we also like the currency. We think the CNY (unhedged) currently offers value, and see further room for appreciation.

For instance, European investors can go into the CNY and diversify. 10-year CGBs are currently trading above 3%, so you are picking up between 300-400 basis points of additional return for what we consider to be a safe-haven asset.

Let’s not forget that Asia is 60% of the global population, a quarter of global GDP, 50% larger as a whole than the US, so the trend toward Asia is obvious and the growth is here.

Brian Huang, Senior Credit Analyst, UBS-AM Asia Pacific Fixed Income

Brian Huang, Senior Credit Analyst, UBS-AM Asia Pacific Fixed Income

China’s three red lines policy and the real estate sector

China property is the key sector for the high yield asset class, and I think that over the next three-to-five years the three red lines policy will be positive for the sector.

Firstly, it will help to deleverage developers over the period and help them improve their financial discipline, which they were not really used to doing in the previous cycle.

Since the three red lines policy was announced in August 2020, we have seen some of the privately-owned real estate developers scale back land acquisition.

To me, the policy is not just significant because of leverage improvement, but because it means that developers are improving their capital structure and moving away from some of the high-cost shadow financing channels. As they move away to lower-cost channels, we believe this is definitely positive from a credit perspective.

The last point is that under the three red lines scheme developers have to report their financial situation to the regulators, and that’s important because they have to report ‘hidden’ off-balance sheet debt. It’s almost like the regulators have done the audit on behalf of credit analysts, so that’s a very big step forward for transparency around the sector.

In the short-term, developers will feel pressure from tighter financing, but I think the majority of them will be able to get through it.

Defaults in Asia and China in 2021

The default outlook for Asia high yield will probably improve slightly in 2021 because most countries in the region will see an economic recovery, most notably countries like Indonesia.

In 2020, default rates were about 5%. In 2021, we expect that to come down to around 3.5%-3.6%, factoring in some of the high-profile cases of stress, such as in Sri Lanka.

Looking at USD space for China bonds specifically, default rates were around 3% and I expect similar levels in 2021. Two forces are playing out: firstly, continued recovery driving cashflow improvements and, secondly, tighter financing in some specific areas.

Under the three red lines scheme…..It’s almost like the regulators have done the audit on behalf of credit analysts, so that’s a very big step forward for transparency around the sector.

Wrapping up the session, Hayden Briscoe summarized it in four key takeaways:

Wrapping up the session, Hayden Briscoe summarized it in four key takeaways:

- Changes in the global economy mean it is time for investors to rethink their portfolio buckets;

- As we move into 2021, both China and Asia have an attractive set-up for fixed income investors;

- Chinese bonds - particularly in the rates space – can be said to have safe haven status, and developments in 2020 support that;

- New policies in China’s real estate sector - the three red lines – may offer a attractive rerating opportunity to bond investors in 2021 and beyond.

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.