China equities: the alpha opportunity

China equities took center stage at the UBS Greater China Conference on January 13th with a deep-dive session with expert panelists.

China equities: the alpha opportunity – key takeaways

China equities: the alpha opportunity – key takeaways

- If investors are looking for higher alpha generation, look no further than Chinese equities;

- The Chinese government means what it says on climate and carbon neutrality by 2060;

- A-shares continue to offer rich opportunities for active investors;

- Recent reforms and structural factors are creating new opportunities for long/short strategies – and investors can actually short now in China;

- If you are concerned about volatility and want to reduce your overall beta without compromising absolute returns then China equity long-short and hedge fund strategies could be considered.

Donna Kwok, UBS-AM Head of Asia Strategy, opened the session by remarking on how China’s equity markets had a strong year in 2020 and how rapid policy support and decisive Covid-19 control controls drove a stout economic rebound in 2H20.

Donna continued, ‘But while the 2020 story remains fresh in our minds, we can’t forget that Chinese equities continue to offer very rich pickings, especially for active investors.’

To illustrate this from a high level, Donna turned the session over to an expert three-man panel, starting with Bin Shi, Head of China Equities.

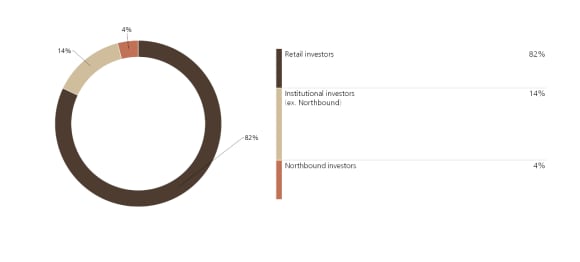

China will soon be a separate asset class

We think that China is soon going to be a separate asset class, even though it is grouped together with Emerging Markets.

The reason is quite simple, China is too significant to be put together with other asset classes.

If you look at China’s economy, it is the second largest economy in the world and bigger than Japan. The Japanese market is a separate asset class, so we expect China will be a separate asset class as well.

Contribution to global growth, 2019-2024

Contribution to global growth, 2019-2024

I think the issue about investing in China equities is not a matter of if, it’s a matter of when and how much.

But even though China is the no. 2 economy, it is still growing very fast and its industries carry significant global market share.

Take the chemicals industry, I listened to a recent conference where an industry executive spoke about the implications of the recent Europe/China trade agreement.

For him, the agreement is extremely significant, and he believed that China will take around 50% of the global chemical market in two-or-three years’ time.

So in the global physical economy China is already so significant, and we expect China will also be very significant in the global asset market as well.

So I think the issue about investing in China equities is not a matter of if, it’s a matter of when and how much.

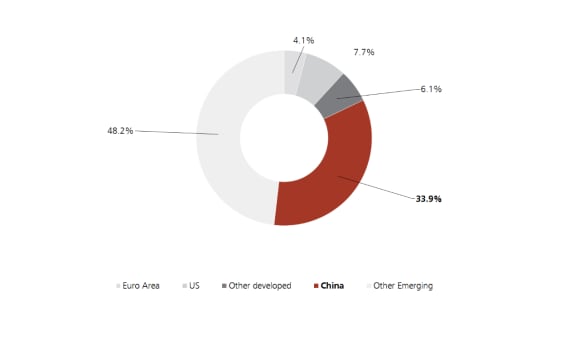

Global asset allocators are still underinvested in China

Perhaps because of a lack of knowledge, global asset allocators have not invested in China for a long time.

But we are seeing more and more interest in China equities from global investors because China A-shares are becoming too big to ignore.

We all know that China A-shares are starting to be included in the MSCI benchmarks.

If they are going to be fully included, A-shares will become a much bigger component of the benchmark and will be close to a 40% share of the EM index, which is why in the long run Chinese equities will be a separate asset class.

Gradual inclusion of China A shares into MSCI Emerging Market index

Gradual inclusion of China A shares into MSCI Emerging Market index

A-shares: retail investors are dominant, correlation is low, and liquidity remains high

A-shares: retail investors are dominant, correlation is low, and liquidity remains high

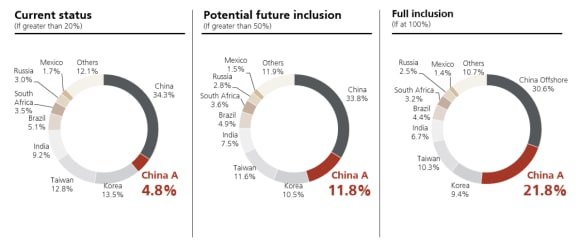

A-shares are becoming more institutionalized, but the share of retail investors still remains much higher than more developed markets.

And the A-share market is a very different animal compared to other markets, it has very low correlation and is driven by its own dynamics.

The A-share market is also extremely liquid compared to say the Hong Kong market. That means large institutional investors can implement sizeable amounts of money quite easily.

A-share investor structure (% of total free-float market cap)

A-share investor structure (% of total free-float market cap)

We are excited to actively participate in the China equity market as relative value investors.

China equities: it’s now about alpha, not just beta

First of all I want to highlight that, after years of opening and reform, China is ready to offer alpha rather than just beta opportunities for global investors.

We define these alpha opportunities in three ways:

- China’s deep involvement in the global supply chain: For us that means China is either quickly following or leading in innovation. So the dynamic between China and the rest of the world can help us generate many profitable ideas.

- China’s entry into a ‘new normal’: This means accelerating industrial consolidation, where leading companies and their competitors will perform very differently.

- QFII and RQFII reforms: these reforms will enable the A-share short borrow market to further develop, so the capacity of long-short equity strategies will significantly increase. As a result, we as relative value investors can benefit from information asymmetries, data science, and our understanding of industries in China to chase attractive risk-adjusted returns with low correlation to other asset classes and fund managers.

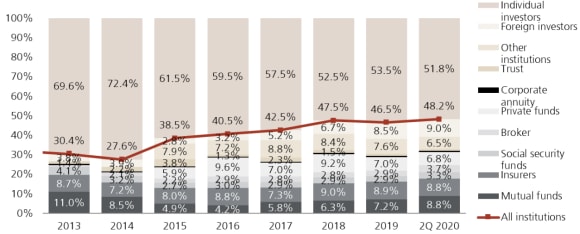

Investor positioning and market structure evolution are conducive to alpha generation

Currently, retail investors drive the market and hedge fund penetration is very, very low.

Value traded by investor type

So we are really excited to introduce biological diversity into the market, which can help to achieve further value discovery and develop a more sustainable ecosystem.

To make this happen, we need some more supportive infrastructure.

We think the new QFII and RQFII rules are really exciting opportunity for us, but we do expect that after the new rules get implemented, the size of short borrow could double as soon as the credit account under the new framework can get ready.

We are very confident that when these changes happen, we will be able to deliver pure alpha driven return to not only global investors but also to Chinese domestic institutional investors.

China alpha opportunities into 2021

Looking into 2021, our outlook breaks down as follows:

- Lower Index return vs 2020: the People’s Bank of China (PBoC) will likely normalize monetary policy in 2021 but we don’t expect policy to cause another drop similar to 2018, since the PBoC has likely learned from it. However, structural opportunities still exist in this scenario, such as:

- Continued global economic recovery likely supports a reflation theme in 2021: we think the interest rate upcycle will kick off and be very supportive for the financial sector, and some of the commodity and export sectors may also benefit.

- Market consolidation: the trend may be further accelerated by financial deleveraging and the changing competitive environment in traditional industries, like real estate development, materials and industrials sectors.

- Environmental policies: This is one of the most popular themes of the past year and we see good prospects for the long term.

- Efficiency improvement: this means opportunities in health care, software, and property services sectors. Each of them can generate both long and short ideas, respectively.

Three ways to look at the China alpha opportunity

China is one of the markets that provides the best alpha generation opportunities for hedge funds, and we break it down in three ways:

- China’s secular growth: from a top down perspective, China offers many secular themes to investors that offers opportunities for investors to identify both winners and losers.

- A favorable market structure: looking from the bottom up, we think the market is under-researched and has high stock dispersion.

- Attractive technicals: China’s markets are less crowded and have low foreign and hedge fund capital participation, which amounts to a fertile environment for alpha generation.

Inefficiency creates opportunities

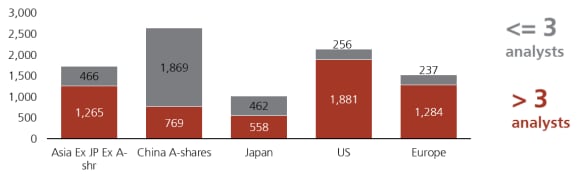

The market is very inefficient, and the best way to illustrate this is to look at the coverage of companies across the different markets.

For China A-shares, 70% of the companies in the market are covered by less than three analysts, that’s a significantly higher percentage than in other more developed markets.

Coverage of companies with USD 500m market cap

Coverage of companies with USD 500m market cap

Low coverage also means much higher dispersion, or higher volatility of the constituents of the market. Simply put, that’s the holy grail for alpha generation and allows you to find opportunities on both the long and the short side.

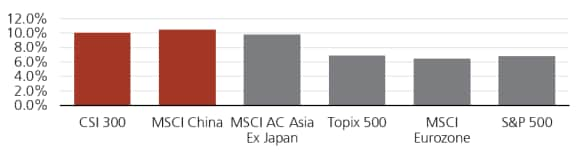

High dispersion of returns in China

High dispersion of returns in China

High turnover creates good entry and exit points

High turnover creates good entry and exit points

Turnover levels in China are off the charts compared to developed markets.

That turnover is really driven by the large number of retail investors in the market, which provides hedge fund investors with good entry and exit points, as well as the ability to trade around that turnover.

Three myths demystified

We hear three kinds of myths about China hedge funds, let me demystify them in turn:

- Isn't it a beta play? Our data tracking shows that China is a market for active investors. We’d go so far to say that active management in China's stock market is essential, especially in a down market and historically, hedge funds have even outperformed traditional active managers.

- Can hedge funds actually produce high returns in China? Absolutely, with capital letters. Our data tracking shows strong returns, and with low volatility. Hedge fund investors care about the destination, but also care a lot more about the journey, and controlling that volatility is very important with good upside and downside capture.

- Isn't one HF manager enough? We think it is not. We believe we can find low correlation between equity hedge fund managers is possible, and that there are opportunities for a different approach to hedge fund investing in the region.

Now we are seeing more institutional investors start to take notice and we have seen a significant increase in both interest and allocations from overseas into China and Asian markets.

Q&A

Q&A

Bin Shi (BS): Investors should stay invested. The A-share market has, overall, done very well and some of the sectors have done even better.

If you look at the overall market, valuations are just above the 10 year historical average so from that perspective it is not so overheated.

In the A-share market you are either hot or not. Some sectors are very hot, but other sectors did not participate as much. We believe we can still find long-term opportunities in those other not so hot sectors. So we are actively deploying our money into the A-share market at this point.

Jia Tan (JT): I would say it is more a process of learning by doing.

When markets collapsed in 2016, regulators were against all kinds of short selling. As I mentioned, years of reform and opening have given them a chance to learn about how to build up healthy capital markets for China.

That’s the reason I stressed the importance of introducing biological diversity to the market.

We wanted to celebrate when we saw the new QFII and RQFII rules last September because we think that is convincing evidence that the regulators are open to embrace the general rules of short selling used in developed markets.

In the beginning, short selling activities are much less than those by long-only players, but give it some time and hopefully we can help to lower the volatility of the market, and then I think the regulators will feel more comfortable to let us do more.

Adolfo Oliete (AO): That’s a good question – they are certainly missing out!

There are two reasons. Firstly, let’s not forget that the hedge fund industry in China and Asia is still pretty nascent. If you look at the current AUM, it is still only roughly 10% of the US and a third of Europe.

We have seen a rapid increase in recent years, and that’s down to China. Before 2008, China equities accounted for about 6% of AUM in Asia, now it is over a quarter, so perhaps now there is a more diverse universe and people are more comfortable with it.

Secondly, though the returns and opportunity set are attractive, it is still not easy to allocate in the region for two reasons: dispersion is high both in the market and the hedge fund universe, and that dispersion grows when volatility increases – so you need to know how to pick; additionally, the market has nuances, like language barriers and stylistic differences.

But institutional investors are starting to realize that the unit of alpha that you extract per unit of risk can be far superior to any other market, so we expect to see more flows from this channel in the future.

BS: There has been some impact, but not too much. The Chinese A-share market is driven by domestic investors and domestic liquidity and global investors’ participation is, at this point, still comparatively small.

US moves to limit investment in some specific companies has had some impact, but that vacuum has been quickly filled by domestic investors.

With regard to ADR relisting in Hong Kong, I think they should continue to be listed in the US because they have benefited from the deep pools of money there and have also benefited US investors too since they have performed extremely well.

The size of the opportunity for Hong Kong depends on how they are treated in the US. If the US regulators can reconcile the difference in accounting standards, I think they (ADRs) will continue to be listed there and potentially seek a secondary listing in Hong Kong, which is fine.

This will benefit investors because at this point I own both ADRs and secondary listed Hong Kong names, and I like the fact I can choose between the liquid market in the US and Hong Kong listings, which trade in my timezone, which allows me to put ideas to work right away, instead of waiting for the US market to open. The ideal situation is to have a primary listing in the US and a secondary listing in Hong Kong and then let investors pick and choose whichever they prefer.

We will have to wait and see though. If Chinese companies are treated badly in the US and get unfair treatment, it is possible they will move their primary listing to Hong Kong, which has the potential to benefit local investors here tremendously.

AO: From a hedge fund perspective, US/China tension creates volatility and that’s good for us. As far as ADRs are concerned, we have seen a significant increase in companies coming back. If companies also continue to be listed in the US, that creates relative value opportunities for us. If they don’t remain in the US, it is good for the Hong Kong market because it makes it bigger and more relevant.

JT: Currently, we can only short stocks on the Stock Connect, so stocks that Northbound investors own. My best guess is that the size of the short borrow pool is around USD 10 billion, which covers all sectors but is mainly limited to large-cap names favored by the Northbound investors.

After the QFII/RQFII rules change, in theory our capacity will increase and we can do short selling on the STAR board. On the main board and Chinex board we can actually use the stocks owned by the prop desk of the domestic China brokers and also reach out to domestic and mutual funds. In the future, maybe other QFII investors, like insurance companies and pension funds, will be able to lend out their stocks to us.

AO: When we talk about China long/short space, it’s not just A-shares. Currently you can have a long/short strategy where A-shares is still very nascent and still run a long/short strategy using shorting capacity in Hong Kong and the US. However, when A-shares come on board, I think it will be the holy grail for hedge funds in the region.

BS: Definitely yes. You can’t just focus on isolated incidents like Ant Financial. A-shares are still not perfect, but neither are other markets. I believe the A-share market is still a good market in which to make money and generate a return.

On antitrust legislation, actually it was announced many years ago. What we are seeing now is stronger enforcement, which may have surprised people. The reason behind it is that the internet platform companies are becoming very large indeed and their strategies can have major impacts on the whole country. As such, I believe there is a need for stronger enforcement of antitrust regulations.

AO: But let’s not forget that antitrust rules are not just China specific, we have seen them in the US and may see an acceleration with the Biden administration. Ultimately the tech wallet is not going away, it just may be distributed to other companies which, again, provides opportunities for new winners to emerge.

AO: Yes. The equity long/short side still dominates the Asian hedge fund industry, certainly from a scalability and from availability of different players and talent. However, from a relative value perspective, QFII significantly changes the opportunity set significantly.

Credit is not as well developed as other markets, but we are starting to see more players and opportunities as the repo market evolves, so you can short a bond and have a proper long/short construct. Fixed income is still not developed enough.

TJ: I’ll highlight two key words: policy and science.

On the policy side, a few policies have been gamechangers for the whole sector. For example, the National Reimbursement List Negotiation and Group Procurement policies have changed the fundamentals a lot.

If we look at the competitive dynamics between the novel drugs and the generic ones, international medical devices and domestic replacements, and the companies focusing on R&D and those focusing on sales and marketing, the long-term outlook will be very different and we believe we can find a lot of structural opportunities.

Looking at the science, many domestic companies have been ‘fast-followers’ of big global pharma companies and some of them have licensed out their molecules to the MNCs and even tried to develop ‘first-in-class’ drugs globally.

Just recently, a Chinese biotech company signed a deal with a global pharma company in which it would receive a USD 650 million front payment and up to a USD 1.3 billion as a milestone payment.

BS: When the Chinese government says something, they really mean it. For the carbon neutral targets, I think they have done a lot of calculations and work behind the scenes to make sure that this is something they can live up to. So I think they are very serious about this target and this most likely means more support for electric vehicles and renewable energy.

TJ: I 100% agree with Bin, I think it is a convincing commitment. My confidence in the Chinese government’s commitment is partly backed by the confidence in the Chinese solar value chain. In the last 10 years, China’s solar manufacturing industry accounted for an estimated 70-75% of new solar capacity globally and delivered a 90% cost reduction.

Closing the session, Donna rounded up with a series of key takeaways:

- If investors are looking for higher alpha generation, look no further than Chinese equities;

- The Chinese government means what it says on climate and carbon neutrality by 2060;

- A-shares continue to offer rich opportunities for active investors;

- Recent reforms and structural factors are creating new opportunities for long/short strategies – and investors can actually short now in China;

- If you are concerned about volatility and want to reduce your overall beta without compromising absolute returns then China equity long-short and hedge fund strategies could be considered.

For marketing and information purposes by UBS. For professional clients / qualified / institutional investors only.

This document does not replace portfolio and fund-specific materials. Commentary is at a macro or strategy level and is not with reference to any registered or other mutual fund.

Americas

The views expressed are a general guide to the views of UBS Asset Management as of January 2021. The information contained herein should not be considered a recommendation to purchase or sell securities or any particular strategy or fund. Commentary is at a macro level and is not with reference to any investment strategy, product or fund offered by UBS Asset Management. The information contained herein does not constitute investment research, has not been prepared in line with the requirements of any jurisdiction designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research. The information and opinions contained in this document have been compiled or arrived at based upon information obtained from sources believed to be reliable and in good faith. All such information and opinions are subject to change without notice. Care has been taken to ensure its accuracy but no responsibility is accepted for any errors or omissions herein. A number of the comments in this document are based on current expectations and are considered “forward-looking statements.” Actual future results, however, may prove to be different from expectations. The opinions expressed are a reflection of UBS Asset Management’s best judgment at the time this document was compiled, and any obligation to update or alter forward-looking statements as a result of new information, future events or otherwise is disclaimed. Furthermore, these views are not intended to predict or guarantee the future performance of any individual security, asset class or market generally, nor are they intended to predict the future performance of any UBS Asset Management account, portfolio or fund.

EMEA

The information and opinions contained in this document have been compiled or arrived at based upon information obtained from sources believed to be reliable and in good faith, but is not guaranteed as being accurate, nor is it a complete statement or summary of the securities, markets or developments referred to in the document. UBS AG and / or other members of the UBS Group may have a position in and may make a purchase and / or sale of any of the securities or other financial instruments mentioned in this document. Before investing in a product please read the latest prospectus carefully and thoroughly. Units of UBS funds mentioned herein may not be eligible for sale in all jurisdictions or to certain categories of investors and may not be offered, sold or delivered in the United States. The information mentioned herein is not intended to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not a reliable indicator of future results. The performance shown does not take account of any commissions and costs charged when subscribing to and redeeming units. Commissions and costs have a negative impact on performance. If the currency of a financial product or financial service is different from your reference currency, the return can increase or decrease as a result of currency fluctuations. This information pays no regard to the specific or future investment objectives, financial or tax situation or particular needs of any specific recipient. The details and opinions contained in this document are provided by UBS without any guarantee or warranty and are for the recipient’s personal use and information purposes only. This document may not be reproduced, redistributed or republished for any purpose without the written permission of UBS AG. This document contains statements that constitute “forward-looking statements”, including, but not limited to, statements relating to our future business development. While these forward-looking statements represent our judgments and future expectations concerning the development of our business, a number of risks, uncertainties and other important factors could cause actual developments and results to differ materially from our expectations.

UK

Issued in the UK by UBS Asset Management (UK) Ltd. Authorised and regulated by the Financial Conduct Authority.

APAC

This document and its contents have not been reviewed by, delivered to or registered with any regulatory or other relevant authority in APAC. This document is for informational purposes and should not be construed as an offer or invitation to the public, direct or indirect, to buy or sell securities. This document is intended for limited distribution and only to the extent permitted under applicable laws in your jurisdiction. No representations are made with respect to the eligibility of any recipients of this document to acquire interests in securities under the laws of your jurisdiction. Using, copying, redistributing or republishing any part of this document without prior written permission from UBS Asset Management is prohibited. Any statements made regarding investment performance objectives, risk and/or return targets shall not constitute a representation or warranty that such objectives or expectations will be achieved or risks are fully disclosed. The information and opinions contained in this document is based upon information obtained from sources believed to be reliable and in good faith but no responsibility is accepted for any misrepresentation, errors or omissions. All such information and opinions are subject to change without notice. A number of comments in this document are based on current expectations and are considered “forward-looking statements”. Actual future results may prove to be different from expectations and any unforeseen risk or event may arise in the future. The opinions expressed are a reflection of UBS Asset Management’s judgment at the time this document is compiled and any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise is disclaimed. You are advised to exercise caution in relation to this document. The information in this document does not constitute advice and does not take into consideration your investment objectives, legal, financial or tax situation or particular needs in any other respect. Investors should be aware that past performance of investment is not necessarily indicative of future performance. Potential for profit is accompanied by possibility of loss. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

Australia

This document is provided by UBS Asset Management (Australia) Ltd, ABN 31 003 146 290 and AFS License No. 222605.

China

The securities may not be offered or sold directly or indirectly in the People’s Republic of China (the “PRC”). Neither this document or information contained or incorporated by reference herein relating to the securities, which have not been and will not be submitted to or approved/verified by or registered with the China Securities Regulatory Commission (“CSRC”) or other relevant governmental authorities in the PRC pursuant to relevant laws and regulations, may be supplied to the public in the PRC or used in connection with any offer for the subscription or sale of the Securities in the PRC. The securities may only be offered or sold to the PRC investors that are authorized to engage in the purchase of Securities of the type being offered or sold. PRC investors are responsible for obtaining all relevant government regulatory approvals/licenses, verification and/or registrations themselves, including, but not limited to, any which may be required from the CSRC, the State Administration of Foreign Exchange and/or the China Banking Regulatory Commission, and complying with all relevant PRC regulations, including, but not limited to, all relevant foreign exchange regulations and/or foreign investment regulations.

Hong Kong

This document and its contents have not been reviewed by any regulatory authority in Hong Kong. No person may issue any invitation, advertisement or other document relating to the Interests whether in Hong Kong or elsewhere, which is directed at, or the contents of which are likely to be accessed or read by, the public in Hong Kong (except if permitted to do so under the securities laws of Hong Kong) other than with respect to the Interests which are or are intended to be disposed of only to persons outside Hong Kong or only to “professional investors” within the meaning of the Securities and Futures Ordinance (Cap. 571) and the Securities and Futures (Professional Investor) Rules made thereunder.

Japan

This document is for informational purposes only and is not intended as an offer or a solicitation to buy or sell any specific financial products, or to provide any investment advisory/management services.

Korea

The securities may not be offered, sold and delivered directly or indirectly, or offered or sold to any person for re-offering or resale, directly or indirectly, in Korea or to any resident of Korea except pursuant to the applicable laws and regulations of Korea, including the Capital Market and Financial Investment Business Act and the Foreign Exchange Transaction Law of Korea, the presidential decrees and regulations thereunder and any other applicable laws, regulations or rules of Korea. UBS Asset Management has not been registered with the Financial Services Commission of Korea for a public offering in Korea nor has it been registered with the Financial Services Commission for distribution to non-qualified investors in Korea.

Taiwan

This document and its contents have not been reviewed by, delivered to or registered with any regulatory or other relevant authority in the Republic of China (R.O.C.). This document is for informational purposes and should not be construed as an offer or invitation to the public, direct or indirect, to buy or sell securities. This document is intended for limited distribution and only to the extent permitted under applicable laws in the Republic of China (R.O.C.). No representations are made with respect to the eligibility of any recipients of this document to acquire interests in securities under the laws of the Republic of China (R.O.C.).

Source for all data and charts (if not indicated otherwise): UBS Asset Management

© UBS 2021. The key symbol and UBS are among the registered and unregistered trademarks of UBS. All rights reserved.

© UBS 2021. All rights reserved.

For professional clients / qualified / institutional investors only

Explore more insights

Original articles and videos with expert analysis, views and opinions on a broad range of asset classes and themes.