The UBS approach to capital market assumptions

Capital market expectations (CMEs) are critical inputs in designing an investment strategy that will help investors meet specific objectives. A pension plan, for example, has liabilities with certain wage, payout and inflation assumptions; an endowment may plan for distributions based on university budget growth; or a family office may have income and real growth objectives. Ultimately, the CMEs must have an economic logic and consistency behind them that tie into the larger setting that investors face.

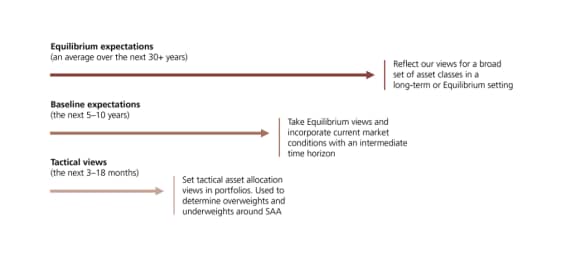

We produce long-term, or 'Equilibrium,' assumptions (average return for an asset class over the next 30-40 years, for the purpose of setting general benchmarks), and Baseline expectations covering five- and 10-year returns, for the purpose of building strategic asset allocations. We update Equilibrium and Baseline assumptions quarterly. We rely on shorter term catalysts—such as earnings revisions, manager positioning, market stress and momentum—to set tactical asset allocation views in portfolios.

We call our long run assumptions Equilibrium because we assume that economic and financial variables ultimately regress to an internally consistent regime around long-term Equilibriums. Our Baseline process incorporates current valuations, market conditions and key forward-looking inputs to generate five- and 10-year expected returns by asset class and region. It is important to note that Baseline forecasts should be taken as measures of tendency rather than point estimates, and can be subject to considerable swings in the five-year period as the economic and market cycle progresses. Our Baseline expectations are used to design and evaluate existing strategic asset allocations.

Valuation is an important component of our Baseline process. Valuation focuses on the deviation of asset prices from their intrinsic value; well established as a key driver of returns over multi-year periods1. When assets are undervalued they tend to be set for a period of strong performance, and when they are overvalued they typically lag, though timing may vary. For example, investing in US large cap growth equities in the late 1990s or long-dated bonds in the 1970s would have been ill-advised. Forward-looking inputs may vary by asset class but generally include inflation, economic and earnings growth, cash yields, 10-year government bond yields and default and recovery rates for investment grade and high yield bonds. We offer direct estimates of value on 11 equity markets, 14 fixed income markets and 33 currency markets. We can use these to determine some broad measures of global expectations.