Bond Bites Bear country - survival tips for the unwary

Jonathan Gregory explains why complacency can be dangerous when investing in the credit markets

Here in the United Kingdom it has been a very long time indeed since anyone enjoying a countryside ramble has feared an encounter with a wild bear. The documentary evidence is limited but it is possible that the last person to see a wild bear in Britain was a Roman legionnaire as his company of troops edged warily into the wildest corners of the Empire nearly 2000 years ago. Today, this lack of first-hand experience of wild animals that may pose a mortal threat can cause problems when British tourists visit countries where bears are still a risk. Conditioning to low risk at home leads to complacency in new environments abroad. I have trekked in some of the wildest areas of North America equipped with nothing more substantial than the idea "if it's brown lie down, if it's black fight back". Luckily I never met a bear at close quarters; a fact you may have already deduced as I am still here to tell you about it. But I should have made better preparations. Being lucky is not the same as being smart1.

A failure to properly assess the risks of a particular environment, and take adequate precautions, is also one of the greatest hazards for investors. This is especially true now as wave after wave of monetary policy action has protected investors against market volatility and killed many proto-bear markets stone dead. The unwary may draw the conclusion that, in this new world, most risks have been eliminated.

Investment grade corporate bonds may be a case in point. But to be clear at the outset; we believe corporate bonds still offer an attractive opportunity for fixed income investors. In our view, corporate earnings will likely bounce back in 2021 in many sectors and credit can still offer an attractive yield advantage over government bonds. All that said, current valuations certainly warrant extreme caution and one must be very selective in allocating credit risk to a strategy.

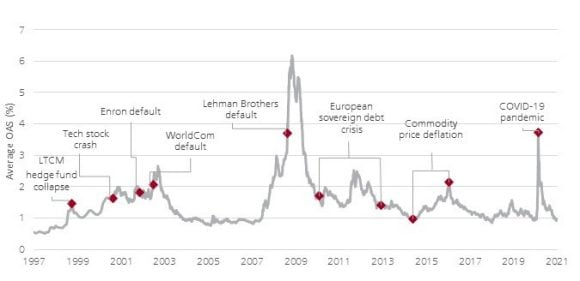

The chart below shows the path of US corporate bond spreads over the past 25 years. So it is the difference in yield between the Bloomberg Barclays US Corporate Bond Index (a broad corporate bond universe) and that on the equivalent duration US Treasuries. The far right hand side shows where we are now – at about 0.95%. This is obviously toward the lower end of the range that spreads have traded in over this period. In other words, investors are being paid toward the lower end of the range in risk-premia priced since the late 90's. This extends to yields as well; the index yield is now just 1.86%2 and closest to the lowest points seen in the past 25 years3. In reality, at the aggregate level, corporate bond investors have rarely been paid less in terms of risk-premia or expected future income.

US corporate bond spreads over the past 25 years

US corporate bond spreads over the past 25 years

The other notable point about the chart, is that while spreads have reached these low levels on numerous occasions in the past, there have been many times when spreads widened quite dramatically and prices fell quickly in relation to Treasuries. I have highlighted a few of the most noticeable occasions. One feature they have in common is how (mostly) unexpected they were: the other is how different in nature. We see idiosyncratic events that led to systemic 'risk off' moments, for example the LTCM (Long-Term Capital Management hedge fund) and Enron defaults; or global events that triggered upheaval in US credit markets such as the European sovereign debt crisis: the tech stock bubble and more recently, the global pandemic.

Clearly, alternate bouts of fear and greed are as evident in credit markets as they are in stock markets. Our mantra is to be cautious when spreads are low and more aggressive in our credit allocation when valuations are cheaper. Somewhat counterintuitively, the most dangerous moments in credit markets can be when spreads are low and stable because it encourages excessive risk taking in the expectation that 'nothing can go wrong'. The period 2005-2006 was a time of low and stable spreads but ended with one of the most spectacular spread blow-ups in credit history, as excessive leverage built up in the financial system.

Fast forward to now and spreads are at a similar level. Optimism generally is very high that central bank support will cap credit market volatility and a dramatic expansion of fiscal policy will drive economic growth. This may well turn out to be the case but our point is that a lot of this optimism is already in the price. Patient investors should aim to benefit from periodic bouts of credit volatility, not suffer from them.

In fact, the chart also somewhat understates the risks in credit markets; over that same period the proportion of all BBB credits – the lowest quality on the investment grade rating spectrum – has increased from 26% to 50%4 and the price sensitivity to changes in yields has gone up (the duration has increased).

Our global strategies aim to balance all these risks. In our base case scenario, corporate bonds should offer some incremental yield versus government bonds; but it will probably not all be a quiet stroll in the woods for investors. It never has been. So we are underweight the areas with the worst risk/reward features; for example, negatively-yielding Eurozone corporate bonds that guarantee a loss in real terms in almost every conceivable outcome. The UK is another region where we have concerns that a very flat yield curve spells danger for credit investors. Instead we much prefer opportunities in the US, with its more diverse opportunity set, and certain emerging market countries such as China and India. The technology and utility sectors also look more attractive to us than some more cyclical areas of the economy that will be vulnerable to prolonged lockdowns.

This is not the right time to 'lie down' and hope potential surprises pass one by. In our view, a more active approach to 'fight back' against the powerful structural forces that have led to stretched valuations is a better option. Our active approach to managing credit risk has helped us handle a lot of bear activity in the past.