Fallen angels – the impact on Fixed Income markets

The number of bonds that have actually been downgraded to high yield from investment grade (fallen angels) has risen dramatically as ratings agencies assess the impact of the crisis on corporates.

The number of bonds that have actually been downgraded to high yield from investment grade (fallen angels) has risen dramatically as ratings agencies assess the impact of the crisis on corporates.

The economic backdrop

The economic backdrop

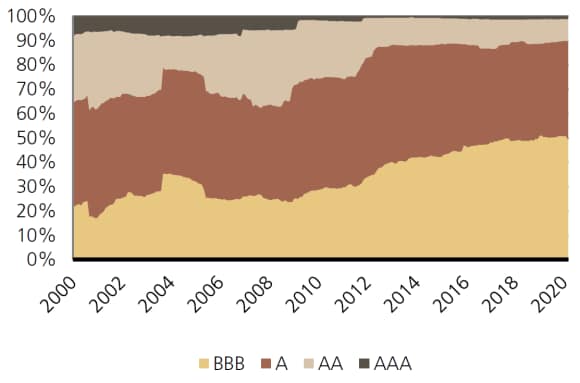

The unprecedented measures taken by governments across the world aimed at slowing the spread of COVID-19 has significantly impacted economic activity. Prior to the emergence of this pandemic, much had been publicized about the re-leveraging and general deterioration in quality that was occurring in high grade corporates. For example net leverage, as represented by Net Debt to EBITDA ratio had increased from 1.1 in 2011 to 1.9 in 2019 in US corporates according to data from Morgan Stanley. Additionally, the lowest quality tier of the high grade debt universe for example bonds rated BBB, had steadily increased from 30% of the overall market at the end of the 2008/09 financial crisis to roughly 50% today as the chart shows.

Although credit rating agencies have selectively downgraded a number of issuers from investment grade (IG) to high yield (HY) over the past few years, the focus was often on borrowers in a handful of sectors such as energy and metals and mining. What seemed to be missing was a catalyst that would trigger a broad based wave of so-called "’fallen angels’, a term used to described bonds that have been downgraded from investment grade to non-investment grade – enter COVID-19 and the collapse of oil prices.

The disruption to economic activity has been staggering with almost all sectors and industries feeling the impact of a global economy at a near standstill. Expectedly, the number of bonds that have actually been downgraded to HY and the number that currently have a rating of BBB-, the last notch within IG, have both risen dramatically as ratings agencies assess the impact of the crisis on corporate balance sheets. For instance, S&P has already stripped 21 companies of their investment grade rating since February of this year, the highest such tally since 2015. Simultaneously, the universe of borrowers it has rated BBB- with a negative outlook (potential fallen angels) currently stands at 96, the highest since March 2009.

While European and US corporate issuers have garnered most of the attention in regards to fallen angels, developments in other areas especially in the Emerging Markets – and to a smaller extent – developed Asia, all point to rising downgrade risks. South Africa's loss of its only remaining investment grade rating last month and Mexico's recent downgrade to BBB- by one of the three major agencies both have significant ramifications for the corporates and quasi-sovereigns in those economies.

In this commentary we share a number of key findings from a recent study conducted by our credit research team on the par amount of likely fallen angels across Europe and the US in the next three to six months. We then examine the impact of these potential downgrades on credit markets and conclude with our outlook and positioning.

Global corporate bonds historical rating distribution

Fallen angels – What is the UBS-AM view?

Fallen angels – What is the UBS-AM view?

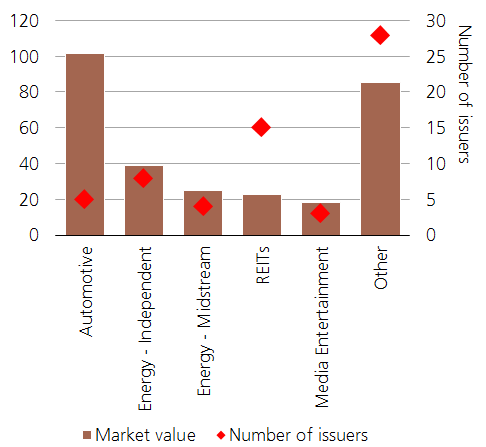

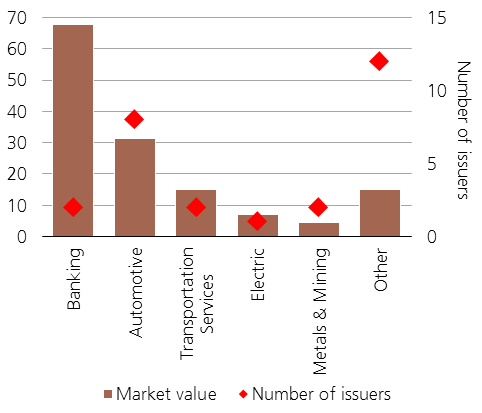

To better understand the impact and the risks associated with fallen angels, UBS-AM credit analysts recently conducted an independent assessment of the US and European corporate bond markets. We summarize their expectations for ratings downgrades in the next three to six months as follows:

- US IG market value: 292 billion across 63 issuers

- EUR IG market value: 141 billion across 27 issuers

After further reviewing the results we made two major observations regarding the types of risks faced by high-grade borrowers:

- Direct risks – These are issuers in industries affected by quarantine measures, such as airlines and transportation services

- Second order risks – These are borrowers in sectors which could suffer in a scenario of rising unemployment, lower consumer confidence and falling business investment spending such as automotive.

US IG fallen angels forecast (USD billions)

EUR IG fallen angels forecast (EUR billions)

The above estimates are not dissimilar to what the broader market expects. However, the situation remains fluid and dependent on several exogenous factors such as the length of lockdowns imposed in various countries and the nature of any potential exit paths. We will therefore continue to reassess market conditions and update our forecasts as the current environment evolves.

What is the impact on credit markets?

What is the impact on credit markets?

Investment Grade

Many fallen angel candidates are already trading at HY levels. For example, at the end of March our expected fallen angels for Europe were trading at 460bps, broadly in line with HY bonds rated BB+/BB. This is in stark contrast with bonds rated BBB and BBB- which traded 360 bps tighter back in January this year. One notable exception to this trend of spread widening in IG can be observed in the US where trading levels have rebounded meaningfully following the announcement by the US Federal Reserve (Fed) that it would begin buying fallen angels as part of its broad-based measures to support markets. Going forward we expect this intervention to provide a floor to pricing levels for US fallen angels with some nuances across sectors.

Compared to the global financial crisis (GFC), the fiscal and monetary support programs being enacted by central banks in response to the current challenges are helping restore order to credit markets. It is also worth noting that banks are healthier today than they were back in the GFC. They have stronger capital and liquidity buffers and we therefore expect a significantly lower incidence of downgrades of subordinated bank debt to high yield. Additionally because banks are in better health, compared to 2008/09, they are in a much stronger position to support businesses during these difficult times.

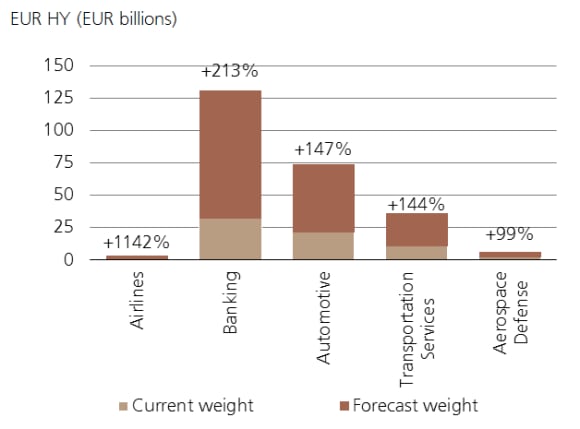

High Yield

Whilst the absolute amount of fallen angels in Europe is forecasted to be lower than in the US, when compared to the size of the respective HY markets, Europe is expected to feel a heavier impact from downgrades. Based on our analysis the EUR HY market is expected to incur an increase in size of close to 50%. This compares to an increase of just over 25% in the US HY universe.

Top sectors most impacted by rating downgrades to HY

Top sectors most impacted by rating downgrades to HY

While the incidence of fallen angels is likely to be elevated in the current environment, the phenomenon of wide-spread downgrades from IG to HY is not without precedence. Similar occurrences took place during the global financial crisis, the Eurozone sovereign crisis and in the oil price collapse of 2014/15. On each of those occasions the market absorbed the supply of those companies that were deemed as being of a higher quality relative to the other downgraded with support bids coming from both dedicated HY investors and cross-over IG investors. Additionally, more recent episodes of downgrades were supported by favorable technical factors such as central bank intervention and yield hungry investors.

Despite the sheer magnitude of expected fallen angels, we believe they will likely be absorbed by the market over the medium to long-term. Key to this will be a balance between supply and demand for high yield credit. Factors supporting a balance are:

- we forecast supply to be lower versus previous years as many issuers have already extended their maturity profiles and current uncertainty will discourage opportunistic refinancings

- investors have substantial coupon income to be reinvested

- an expected improvement in the quality of the HY universe generally due to BB rated fallen angels entering the universe and deeply distressed default candidates leaving

As previously mentioned, a key support to the US HY market is the commitment of the Fed to buy fallen angels. With regards to other markets, further intervention from central banks cannot be ruled out due to the unprecedented nature of the crisis. However, it is important to note that there will be some nuances with regards to sectors. We expect those with significant downgrades to take more time to digest and consequently exhibit higher spread volatility.

What are we doing in light of these findings?

What are we doing in light of these findings?

Based on the analysis undertaken by our credit research team we conclude that while the road ahead will be a bumpy one it could also offer attractive opportunities for us to deploy capital on a select basis. Specifically, we see value in:

- US IG and EUR IG as these are segments of the market which are supported by direct central bank bond purchase programs and valuations appear attractive

- Prefer short-duration US HY based on Fed HY ETF purchases with a bias towards the higher-quality segment of the market that benefits directly from Fed bond purchases. Additionally, Asia HY based on China property companies receiving government support

Through these challenging periods, what remains unwavering is our commitment to active management of bond portfolios and the reliance on strong bottom-up fundamental credit research coupled with forward-looking macro insights to generate the best possible risk-adjusted return outcomes for clients.