Smaller companies, larger returns?

Why we believe small cap stocks offer the potential for better long-term returns

Kevin Barker, Head of Equity Specialists

David W. Sullivan, Investment Analyst, US Small Cap Growth Equities

Viara Thompson, Research Analyst, Pan-European Small & Mid Cap Equities

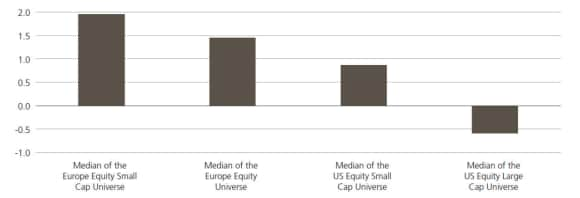

The Coronavirus pandemic has had a profound effect on share prices this year, and smaller companies have been no exception. In the first seven months of 2020, the MSCI All Country World Small Cap index (ACWI Small Cap) fell by 8.7%, against the 1.3% drop of the MSCI All Country World Index (ACWI) . Small cap stocks typically deliver higher long-term returns, and we explore why we believe that now is a good time for investors to consider their allocations to small cap.

We believe small cap stocks offer investors:

We believe small cap stocks offer investors:

- Potential for better long-term returns; the MSCI ACWI Small Cap index outperformed the MSCI ACWI index by 2.4% per annum over 20 years1

- Lower research coverage which leads to greater market inefficiency

- Broader universe with higher active share, thereby providing potential for better active returns

- Higher risk, but compensated by better returns over the long term, providing improved Information and Sharpe Ratios

- Lower liquidity and higher cyclicality, which may be a positive in post-COVID-19 recovery

- Small caps trade at a lower price/book (P/B) ratio than large cap stocks, providing a more attractive entry point

Why invest in small caps?

Why invest in small caps?

We believe there are several key attractions for investors when looking at small cap stocks today.

To read more, download the full paper.

To read more, download the full paper.

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.