Macro Monthly The dueling threats to US, China tech

Escalating US-China tensions as the November election nears are likely to foster volatility, with measures taken against Chinese technology a focal point.

Highlights

Highlights

- Escalating US-China tensions as the November election nears are likely to foster volatility, with measures taken against Chinese technology a focal point.

- An abrupt US-China tech decoupling is unlikely in the near term, but a longer term likelihood.

- Investors underestimate domestic policy support for Chinese tech as well as policy risks to US tech.

- An overly sanguine outlook for US tech stocks is indicative of the broader risks to its domestic equities, which reinforces our preference for global equities relative to the US.

The drumbeat of US-China tensions is likely to crescendo in the coming months, with the relationship devolving across geopolitical, diplomatic and economic fronts. From a market perspective, Chinese technology stocks could face significant volatility given escalating conflicts between the two sides. Meanwhile, conventional wisdom holds that the dominant market position and earnings power of US technology heavyweights are unassailable.

However, investors should not lose sight of the big picture. We believe that any disruption over coming months could provide pockets of opportunity in Chinese technology stocks, which enjoy supportive underlying trends that include a deep, captive domestic base and a government committed to the development of technology champions as well as macroeconomic stability.

In our opinion, there are two overarching questions that investors must keep at the forefront of their minds in assessing the degree and nature of their preferred exposure to technology:

- What is the potential for a disruptive acceleration in US-China tech decoupling as the relationship between the two countries deteriorates?

- How much will global as well as domestic tax and regulatory shifts threaten to undermine the dominant position of US tech firms?

We believe that US-China tech decoupling is a longer-term story, and the prospect of an abrupt fracturing in this relationship does not appear imminent. And in a world in which COVID-19 has exacerbated and laid bare the hardships of victims of economic inequality, politicians in the US and abroad may be incentivized to rein in the financial benefits accruing to the more profitable and monopolistic entities, the US tech giants.

Exhibit 1: US-China tensions more priced in for Chinese stocks

Exhibit 1: US-China tensions more priced in for Chinese stocks

Nonetheless, a degree of portfolio protection is also prudent in light of the growing rifts between the world’s two largest economies in the coming months. As such, we remain long the US dollar relative to cyclical Asian currencies, like the Taiwanese dollar and Korean won, which would likely come under acute pressure should tensions between the two sides – trade or otherwise – flare up.

Cold tech war, not hot

There is bipartisan support in the US for using all means necessary – legislation, executive orders and soft power – to limit China’s ascension in global technology and allay national security concerns surrounding the potential deployment of Chinese communications technology in the US and other parts of the developed world.

But the most at-risk segments of the Chinese market seem priced to reflect some of these downside risks, while evidence from the trade dispute implies a full clampdown on the Chinese technology sector is not in the best interest of the US.

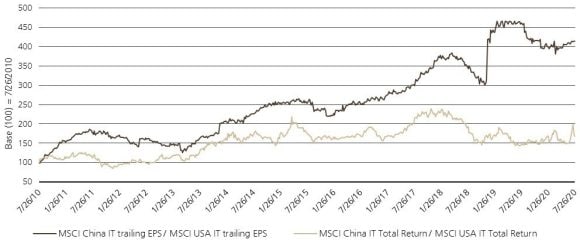

Chinese stocks still bear scars from the trade war that preceded the Phase 1 agreement signed in early 2020, judging by the gap in returns between Chinese stocks with heavy exposure to the US and American firms that generate a substantial share of revenues from the world’s second-largest economy since the 2016 US election. All of the relative underperformance of broad proxies for Chinese tech vs. their US peers occurred during a six-month span in 2018 when the trade conflict began.

A détente on trade was reached before the US imposed tariffs on imports of popular consumer goods from China, indicative of the US administration’s reluctance to introduce measures that are too visible to consumers or too disruptive to some of the biggest US technology companies.

Exhibit 2: 2018 trade war initiation is all that separates Chinese tech from the Nasdaq 100

Exhibit 2: 2018 trade war initiation is all that separates Chinese tech from the Nasdaq 100

Turning from a trade war to a tech-centric war would accentuate those pressure points. For instance, a blanket ban on major Chinese smart phone producers would see US technology excluded from roughly 50% of global annual sales in that market.

Huawei has garnered the most attention and action from the US government. No other Chinese firm involved in physical technology has the same stature on the global stage, and its 5G ambitions pose untenable security challenges. This unique set of circumstances suggests extrapolating directly from the US-Huawei relationship to the rest of the Chinese tech ecosystem is not an appropriate base scenario, and closer to a worst case outcome. The rollout of additional export controls may introduce more complications for both US and Chinese technology companies, but are likely to be sufficiently porous in the short term rather than an inviolable supply chain severance.

The scale of the mutually assured damage to both US and Chinese companies that would follow a “sudden stop” moment of tech decoupling suggests the US government will instead continue to gradually refine the mechanisms by which it restricts China’s access to technology.

Domestic fortresses

As is the case with leading US firms, a more expansive definition than the IT sector is required to capture Chinese leaders who make extensive use of technology or online platforms but fall in the communication services or consumer discretionary sectors.

This broader group of Chinese tech leaders – Tencent, Alibaba, Baidu, Meituan-Dianping, and JD.com – have much more concentrated domestic exposure than the FANG stocks, Microsoft, or Apple in the US, and have a much larger weighting in MSCI China than the traditional IT sector. These companies are important sources of demand for high-tech products produced around the world rather than a meaningful part of global supply chains.

Despite their size and pervasive reach, Chinese technology heavyweights are not frequently at odds with the domestic authorities. The propensity for cooperative, symbiotic relationships between industry titans and the state entails that dominant positions are a feature, not a bug. This relatively insular position and access to a significant, captive domestic market may prove a stabilizing force for China’s biggest companies, as there are fewer regulatory points of conflict and a ruling class whose commitment to macroeconomic stabilization and the success of technology is resolute.

Beijing has also shown an increasing willingness to underwrite activity in the traditional IT sector in a bid for eventual import substitution (Made in China 2025, a state-led industrial policy that seeks to make China dominant in global high-tech manufacturing), enhancing this structural trend. Money is no panacea in a worst-case scenario that includes the loss of foundational US technologies, but does help reduce the ramifications of any cyclicality in Chinese tech and offset the adverse impacts of restrictive US policies. For instance, Huawei was able to grow revenues at a double digit pace year-on-year in the first half of 2020 thanks to its leading position in the domestic smartphone market and demand from state-owned Chinese enterprises across a variety of business units.

Global Presence, global stakeholders

The ability of US tech heavyweights to post persistently elevated profitability or add to their commanding global footprints will be challenged by politicians who question aspects of their business models that provide this dominant market position and how little their tax burden is proportional to their size and success.

A bipartisan consensus of US politicians favors more scrutiny of domestic technology giants, which have come under fire over low effective tax rates, tolerance of disinformation, privacy concerns and anti-competitive behavior.

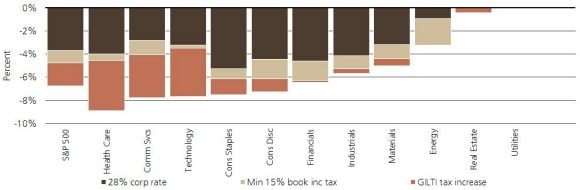

Democrats would likely be more aggressive and thorough in redressing the perceived societal and economic ills linked to the sector. Current polling and prediction markets suggest that if the November US election were held today, the expectation would be for Democratic candidate Joe Biden to prevail, with the Democrats retaining control of the House of Representatives while also taking the Senate. Biden’s plan calls for a tax on minimum book income and a higher rate levied on profits associated with intangible assets shifted to a lower-tax foreign locale. US tech multinationals would be among the most negatively affected by these measures. Foreign governments are also likely to push for taxes as well, based on these firms’ substantial international presences.

Exhibit 3: Earnings impact from Biden proposed tax plan...

Exhibit 3: Earnings impact from Biden proposed tax plan...

While any antitrust campaigns may take years to produce tangible actions, any traction on this issue could cause investors to question whether the longer-term earnings power of many leading companies would be sustainable under current valuations. Conversely, these firms may prove relatively immune from political breakup pressures under the pretense that they are domestic champions integral to maintaining US technological superiority.

What’s in the price?

The pandemic has likely accelerated technology adoption and pulled forward digitization. This thesis has been embraced much more by investors in US IT stocks compared to their Chinese peers, judging by the relatively muted earnings outperformance vs. the benchmark expected for the latter over the next 12 months.

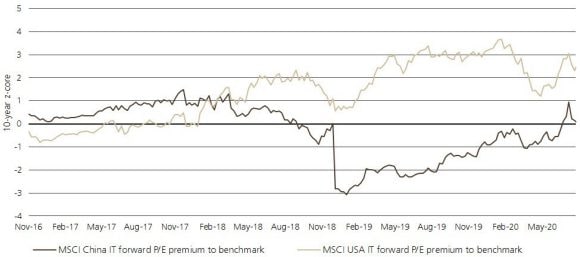

Chinese IT stocks have typically traded at a meaningful premium to their US rivals on a forward price to earnings basis, though this has materially ebbed since the start of the trade war in 2018.

Exhibit 4: Chinese tech returns, earnings dwarf US

Exhibit 4: Chinese tech returns, earnings dwarf US

Exhibit 5: US tech valuation premium elevated vs. benchmark

Exhibit 5: US tech valuation premium elevated vs. benchmark

Higher valuations are also indicative of the past cycle’s trend in earnings growth, with Chinese IT handily outstripping its US counterpart. And compared to other Chinese equities, tech stocks aren’t at historically stretched levels, in stark contrast to the setup stateside. The MSCI USA IT index has a multiple that’s two standard deviations above that of the MSCI USA based on the past decade of observations; the comparable premium for MSCI China IT is only modestly above average. Pure IT is a relatively limited part of the MSCI China Index, but this differential in the relative valuation premium also generally holds for some of the biggest companies in these markets, like Alibaba and Tencent in China and Amazon and Microsoft in the US.

The US tech sector is the preeminent source of software stocks globally, which account for one-third of the index and can exhibit defensive characteristics during periods of economic stress. China’s tech sector is more physically oriented, with nearly 60% weighted in technology hardware and equipment. Semis account for just more than one-fifth of the tech sector in China, and a little less than that level in the US. This industry composition would also tend to work more in China’s favor at the onset of an early cycle environment.

Conclusion

Based on both US-China tensions and valuations relative to benchmark, there is more good news priced into American stocks – even as a potential turning point on taxation and regulation looms. That sets a high bar that may lead to more scope for disappointment should the underlying fundamentals show any signs of deterioration.

A preference for Chinese equities is reflective of our asset allocation, which sees more value in early-cycle trades and favors exposures outside the US. The upcoming November election is just one example of the broader risks facing US risk assets. In addition, the US’s poor ability to control the COVID-19 virus relative to other advanced economies, ensuing implications for the timing as well as durability of the economic recovery, and step-down in fiscal support leave us broadly negative on the US dollar and more positive on global risk assets.

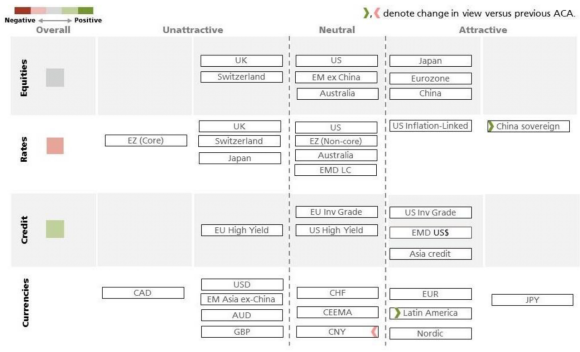

Asset class attractiveness

The chart below shows the views of our Asset Allocation team on overall asset class attractiveness, as well as the relative attractiveness within equities, fixed income and currencies, as of 30 July 2020.

Read more

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.