Macro Monthly Reopen vs. reactivate: Lessons from China's experience

This edition examines China's ongoing reactivation as a leading indicator for Europe and the US.

Highlights

Highlights

- Investors must focus not just on when economies are set to reopen, but when and how consumers and businesses will feel safe resuming normal activities.

- We examine the experience in China, where discretionary consumption is recovering slowly as individuals change behaviors to reduce risk of infection.

- Developed economies are likely to face more difficulty normalizing than China or other North Asian countries, as there may be less individual acceptance of tracing and surveillance.

- We suspect the outlook for risk assets will become more challenging from here, as investors must price in greater uncertainty and solvency risks on the recovery path.

- Regionally, we prefer North Asian equities and credit given advantages in containing the virus.

Across the world, investors and non-investors alike are focused on when and how economies will 'reopen,' after COVID-19 related shutdowns. But just as important, if not more so, is when will economies 'reactivate?' In other words, when and how do consumers feel safe enough to resume normal spending behaviors? When will businesses feel they have created a safe enough environment to bring back workers and resume pre-crisis levels of production? It is well understood that a widely available vaccine is still several quarters away. It is also broadly agreed that a reduction in social distancing policies risks second waves of infections and potentially renewed shutdowns. Therefore, in addition to the tendency for consumers and businesses to be cautious in the aftermath of a recession, we have to monitor behavioral changes based on lingering fears of further virus spread.

In attempting to examine potential post-virus behavioral changes, we think it most useful to look at China as a leading indicator for Europe and the US. China is a useful barometer given it is a country that experienced a severe bout of the virus but is now roughly two months into its 'reopening.' There are of course major differences across countries, given varying levels of severity of the virus, significant variation in public health infrastructure including testing and contact tracing, diverse macro policy responses, unique reopening strategies along with political and cultural differences. So we have to be cautious in drawing definitive conclusions from China's experience for western democracies. Still, we'd argue that the basic contours of human behavior are the same across regions, and that Chinese consumer and business behaviors post-reopening can provide important clues as to how things will look in the west.

China's reopening

China's strategy for containing the virus involved a nearly two- month-long lockdown of Hubei, the epicenter of the COVID-19 outbreak in China, which ended on March 25. Outside Hubei, Chinese local officials began opening up their economies two to three weeks after the extended Chinese New Year's holiday ended on February 3. The real catalyst came during the February 21 Politburo meeting, where the central government pushed hard for work resumption while remaining committed to containing any second waves. This required a strong contact tracing system, surveillance, temperature checking and some travel quarantining requirements. As an example, China mandates that individuals have barcodes on their phones signaling their relative health risk to others before accessing public transportation or entering buildings. Potentially contagious individuals face a mandated quarantine if they are deemed high risk to others. While there have been small outbreaks of the virus in particular localities, most seem to be imported from other countries. In response, China has sharply reduced international travel and mandated strict quarantine guidelines for incoming travelers.

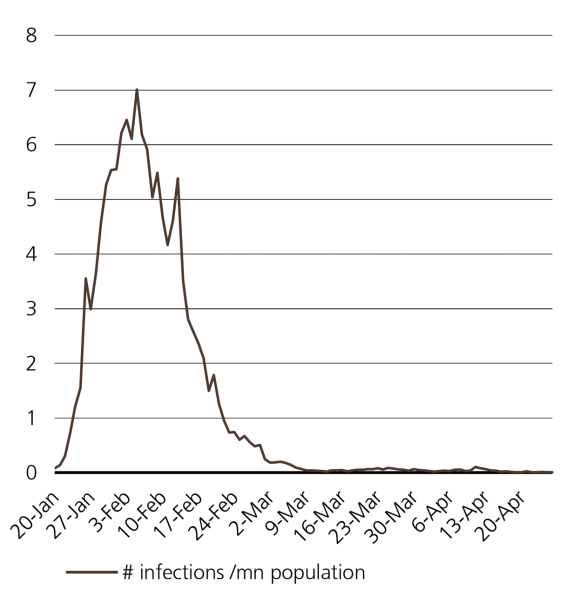

Exhibit 1: Daily new infections/million pop. in China

Given the challenge of reopening the economy while making sure the virus is contained, the slope of economic activity was inevitably flat at the very beginning and gradually moved higher as the government and the public gained more confidence in health conditions. The signs of an acceleration of daily activities as measured in coal consumption, property sales and city traffic congestion levels are visible around late February and early March, following the aforementioned Politburo meeting on February 21. But two months in, current levels of activity are still somewhat subdued from previous years.

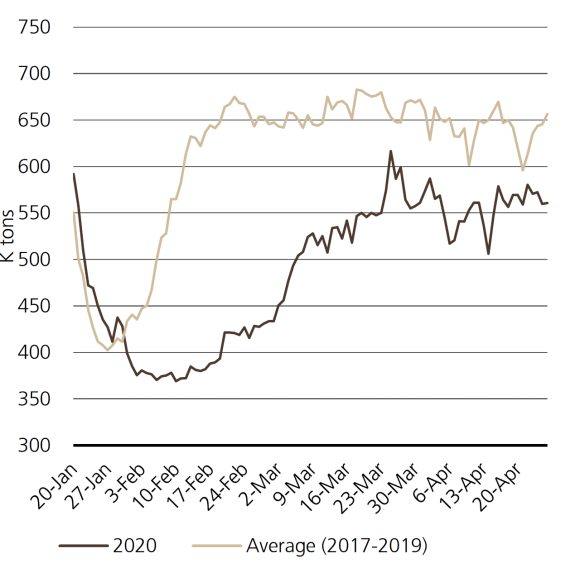

Exhibit 2: Coal consumption of 6 largest power groups

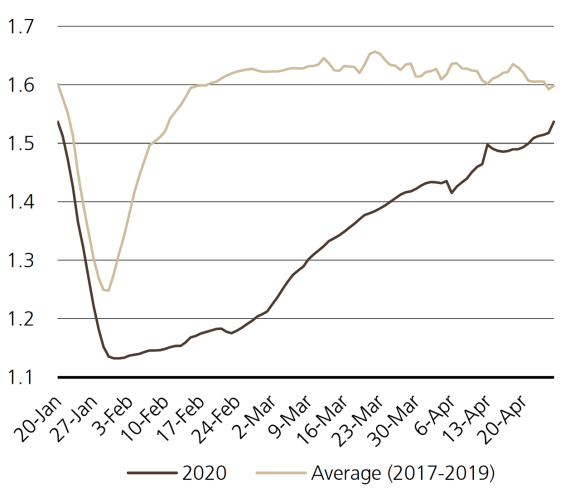

Our colleagues in China do note a change in much of the public's daily routines. Ridership of city public transport has remained far below pre-outbreak levels, with many preferring to drive to work. Indeed, city traffic congestion has almost returned to pre-outbreak levels, and during peak hours is particularly congested. But the length of such peak hours has shrunk, as individuals choose to return home from city centers as opposed to staying out for leisure purposes.

Exhibit 3: 100-city traffic congestion index (7-day ma)

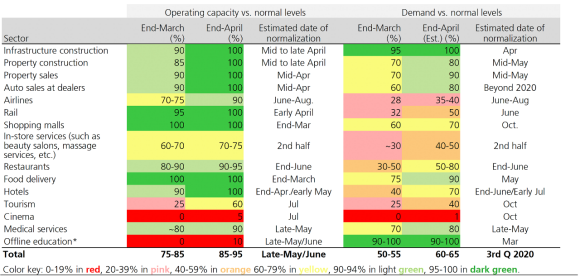

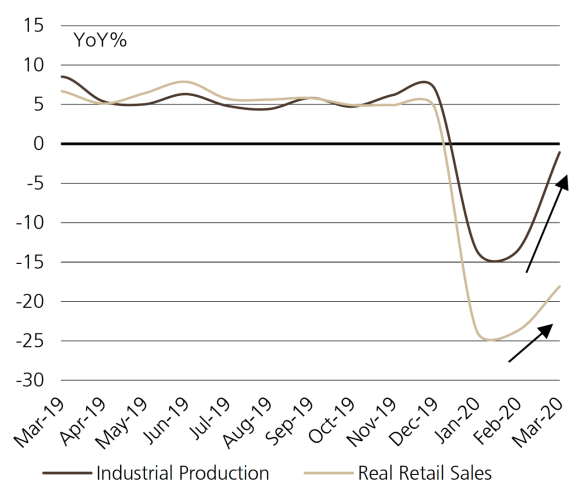

Exhibit 4: Chinese consumption demand recovery lags supply

Indeed, while China has largely returned to work, the country has yet to return to spending in earnest. Overall discretionary consumption was down 20% from last year.1 To be sure, much of this is due to the decline in real disposable income by 3.9% YoY in 1Q, the sharpest fall since data became available in 2002, as well as uncertainty about the future. But there is also a general desire to avoid crowds which has led to a slow recovery in discretionary spending. Shopping malls are open but are much less populated as people have chosen to avoid gathering. Dining out at restaurants is still a fraction of what it was pre-pandemic as is spending on in-store services like beauty salons. There has been a move away from offline towards online spending, with the former down 13%YoY and the latter up 11%YoY in March, according to official data. These fail to offset though because offline consumption is still roughly three-fourths of consumer spending. Exhibit 4 displays current and predicted activity levels across various areas of the economy, showing that while the supply side is mostly up and running, various areas of demand will take longer to normalize.

A recent paper from the National University of Singapore2 has used high frequency data to track offline spending in China. The authors find that consumption patterns show a strong negative relationship to the severity of the health crisis, even accounting for distancing and mobility restrictions. Specifically, when the one-day lagged number of new cases rises, day-to-day consumption declines, and vice versa. This includes data in the first half of April, when most mobility restrictions had been relaxed and concerns grew over potential second waves of infections (either from imported or asymptomatic cases, which the government started to report at the beginning of April). The authors attribute much of the decline in consumption to uncertainty around the disease itself, suggesting that the more that can be done to manage the public health crisis and make people feel safe, the more genuine a recovery in normal consumption behavior will occur.

Exhibit 5: Supply outpacing domestic demand in China

Early lessons from China's experience

China's approximately two-month re-opening process offers some guidance on what developed economies should expect. One takeaway is that there will likely be a very hesitant and gradual recovery in developed economies. Just because a business has reopened, it does not mean consumers will flock to it if they generally want to stay out of crowded places. A related and logical conclusion is that the safer people feel, whether that is due to low case growth nearby or trust in the public health infrastructure, the more likely they are to resume semi-normal activities.

There are of course reasons to expect a less successful return to normal in developed economies than China's experience. The US and Europe have undergone much more severe outbreaks and longer plateaus of new case growth before declining. While contact tracing and surveillance tools are in development, participation is likely to be voluntary as opposed to mandatory in most situations. And unemployment rates, in the US in particular, are skyrocketing relative to China's. This means a slower reunion of workers and employers as well as a more cautious consumer.

Market implications

The above suggests caution is warranted on risk assets as global equity markets appear to be pricing in a swifter recovery with more certainty than is likely, given China's experience and differences from western economies. The S&P 500 is only down about 10% for 2020 which is quite remarkable given the sharp decline in the growth outlook and lofty valuations entering the year. As discussed in the April Macro Monthly, we have tremendous respect for the power of coordinated monetary and fiscal policy in providing a bridge through what will be a bumpy road for developed economies. But we would argue that policy support is largely priced in, and that current valuations do not adequately embed the meaningful uncertainty around growth and earnings over coming quarters and years. Indeed, while policymakers have helped provide liquidity where needed, they have not erased solvency risk. Credit and equity performance is likely to be more sideways as markets grapple with the risks of a much more difficult road to recovery, including potential for second waves of COVID-19. We have moved tactically underweight global equities after the recent rally.

Within equity markets, the rebound has been driven by defensives and growth stocks – which is not part of the typical recovery playbook but understandable given the prolonged uncertainties we face. Valuation spreads between cyclicals and defensives are at extremes and will eventually snap back. We would expect this to occur in anticipation of a normalization in global spending patterns – which may require greater visibility on a vaccine. For now we favor a moderately defensive equity allocation which should include sectors that are less impacted from lockdowns such as communication services or health care in the current environment. As the road to recovery becomes clearer, we would expect the most sold-off sectors (e.g., automobiles, banks, energy) to bottom from an absolute point of view given they trade at deep recession prices and should eventually recover. Therefore, for investors with a longer time horizon and ample risk tolerance we believe that buying into those sectors on dips is likely to pay off.

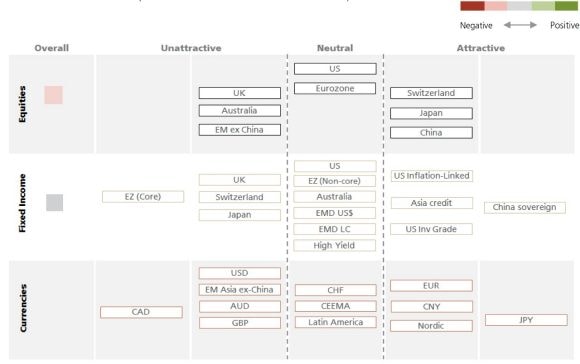

We prefer China and other North Asia economies over their EM counterparts as the former have shown greater ability to manage the health crisis and control the outbreak. At the same time, markets like Korea, Taiwan and Mainland China are less vulnerable from an external financing point of view and have more room for policy action. We are expressing this view across equities and fixed income, the latter reflected in a preference for Asian high yield relative to broader emerging market debt. Over time, we expect the overvalued USD to weaken and gold to rally given extraordinary monetary and fiscal stimulus in the US.

Asset class attractiveness

The chart below shows the views of our Macro Asset Allocation Strategy team on overall asset class attractiveness, as well as the relative attractiveness within equities, fixed income and currencies, as of 30 April 2020.

Read more

Make an inquiry

Fill in an inquiry form and leave your details – we’ll be back in touch.

Introducing our leadership team

Meet the members of the team responsible for UBS Asset Management’s strategic direction.